Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Photo by Cody Chan on Unsplash

Photo by Cody Chan on UnsplashShark Cage

It’s a contentious topic. More so since the massive drop in price of Bitcoin in early 2018 from its record high of the year before, when everybody was buying it from Asia to South America, India to Japan. It was a fun free-for-all, with crazy prices and crazy people sniffing a killing to be made, surrounded by fraudsters and bad players, with ICOs here, there and everywhere.

And then it just happened. Regulators butted in. Rules were created and the slide in Bitcoin’s price fell. Blood was on the streets. Investors lost big. The critics of the digital currency were like sharks around chum.

Photo by Jakob Owens on Unsplash

Photo by Jakob Owens on Unsplash

Cages don’t help in this environment.

They became the clever ones. They believed fiat was king and cryptocurrencies were just a fleeting fashion. There were cries on Wall Street, London and all the other financial centres of the world of ‘we told you so’.

They felt vindicated.

And who could blame them?

It’s naturally in business. Some people win and some people lose.

They knew nothing, though, about the coming tide, the change of technology in the financial niche that is going to change the way we think about monetary exchange forever.

So, why is Bitcoin as good, no sorry, better, than fiat currencies?

Historical Perspective

First off, we have to realize that since the dawn of time, since the stone age trade of teeth, shells and fish until things got sophisticated with obsidian in western Africa, into the Neolithic era in Europe when man started trading and bartering in other materials such as jewels and furs with their neighbours in the Levant, business has occurred. From ancient Mesopotamia to Egypt, Greece, then Rome and into the Dark Ages, trade and commerce have been at the centre of human history. For most of that time, gold was used as standard currency until fiat replaced the gold standard in 1971.

Issued money, however, of the paper and coinage varieties, comes in and goes out of circulation, loses its value, can be destroyed by melting or burning, be price manipulated by governments, overprinted which can cause inflation and the inevitable suffering of populations.

This is where Bitcoin, along with other cryptocurrencies, is far better than fiat.

Why?

Satoshis

There will only ever be 21 million Bitcoin in circulation, meaning hyperinflation will never become a tool of corrupt or irresponsible governments. Additionally, though it is limited in number, Bitcoin can be divided as many times as you want. There are 0.0000001฿ satoshis to one Bitcoin, so that’s just $9,700 satoshis to one dollar (at the time of writing anyway, but I’m sure it’ll be different tomorrow). Talk about being divisible. Moreover, unlike fiat currency, a Bitcoin can never be copied, counterfeited, reproduced, or say in gold’s case, metal impurities added to it to bulk it up and boost its value.

Another advantage it holds over fiat currencies and precious metals like silver and gold is it can be sent anywhere, instantaneously, cheaply, with little or no fuss, across the globe, breaking borders as it does, because in contrast to those types of exchange it wants to replace, it is an intangible asset, a line of code, if you will, that cannot — thank God — be confiscated or taxed.

Third parties have earned too much off fiat currency transfers for too long. With Bitcoin, there is no fee (or fractionally small), as everything is done between two parties, or nodes, requiring no intermediary, no central bank or lead authority like governments to conduct, oversee or evaluate the transaction. It is totally free of all these.

The shackles have been broken and cast off forever.

Isn’t that swell!

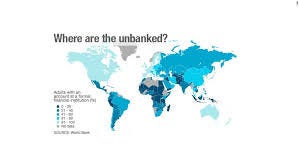

Third World Adoption

You can balk at this notion all you want. But let me tell you this: if we, and I’m talking about people in the western world now, don’t adopt Bitcoin universally as a medium of exchange tool, then people in the developing and Third worlds definitely will. It is there, in those geographical locations, where the majority is unbanked, that Bitcoin and other cryptocurrencies will see their greatest successes. As they have nothing to lose, they will be enthusiastic about its cause.

In Venezuela already, a country racked by political misdeeds and a catastrophic economy brought about by the arrogance, stupidity and overall bungling attitude of Chavist Nicolas Maduro, we see Bitcoin being used and ratified by a portion of the population who see their national currency demoralized by hyperinflation.

Now, currently detractors of Bitcoin say it is just a digital asset, and a highly volatile one at that, I know, but they fail to see the point that just like gold became thousands of years ago, after being just a mineral in the ground, people discovered it, began to appreciate it, then value it as a commodity, before mindfully allocating it subjectively as a store of value.

Psychologically speaking, value is only in the eye of the beholder, it is a subjective choice, consensus-bound within the group or society.

Asset.

Store of value.

A medium of exchange.

Unit of account.

These are the cornerstones of any economic system. Today, gold is all of these. Fiat currencies, too (except maybe the Venezuelan bolivar and the Cuban peso amongst others). Bitcoin is definitely the first and the third, at least between users on the blockchain, becoming more of the third and will, I hope with time, claim the fourth one as well.

As far as the future of Bitcoin, though, who knows?

Mainstream Use

None of us are fortune tellers, no matter what the vile cretins (though not always) on Wall Street and the City of London seem to think of their self-acclaimed financial savvy. But if Bitcoin becomes accepted into the mainstream, by that assumption with countless use cases of its successful implementation in the commercial and technological sphere, proves it’s a reliable utility as a ‘currency’ (should I say that word?), then I can only see it expanding its presence and influence globally. Whether it does or not is still open to debate. Early days are early days. Even though we are at Bitcoin’s ten-year anniversary already, in real terms we have hardly started.

That is both exciting and a little frustrating. Exciting because we can build its legacy from the ground up, create its utility that best serves mankind. On the other hand, though, being almost at its inception in regard to practical use cases in execution and performance can leave us with many more steps to take before it becomes part and parcel of our daily lives, accepted as a mainstream medium of exchange and store of value.

So, sit back, pour yourself a stiff one, light a cigar and watch the show.

Because it’s going to be a good one, believe me.

Bitcoin: The Shining Light of Money (Sorry, I Meant Cryptocurrency) was originally published in HackerNoon.com on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.