Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Ownership investing, or “equity” as it’s better known as, is purchasing investments such as stocks, real estate, collectibles, or whole businesses for the purpose of making you a partial owner of the underlying company or asset. And when the value of your investment goes up, you share that increase with all of the other owners.

There are no guarantees that there will be earnings, let alone how much they’ll be, but thanks to security laws, you are protected as an investor and if it goes down you’ll be sharing the loss as well, giving you a good risk-reward balance. That’s the “making money with money” instrument that privileged investors are using to make sure they stay rich.

That’s right. Not becoming rich; remaining rich. Because an investor should bring proof of having an annual income exceeding $200,000 or having a net worth exceeding $1 million in order to become “accredited” and have access to these deals. Is that you? If so, then you must already own equity in some pretty successful companies. If not then keep reading because, thanks to the blockchain technology, the following investments became available to any and all types of investors:

- Blue Hill Foundation makes it possible for you to become a co-owner in a real mining operation for as little as €247 (~$280)

- Brickblock makes you one of the owners of a €2 million property in Germany

- 7Pass shares its cannabis business profits with you

- And WestCan Energy makes you a direct owner of their oil and gas acquisitions

These are investment opportunities that for years stayed closed to mainstream investors. In this article we’re going to find out how these companies and many others could open up a traditional sector to global investors and what the catch is. (Spoiler alert: there isn’t one!) If you’re looking for in-depth descriptions on how you can invest in any of the listed companies, we’ll be covering them all later in this article.

Sharing economy: become a co-owner

We already started this conversation talking about ownership and risk management by sharing the earnings and losses with the other owners. This is not just a way of saying that ownership investment makes you a rightful co-owner. As an individual, you will share ownership in an asset with another individual just like you. The investment amount may be different, however, and this translates into a percentage (you own a percentage of the underlying asset or business), but the rights of each owner are the same according to an ownership agreement.

The relationship between co-owners may vary, and the financial and legal obligations vary from one case to another. For example, in regard to real estate , the legal concept of co-owner is defined by the Joint Tenancy or Tenancy In Common. Similarly, co-owners of a bank account or a brokerage account are bound by strict procedures and legal constraints. When that account is closed, all co-owners must be involved.

Can a blockchain impose ownership constraints programmatically?

Currently, most of the ownership rights are gained by signing an ownership agreement; a paper document. There’s nothing wrong with it, but in today’s digital environment is this artifact of the past still efficient? We are claiming to live in a global world, but when it comes to co-ownership deals, all of the involved parties need to find themselves in the same room in order to participate. Otherwise, in order to be part of the deal they have to bring a mediator; a financial institution serving as a deal underwriter. Of course, as a middleman they will take their commission in the meantime. From an investor standpoint, every cent matters, so a lengthy and expensive investing process can be a dealbreaker.

But we know that the blockchain can be used to self-execute contractual clauses to perform credible transactions without the need of a third party, in our case the financial institution. On top of that, the blockchain can also be used as a record of the transactions among the participants, becoming the ultimate proof of ownership. Involving the blockchain in the process adds higher security and lowers costs. Plus, it can “digitally split” the ownership of a single asset into as many fractions (tokens) as needed.

Partial ownership has been a long-standing concept in the form of stocks for publicly-traded companies. Stocks already allow consumers the chance to acquire fractional ownership in companies. The novelty that the blockchain brings is an immediate and convenient way to distribute the ownership of these complex assets, giving entrepreneurs and inventors more financial opportunities than ever before. Because a digital token is more accessible and liquid than a paper contract, it opens up the opportunity to attract funding to a wider range of entrepreneurs, which could fuel a technological revolution.

Are tokens used as funding tools even legal?

It all started when two Florida-based corporate defendants offered real estate contracts for tracts of land with citrus groves. Buyers would become owners of the lands but, as most of them were not farmers and did not have any agricultural expertise, they had the option to lend it back to the defendants who could harvest, pool, market the citrus, and share the profits. Good deal, right? Anyway, this action was deemed illegal by the U.S. Securities and Exchange Commission (SEC). They found that the “buy-lend-share” contract was actually an investment contract and should be registered as a security.

Right after this scandal, the SEC developed a test that can be used to determine whether or a certain transaction is an investment contract. This test is still used today and is known as the “Howey Test”. This is essentially what the Howey Test asks:

- Is it an investment of money?

- Is the investment in a common enterprise?

- Is there an expectation of profit from the work of the promoters or the third party?

Sounds a lot like the “ownership token” we were talking about previously, right? The token is an investment contract that represents the legal ownership of an asset, like a business. Ownership that can be verified within the blockchain. It successfully passes the Howey Test. That’s why it is called a security token, and if all the regulations are properly met, then these tokens have immensely powerful use cases.

