Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Money has come a long way since its origins. From cowry shells to crypto, transferable, divisible, and economically sound means of exchange have been adopted by market actors everywhere. Modern history has brought us to a dangerous place, however, a cultural climate where politics and bad economics have co-opted monetary utility in the name of control and coercive influence. Blockchain and crypto provide everyone the opportunity to experience clean, sound, peaceful money. Many, especially younger generations, are now waking up to this reality.

Also read: How to Cold Store Your Cryptocurrency for Safekeeping

The Empty Promise of Free Money

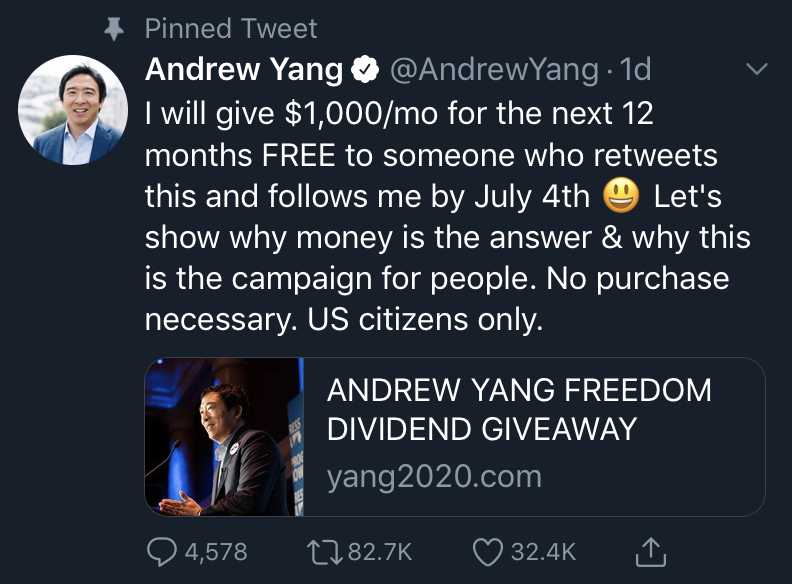

A few days ago, 2020 Democratic Presidential candidate Andrew Yang released a telling tweet.

Of course, paying $1,000 to someone is never “free,” but beyond his misinformed promise, what seems most striking about this is the phrase “money is the answer.” As if money itself, divorced from economic application, can solve anything. U.S. President Donald Trump has recently claimed in similar fashion on live TV that “you never have to default because you print the money…” This is akin to claiming one never has to starve because food will magically appear on the table.

What Money Is

Money as a bare, standalone economic concept has nothing to do with politics, of course. That’s not always easy to tell, however. In a reality where centralized, government-embedded ‘Federal Reserves’ and ‘Financial Services Agencies’ run the socioeconomic landscape, critical definitions have been lost. The concept of money has been grossly perverted. Money is a tool for exchange. A symbol of value. In and of itself it’s not “political” at all.

The history of money predates written record, and as such is subject to much contentious debate. Still, some basic observations can be hazarded. From the cowry shell economies of ancient times all the way to the present day, monetary utility has been recognized and celebrated by humans all over, and for good reason. One man makes wagon wheels. Another, cheese. There comes a time when the one doesn’t need another wagon wheel. But the other guy still needs the cheese, creating a very real problem. Trade becomes impossible. A useful medium of exchange such as tiny shells, bills, or gold coins solves this dilemma by creating an easily transferable and readily divisible representation of value.

Money as Political Propaganda

Donald Trump’s recent tariff-slinging toward Mexico and China has already begun to engender trade war overtones. On the other side of the statist aisle, Democratic opponents of the president are calling for more taxation to pay for everything “for free.”

Trump’s tariffs ultimately penalize the individuals they purport to protect by raising prices and restricting demanded imports. The “everything for free” cries for endless taxation from Democrats results in a restricted free trade as well, as capital and resources are consumed parasitically by the state. Price calculation becomes clunky, centralized and inefficient. Both methodologies are intrinsically violent. They both require legislated threats of aggression to uphold and enforce. Both ideologies are also anti-trade and anti-money. As money’s development was originally a means of keeping peace and order between market actors, the current propagandized model is thus incompatible.

