Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

After a meteoric rise from under $1,000 to almost $20,000 in 2017, bitcoin, the largest cryptocurrency, crashed to $3,000 at the end of 2018. Investors who bought in at the peak of the mania watched their investment shrink by 85%.

In 2019, however, the price has quietly risen by over 300% — back to over $10,000.

There are reports that large institutional investors and funds may be at least partial drivers of the recent rally. Many people believe that the recent rally can’t be sustained without support from more than just bitcoin’s early adopters.

However, investing in crypto is not the same as investing in other asset classes. Not only is it highly volatile and speculative, it comes with new and unique challenges such as valuation methods, technical due diligence, custody, and liquidity. Large institutional investors — such as hedge funds, banks, family offices, and endowments — will need many of the same products services that they need for investing in other asset classes.

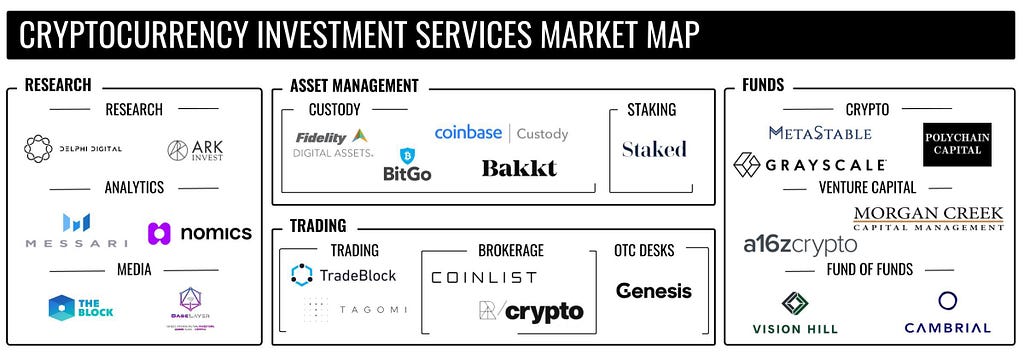

The massive amounts of capital that hasn’t gone into crypto yet has the potential to take crypto back to its all time highs and far beyond it. This article highlights the companies that provide products and services that help hedge funds, banks, endowments, and family offices invest in crypto.

1. Research and Education

Investing in cryptocurrencies requires different due diligence practices and analyses than investing in commodities, stocks, or currencies. You need to evaluate blockchain technology and economics and there aren’t any commonly accepted valuation methods. There are a now a number of companies that educate investors about crypto assets.

Investment Research

On Wall Street, equity research firms conduct extensive due diligence and financial analysis on public companies so that investors can make more educated investment decisions.

Investment research firms in the crypto space — such as Delphi Digital and Ark Invest — provide the same value proposition but have specialized expertise in crypto assets.

