Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

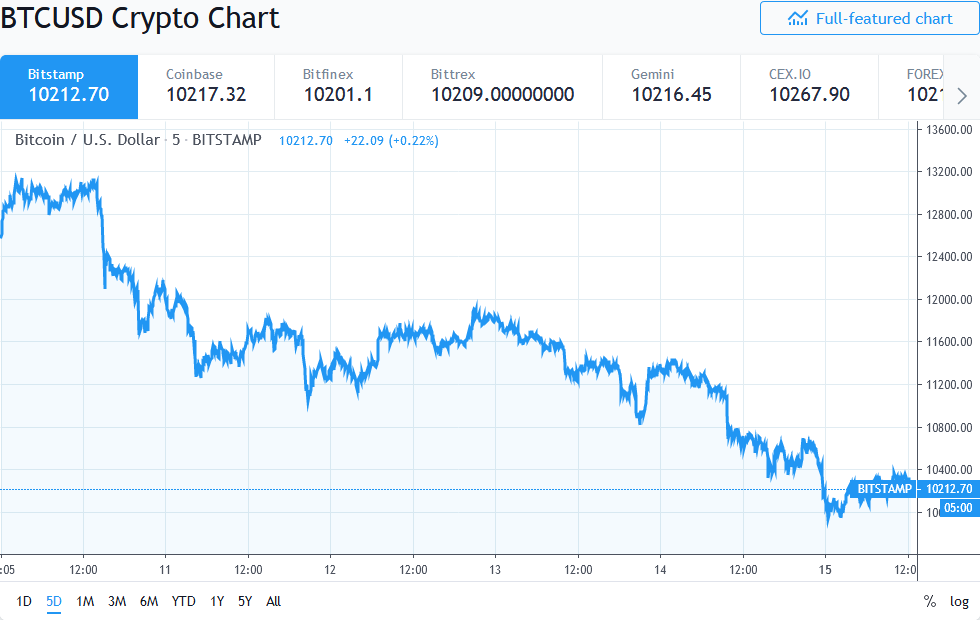

Crypto exchanges are seeing significantly higher outflows of US dollars than inflows over the last 24 hours as bitcoin price hovers tentatively around the psychological $10K support.

Bitcoin Volatility Sends Exchange Users Packing

Tweeting on Monday (July 15, 2019), TokenAnalyst revealed that on-chain inflows for major bitcoin exchanges have been much lower than outflows in the last 24 hours. This trend indicates panic selling as the bitcoin price looks likely to fall below $10,000.

24H BTC exchange on-chain flows:#binance: $85M in | $97M out#bitstamp: $69M in | $159M out#bittrex: $4M in | $6M out#poloniex: $6M in | $4M out#bitmex: $26M in | $24M out

See more at https://t.co/6AFFM1D63p

— TokenAnalyst (@thetokenanalyst) July 15, 2019

Bitcoin is down more than 20% in the last five days since crossing $13k last Wednesday (July 10, 2019). That particular move above $13,000 was the second such occurrence in 2019.

These outflows may be a minor shakeout of weak hands who might have been hopeful for a sustained run beyond $13,000. With the bitcoin price hovering above the $10,300 support level, there is a concern that the top-ranked crypto might lose ground on the gains accrued since June.

According to TokenAnalyst, Bitstamp has seen the largest BTC outflow. As at press time, total withdrawals over the last 24 hours stands at $159 million against just $69 million in deposits.

Other leading crypto exchanges, including Binance and Bittrex have also reported disproportionately higher withdrawal amounts than deposits as their customers exit the volatile market in droves.

Mid-Summer BTC Blues Strikes Again

The previous price march above $13,000 in late June saw a decline that bottomed out at $9,800. At the time, $11.5k proved to be resistance level for bitcoin.

Back in late June, Bitcoinist reported that bitcoin was likely to be overbought by July 13 based on Alex Krüger’s analysis. The Economist and crypto analyst also predicted that BTC will likely fall below $10,000 as a result.

Over the last five days, there has been a growing narrative of BTC likely falling to the $8,000 price level. Bitcoin hasn’t traded at $8,000 since mid-July 2019.

A fall to the $8k level effectively nullifies all the gains accrued since the middle of June. Such a price drop is also in keeping with the mid-summer price blues for bitcoin.

As previously reported by Bitcoinist, the latter half of summer often sees the worst monthly performance for BTC. BTC analyst. Josh Rager. revealed that high selling pressure at BTC’s current price could see a drop to $8,000.

There is also a CME BTC futures gap at $8,500 that is yet unfilled. However, given the overarching bullish narrative which still persists, any pullback will only be a precursor to another upward price march in the long-term.

Do you think the bitcoin price will slide to $8,000 during this price reversal? Let us know in the comments below.

Images via Twitter @thetokenanalyst, Tradingview, Shutterstock

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.