Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The top 10 crypto assets are responsible for Lion’s share of both transaction volume and market capitalization in the cryptocurrency sphere. Therefore, it’s not inaccurate to claim that the changes to the blockchain wallet statuses of the top 10 cryptocurrencies accurately represent and shed light on the overall state of the cryptocurrency market. This data can be collected by analyzing each cryptocurrency blockchain separately and developing a set of indicators to accurately reflect upon the state of the cryptocurrency market and tell the story of what has transpired during the analyzed period. June 2019 cryptocurrencies transactions and activity Corindex crypto report does just that, aiming to supply you with the most relevant and crucial information on the blockchain trends and development. The report is split into nine chapters, each of which is dedicated to a particular indicator and its performance over 3 different time periods: 24 hours, 7 days and 1 month. Combined they allow for accurate assessment of the blockchain performance and activity.

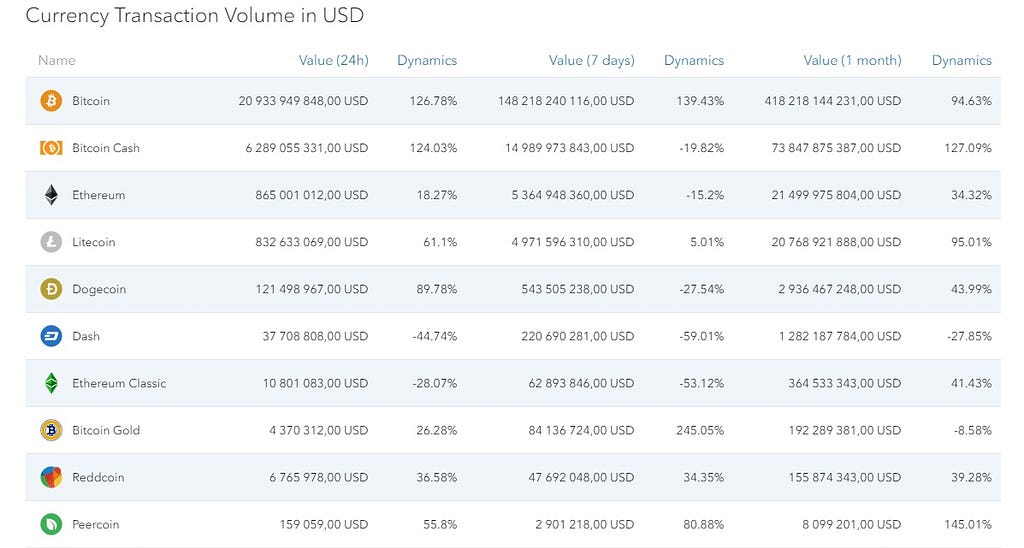

Currency transaction volume indicator is perhaps the most definitive mean of assessing the popularity of a particular currency as well as defining just how much use it actually sees. Furthermore, it can be used to track the progress of a particular blockchain, as most cryptocurrencies are designed to be utilized, not hoarded. Thus, the positive dynamics in the volume of the particular coin may indicate a rapidly developing product and well thought-out use case, even if the price is currently lagging behind.

According to the first chapter of the report, Peercoin (PPC) has demonstrated the largest growth among all advertised cryptocurrencies — 145.01%. This brought it up to 8 099 201,00 USD of monthly volume. BitcoinCash is second largest gainer with a positive dynamics of 127.09% and the monthly volume of 73 847 875 387,00 USD. Litecoin takes up the third place due to an increase in the volume of 95.01%, which carried it to 20 768 921 888,00 USD worth of transaction volume. Bitcoin is only slightly behind, having added 94.63% this month to its already gargantuan volume, which boosted the number up to 418 218 144 231,00 United States dollars. Dogecoin has seen a 43.99% increase in the monthly volume of transactions and now sits at 2 936 467 248,00 USD. A 41.13% positive dynamics was observed in the network of Ethereum classic, so now the volume totals at 364 533 343,00 USD per month. Reddcoin achieved a volume increase of 39.28% with a total of 155 874 343,00 USD worth of RDD being traded per month. BitcoinGold and Dash, on the other hand, are surrendering their positions. Due to a -8.58% decline, only 192 289 381,00 USD worth of BTG changed hands during this month, and Dash has suffered a substantial decline of nearly 28%, which brought its monthly currency transaction volume down to 1 282 187 784,00 USD.

https://corindex.com/reportRating/2019/June/22/1

https://corindex.com/reportRating/2019/June/22/1

The currency transaction volume oftentimes has almost nothing to do with the actual amount of transactions performed, as moving a few dollars worth of some currency is just as easy as moving a few hundred million dollars worth of it. Some factors may also influence the number of currency transactions. Among these are the use case of the coin in question, the demographics of its user base, the technical properties of the blockchain it’s operating on, how widespread the coin/token e.t.c. All the aforementioned factors and many more influence the number of transactions performed on popular blockchains to the point where it may no longer be tightly connected to the transaction volume, so the third chapter of this report deals with how much transactions were successfully performed on the observed blockchain networks.

