Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

After a particularly tumultuous and volatile few months, this week we saw Bitcoin markets stabilize slightly as their trading volume dipped. The SEC rejected yet another pile of Bitcoin ETF requests. Regardless of the small price drop, Bitcoin seems to be continuing its positive trend.

The US-China trade war continues, and in the face of the declining capital markets, the prices of gold and silver continue to rise. However, unlike in past economic crises, Bitcoin is also in the picture. If we look at domestic crises in recent years, Bitcoin has responded with sharp price rises. It is only logical to assume that it may behave the same in a significant international crisis.

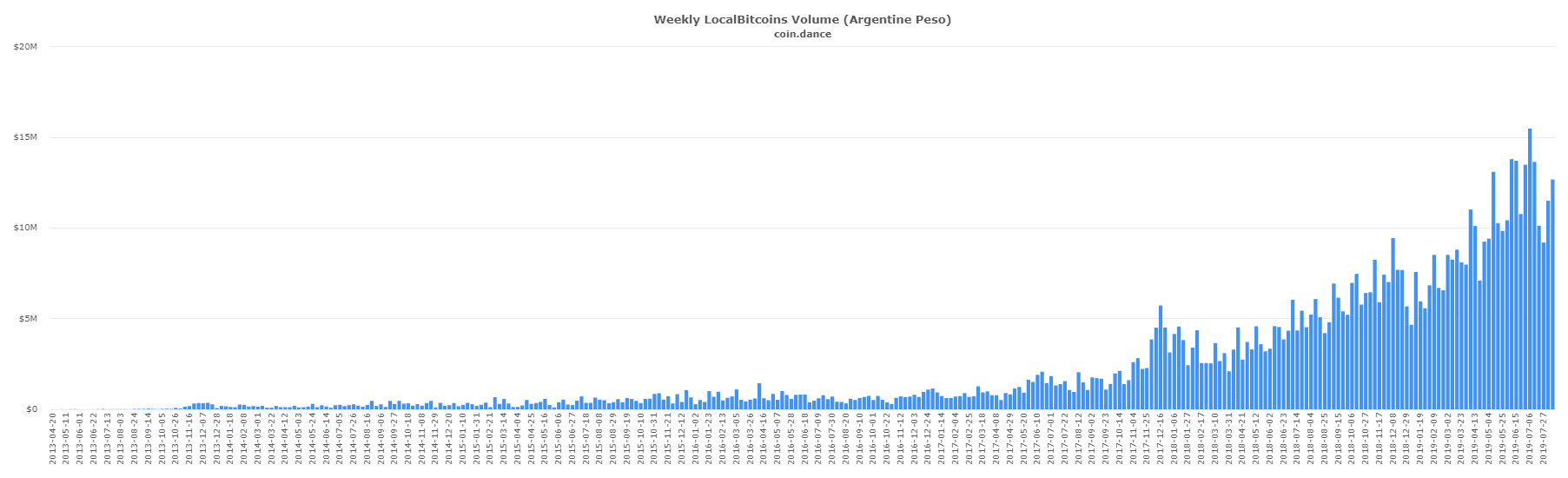

Meanwhile, trading volume on popular P2P exchange LocalBitcoin has reached new highs in response to the downfall of the Argentine peso and collapse of the country’s stock exchange.

In the alts arena, the declines were somewhat halted, and after Bitcoin’s dominance rate reached nearly 70%, alts have started to move upward. However, the price floor is difficult to establish, and Bitcoin’s dominance may continue to climb. The correction in the alts market is a result of the ICO trend that has inflated the space.

However, after regulators clarified their positions on the ICO model, the IEO trend has gained momentum but failed to reach the former’s scale. It is important to remember that not all alts are seeing lows in USD terms, but against Bitcoin, a lot of them have been bleeding and it takes serious imagination to envision a rebound.

Meanwhile, the market is continuing its maturation process. It is no longer a tiny niche comprised of enthusiasts in the wild virtual west, as in recent years large players have entered the market along with regulators which are still trying to understand what crypto is.

In summary, we saw a relatively calm week in the market, and it seems the quiet will not last for long. The price of Bitcoin is in a critical area, and past experience indicates that stability in the market is only the calm before the storm.

Market Data

Market Cap: $293.4B 24h Vol: $44.9B BTC Dominance: 68.6%BTC Longs (BFX): 25.8K BTC

Crypto News

Bitcoin Mainstream Media Adoption: CNBC.com Replaces CAD Tracker With Bitcoin. Prominent media outlet CNBC has put a Bitcoin price tracker on its website. The new tracker replaced that of the Canadian dollar (CAD), signaling greater publicity and adoption of the largest cryptocurrency by market cap.

Bitcoin’s Scarcity: Can It Eventually Catch up With Gold and Silver? Charting a comprehensive Stock-to-Flow model accounting for Bitcoin’s scarcity, popular analyst PlanB thinks that the cryptocurrency will eventually catch up with gold and silver. The model puts the price per Bitcoin at $55,000 following its halving event.

New Zealand to Legalize and Tax Bitcoin Salary Payments Starting in September. New Zealand is set to allow Bitcoin and cryptocurrencies to be used for salary payments starting in September. A ruling also stipulated that they be taxed as per existing PAYE regulations.

Binance Is Investigating a Telegram Group That Might Contain Your KYC. A large number of KYC photos have been leaked to a Telegram group. Binance stated that the company was already working on the issue and announced a bounty of up to 25 BTC for anyone who is able to provide them with valuable information on the matter.

Coinbase Sets Out How It Foiled a ‘Sophisticated’ Hacking Attack. US-based cryptocurrency exchange Coinbase described how it was targeted by a sophisticated and targeted hacking attack. Hackers aimed to access the company’s systems and claim some of the billions it has in holdings.

Goldman Sachs Gets Bullish on Bitcoin With a Price Target of $13,971. International financial giant Goldman Sachs gave a rather bullish forecast on Bitcoin’s price. In a note to customers, its analyst suggested a short-term target of $13,971 which could be the completion of a v wave count from July.

US Federal Reserve Launching Payment System, Crypto Bulls Nonplussed. The US Federal Reserve Board plans to release a system for real-time payments and settlements. The goal is to further boost the country’s payments infrastructure. Dubbed ‘FedNow’, it aims to modernize existing infrastructure and allow for around-the-clock payments, even on weekends.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.