Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

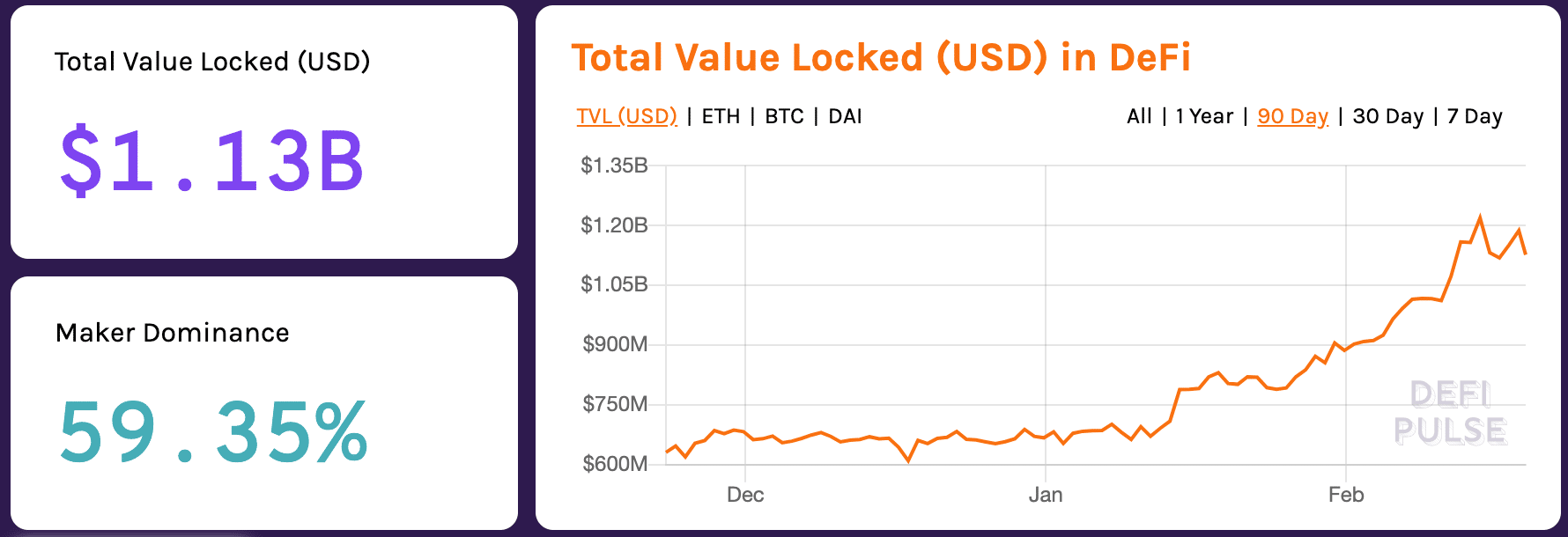

Decentralized Finance “DeFi” has experienced tremendous growth in the past few months, and it looks like it’s only going to continue ramping up. According to DeFi Pulse, there is roughly $1.13B locked into DeFi contracts, nearly double the amount at the start of 2020.

The underpinning of DeFi’s recent rise to popularity is the series of unconventional financial tools that are helping democratize the future of global peer-to-peer lending and transactions.

The underpinning of DeFi’s recent rise to popularity is the series of unconventional financial tools that are helping democratize the future of global peer-to-peer lending and transactions.

We connected with the Chintai team, a Cayman-based platform that seeks to enable the leasing of unused utility tokens. If you haven’t heard about utility tokens in a while, you’re not alone. Utility tokens, or tokens that are essentially a promise to access a future product or service, were exceptionally hyped in the 2017 ICO craze, but the ensuing bear markets cooled off the utility market landscape.

Utility tokens are meant to be used, but most of them are lying dormant. Utility token holders have seen some of their utility token values plummet upwards of 95% and have moved onto focus on other things.

Chintai wants to let utility token holders get some actual utility out of their tokens. With over 250M in transaction volume, Chintai appears to be offering a significantly attractive value proposition, if not at least demonstrating the DeFi ethos of enabling uncaptured financial opportunity in action.

