Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

How Profitable will Libra be for its Early Investors?

In a previous article, we, briefly, examined Facebook’s newest adventure, Project Libra, and the characteristics of its to-be cryptocurrency, Libra. Particularly, we looked at the design of the underlying Libra Reserve, which according to documents released so far by Project Libra, it is to be a reserve of liquid assets in different currencies to fully back any Libra in circulation.

To recap, the Libra Reserve will function as the de facto foreign exchange reserve for Libra, the Libra will likely go live at a predefined peg level, e.g. 1 Libra = 1USD, and the reserve will function as the bottom line of value exchange, that is, if the market value of Libra drop below the peg level, one can always exchange it (with some twists) against the reserve at the fully pegged value, therefore, pocketing the positive difference.

This design will strongly incentivise the market to not trade Libra below its pegged value, however, it is not clear from the documents released so far whether Project Libra will actively intervene in the market to buy Libra when if it falls below the peg and sell if it raises above (it was noted in the previous article that incentive alone is unlikely to keep market speculation in bay and maintaining the peg level).

Project Libra also promised to not engage in “money printing” and that “On both the investor and user side, there is only one way to create more Libra — by purchasing more Libra for fiat and growing the reserve.”

The previous article also noted a rather “controversial” design to rewards Libra holders/users, that is:

Users of Libra do not receive a return from the reserve… [assets’] returns will go to pay dividends to early investors in the Libra Investment Token for their initial contributions.

In other words, the assets Project Libra buys and holds will yield interest returns, however, only early investors will receive these returns (after excluding administration costs) but normal users will not.

So, how profitable will the Libra be for its early investors? The short answer is, of course, it depends, and the longer answer is what this article sets to answer.

Note: this is not the usual type of article I write or even like to write, as it is pure speculation, a sterotyped guru/specialist prediction into a random and chaotic future seeking for certaintly when there is, by definition, none. However, for the sake of, I suppose fun, let’s give it a try.

As for any socio-economics estimation, it relies on assumptions, and for this one, let’s assume the following, for simplicity and for clarification necessities:

- There will be only one round of early investment for a fixed amount (e.g. 1 million USD) and no subsequent investments qualify as “early”.

- The Libra Reserve will constitute of standard foreign reserve assets composition and therefore, yield similar returns (more details later).

- Interest rates from assets remain constant or will not change drastically (probably the weakest assumption).

- The Libra Reserve will grow at an annual fixed compounding rate (for simplicity).

- No administration costs and, thus, all interests are paid out as dividend (for simplicity).

Libra Reserve Composition

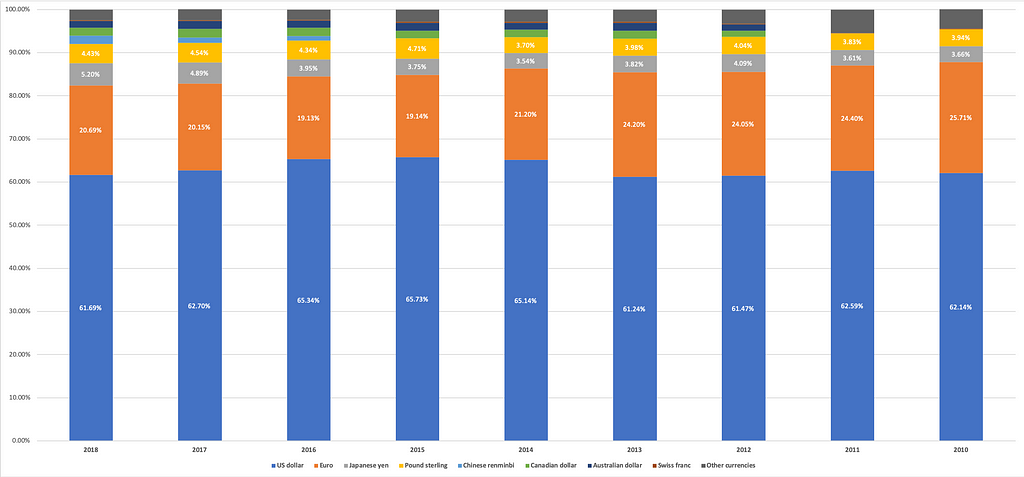

To estimate the annual interest return of Libra Reserve, one needs to first have an idea of what are components of such reserve. As of 2018, a standard foreign exchange reserve held by central banks around the world would consist of the following currencies and proportions:

Source: International Monetary Fund (2018 data).

