Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitcoin markets experienced a bit of a pullback on October 23 as prices dipped roughly 3 percent after reaching new highs this past weekend. At the moment the price per bitcoin is coasting along just above the $5,830 range after dropping to a low of $5,620.

Also Read: Extreme Cold Storage: A Fortress of Solitude for Bitcoins

After Touching $6,180 Bitcoin’s Price Sees a Slight Correction

Five days ago during our last price report, bitcoin had dipped a touch after reaching a high of $6K per BTC. Following the slight drop, bitcoin markets rallied once again to an all-time high of $6,180 on October 21. Since then the decentralized currency’s market value corrected as the price consolidated around $5,860-5,900, but has been heading south ever since. At the moment BTC’s market value has hit a temporary buffer zone above the $5,725-5,800 area, and it seems it’s trying to form some consolidation in this price region.

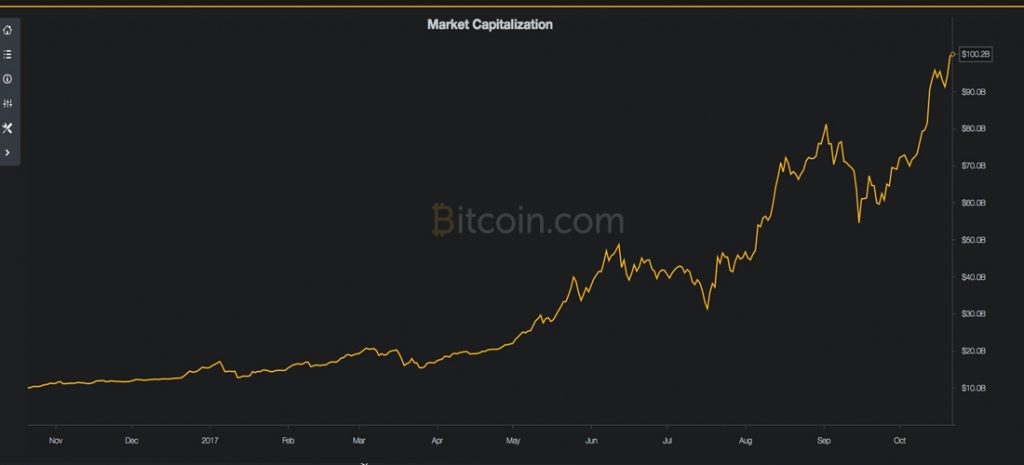

Bitcoin’s market cap shaves $5 billion on October 23.

Bitcoin’s market cap shaves $5 billion on October 23.

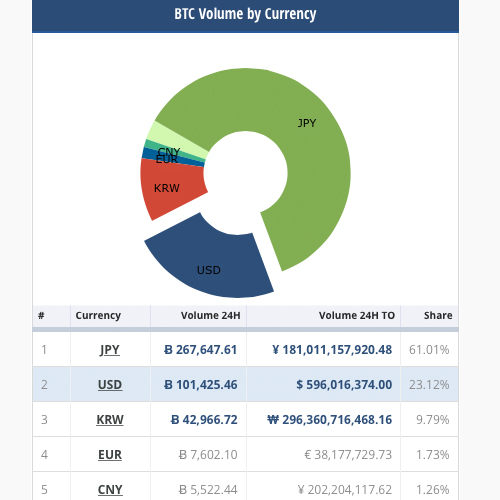

Bitcoin trade volume is decent as $2B worth of BTC trades have taken place over the past 24-hours. The Japanese yen is still in the lead as far as bitcoin trade volume by currency is concerned, as JPY accounts for 61 percent of the market share right now. Other currencies like the dollar, won, euro, and the renminbi are following Japan’s lead. The top five exchanges by volume are Bitfinex, Bithumb, Bitflyer, Bitstamp, and GDAX.

The Japanese yen is leading by over 60 percent.

The Japanese yen is leading by over 60 percent.

Technical Indicators

At the moment charts indicate some consolidation is taking place and bitcoin bulls are finding new positions. Looking at the golden ratio (Fibonacci) trend lines at 61.8 percent, the current pullback could drop a few percentages lower. However, the 100 Simple Moving Average (SMA) is still very much above the longer term 200 SMA which indicates upside targets are still within reach. Although the 100 SMA is heading south presently, and this could also reveal the tides are changing.

