Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Photo by Patrick Lindenberg on Unsplash

Photo by Patrick Lindenberg on Unsplash

The first decade of the existence of cryptocurrencies was everything but lacking events and novelties. The count of “live” cryptocurrency projects has exceeded 2000, with at least an another thousand announced. The number of holders of cryptocurrencies is estimated to be between 13 and 25 million at the end of it.

Starting with Satoshi’s “A Peer-To-Peer Electronic Cash System”, the use cases for cryptocurrencies have extended, diversified, wandered astray, becoming — especially during the beginning and the bloating of the ICO bubble — mainly means to make a few quick bucks on pompous marketing of white papers and LinkedIn profiles.

Several exposed scams and the loss of the vision presented in the Satoshi paper ultimately lead to the burst of the ICO bubble, several months of continuous loss of value of the total market capitalization of the cryptocurrency market, regulatory pressure in certain (financially significant) countries and the discontinuation or cancellation of many announced projects.

The decade of infancy, in spite of providing a number of solutions and improvements through dialectics, still didn’t manage to provide long term solutions to at least three re-occurring problems of crypto, that will have to be solved before the crypto-sphere reaches the Crypto V.3 stage and succeeds in eventually becoming the borderless, decentralized, immutably reliable, censorship resistant and accessible to all electronic cash of the future, growing out of what it is today — a tradable asset, valued through the amount of fiat needed for its’ purchase.

The three core problems of crypto that have to be solved in the quest to find the sound money of the future can be simplified into: sustainability of cryptocurrency mining, (de)centralization and mass adoption.

The sustainability problem of cryptocurrency mining has been observed from the moment Proof Of Work (PoW) mining became a business. The emergence of PoW mining farms, built on power-hungry ASICs and arrays of GPUs brought the concern of electricity consumption and the adverse environmental effects it has.

While last year’s decline in Bitcoin price reduced the number of miners, and consequently the total Bitcoin electricity consumption, its’ price recovery has brought the total back up to being close to the electricity consumption of the Czech Republic. With the awareness of the detrimental effects of PoW mining to the environment in the long run, more and more blockchains introduce the Proof Of Stake (PoS) as their main consensus algorithm to forge blocks. While the PoS consensus requires, no doubt, significantly less power, it introduces — or doesn’t help to solve — the problem of centralization.

(De)centralization

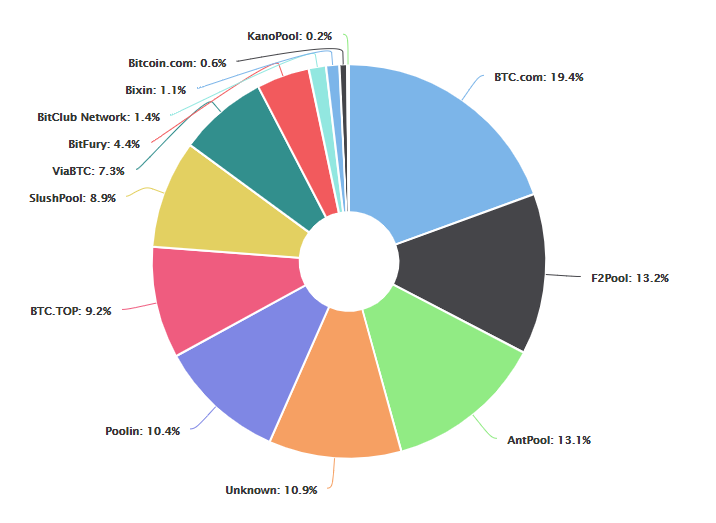

The biggest novelty brought by the cryptocurrency paradigm is in fact decentralization — as opposed to the centralized governance of conventional monetary systems, it hands back the control to the “user” — i.e. the network, which by means of consensus validates transactions and maintains immutable records. Initially, PoW miners enabled high decentralization, but with the accumulation of hashing power of mining farms, mining pools have also grown, which all together increases the risk of centralization of mining resources.

Bitcoin mining pools share on June 29h, 2019. (Source: https://www.blockchain.com/pools)

Bitcoin mining pools share on June 29h, 2019. (Source: https://www.blockchain.com/pools)

With PoS cryptocurrencies, the risk of centralization is a given — the concept of staking distributes rewards for block forgers proportionally to the amount at stake, and with low initial distribution, it doesn’t take too much mathematics to calculate how quickly the network becomes centralized and at risk of a “takeover” — a 51% attack.

Mass adoption

The low adoption of cryptocurrencies as means of payment for purchased goods or services rendered is the result of globally low number of cryptocurrency holders and their mindset that makes cryptocurrencies an investment vehicle rather than a currency for daily use. A part of reasons why the adoption remains low in spite of the large number of cryptocurrencies available is in the primary distribution — crypto is either obtained by mining or by taking part in ICOs, both of which are available to those who can afford/access them.