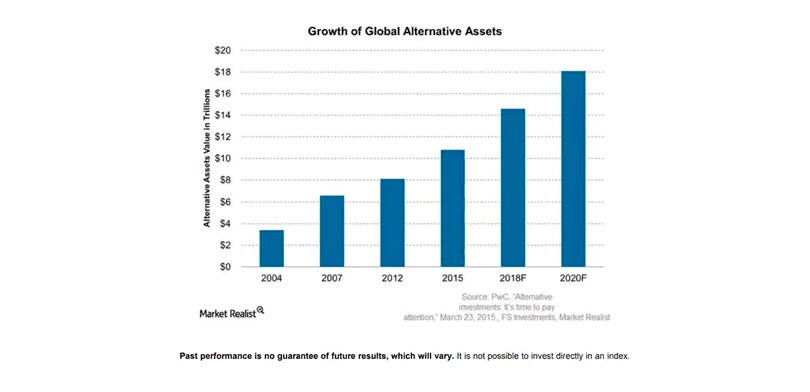

“It’s inevitable that security tokens will transform equity just as bitcoin has transformed currency, because they afford the owner a direct, liquid economic interest and the expedited delivery of proceeds. Every type of ownership can be tokenized, which is a massive multi-trillion dollar addressable market,” as stated by Carlos Domingo, the founder of SPICE Venture Capital.

How can you become an owner via the blockchain?

Business owners are usually running a security token offering (STO) when they can distribute the token in question. Investors would be able to trade these fractional shares like they would any cryptocurrency; accumulating, holding, and selling it as they see fit. The ultimate goal is to hold the tokens until the real asset becomes publicly traded, like stocks, an event that could produce an immediate increase in their value. Where can an individual investor find such opportunities?

The first and most surprising one comes from the “Blue Hill Foundation”, which is responsible for the pre-sale of BHF-Tokens. These will be exchanged for BHM Tokens, which hold the rights to (0.00000004%) co-ownership of the “Blue Hill Mine”, a large-scale mining operation that is forecasted to have one of the largest copper reserves in Asia (located in Mongolia). BHF-Tokens are available for all types of individual investors. They are not regulated, they follow the FINMA and the SEC terms and conditions, and they will be exchanged for the fully regulated BHM-Tokens (1-to-1) during the B.H.Mining-STO. BHM-Tokens will be listed on the exchanges for $0.45, but today BHF-Tokens can be purchased at a preferential price.

By the end of the process, you will be a partial owner of the “Blue Hill Mine”, which is in the form of digital, asset-backed programmable ownership. “Blue Hill Mining” aims to create sustainable growth using part of the profits generated from the sale of raw materials to the market, as well as their future “Blue Hill Platform”, a peer-to-peer platform for trading mineral resources. The next important step, for now, is regulatory approval from one of the authorities (European Regulation, FINMA, SEC) of the B.H.Mining-STO. But even in the very unlikely case where regulatory compliance is not granted, the investors will be indemnified from the sale of the “Blue Hill Mine” to the stock market.

For those interested in real estate, Brickblock is developing a smart contract platform for selling and investing tokenized assets, such as real estate. Investors can buy Proof-of-Asset (PoA) tokens with other cryptocurrency, which entitles its owners to the profits of the underlying asset. It can be seen as a connection between the mortar assets (real estate) and crypto funds powered by smart contracts. By cutting out the middlemen, Brickblock reduces the cost of investing for a more streamlined process. Keep in mind, the process has not yet been finalized and the tokens can’t be converted into fiat; a feature that is scheduled to be made available in the final quarter of 2019.

With the cannabis industry currently booming, the team at 7Pass is focused on how cannabis positive effects are delivered to people and provide capital for selected entrepreneurs to start and grow their own businesses in the field. That opens up the opportunity for you as an individual to invest in a spectrum of emerging companies in the cannabis sector. Through the tokenization of their shares, 7Pass offers a security token, the 7Pass token, which makes you a shareholder in their company and gives you direct access to the investment returns. Despite their promise to identify and build cannabis market leaders, there is a long road ahead of them in terms of legislative dissonance, nascent financial infrastructure, and companies with little or no operating history.

Similar to the B.H.Foundation, WestCan Energy opens up a traditional sector to individual investors, and the company is set to acquire and develop high-quality, undervalued oil and gas assets. Then, by using standard field development techniques, they can operate the fields to maximize oil recovery. Their operation is funded through an asset-backed security token backed by the market value of the acquired oil and gas assets. This token gives owners direct rights to the underlying oil and gas commodity value. But because security tokens are subject to regulation in the United States, Canada, and other jurisdictions, this opportunity remains available only for the accredited investors in those regions.

Who’s going to benefit on this opportunities?

Security tokens are becoming the preferred mode of crowdfunding, opening new investment opportunities to individual investors. They are regulated and secure like IPOs, but they are also coming at a cheaper price for both entrepreneurs and investors. The removal of the middleman comes with financial advantages. However, financial institutions are set to meet more functions than deal underwriting. They are also in charge of solicitation of investor interest, insurance of high levels of security, and compliance regulation. That’s, without their involvement, security tokens as investment come with a greater risk.

Regardless of the critics, the blockchain is opening up “programmable ownership” to a wide variety of people. Before stating that the investment market won’t be able to successfully replace traditional financial institutions, we need to wait and watch if these fears have any basis or not. Sitting on the sidelines can make you miss the best opportunities only early adopters usually get. But, by the end of the day, the decision is always yours!

Programmable Ownership: What Security Tokens mean for Individuals was originally published in HackerNoon.com on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.