Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Greenspoon Marder LLP partner, Katya Fisher, and compliance attorney, Adam Kemper weigh in on Facebook’s penetration into digital currency.

(L): Katya Fisher, Esq. and (R) Adam Kemper, Esq. | Greenspoon Marder LLP

(L): Katya Fisher, Esq. and (R) Adam Kemper, Esq. | Greenspoon Marder LLP

Twelve years after the world was dealt with its first form of digital currency, Bitcoin, the world’s social media giant, Facebook, has announced that it would be rolling out “Project Libra,” consisting of its own digital currency which will make its official debut in 2020.

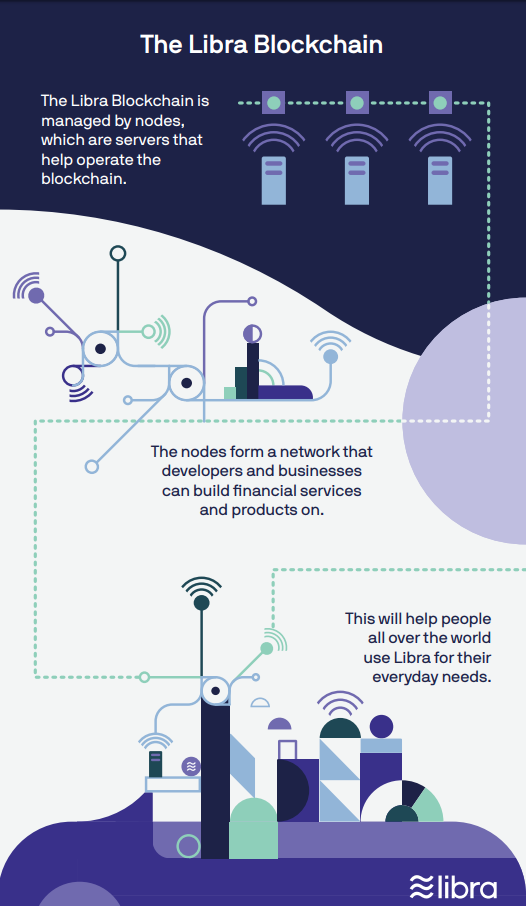

The digital currency, Libra, will be built upon the Libra Blockchain, held in Calibra, a digital custodial wallet that enables storage and usage of the Libra digital currency. Calibra, Inc., a subsidiary of Facebook, Inc., serves to provide financial services as a regulated entity, while reflecting the importance of keeping Calibra’s financial data separate from Facebook’s social data.

“Libra holds the potential to provide billions of people around the world with access to a more inclusive, more open financial ecosystem. We look forward to participating in the Libra network as a Founding Member, as well as through providing our community with access to Libra through Calibra. We know the journey is just the beginning, but together we can achieve Libra’s mission to create a simply global currency and financial infrastructure that will empower billions of people.” — David Marcus, Head of Calibra, Facebook

In light of its announcement back in June, Facebook hasn’t convinced everyone, particularly regulators and lawyers.

So, why is Facebook’s Libra currency off to a rocky start? U.S. lawmakers are not too thrilled given the social media giant’s dubious track record with privacy.

The Recent Request to Halt Libra

Most recently, the U.S. House Committee on Financial Services (CFS) has officially requested that Facebook halt its plans to further continue with the project. Led by Representative Maxine Waters, the committee wrote a letter addressed to Facebook CEO’s, Mark Zuckerberg and David Marcus, as well as COO, Sheryl Sandberg, asking for an immediate moratorium on its plans to implement the project for numerous reasons:

(1) Implementing an entirely new global financial system intended to rival U.S. monetary policy and the U.S. dollar;

(2) Serious privacy, trading, national security, and monetary policy concerns

(3) Evident risks and lack of regulatory protections make it no different in terms of vulnerability than any other cryptocurrency, exchange, and/or digital wallet on the market; and

(4) Lack of depository insurance

However, regarding oversight, Facebook has said it plans to hand over Libra to an independent consortium, called the Libra Association, which would help to facilitate the operation, development, promotion, and expansion of the Libra network and its cryptocurrency. While the CFC committee acknowledged the Libra Association’s existence in its letter, this on its face, still is not enough to instill confidence to the world.

In its conclusion, the committee believes that “because Facebook is already in the hands of a over quarter of the world’s population, it is imperative that Facebook and its partners immediately cease implementation plans until regulators and Congress have an opportunity to examine these issues and take action.”

[…]

“During this moratorium, we intend to hold public hearings on risks and benefits of cryptocurrency-based activities and explore legislative solutions. Failure to cease implementation before we can do so, risks a new Swiss-based financial system that is too big to fail.”

And Facebook’s intention? Compliance and transparency.

“We look forward to working with lawmakers as this process moves forward, including answering their questions at the upcoming House Financial Services and Senate Banking Committee hearings,” a Facebook spokesperson shared with me.

As of today, twenty-seven companies, including financial institutions such as Mastercard, Visa, and PayPal have signed up to act as “nodes,” which requires a $10 million buy-in.

What’s the Legal?

Facebook has recently become notorious for its privacy issues. Problems abound with respect to the safety and security of cryptocurrency wallets and the industry lacks clear and established legal remedies in the event of breach or loss.