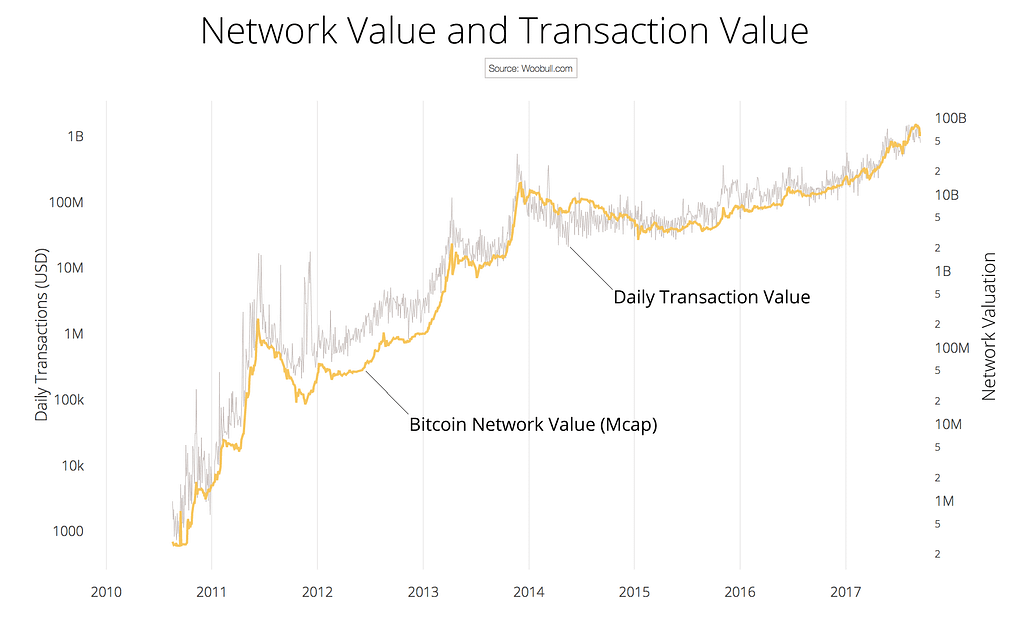

On-Chain and Exchange Analytics Source: Willy Woo

Source: Willy Woo

Companies including Messari, Nomics, Chainalysis, Digital Asset Data, and Adaptive Capital provide metrics on on-chain and crypto exchange activity. For example, Willy Woo, a Partner at Adaptive Capital, reports on bitcoin’s network value and the transaction value flowing through the blockchain to determine when the asset may be over or under valued.

News and Media

There are a number of large media companies that provide news analysis on traditional. Who will become the CNBC of crypto? The Block and CoinDesk are the early front runners.

There are also a number of excellent podcast that that are geared towards institutional investors, including Base Layer by David Nage, Chain Reaction by Tom Shaughnessy, and Off the Chain by Anthony Pompliano.

2. Asset Management

Buying, holding, and managing cryptocurrencies has unique challenges. You need your private keys to make transactions and access your crypto assets. However, private keys are almost impossible to remember and can be stolen or hacked. Online wallets and exchanges are options but there have been many major news stories about hacks and security flaws that have kept less risk-tolerant investors on the sidelines.

Custody

No one wants to invest in an asset and then have it get lost or stolen. Custody companies provide storage and security services for cryptocurrencies.

There’s been a tremendous amount of progress in this sector. Most notably, Fidelity has formed a digital assets group called Fidelity Digital Assets that provides custody and execution services. BitGo, Coinbase, Ledger, and Kingdom Trust also provide crypto custody services.

Staking

Proof of stake is a system for verifying transactions on a blockchain. Whereas cryptocurrencies with a proof of work system, validates transactions and creates new blocks when users perform computational work, a proof of stake system validates transactions and creates new blocks based on the amount of the cryptocurrency that the user owns.

According to Staked, a company that provides staking services for institutional investors, “~25% of the total cryptocurrency market will use proof of stake as a security model by the end of 2019.” That means that owners of proof of stake cryptocurrencies can participate in governance and collect staking rewards.

3. Trading

You can buy stocks through almost any traditional bank or brokerage company. However, until recently, prospective crypto investors didn’t have all the tools and services that they need to buy and trade in a safe and efficient manner.

Trading

TradeBlock, Lumina, and Tagomi provide trade execution, portfolio management, and analytics products built for the needs of large investors.

Brokerage

In 2017, as bitcoin was screaming towards all time-highs, many new crypto projects came to market with hopes of providing similar returns. However, many of these projects are low quality at best and scams at worst. Companies such as CoinList and Republic Crypto help investors filter through all the noise and find the best investment opportunities.

Over the Counter Trading Desks

Most cryptocurrencies don’t have nearly as much trading volume as assets such as large cap stocks. Therefore, if a large investors were to place a large buy or sell order on an exchange such as Coinbase, it could send the market up or down and therefore reduce the investor’s ability to sell at their desired price. Over the counter trading desks such as Genesis connect large buyers and sellers who then make transactions directly.

4. Funds

Many large investors allocate capital to funds who then make direct investments in different assets. For example, rather than investing in specific startups, a family office can invest in a venture capital fund who then sources, evaluates, and invests in a portfolio of startups. There are now a number of funds who make investments directly into various cryptocurrencies and companies who provide products for the cryptocurrency ecosystem.

