Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Universal Basic Income: The Value of Post Scarcity [Part 2]

“Universal Basic Services” is better than UBI, but for either to work, we’re going to have to re-evaluate economic meaning.

In Part 1 of this series, I explained that the beginning of post-scarcity is already here, but is difficult to recognize because economics paradigms have thus far equated value with scarcity and demand. Goods which are scarce and highly demanded are those which fetch the highest “prices” on the market.

I pointed out that goods which are anomalies in these economic paradigms (good which are post-scarce), are met with regulations and attempts to create artificial scarcity (in the form of IP laws, or even simply waste). Creating artificial scarcity is rational — because people must increase profits to pay bills and to wealth-signal.

Unfortunately, rational behavior in this economic paradigm sometimes betrays our moral intuitions. If a good is post-scarce (like certain foods are), is it morally okay to deny access to people who want it or need it, but cannot afford it? In this current scarcity-centric economic paradigm, many people will say “yes, it’s okay, because that’s where the consumer’s fist meets the producer’s nose.”

But that’s exactly the problem. A problem that I think can be at least partially alleviated with a new economic paradigm that’s capable of understanding a thing’s value not just by its relative scarcity, but also by its real, experienced value.

Road-blocks to the new economic paradigm

Before explaining the bones of a new economic paradigm, it’s important to identify why scarcity-centric paradigms are the standard in the first place. So let’s peel those layers back.

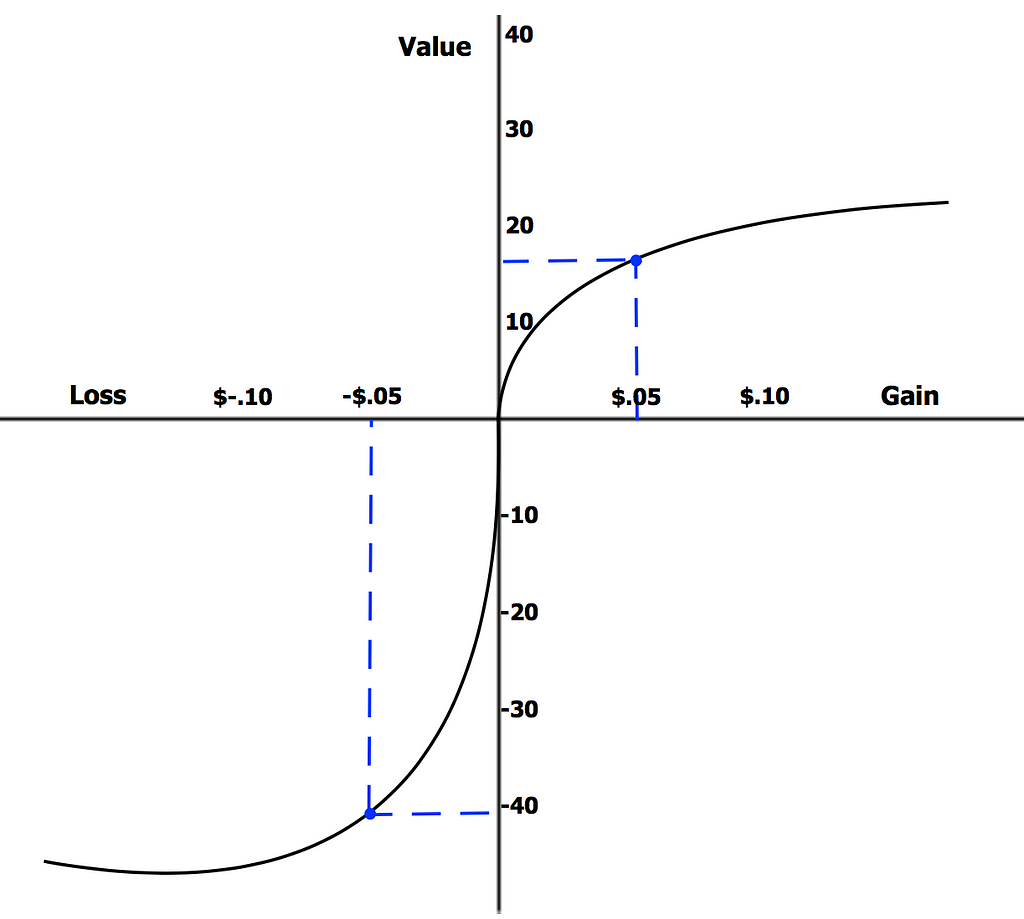

In part 1 of this series, I explained that scarcity was indeed more widespread the further back in history you go. There are evolutionary mechanisms which may help explain why scarcity — even to the extent that behavioral economists have found that we value goods more highly when told our access to them will diminish.