Source: International Monetary Fund (2018 data).

As you can see, over 92% of the world foreign currency reserve is in just four currencies: US dollar (USD, 62%), Euro (EUR, 21%), Japanese Yen (JPY, 5.2%) and British Pound (GBP, 4.43%). This is has remained largely unchanged for over two decades (and trust me, if you wonder, it has not changed much in 2019 either). Therefore, as per Assumption 2 above, we will assume that the Libra Reserve will hold these currencies and follow the same proportion as well (in fact this assumption will likely hold true, as Project Libra aims to be a global cryptocurrency and largely mimic a central bank function and structure anyway).

As Project Libra stated that the Libra Reserve will hold only safe and liquid assets, we can also safely assume that this means cash and short-term government bonds. As of today, the top four currencies’ short-term bonds (1-month) yield the following (let’s drop the remaining currencies from the calculation and attribute the remaining 8% to USD for simplicity, as it will likely be the case and the result will not change much, if at all): USD 2.23%, Euro -0.54% (mixed between German and French at equal proportion), JPY -0.11%, and GBP 0.74 (in case you are surprised, yes, we do sometimes pay to lend).

A basket of the above proportion (USD 70%, EUR 21%, JPY 5.2% and GBP 4.4%) of assets and returns in bonds will approximately yield an annual return of 1.5% (I’ll spare you of the math here, as it is a basic weighted return calculation). Furthermore, since cash do not yield return or very low (which is not entirely true, you do receive, or paid interest, by parking cash with central banks overnight, but this is usually only applicable to large financial institutions and not sure how much Projects Libra will benefit from this), let’s then discount the cash portion by reducing the annual, and final, yield from interest to 1%.

From this, we derived and established that the Libra Reserve will likely yield:

approximately 1% return annually before administration costs and taxes.

Return Analysis

Any reader with a good finance background will understand that in the world of “professional” (although, it could be argued that sometimes there isn’t much difference between professional and foolish) investment, any positive investment return is always judged by the level of leverage that could be “safely” applied, and to those without, let me explain with a simple example.

Imagine you have USD1m cash and you invest in a bond (safe and liquid) that yields 1% annually, at the end of the year, you’ll receive USD10k or 1% exactly. However, if you manage to find a source of cheap or, better, free financing, you can buy nine more of these nice bonds, making the total bond you hold USD10m when having only USD1m cash. At 1% rate, you’ll now get USD100k at the end of the year, and voilà you now earning at 10% annually before financing costs and taxes.

This, however, is a rare occurrence. As nobody will borrow you money at below government bond rate and if you borrow at above the rate it wouldn’t make sense (i.e. if you borrow for 2% and lend it for 1%, you won’t stay in business for long). In fact, there is pretty much one occurrence (maybe soon to be two) when such an opportunity arises, that is us depositing our money with our banks (to be fair, sometimes banks do pay interests for your deposit but to attract more deposits and grow the snowball of course). Banks are in the business of borrowing for short-term (i.e. day to day deposit) and lending for longer-term (i.e. 1-month government bond) and this is what consists of the core banking business, in case you wonder why bankers complaints when interest rate or government bond yield is low.

In the case of Project Libra, at least in the current design, following the above analogy, Project Libra is the bank (early investors, the shareholders) and users are the sources of cheap, in fact, free financing.

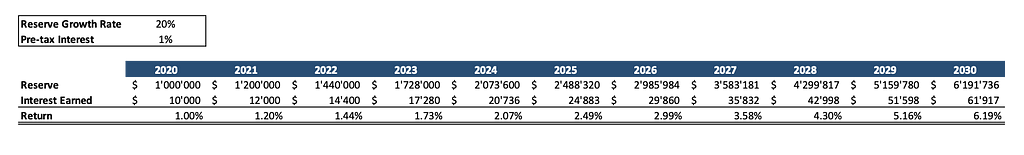

Now, finally, let’s see based on our assumptions what can we expect the early investors of Libra to receive on an annual basis for a ten years horizon using an extremely basic Excel model:

At an assumed constant 5% compound growth rate of the reserve (a rather conservative assumption), we can expect an early investor of Libra to receive 1% interest return in the first year from his/her initial investment and steadily rise to 1.63% per year in about a decade. Not an impressive figure (sorry for disappointing), but keep in mind that this is return just from the safest of the assets and only from interests, without including capital gain/loss (which is too uncertain even to begin to speculate).