Bitcoin markets did rebound after dropping to $5,620 this morning back to $5,800 but the price is currently hovering just above the $5,700 region.

Bitcoin markets did rebound after dropping to $5,620 this morning back to $5,800 but the price is currently hovering just above the $5,700 region.

Order books show decent floors between the $5,300-5,500 range but also show sizeable sell walls above the $5,850 territory. Relative strength index (RSI) is overbought while the Stochastic is meandering through overbought conditions as well. For now, charts suggest some consolidation over the next few days which could lead to another ‘surprise’ upwards spike at some point this week. Looking at the golden ratio from a different perspective, an upside trend could still lead to highs of $6,500 to $7K before the pending November fork.

Crypto-Markets In General Slump

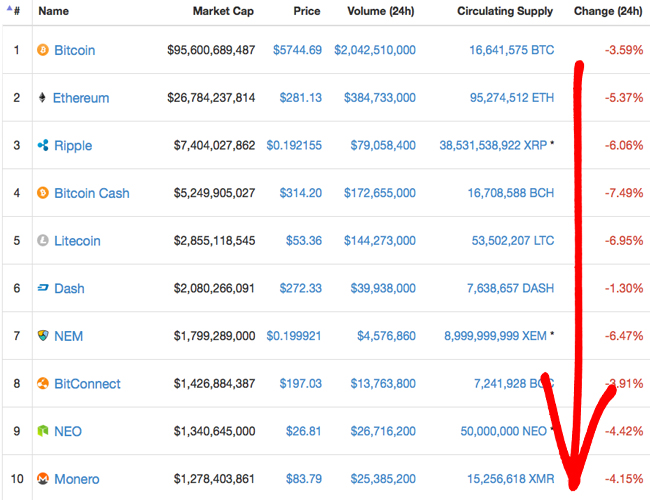

Other digital assets are also experiencing negative prices at the moment following suit with BTC’s drop. Ethereum (ETH) markets are down 5.3 percent at the time of writing as one ETH is $281 per token. Ripple (XRP) markets have dropped lower too with prices slashed by 6 percent as one XRP is $0.19 presently. Bitcoin Cash (BCC) markets have consolidated for the time being at $315 per BCC, but markets are down 7.4 percent. Lastly, Litecoin (LTC) has also seen better days as markets are down 6.9 percent as one LTC is $53 per token at press time. Overall cryptocurrency market valuations have shaved roughly 5 billion off all of the digital asset capitalizations to a low of $164B.

Nearly every other digital asset is following bitcoin’s price drop.

Nearly every other digital asset is following bitcoin’s price drop.

The Verdict

Of course in the eyes of most bitcoin investors, today’s dip was a mere flesh wound, and many traders are still optimistic about reaching new price highs. Positivity in this regard is high as people can still envision bitcoin markets reaching $6,500 to $7K+ before the 2MB hard fork. As we stated during our last markets update, price swings are sure to be volatile in-between this time period. Prices could also drop further than we are today intermittently, but then spike as the days draw closer to the fork. Presently, there are more than two weeks left until the Segwit2x event.

Bear Scenario: Prices could drop to the $5,300-5,500 range from here and maybe dip even further. It’s highly unlikely a drop under $5K will occur from this point forward, but as we explained last week if support breaks under $5,100 then panic selling could ensue. Right now there’s a solid floor just a few hundred dollars lower than the current price, but there are definitely traders hoping it will drop lower. Right now the RSI indicates markets are currently oversold and we will likely continue seeing bearish sentiment, at least for the short term.

Bull Scenario: Bitcoin’s price kettle is still steaming, and volume is pretty good today. It’s likely the current bearish sentiment will reverse after bulls choose better positions. Fibonacci extension levels show prices could still easily reach $6,500 to $7K over the course of the next two weeks. The bullish pressure may be temporary though, as things could drastically change during and after the Segwit2x fork event scheduled for mid-November. However, Bulls don’t seem too exhausted right now, but are merely re-arranging their musical chairs for the next song to begin.

Where do you see the price of bitcoin heading from here? Let us know in the comments below.

Disclaimer: Bitcoin price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Bitstamp, Pixabay, and Crypto-Compare.

At Bitcoin.com there’s a bunch of free helpful services. For instance, check out our Tools page!

The post Markets Update: Bitcoin Price Drops a Touch After Reaching New Highs appeared first on Bitcoin News.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.