A hallmark study found that how well a laundry detergent worked seemed to depend on whether you asked consumers in a region in which it was being regulated away (they said worked better), or in a region in which no regulations were being put in place (they said it worked worse). For those interested in how are brains are particularly attuned to scarcity, I encourage you to follow-up by learning about loss aversion, reactance, and delay discounting.

I will not delve deeply into these issues, because I think that the far more compelling road-blocks to adopting a new economic paradigm, are our deeply-held philosophical assumptions about the nature of reality. This sounds a little matrix-y but hang with me.

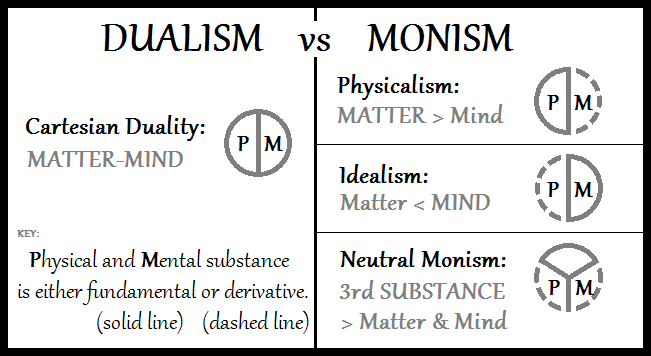

Hermeneutic thinking is closest to “neutral monism” depicted here.

Hermeneutic thinking is closest to “neutral monism” depicted here.

From Newton’s heyday until Einstein’s, the overwhelming way in which scientists have thought about reality is in dualistic terms.

By this, I mean that there are two different spheres of reality: the objective, and the subjective. The objective world is generally thought to consist of physical matter, while the subjective world is the mental world — it’s how we project ideas onto the objective world and make sense of it.

Importantly, however, is that the subjective world is thought to be less “real.” It contaminates our understanding of “objective” truth — and needs to be disposed of when conducting scientific experiments. That’s why scientists obsess over control groups and keeping sterile lab environments lest they “bias” results.

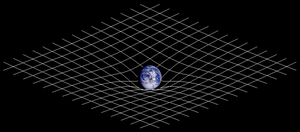

When Einstein came around, the unthinkable happened — he turned the dualistic scientific paradigm upside-down. The speed at which something moves — and even the temporal ordering of events and the experience of time — depend on one’s location and relative speed — there simply is no uncontaminated “objective” reality, just a collection of relative realities as infinite as the universe itself.

Somehow, scientists influence results of a study no matter what. Later came quantum mechanics — a particle could be in two places at once, a cat could be in opposite states simultaneously. Light could be a particle or a wave — not because the researcher is biased or failed to have adequate controls, but indeed because the nature of reality depends on mesh networks of things comprising one another — and humans are part of that network.

2d illustration of 3d space-time curvature as posed by Einstein’s general theory of relativity.

2d illustration of 3d space-time curvature as posed by Einstein’s general theory of relativity.

While physical scientists have been trying for years to wrap their minds around the implications of relativity and quantum mechanics, social sciences don’t seem to be adjusting.

Although social sciences largely borrowed their philosophical assumptions about the nature of reality from the physical sciences under the rich influence of dualistic Newtonian physics, they just haven’t adapted to the new widely-accepted assumptions — understanding that reality is not dualistic, but monistic. The universe is not comprised of two spheres: the immutable objective and the mutable subjective — but instead is simply one seamless reality.

Despite it’s complete rejection by physicists, the social sciences continue to operate from that old dualistic conception of reality. Capitalists are still leaning heavily into Adam Smith’s The Wealth of Nations which was published in 1776 — fewer than 50 years after Newton’s death! While the call for democratic socialism is increasing, it’s trying to define itself on the back of dualistic conceptions of economic functioning.

Objective & Subjective Measures of Value

Capitalism’s most basic premises treat value dualistically. In a grossly simplified way, you can generally think about macroeconomics as focusing on value from an objective perspective, and microeconomics considering value from a subjective perspective.

