Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Economist and crypto analyst Alex Krüger believes that $20,000 won’t be the all-time high (ATH) bitcoin price for much longer.

Expect Bitcoin Price to Hit $50,000

In a Twitter thread published on Saturday (August 17, 2019), Krüger outlined his argument for the bitcoin price going as high as $50,000 by 2021 at the latest.

According to Krüger, there is a far greater weight of positive driving factors than any negative headwinds that could adversely impact the bitcoin price trajectory.

An excerpt from the thread reads:

Bigger picture, the upside is IMO considerably larger than the downside. Think $BTC will eventually break through $20K, in 2020 or 2021, and once it does, it should trade $30K, $40K and $50K fast. Must be long for when that happens, and enjoy the ride as others FOMO in.

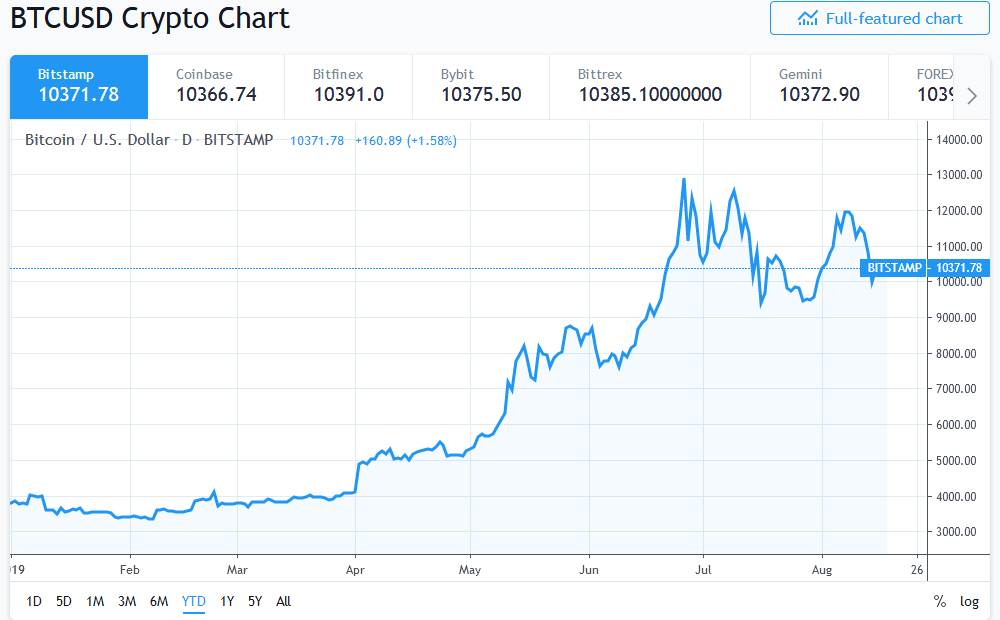

Currently, the bitcoin price is under resistance in the region above the mid-$10,000 level. thus, the top-ranked crypto has appeared range bound between $9,000 and $12,000.

Possible Drawdown to $8,500

Krüger also addressed the debate about a possible bitcoin price slide to $8,500 — the midway point of the current 2019 performance. Some commentators point to the unfilled CME futures gap at this price level as an indication of a likely retracement.

For Krüger, filing the CME gaps isn’t a given pointing to the absence of significant support or resistance as such price levels. Furthermore, the focus on unfilled gaps often takes away from the non-stop trading activities occurring in the spot market.

However, if bitcoin falls below $9,000 there is every likelihood of a steep fall to this $8,500 price mark. According to Krüger, any further downward slide should be taken as a “gift” — a buying opportunity in preparation to a slingshot advance beyond the current 2019 high.

Headwinds for New BTC Price ATH

While the signs appear bullish for bitcoin in the long-term, Krüger believes that there are significant headwinds for BTC.

The profitability for miners remains high as long as the bitcoin price performance remains positive. Thus, it wouldn’t be unusual for miners to “hodl” not just only profits but revenue to be plugged in to cover the cost of running nodes.

However, this profitability encourages the influx of more miners which in turn raises the hash rate and by extension difficulty. More miners in a bull market often mean lower profit margins so participants aren’t “hodling” as much as before.

Do you think the bitcoin price will reach a new ATH before the end of 2019? Let us know in the comments below.

Images via Twitter @krugermacro and Tradingview.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.