We spoke with Ryan Betham, Chintai COO, about DeFi, Chintai’s recent growth, and the utility token landscape.

Why is DeFi an exciting space right now?

DeFi pioneers are producing tangible use cases that deliver on the dreams which ignited the cryptocurrency movement in the first place. It’s about giving people control of their money, and democratizing access to opportunity – all while eliminating value extractors.

So, here we are today with a plethora of DeFi protocols. Many of which are offering decentralized lending. And it’s working, really well. We’re seeing proof that we don’t need 3rd parties to facilitate one of the most basic building blocks of a new economy – borrowing and lending.

And it’s being done on a global scale, without borders, all executed with code. It’s like watching sprouting seeds for a vision of a new digital economy. How cool is this stuff?!

Can you hypothesize how much more the DeFi space has to grow?

If you broaden the definition of DeFi to include any financial instrument that relies on smart contracts and distributed ledger technology to function, the sky’s the limit. The total monetary value of the global financial system is somewhere around $300 trillion– with a “T”. Not everything needs to be on blockchain.

But there’s a good case to be made that we could see a global financial system that is mostly reliant on blockchain tech. It’s simply too efficient and secure compared to the existing infrastructure. Market principles would suggest you either adapt or die.

Take the $109 trillion bond market as an example. That’s something we’re trying to help fix and blockchain technology is a perfect instrument to bring massive efficiency gains in bond markets. And the great thing is that the solution is disruptive while still being beneficial for big banks, small banks, businesses, and investors simultaneously. Incentives align and everyone wins.

So once people understand the value proposition, we expect this stuff to catch on like fire. It’ll be one of those leaps in evolution that seems slow in the moment, but fast in retrospect.

“Utility tokens are meant to be used, but most of these tokens are lying dormant, collecting virtual dust for the investors that purchased them.” How does Chintai aim to address this issue?

We built the first high-performance, decentralized exchange for lending and borrowing token utility. Not borrowing the currency – borrowing the utility itself. We started with an EOS token leasing market.

For people that don’t know, EOS tokens give you ownership of network CPU and NET. You can think of CPU and NET as the battery power you need to run an application or transact on the network. Without CPU and NET you can’t use the network. So people who own the EOS token, but don’t need to use the CPU and NET, can set an interest rate and lend out their resources to someone who needs CPU and NET.

The borrower pays that interest rate for a fixed period and receives the CPU and NET for their applications or transactions. The cool part is that the borrower doesn’t actually have possession of the tokens because you can delegate CPU and NET while maintaining custody of the token itself.

The whole process is handled by smart contracts so counterparty risk is virtually non-existent. We saw $250 million in transaction volume within six months, had 33,000 unique accounts using the instrument, and roughly $3 million in interest generated for lenders.

Now we’re taking that concept and applying it to any utility token and even NFTs, which represent unique or bespoke items. So you know virtual items in games? Swords, skins, characters – whatever. We want to enable leasing of those items too. We’re also launching a handful of new leasing markets in early 2020 and we’ve already seen promising outcomes. It’s hard to not get excited about this stuff.

What milestones does the non-fungible token (NFT) ecosystem need to hit to reach a point of critical mass?

Generally speaking, the most important milestone is having developer tools that can enable smooth UX. Let’s take gaming for example.

It’s an ecosystem that is ripe for disruption, but doesn’t quite have the tools that game devs need to fully utilize the benefits of blockchain tech.

Gamers are already accustomed to in-game economies. But do you really think they’re going to manage private keys and login to a blockchain account for tokenized virtual assets? Mostly no. So game developers need tools to embed virtual items into games in a way the end-user doesn’t realize they’re using a blockchain at all. We’ve built instruments for this use case specifically. The same engine that facilitates token leasing can also facilitate transactions for NFTs in games.

And that engine can be used in the background, using our API, to embed the process of exchanging virtual items directly into games. No friction for the end user, but all the benefits of blockchain for the gaming industry.

Can you explain how what Chintai is offering is different from competitors?