Macroeconomists are interested in overall functioning of economies, and the patterns of bubbles and busts. Specific indicators are selected to represent whether value is increasing over time (i.e. GDP, unemployment rate, inflation). These are, in a sense, an “objective” way of determining whether or not an economy is doing “well” or “poorly.”

Cartoon posted on a “safe space” for socialist discussion on Reddit. Ironically illustrates frustration with the ethical dilemma that “market inefficiencies” (or artificial scarcity?) can create.

Cartoon posted on a “safe space” for socialist discussion on Reddit. Ironically illustrates frustration with the ethical dilemma that “market inefficiencies” (or artificial scarcity?) can create.

Socialism is an attempt to push “objective” valuing down to a subjective level. People are given equal goods or access to goods, because those goods and access to those goods are presumed by the state to be equally valuable to all people.

Abstract indicators like the GDP and inflation are thought to be value-boosters and value-dampeners that ought be divided quasi-equally. The idea is that some people somehow extract greater “real” value from their actions (bigger bang for the buck), and that the state’s job is to fix the “real” value inequities as they emerge.

Microeconomics addresses a smaller scope: the economic decisions of people and businesses. Microeconomics still maintains elements of attempting to objectively understand the phenomenon of “value.” However, it makes more room for the subjective experience of value — noting that the relative utility of a good may decrease when considered in relation to how much of a given good a consumer already has (after one gallon of milk, buying two, three, or four might not look so attractive). Behavioral economics arose from this sort of economic study. Kahneman and Tversky realized that people frequently and consistently made decisions that defied classical economics.

Perceived value discrepancy between losses and gains; “loss aversion” discovered by Kahneman and Tversky.

Perceived value discrepancy between losses and gains; “loss aversion” discovered by Kahneman and Tversky.

Social psychologists have oft pointed to behavioral economics as proof that humans behave “irrationally.” They think that a mug they own is worth more than a mug they don’t own. They think losses should be avoided more than identical gains should be pursued. They are looser-pursed when time is of the essence than when they’ve got time to kill. And, as mentioned before, they like to buy stuff more when they’re told they won’t be allowed to in the future. Some of these mental “heuristics” along with economic regulations might perpetuate so-called “market inefficiencies.” These efficiencies, sometimes called anomalies, refer to glitches in the market — when prices of a good don’t reflect it’s “true value” as predicted by supply and demand curves.

Shortcomings of Dualistic Functions of Value

Attempts to ground value in the “objective” and in the “subjective” both fall short. Objective orientations to declaring value cease to be practical — they break with real-world experience. When considering whether to buy a small or a large box of crayons, a person is hardly running mental supply and demand curve calculations.

Whether or not a shirt is worth $20 is often difficult for us to determine. Likewise, most forms of value are incommensurate — would you rather spend $500 on a road trip, or $500 on a TV? These are difficult questions because the values of each don’t lend themselves to direct comparison.

But subjective orientations to declaring value become entirely relativistic and make it impossible to teach economic competence. A person who says that a large bag of jellybeans is worth $1 and a small bag of jellybeans is worth $2 must be “correct.”

An entirely subjective orientation to value also breaks from any ethical realism as well. A person may declare the value of another person’s medical care by setting a price on medication — and this value must be “correct” from a subjectivist approach. Subjectivist approaches to declaring value would naturally allow for price discrimination in order to accurately capture exchanges of value — a dirty word particularly in conjunction with medicine (an inelastic good).

Attempts to value goods purely subjectively also seem to have no leverage. If everyone gets to arbitrarily name their price, then economic incentives crumble. The productive factory owner ceases to have greater purchasing power than their less productive counterparts, and economic progress stunts. That is, if one person can pay $5 for a mug, and the other can pay $2 for the same mug, why bother working so hard?

Dualistic attempts to define value, then, find themselves in an Escher sketch: “objective” measures of value depend on behaviors of so-called “irrational” human beings (and their subjective, mistaken calculations), and efficiency or correctness of “subjective” measures of value depend on the cold, hard facts of abstract concepts like scarcity, supply, and demand elasticity (the basis for declaring economic decisions favorable or unfavorable). Neither attempt to ground value is satisfactory.

Of course, these conceptions are all troubling if one rejects dualistic notions of reality in favor of the monist, hermeneutic one implied by current physics research. What is value, if it is not constituted by the very relationship of goods in relation with persons in a specific context, at a specific time? How could a person ever behave “irrationally” when they are constructing the value of a good by their very actions?