Secondary markets, even though they are at times very lively, are again accessible to those that come from countries eligible to pass KYC procedures and to those who have enough excess funds to invest in the super-volatile cryptocurrency market.

As long as the access to cryptocurrencies comes at a cost measured and paid for in fiat — such as e.g. the price of building a PoW mining rig or buying cryptos in exchanges, the main use case of cryptocurrencies will remain “investment”, as the holders expect to cover their initial investment and make a profit in fiat, before they are ready to transact with the cryptocurrencies they have.

Why Proof Of Capacity?

Energy Efficient

The Proof Of Capacity (PoC) consensus algorithm has been around since 2014, after it was introduced as the base protocol of the Burst blockchain. The resource used to mine blocks of PoC cryptocurrencies is storage space, where miners store pre-computed hashes — plot files. Every time a block is mined, miners read plot files from hard drives, searching for deadlines computed from stored hashes, which is then submitted to the pool or the wallet. The lowest deadline submitted to the network forges the block.

Given that the operation of hard disks requires considerably less energy (5–10 W), the processing on one transaction on the Burst blockchain uses less electricity than the processing of one Bitcoin transaction by several orders of magnitude (~100.000).

Enabling And Promoting Decentralization

As storage space comes with any computer or handheld device, anyone having unused space on their computer, laptop or even mobile phone can create a plot file and start mining a PoC cryptocurrency, without the need to purchase additional devices or equipment.

The electricity consumption of PoC mining is, in fact, so low that running the Scavenger miner on Android mobiles doesn’t impact the user-perceived duration of the mobile’s operation on one battery charging.

Since the PoC consensus algorithm has been deployed, the PoC plot file has been improved from the PoC1 to the optimized PoC2 plot format, by the Proof Of Capacity Consortium (PoCC), an anonymous developer group focused on the development and the improvement of PoC technology. PoC2 is the current standard plot file format for existing PoC cryptocurrencies. The PoCC recently went one step further in optimization of PoC mining, by introducing the revolutionary Helix plot file format, that doubles the effective mining capacity of PoC miners by “compressing” hashes.

Even though the Helix requires a GPU on the mining system, the total energy consumption of the mining process is lower than with HDD-only setup of equivalent capacity. The innovation has been introduced with the intention to “level the playing field” between big-professional miners that operate miners of up to several petabytes and hobbyist-enthusiasts who mine PoC coins with less hardware, and thus slow down or prevent the centralization of mining resources on PoC blockchains.

An another evolutionary step for PoC, the prototype of which has been prepared by the PoCC is the PoC3 plot file format, that allows for data other than hashes to be mined. The PoC3 concept uses individualized plots, that will contain “the knowledge of mankind” — documents, encyclopedic material and files, which PoC miners will be able to mine.

The current efforts regarding PoC3 are focused on creating a list of relevant files to be used for mining in the future. PoC3 mining addresses smaller mining setups, by enabling them to increase the profitability of their mining operation by taking part in this philanthropic project.

Image courtesy of https://starburst.pink/post/scavenger-mining-android/Accessible To Everyone

Image courtesy of https://starburst.pink/post/scavenger-mining-android/Accessible To Everyone

The technological improvements that have been and are being introduced into the Proof Of Capacity ecosystem grant access to cryptocurrencies for more people than any other paradigm within the crypto-sphere. Given that the number of mobile phones used across the globe already exceeds the number of people, it is a question of mobile appstore policy changes before running mobile crypto miners is a “normal” thing to do.

With the Helix and PoC3, the entry barrier into the primary cryptocurrency market is also being substantially lowered. Having more holders of cryptocurrencies — increasing the geographical “density” of them actually, is likely to encourage the business adoption of cryptocurrencies as well. If one thinks about it — in case there were 100 crypto-holders in a neighborhood, the owner of the local coffee shop, deli or kiosk would have a greater interest to start accepting crypto as payment than when there’s no more than one or two occasional customers that are willing to use their crypto as money. In that way, the business adoption of crypto could be pushed not just by companies driving cryptocurrency projects — which is the current case, with projects striving to create “partnerships” with different businesses, but also from the layer of consumers.

Until now, the PoC layer of the world of crypto has been represented only by Burstcoin. Other coins using the Proof Of Capacity have started to operate only late last year, with several others announced for the future— such as Chia and Diskcoin. It is likely that other projects based on the Proof Of Capacity consensus will soon emerge — given that there are attempts, some of questionable nature, to issue PoC cryptocurrencies.

With the technological improvements introduced in the past year within the PoC ecosystem, that strive to make cryptocurrencies accessible to many — regardless of how much or little they can invest into mining equipment and regardless if they can access secondary cryptocurrency markets, it is just possible that the future in which one can buy their morning coffee on their way to work using the money their mobile phone mined during the night is not too distant.

Crypto V.3: Proof Of Capacity was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.