Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Cryptocurrency hedge funds’ assets under management have been increasing significantly, rising to more than $2 billion at the end of last year, according to a recent survey. The crypto hedge fund industry is expected to “grow significantly” along with the price of bitcoin.

Hedge Funds’ AUMs Doubled in 2019

Cryptocurrency hedge funds’ assets under management more than doubled in 2019, according to a new survey by PWC and Elwood Asset Management Services Ltd. Entitled “2020 Crypto Hedge Fund Report,” the document was published on May 11, the day of the third Bitcoin halving. The data comes from “the largest global crypto hedge funds by assets under management (AUM),” the report details, adding that it includes crypto index funds and crypto venture capital funds.

“Our Q1 2020 research shows that there are around 150 active crypto hedge funds. Almost two thirds of these (63%) were launched in 2018 or 2019,” the report’s authors wrote, elaborating:

We estimate that the total AUM of crypto hedge funds globally increased in 2019 to over US$2 billion from US$1 billion the previous year … The average AUM increased from US$21.9 million to US$44 million.

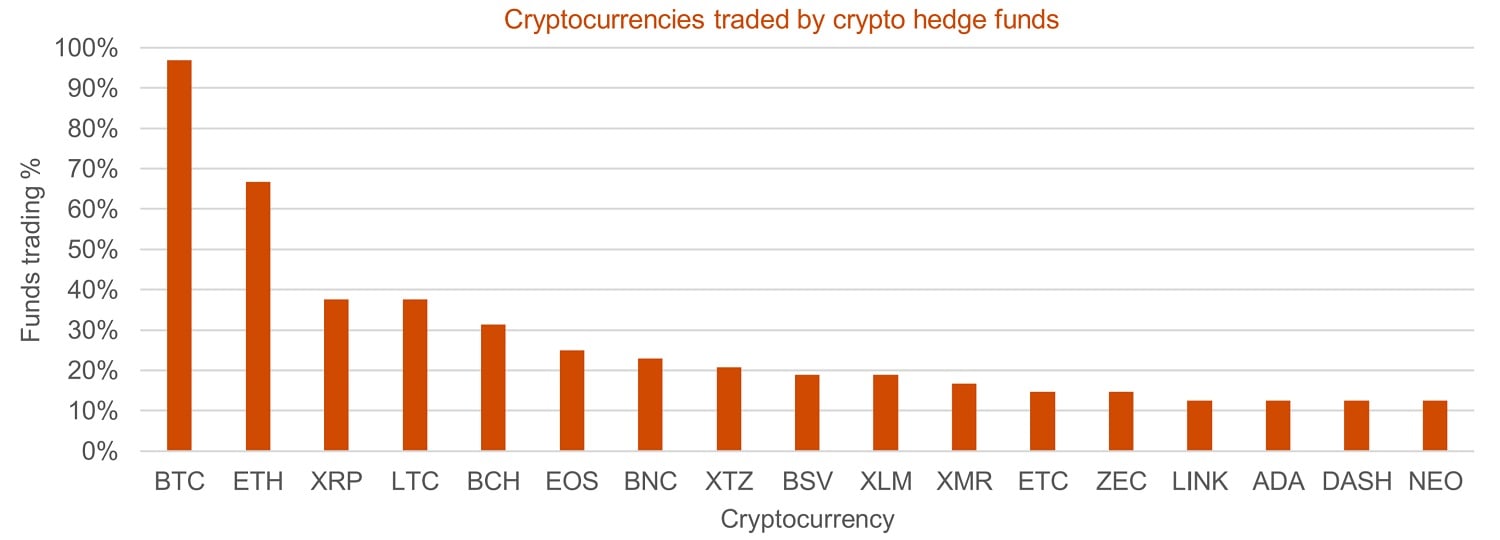

Most cryptocurrency hedge funds surveyed (97%) traded BTC, followed by ETH at 67%, XRP at 38%, LTC at 38%, BCH at 31%, and EOS at 25%. The substantial increase in AUM could also be attributed to the increase in the prices of cryptocurrencies. Bitcoin’s price, for example, rose from $3,872 on Jan. 1 last year to $7,174 on Dec. 31.

The top cryptocurrencies traded by crypto hedge funds surveyed by PWC and Elwood Asset Management. Source: Report by PWC and Elwood.

The top cryptocurrencies traded by crypto hedge funds surveyed by PWC and Elwood Asset Management. Source: Report by PWC and Elwood.

The median AUM at fund launch is $2 million in 2019, “indicating that funds have generally seen a 4X increase in AUM,” the report emphasizes. During the year, the percentage of crypto hedge funds using an independent custodian increased from 52% to 81% and 86% used an independent fund administrator. About 90% of hedge fund investors were either family offices (48%) or high-net-worth individuals (42%). A small percentage of respondents were foundations, endowments, venture-capital funds or funds-of-funds but none cited pension funds.

Furthermore, cryptocurrency hedge funds tend to be domiciled in the same jurisdictions as traditional hedge funds, most of which are in the Cayman Islands (42%), followed by the U.S. (38%) and the British Virgin Islands (8%). The report also points out that the survey results were based on answers by fund managers and were not verified by an independent party.

‘Significant’ Growth Expected

The report additionally finds that “the launch of actively managed crypto funds is highly correlated with the price of bitcoin (BTC)” and “The Bitcoin price spike in 2018 appears to have been a catalyst for further crypto funds to launch.”

The number of new cryptocurrency hedge funds launched from 2012 to Q1 2020. Source: Report by PWC and Elwood.

The number of new cryptocurrency hedge funds launched from 2012 to Q1 2020. Source: Report by PWC and Elwood.

After the third Bitcoin halving, many people expect the price of bitcoin to rise by the end of the year. Among them is Galaxy Digital CEO Mike Novogratz who believes that the price of bitcoin would hit $20,000 by December. Virgin Galactic Chairman Chamath Palihapitiya has been saying that bitcoin’s price could go to $1 million or more while Pantera Capital CEO Dan Morehead said it could peak at $115,000 by August next year.

Another bullish move for the crypto industry comes from the hedge fund manager Paul Tudor Jones who revealed on Monday that he has almost 2% of his assets in bitcoin. He explained that he is buying bitcoin as a hedge against the inflation and central banks’ money printing, as bitcoin reminds him of the role gold played in the 1970s.

PWC partner and global crypto leader Henri Arslanian was quoted by Bloomberg on Friday as saying: “The volatility of crypto markets offers many opportunities for quant traders … The performance of crypto quant funds tends to be more linked with market volatility rather than market performance.” He elaborated:

I expect the crypto hedge fund industry to grow significantly over the coming years as investing in a crypto fund may be the easiest and most familiar entry point for many institutional investors looking at entering this space.

Several analysts have predicted that interest in cryptocurrencies from institutional investors will increase post the covid-19 pandemic. Last month, a Japanese analyst outlined three key reasons why institutional demand for cryptocurrencies would rise after the coronavirus crisis. Grayscale Investments recently released its Q1 2020 earnings report showing record capital inflows, 88% of which were from institutional investors. Furthermore, a pro-crypto commissioner with the U.S. Securities and Exchange Commission, Hester Peirce, said she sees institutional demand rising.

What do you think about hedge funds increasingly investing in cryptocurrencies? Let us know in the comments section below.

The post $2 Billion Cryptocurrency Hedge Fund Industry Set to ‘Grow Significantly’ appeared first on Bitcoin News.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.