This desperate jockeying for political position is the new “money,” and the cost of the departure from meaning is paid in human lives. This is manifested in the quality of life and in the erosion of free trade itself. When finance is leveraged not as a means of free exchange, but as punitive policy, sanctions begin to starve people. Bombs begin to fall on non-violent men, women, children, and babies. Trade wars escalate tensions. And of course, consumers suffer. Voluntary exchange is made “illegal” in order to ensure that political interests hold sway over all of us.

Fairy Tales From the Wall Street War Machine

“Beautiful ideals were painted for our boys who were sent out to die … No one told them that dollars and cents were the real reason. No one mentioned to them, as they marched away, that their going and their dying would mean huge war profits. No one told these American soldiers that they might be shot down by bullets made by their own brothers here.”

-Major General Smedley D. Butler, War is a Racket.

Most have heard the basic Wall Street fairy tale: the great stock market crash of 1929 was caused by a huge credit bubble. This was the result of unregulated, leveraged trading and speculation in the still relatively new and exciting stock market of the time. If the government would have stepped in, it could have been prevented. Or at least mitigated.

But wait a minute. These very same issues persist today, in spite of massive economic regulations and new laws. 2008’s subprime mortgage crisis and taxpayer subsidized bailout of huge banking interests is one example. The US Department of Defense being unable to account for trillions of dollars is one more of many. If more state regulation is the cure-all, it doesn’t seem to be working.

The classic line is there were too many backroom deals and a systematic private sector gaming of the market in 1929. This is not the whole truth. Politicians and representatives of the state—in conjunction with the Federal Reserve—were also making these secret negotiations and implementing reckless financial policies. The disaster would eventually plunge America into the deeply impoverished period known as the Great Depression. The market did exactly as expected, economically speaking. It corrected itself.

War Is Not the Cure-All

The words of Smedley Butler ring true today. As the world’s leading military arms dealer, and seat of exactly half of the world’s biggest defense contractors, killing in America is big business. U.S.-based arms companies sold an estimated $226B in arms in 2017. One of these companies—Lockheed Martin—sold a bomb to Saudi Arabia which would later destroy a school bus in Yemen. The blast killed 51 people—mostly children. A recent Cato report notes that it’s not uncommon for American soldiers to face enemies wielding U.S.-manufactured weapons on the battlefield.

It would be beyond the scope of this article to trace the complete history of the war-money racket. Suffice to say that Keynesian economists usually point to World War II as “solving” the Great Depression. This isn’t true. According to Richard W. Fulmer, freelance author for the Foundation for Economic Education:

“Contrary to popular belief, the “public works program” known as World War II did not end the Great Depression; it ended the New Deal. The end of the war brought federal spending and tax cuts and the repeal of the Smoot-Hawley tariffs.”

Fulmer is far from alone in his assessment. Boosting GDP statistically, wartime economies do demonstrate remarkable growth. But the production focuses on munitions and other wartime necessities, not items critical to sustaining a flourishing, peacetime economy. There is always a shortage of these goods. Keynesians love the myth, though. It justifies unlimited spending and firing up their beloved Federal Reserve printing presses. The true cure for economic despair, however, is not war, but less centralized interference in markets.

A Return to Concept and Consent via Crypto

If holding vast amounts of money equates to a significant influence in a given society, then controlling the money supply itself would be something akin to godhood. As such, government-backed centralized banks like the Federal Reserve reign supreme. To question them is to question the “almighty,” as it were. To exercise financial autonomy and hold one’s own money directly, and without interference, is the new “blasphemy” for the old guard.

Notwithstanding, this is the return to sound concepts which blockchain and cryptocurrency are providing to many. A property and self-ownership based view of monetary tools. It’s also why so many—especially younger generations—are taking a newfound interest in economics and financial literacy.