How can one claim that a mug in the abstract is worth anything? Is there some platonic form the mug floating around a vacuum, declaring that it is, in fact, worth exactly $5.323? Of course not. Humans are not capable of acting “irrationally” when they make a value claim. That value is an embodied, situated value.

Hermeneutic Valuing

At the heart of monistic, hermeneutic frameworks is the idea that reality is constructed less of “objects” and more of “meanings.” Meanings are constituted by states in formal systems. Objective valuing mechanisms and subjective valuing mechanisms are inseparable.

Natural language processing works similarly, because each word in a sentence and the location and time the sentence is constructed serve as the context to understand the sentence (“the bat barely missed hitting his head” probably means something different in a cave than it does on a baseball field).

So a pile of cash, a mug, a store, and a customer serve to engender one another, and the value of a mug will depend on context (just like the word “bat”). Hermeneutic valuing frameworks find that objective facts and subjective preferences are inextricable, and so the economic value of something is “real” despite being partially comprised of individual preferences. How?

First, think about how people experience their economic situations. A bank robber who is asked why he stole a bar of gold will likely say “because it’s valuable.”

The robber probably does not think about the bar of gold as a collection of atoms which he imbues with value. The bar of gold just is valuable. If the robber’s police interrogator were to say the bar of gold is “valueless,” we would rightly say that the interrogator is mistaken. The bar of gold, situated in the complex mesh network of the planet, is valuable in a real, meaningful sense.

This book provides an excellent account of how technology has and will yield post-scarcity and give rise to a post-capitalist sharing economy.

This book provides an excellent account of how technology has and will yield post-scarcity and give rise to a post-capitalist sharing economy.

The problem with the current economic paradigm, is that scarcity is the limited scope by which value is constituted.

Thus, there is no room for a network in which goods of plenty are valuable even though we can imagine situations in which this might occur. Despite the fact that everyone who is publicly educated knows the Pythagorean theorem (it is post-scarce), it remains extremely valuable, especially for visual artists, architects, and rocket scientists.

Likewise, many post-scarce goods would continue to be valuable despite their post-scarce nature. Experiences like consuming entertainment are valued not for the sake of something else, but rather for their own sake. For such goods, relative scarcity becomes less meaningful in its mesh-network of value. Perhaps a mug is less valuable to me when there are millions of mugs (though I will always want a few), but is a movie less valuable to me when everybody else can watch it too? Probably not.

If we can create a value-tracking system which accounts for the meanings that people assign to a good, then we can create a value-tracking system which can compare the value of scarce and post-scarce goods.

This would allow business owners to efficiently release their full value to the world, without fear that such a pouring out would reduce overall profits. The way I see it, the ability to equate the relative value of scarce and post-scarce would unleash a huge explosion of progress and a tremendous rise in standard of living, particularly among the poorest. While it allows the wealthy to maintain the wealth they’ve worked hard for, it also increases the mobility of socioeconomic class.

Rather than pitting affordability against profitability, a meaning-centric valuing system would find that more affordable goods are more valuable to people — a bird in the hand is worth two in a bush. It makes it possible to align the incentives of the poor and the rich, while still creating incentives to work hard and climb the SES ladder. Isn’t increasing opportunity valuable to those in the lower classes? Thus, the wealthy will be those that empower the poor.

This is the mechanism which could make universal basic services feasible. Today’s welfare programs are band-aids to fix the unseemly byproduct of a society full of individualists obsessed with stockpiling as much scarcity for themselves as possible. Poverty is a natural byproduct. Instead, a monetary system that’s concerned with generating real value would be full of groups obsessed with continually giving meaningful value to others. In this system of “freeism,” giving value to others is not a loss, and it’s not a moral band-aid, it’s how you thrive economically.

I think this is a beautiful vision for the next steps in economics and politics, and it’s modeled after the meaning-full nature of reality. But how do we get there? Clearly nothing like fiat, or even cryptocurrencies as we know it, are capable of tracking these meanings.

What are some of the next steps to make this vision technologically feasible? Cue the cliffhanger to part 3.

I am building out the egalitarian infrastructure of the decentralized web with ERA. If you enjoyed this article, it would mean a lot if you gave it a clap, shared it, and connected with me on Twitter! You can also subscribe to watch or listen to my podcast!

Universal Basic Income: The Value of Post-scarcity, Pt. 2 was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.