Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

In the latest report summarizing the Q3 2020 developments in the cryptocurrency field, CoinGecko has classified the outcome as the “summer of decentralized finance (DeFi).”

The popular data aggregator noted that the top-performing decentralized exchanges saw (DEX) massive growth in terms of trading volume resulting in reducing the market share of centralized exchanges (CEX).

DEX Are On The Rise

CoinGecko’s report emphasized on the developments within the decentralized finance industry, and especially the performance of decentralized exchanges. According to the data in the document, “Q3 2020 had been a vibrant quarter where the DeFi hype and yield farming frenzy took over the crypto-sphere. This resulted in a $155 billion increase (88%) in total trading volume.”

Q3 Total Trading Volume. Source: CoinGecko

Q3 Total Trading Volume. Source: CoinGecko

As the graph above demonstrates, August and September saw a massive increase in trading volumes. DEXes have enjoyed an impressive surge in the market share from $3.8 billion in volume in July to over $30 billion in September.

The volume growth “far outpaced CEX,” which actually shrank in September.

DEX Vs. CEX Trading Volume Growth Q3. Source: CoinGecko

DEX Vs. CEX Trading Volume Growth Q3. Source: CoinGecko

“Centralized exchanges still have the bulk of the trading volume, but obvious erosion of market share by DEXes have been observed. Currently, DEX volume stands at 6% of CEX.”

Uniswap and Curve Occupied The Leading Spots

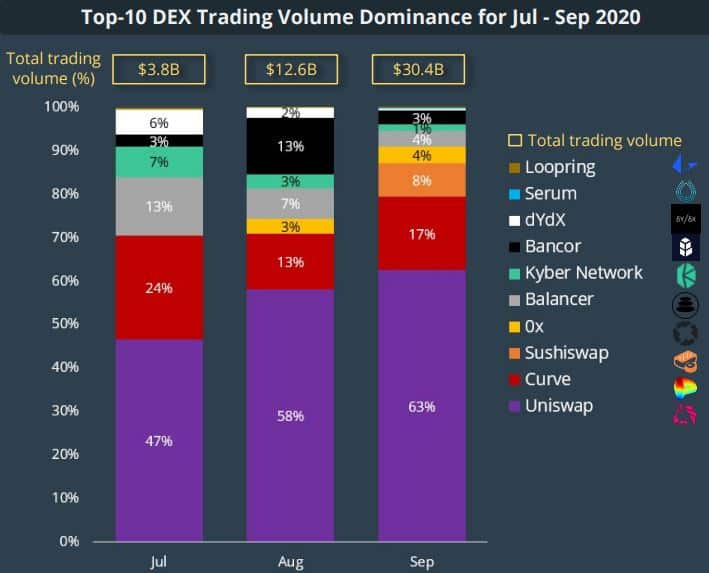

The report went into details in examining the top 10 DEXes and their respective market share. It concluded that Uniswap has been and continues to be the most widely utilized decentralized exchange.

Uniswap was responsible for 47% of the $3.8 billion trading volume in July. As the volume expanded to $30,4 billion in September, Uniswap’s share surged to 63%.

DEX Trading Volume Dominance. Source: CoinGecko

DEX Trading Volume Dominance. Source: CoinGecko

Curve is the other exchange with a consistent double-digit trading volume percentage. However, it has dropped from 24% in July to about 17% in September.

CoinGecko highlighted SushiSwap’s role as the dark horse in this race. SushiSwap started as a fork of Uniswap. It attracted a substantial amount of Uniswap’s liquidity during its explosive start by offering extra incentives in what became known as a “vampire attack.”

Despite some controversy regarding the project, SushiSwap was responsible for about 8% of the total DEX trading volume in September.

“Uniswap and Curve further cemented their positions as leading DEXes, but it remains to be seen if SushiSwap can continue to grow its market share.”

The post Flippening: Crypto Decentralized Exchanges Grew More Than Centralized Ones In Q3 2020 appeared first on CryptoPotato.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.