The New Cowry Shell Generation

According to Financial Post “Four percent of millennials have owned bitcoin —twice as many as the general population…30 percent said they would prefer to own $1000 of bitcoin over the same value in government bonds. More than a quarter (27 percent) said they considered bitcoin more trustworthy than big banks.” Young people are beginning to look at money differently.

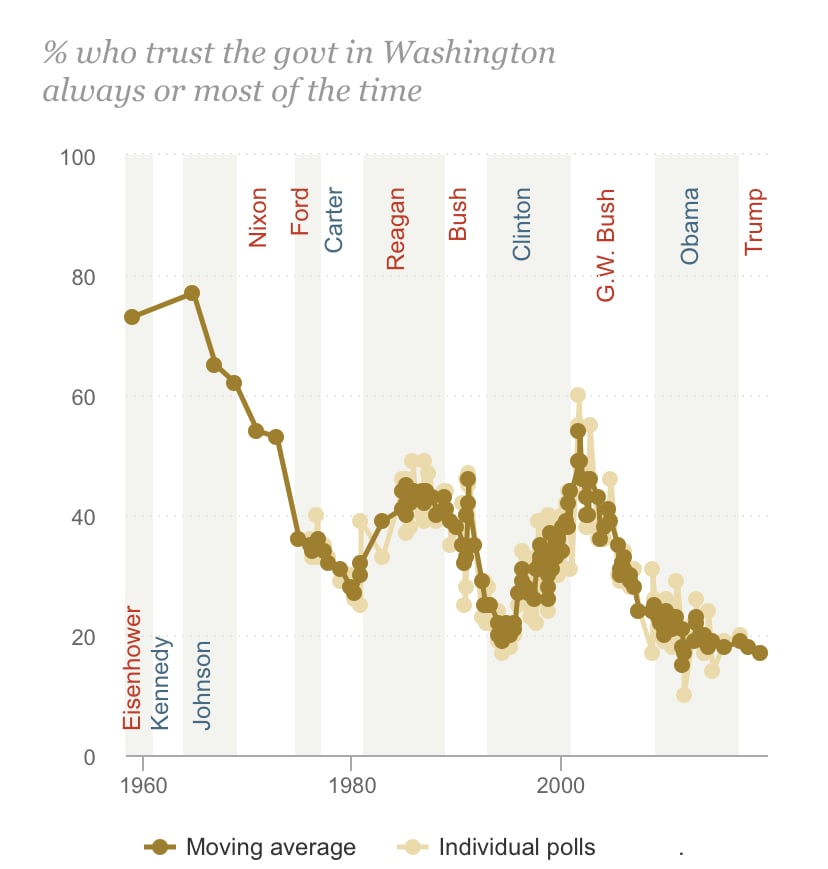

Paying for war with taxes, funding criminal bankers, police, and politicians who harm and kill others, with no say in how one’s money is allocated, is becoming less and less popular. This is not only true for young people, but individuals of all ages and backgrounds. In fact, U.S. public trust in government is now near historic lows, with just 17% trusting the government. Individuals are disengaging from a paradigm rapidly losing any real meaningful relevance to their lives. In the 2016 U.S. presidential election, a whopping 43% of Americans didn’t even show up to the polls.

Great revolutions are philosophical ones. Ideas, and not the initiation of force and violence, have historically been what bring about lasting innovative change and improvements. Information available at the click of a mouse, or the swipe of a smartphone screen is changing society; individuals are questioning the very economic premises once thought to be unshakeable.

A sense of dread and unease has pervaded the fiat system for many, though perhaps they couldn’t pinpoint why. Now they can. Crypto affords a clean, sound means of exchange. A new cowry shell. No inflationary printing, no degrading “percentage of theft” charged under threat of violence, and no ties to war machines destroying human life.

Will new monetary technology like blockchain and cryptocurrencies bring about a philosophical revolution? Let us know in the comments section below.

OP-ed disclaimer: This is an Op-ed article. The opinions expressed in this article are the author’s own. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the Op-ed article. Readers should do their own due diligence before taking any actions related to the content. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any information in this Op-ed article.

Images courtesy of Pixabay, fair use, and the public domain

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.