As stated in this chapter, Ripple has achieved the largest growth spurt of this month — 71.01% and now processes 27 170 529,00 transactions per month. That’s a solid 10.5 transactions per second. The number of Litecoin transactions increased by 44.82% during June up to 986 867,00. The growth of 33.71% has brought Ethereum to 26 994 323,00 monthly transactions. 24% more transactions were verified on the Ethereum Classic’s blockchain than during May — a total of 1 324 407,00. Due to a growth of 20.55% Dash has almost reached half a million monthly transactions. With an increase of 9.17%, Dogecoin’s network now processes 915 250,00 transactions per 30 days. 8% increase delivered Monero to 288 885,00 verified transactions. Zcash’s number of transactions had seen a positive dynamic of 5.32% and is 127 370,00 now. Bitcoin maintains a steady positive growth of 4.38% and is now up to 10 833 486,00 monthly transactions. The only top 10 currency that had fewer transactions than during the previous monthly analyzed period is BitcoinCash with 1 475 599,00 transactions — 1.02% less than during May.

https://corindex.com/reportRating/2019/June/22/2

https://corindex.com/reportRating/2019/June/22/2

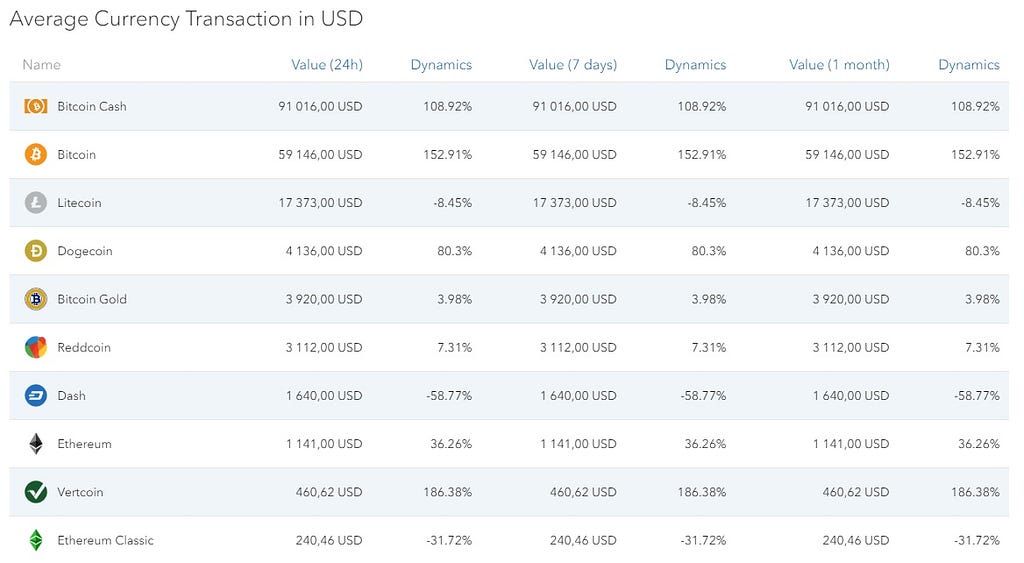

Two previously covered indicators allow for a calculation of the average currency transaction size in USD — an indicator that displays how much value the average cryptocurrency transaction on a particular network holds expressed in terms of United States dollars. It is calculated by dividing the sum of all transactions in USD during a particular period by a number of all crypto transactions during that period. The third chapter of the Corindex report shows how much value is transferred, on average, with a transaction over a particular network.

Accordingly, Vertcoin has seen the largest increase in the transaction size of 186.38%, which brought it up to an average of 460,62 USD per transaction. Despite its huge number of transactions, Bitcoin’s average grew by 152.91% and is now 59 146,00 USD. The average transaction over the Bitcoin Cash’s network has increased by 108.92% and is now 91 016,00 USD. A positive trend of 80.3% brought Dogecoin to an average transaction size of 4 136,00 USD, despite its core idea to be a tipping currency, and Ethereum’s average increased by 36.26% up to 1 141,00 USD.

https://corindex.com/reportRating/2019/June/22/3

https://corindex.com/reportRating/2019/June/22/3

Please note that this article is not a call to action and is not intended to encourage to be the reader’s sole source of information to act on. The presented information has been compiled using publicly available sources and is accepted as is. This article contains no promotional material and is solely intended to inform its reader. Corindex bears no responsibility for any inaccuracies or misrepresentations in this document, nor any outcomes resulting from actions taken based on this information.

June Corindex Analytics of top 10 Blockchains was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.