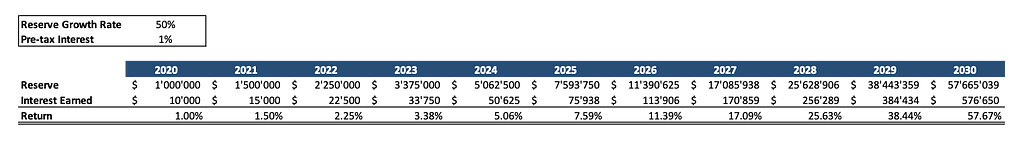

However, as for any compounding return, it can change drastically with time and changes in growth rate (if the above remains true and continue for 100 years, you’ll own the planet). So for the sake of dramatisation, let’s look at examples of much higher Annual Compounding Reserve Growth Rate (i.e. 20% and 50%, which are probably highly unlikely, at least the latter)

If you can manage a return of about 4% return per year from safe government bonds with a sizeable asset pool, you’ll be named “Bond King” on Wall Street. If you manage 57.67% per year you’ll probably be named “Your Majesty the Bond God, Conqueror of the Universe, Ruler of All Kinds,…”.

Risk & Reward Analysis

Similarly, any investment would also need to be judged with regard to its risk and reward. Generally speaking, the higher the risk, higher the reward, and vice versa. However, in the case of Libra, we could be seeing a rather rare case of low risk but high (relatively high at least) reward scenario (please note that this last statement is highly speculative and derive only from my personal opinion without much evidence and analysis).

First, the lack of fiduciary intends (as it is supposedly not meant to be an investment but a medium of exchange). With the creation of an independent entity, Calibra, and its management body, the Libra Association, Facebook Inc (that is the parent company) and the early investors, while meaning to maintain its independence, it also conveniently and have in fact, legally speaking, distance themselves from any potential disasters, so limiting their losses to the amount invested with no financial spillover other than perhaps reputation damages.

Also, since the Libra Association will be the executive management body (similar to that the role of a central bank), there is nothing, legally speaking (I’m personally unaware if there are any technically speaking from the blockchain and protocol perspective) for the Libra Association to change the rules, such as debasing the Libra against its peg level. A kind reminder here to the readers, historically pretty much all countries and governments have promised to not devaluate currencies at their fitting until they felt the need and found the justification to do so (more often than not, due to wars). Similarly, nothing really stops the Libra Association to devaluate the Libra if it becomes a target of “unexpected” and massive speculative attacks. Therefore, saving the reserve at a stop loss level.

Second, if Bitcoin and other cryptocurrencies currently in circulation could be used for any sort of guide, the speculative pressure surely seems to be upwards (increasing market value of the reserve) rather than downwards (reducing the market value of the reserve, therefore, depleting it). Which in the case of the former, it is yet to be clear what Project Libra will do if the total value of the Libras in circulation, due to speculation, raises above the underlying total value of the reserve.

Conclusion

Project Libra isn’t a get rich scheme and certainly isn’t for its normal users, but it has the potential to be a lucrative investment (if we can even call it such), that is, for its early investors. Much remain to be seen and, under pressure from regulators around the world, a lot could still be changed (such as the design of paying dividends to only early investors). Given the above, some regulatory oversights may even be welcomed, not from jealousy or fear as some are possibly suggesting (even in the best of the scenario, fiat currencies are decades ahead, thus, leaving plenty of time to react), but from reasonable concerns and sound minded answers seeking.

The author is an economist and founder at www.iyokus.com, this article reflects only the personal opinion and knowledge of the author and does not necessarily reflect the opinion of any associated parties.

How Profitable will the Libra be for its Early Investors? was originally published in HackerNoon.com on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.