We’re kind of like a swiss army knife for DeFi. The reason why we can have such a diverse offering is because of our high-performance on-chain order management system (OMS). This is super FinTech geeky stuff so bear with me.

OMS’s match orders and execute agreed terms between buyers and sellers – it’s how an order book is populated on say a crypto exchange except those order management systems are offchain so you lose the transparency that comes with an on-chain OMS.

Our on-chain OMS is agile and highly configurable. It allows us to rapidly build markets for anything from token leasing, to decentralized bonds, NFT trading, and everything in between.

The other cool aspect of our OMS is that we can white label businesses to take part in any Chintai market by allowing them to curate their own front-end UI, set their own fees, and use our exchange in the background to facilitate order management and execution.

This allows people to create highly customized portals or UIs for very specific needs. And the liquidity for every market is shared, so you don’t end up with fractionalized markets.

“Decentralized exchanges that lack compliance with global regulators are at risk of being shut down due to lack of consumer protection and anti-money laundering laws.” – What alternative does Chintai offer?

The on-chain OMS I just mentioned is a big part of it. Regulators want transparency. Since our OMS is on-chain they can trace and see token movements. In our case, accounts will link back to a person’s identity using KYC.

Our users will have their compliance laws encoded into their accounts. And tokenized securities will also have compliance controls coded in as well. So as a user you can only access tokens that are considered legally compliant within the jurisdiction you live.

“Chintai lowers the cost for those who are trying to use the tokens while also providing yield to those who lend them.” – What interest rates does Chintai offer?

Chintai enables markets that have fluctuations like any other market. We’ve seen APR as high as 40%. But usually the APR is more reasonable. Somewhere around 3-10% depending on the market.

Chintai’s suite of products looks pretty, well, sweet. Which of these is the most popular among your users? Which product do you think is being underutilized and offers a ton of value?

The token leasing markets are most used. Mostly because they’ve been live the longest and the DEX is awaiting licensure approval from the Monetary Authority of Singapore so it’s not yet live. The most underrated aspect by far is the Chintai Merchant Network, i.e our OMS white labeling service.

Merchants can set their own fees, build their own custom UI, and Chintai takes care of all order management and execution. It’s extremely powerful. After all, what good would it be if we had all these cool tokens, but couldn’t make a proper market to exchange them within applications or for various use cases?

Can you walk us through how the most popular one works?

Talk to us. We explore exactly what market you want to make and we customize it for you. Or if we already have a market you want, but think could benefit from a better UI, then we white label you to use our OMS and share liquidity that’s already been established. In either case you need to build your UI and set your own fees. But we take care of the rest.

Why EOS?

Chintai was designed to be a high performance, enterprise-grade, fully on-chain Order Management System (OMS). This inherently required us utilizing a blockchain that can handle high transaction volume with low cost; this made Etheruem an unsuitable choice in late 2017 when the project launched.

While the Chintai tech stack does utilize eosio, we are deploying on multiple instances including Worbli (for DeFi) and WAX, Ultra (for commercial gaming) – the EOS blockchain itself features as only a small component of the markets and services.

Additionally, Chintai will shortly be utilizing Liquidapps DAPP Network for horizontal scaling, which includes their LiquidLink service to enable dApps on Ethereum to also leverage Chintai, with the benefits of the on-chain transactional throughput and reflecting back to Ethereum at settlement to minimize gas cost.

From financial service industry discussions to date, indications in terms of preference have been towards leveraging or spinning up an industry/private instance of eosio as the basis for DeFi services, and there is a reluctance to leverage any of the existing public blockchains.

We will continue to make decisions based on our partner feedback and customer needs in that regard, but feel we have the right tech stack to be able to service and scale while leveraging the efficiency benefits of blockchain.