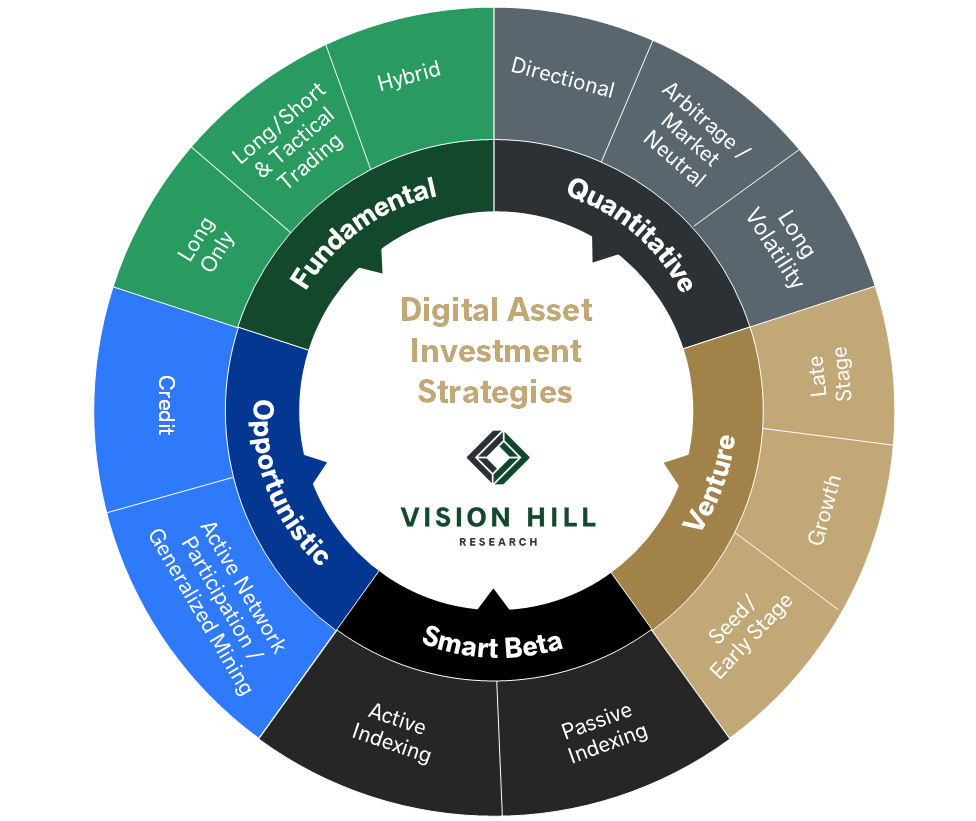

Vision Hill Advisors, a cryptocurrency fund of funds, provides a helpful graphic on the different strategies that crypto funds deploy:

Many funds deploy a mix of these strategies. Here are some of the funds that invest directly in cryptocurrencies, startups in the crypto market, and crypto funds.

Direct Cryptocurrency Investments

Polychain Capital, BlockTower Capital, MetaStable, Bitwise, Multicoin Capital, Arca, Digital Currency Group, Galaxy Digital, CoinShares, and Grayscale Investments are a few of many funds who make direct investments in cryptocurrencies.

Venture Capital

Crypto venture capital finds make equity investments in companies that provide products for the crypto ecosystem. There are a number solutions that are needed to make bitcoin a viable payments system, store of viable, or viable investment opportunity for retail investors and investing in the companies that provide these solutions can deliver significant returns. For example, Coinbase, one of the largest exchanges, is reported to have been valued at $8 billion, which is more than enough to provide significant returns for funds who made venture investments in the company.

a16z Crypto, Pantera Capital, Blockchain Capital, and Digital Currency Group are among the most active dedicated crypto venture capital funds. There are also many venture capital firms who investment in startups in industries outside of crypto who have made investment in the space, such as Union Square Ventures and Boost VC.

Fund of Funds

Similar to investing in cryptocurrencies, investing in crypto funds requires unique expertise and due diligence practices. Institutional investors invest in funds of funds who evaluate crypto investments and invest their clients capital across the best funds. Vision Hill, Cambrial Capital, and Hutt Capital are among the most prominent crypto funds of funds.

The Companies Helping Institutional Investors Buy Bitcoin was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.