Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

July — Cryptocurrency Exchange Data Analyzed

https://corindex.com/reportRating/2019/July/07/

https://corindex.com/reportRating/2019/July/07/

An analytical platform that focuses on becoming the most comprehensive and exhaustive source of cryptocurrency related analytics, Chain Open Research, has just released its “July 2019 Key Cryptocurrency Exchange Data” report centering around most essential cryptocurrency exchange data up to date.

A Lion’s share of all cryptocurrency transactions happens on cryptocurrency exchanges. Even excluding traders, which are responsible for a substantial part of the transaction volume of any cryptocurrency, there is simply no way for someone to operate within cryptocurrency sphere without utilizing the cryptocurrency exchange (or some other solution allowing for similar procedures) at least occasionally. (e.g. to enter or exit). That is why by analyzing the cryptocurrency exchange data one can get a grasp of the overall state of the crypto game. This corindex report consists of ten chapters, which cover average weighted currency rates, volatility, market capitalizations, unrefined and refined transaction volumes, and other Bitcoin and Cryptocurrency Data.

The first chapter, Average Weighted Currency/USD Rate, is dedicated to the price most transactions were conducted at, calculated as a product of all transaction volumes by the rate at which the transaction was conducted divided by the sum of all transaction volumes.

According to it, Bitcoin has shown the largest increase in the weighted Currency/USD rate of 47.16% during the analyzed period by achieving an average weighted monthly value of 11 386,98 USD. Zcash is second with an increase of 29.49% and a weighted monthly value of 102,88 USD. Decred and Ethereum go toe in toe with increases of 20.2% and 19.34% respectively, which brought them to 30,63 and 280,96 USD. Litecoin wraps up the top 5 by growth, having gained 13.8% during this month achieving the price of 119,19 USD.

https://corindex.com/reportRating/2019/July/07/3

https://corindex.com/reportRating/2019/July/07/3

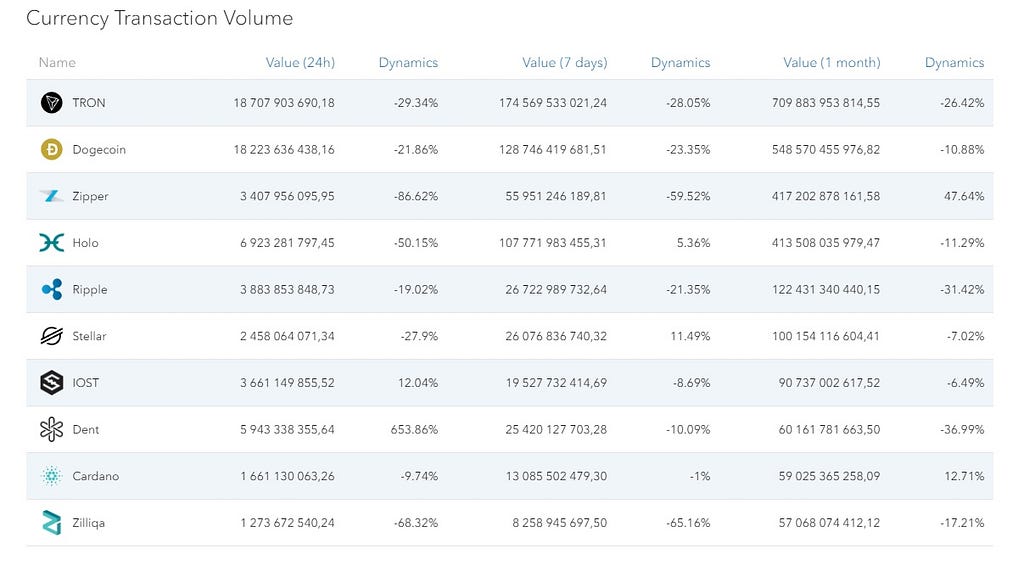

Third and fourth chapters of the corindex report are dedicated to the combined transaction volumes of the main cryptocurrencies on all exchanges.

As stated in them, even despite 26.42% Tron retained its position as the most traded currency with 709 883 953 814,55 TRX being traded during the monthly analyzed period, which amounts to 62 271 425 480,03 USD/USDT. Dogecoin is second with over 35 093 183 385,49 USD worth of it changing hands, even though the number of DOGE traded decreased by almost 11% during this month. Zipper is third with a positive dynamic of 47.64% and over 417B of ZIP being traded over a month, amounting to 52 364 940 787,73 USD. Holo is slightly behind due to a decrease of -11.29% which dropped it down to 413 508 035 979,47 HOT traded during this monthly period. (33 586 648 352,46 USD) The number of XPR traded decreased by -31.42% down to 122 431 340 440,15 Ripple — or 16 386 427 136,02 when expressed in USD/USDT.

Even more so than with stocks, the value of one cryptocurrency coin can range from tiny fractions of a cent to thousands of dollars. Therefore, when talking about the amount of a particular coin traded, one must take into account not only how much of it had been traded, but at what rates as well. The fifth and sixth chapters of this report are dedicated to Currency transaction volumes expressed in USD.

As always, Bitcoin is leading with over 702,11 Billion USD of monthly volume, even though it has dropped 4.21% during this monthly period. Ethereum is second with a volume of 269 360 703 212,00 USD and a drop of -15.52%. With an increase of 9.43%, Litecoin is third, falling shy of 140B USD worth of it traded on all exchanges. EOS takes up the fifth place with 77 070 491 237,00 USD worth of it being traded, which is a -21.78% decrease when compared to the previous month. BitcoinCash and Ripple are relatively close together with 57 589 869 643,00 USD worth of the first and 52 000 623 336,00 USD worth of second having been traded during the monthly analyzed period: negative dynamics of -26.53% and -26.53% respectively.

Even though the declared volumes can be monstrous, the actual amount of currency being used for completing transactions is far less impressive, as during trading coins are usually being sold and bought back dozens of times.

Just like that, only 63 294 255 872,77 USD worth of BTC was used in completing all of this month’ BTC transactions on cryptocurrency exchanges, which is nonetheless 77.79% more than during the previous month. 15 738 261 576,24 USD of ETH was used for completing transactions this month (only 1% less than during previous.) The amount of LTC used increased by 10.78% up to 11 710 724 137,56 USD worth of it. EOS is marginally behind with a drop of -3.36% which led to only 10 327 004 011,90 USD worth of EOS being used for completing transactions. Almost 7 Billion dollars worth of XPR were used for carrying out all the transactions. (That’s 11 percent less than during the previous month.)

Cryptocurrency markets are relatively young and therefore single assets can take up large portions of the total capitalization. The seventh chapter of the report developed by Cryptocurrency Analytics Platform Chain Open Research is dedicated to Currency Shares in Total Cryptoasset Market Capitalization.

Unsurprisingly, Bitcoin contributes a lion’s share — over 67% of value to the cryptocurrency market, which is 12.07% more than during the previous 30-day period. Ethereum is second, taking up 10,354826% of the market share, which is -9.31% decrease when compared to its previous monthly results. Ripple’s capitalization contributes 0,05571015 to the total cryptocurrency market cap — 27 percent less than during June. Litecoin and Bitcoin Cash contribute nearly equal amounts: 0,02481472 and 0,02433924, both having dropped by -15.83% and -19.76% respectively. The contribution of EOS decreased by -28.93% and is now only 0,01790809.

July Cryptocurrency exchange data analyzed was originally published in HackerNoon.com on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.