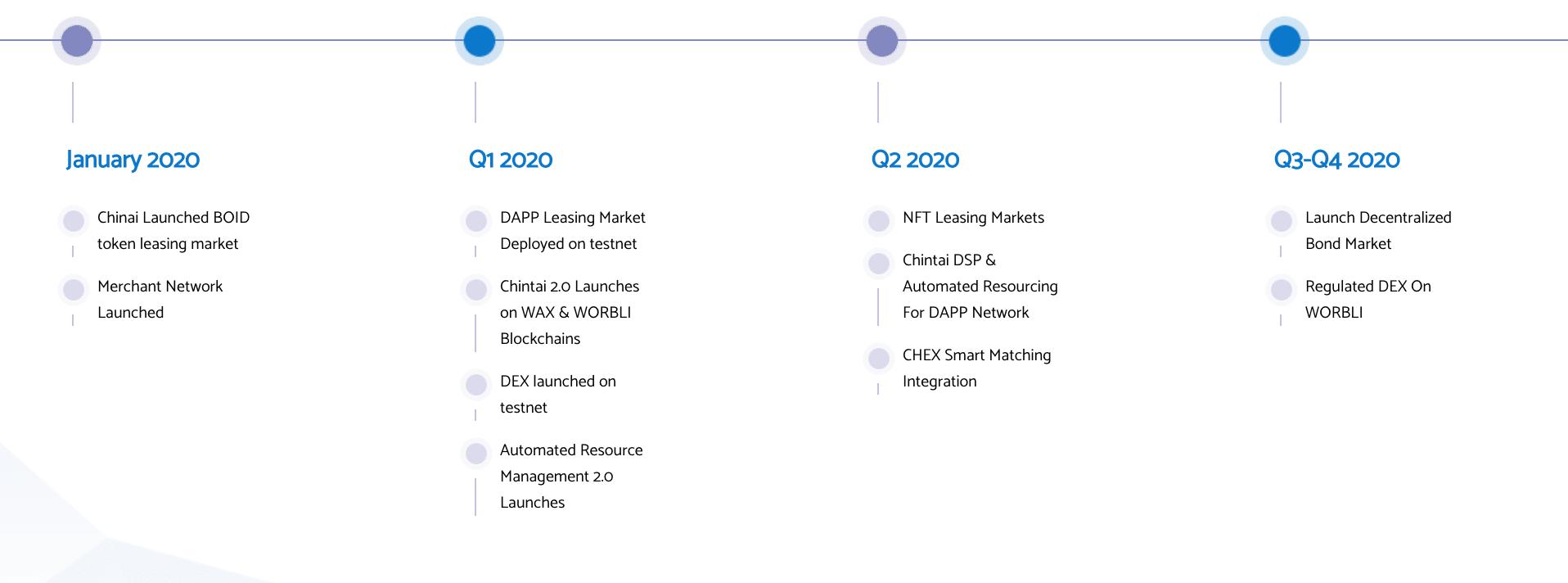

What does the Chintai Roadmap look like for 2020?

2020 is a year of accelerated takeoff. Our primary focus is readying our tech and business for the DEX. We’re establishing our business development team in Singapore to enlist a consortium of banks to issue decentralized Bonds and securities and we’re opening a branch in Germany for our technical team.

This includes lining up a few companies that will pilot STO issuances on the regulated DEX. We are also launching a handful of token leasing markets and formalizing partnerships that will integrate our OMS for gaming, tokenized commercial real estate, and FinTech.

This includes lining up a few companies that will pilot STO issuances on the regulated DEX. We are also launching a handful of token leasing markets and formalizing partnerships that will integrate our OMS for gaming, tokenized commercial real estate, and FinTech.

To help power it all we’ve just opened a pre-seed round in early 2020. But what ambitious startup isn’t trying to raise money? So you probably knew that already.

How can someone get involved with Chintai?

We are probably one of the more transparent and interactive teams. If you ask us what we’re doing at any moment we will tell you as much as we can.

We’ve really enjoyed building a culture where our followers, users, and supporters can go on the ride with us. The best way to get close to the action is telegram or twitter. Both handles are chintaiEOS. Twitter: @chintaiEOSTelegram: https://t.me/ChintaiEOSEmail: hello@chintai.io

The post Crypto’s New Deal: This DeFi Platform is Putting Unused Tokens Back to Work appeared first on CoinCentral.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.