I spoke with Katya Fisher, a partner at Greenspoon Marder LLP and Adam Kemper, a cryptocurrency compliance attorney at the firm’s Blockchain Division, about the regulatory impact Facebook’s Libra brings to the consumer market.

“It is unclear to what extent Facebook will have access to consumer financial information or creditworthiness and how it might use and safeguard such data,” Kemper stated. “Although [Facebook] has stated that it intends to comply with financial regulations, details remain to be seen and liability concerns exist for money laundering, fraud, and compliance with various regulatory bodies such as the Financial Crime Enforcement Network (FinCEN) and Commodity Futures Trading Commission (CFTC) in the United States as well as each country in which it intends to effect transactions.”

Andrew Rossow: Katya, in light of regulatory backlash, what do you see as the major issue(s) in the implementation of Libra?

Katya Fisher: I think the representatives from the Committee of Financial Services did a pretty good job summarizing the regulatory issues. From a consumer standpoint, one of the biggest concerns is privacy and data collection. Facebook is currently facing up to $5 billion in fines for privacy violations and sharing data on its users. This is not to be taken lightly: just as one example, Cambridge Analytica gained access to 50 million Facebook users as a way to influence American voters during the election. Now, Facebook will have access to financial data along with other members of the Libra Association.

Many other questions remain. Could the currency be deemed a securities offering? How will Facebook succeed with regulators where so many others have failed? How will Facebook address consumer risks with respect to risk mitigation and insurance for potential hacking and/or breaches? So much remains speculative at this time.

Let’s also not forget that Facebook attempted to launch a digital currency ten years ago and failed. The technology and concept are different now — and times have changed — but it’s anyone’s guess as to how well Libra will succeed.

…

In my conversation with Calibra, it shared with me that it will not be sharing account information or financial data with Facebook, Inc. or any third-party without customer consent. In other words, Calibra customer’s account information and financial data will not be used to improve ad targeting on the Facebook, Inc. family of products.

AR: How about a major benefit?

KF: Facebook and its partners in the Libra Association have tremendous reach and power. If they pull this off, which they very well may, the currency could help bank the unbanked in countries worldwide and help usher in a new era for international finance and payments. Cryptocurrency and decentralized governance structures are being legitimized by a company like Facebook which helps the entire ecosystem.

AR: Do you believe that Facebook can escape the stack of privacy issues before this project is taken seriously by lawmakers and regulators? If so, what do you think are the next steps in remedying the damage already done?

KF: The executives at Facebook are not stupid. They understand privacy is an issue, not just for regulatory reasons, but for user confidence as well. Adopting some of the tenets of cryptocurrency — decentralization and the concept of a trustless system — is an opportunity for Facebook to rehabilitate its image and remain current. I don’t think Facebook can escape these issues entirely but it certainly has a chance for some redemption.

Adam Kemper: Consumers won’t be the issue. Despite its reported privacy concerns, Facebook STILL has roughly 2 billion users and is STILL THE number one social media platform used by people around the world on a daily basis. Therefore, if people use Facebook to communicate with each other from around the world, why not also transact business or exchange currency using the same “easy to use” platform?

Interestingly, there are roughly the same number of people in the world’s population that do not have access to traditional banks (i.e. 2 billion). According to the Libra White Paper, Libra endeavors to make trading easier and more accessible to billions of people (including the unbanked or underbanked population) which may have access to internet and smart phones.

Fortunately for Facebook, it has had the benefit of observing and studying ten plus years of many failed attempts by others to create an easily tradeable and usable form of cryptocurrency to follow Bitcoin’s success.

Indeed, Facebook has structured relationships with the likes of PayPal, Visa, Uber, Coinbase, Lyft, Mastercard, Ebay, Spotfiy, and other major corporations in the financial services and consumer use space to give Facebook and Libra the greatest chance of success. On paper, Libra appears to be THE answer to banking the unbanked population.

However, we still have regulatory uncertainty in the digital currency space. Libra is coming out during a time when laws have not caught up to existing technology and methods of trading forms of digital currency. Regulations are evolving, but yet are still murky regarding the use of cryptocurrency.

As a result, regulators and lawmakers have already exhibited skepticism and resistance to Facebook and why wouldn’t they? Facebook through Libra can very well disrupt the banking system as a whole and change how individuals transact on a daily basis. We are in the midst of a financial revolution.

Regulators understandably want to be to address concerns regarding privacy, consumer protection laws and whether the use of the Libra will provide a mechanism for individuals to launder money or evade taxes. The discussions are ongoing.

Thus, my sense is regulators and lawmakers have requested a moratorium to slow the process of implementation of Libra so they can understand it and try to regulate it before it reaches mass adoption and use. Stay tuned.

…

At the end of the day, Calibra had indicated that it will use Facebook, Inc. data to comply with the law, secure customers’ accounts, mitigate risk, and prevent criminal activity. Beyond those cases, if a Calibra product feature can be personalized or improved with data from Facebook, “we will first obtain customers’ consent to share the relevant data with Calibra.”

Is Facebook Ready for Digital Currency? was originally published in HackerNoon.com on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.