Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

You Missed Out On Crypto — Don’t Miss Out on This, Too

The Time is Now (for Security Tokens)

Something very interesting happened in the US Supreme Court in 1946, that anyone who is anyone in the blockchain space should care about*

*Unless you want to end up in prison.

That year, the SEC v Howey case resulted in the Howey Test — determining that any asset that meets these elements is a security:

- It’s a monetary investment in a common enterprise

- With an expectation of profit

So why, 73 years later, should we care about this?

If you put your money in a token or cryptocurrency hoping that you get more money out, you’ve invested in a security token (not-a-utility).

What this means is that the security token industry supersedes the utility token industry.

The Problem

The problem with security tokens is that few people really understand the industry. It’s for two reasons:

- The industry is still in its crib

- Stakeholders don’t know what to do, or how to do it

Here’s proof:

The potential market for security tokens is in the trillions of dollars. The actualized market, however, is only in the millions.

This means that we’re roughly four orders of magnitude away from the potential peak of the ST market.

Bitcoin is currently trading at $5,700, and even John McAfee wouldn’t forecast a price four orders of magnitude greater — or 57 million USD.

We’re only a negligible fraction of the way to unlocking the power of security tokens.

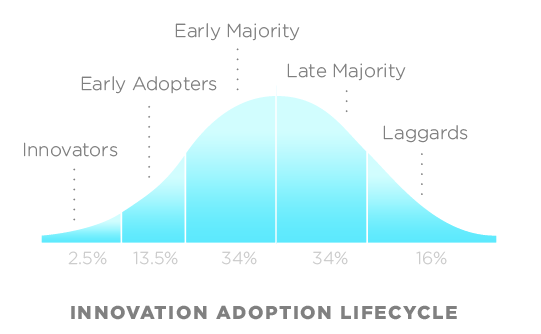

If we take a look at the innovation adoption life-cycle, we’re at the very very left-hand side of Innovators. We want to expedite the adoption of security tokens, so we’re not stuck there for years.

Why are Security Tokens so Important, Anyway?

So why is the potential security token market so mind-boggingly massive? Is it just the birth of a new hype-trend, or something greater?

In a nutshell, digitized securities are an effort to bring regulation and legitimacy to digital assets.

Many people have an adverse reaction to hearing anything remotely similar to crypto, ICO, or blockchain, not the least of which being the countless scams plaguing the industry.

Since normal “utility” tokens don’t comply with securities regulations, you never know what you’re going to get as an investor. That’s why they’re a huge turn-off for big banks and legal authorities, which makes cryptocurrency a no-go for mass adoption.

With Security Tokens, you still get the main benefits of blockchain — dis-intermediation and distributed trust.

Let’s say you have a real estate asset worth $250,000. Let’s make 1 token equal to $25. That means each token represents 0.01% shares of the asset.

Now, anyone anywhere in the world can invest, any amount (fractional ownership) no matter how small. Unlike utility tokens, you’re investing in a regulated security. And unlike traditional securities, transactions are fast and cheap.

Another benefit: Security Token Offerings, or STOs. A typical security undergoes an Initial Public Offering to become a publicly trade-able asset, that can cost millions of dollars. In an STO, you have digital representations of stocks, and instead of closing at 4pm and on holidays like NASDAQ, security token exchanges don’t close. You don’t have to buy “1” or “2” stocks, you can buy “0.01” tokens.

Clearly, many parties benefit:

- Real Estate entities (real estate is a prime market for security tokens)

- Anyone involved in, well, virtually any traditional asset

- Regulators (security tokens are far more palatable than utility tokens)

- Traditional investors (all the benefits mentioned above)

- Crypto investors (a safer alternative to utility tokens)

The Solution — Trailblazing A Faster Path

Rather than wait out years for winners to emerge in liquidity, exchanges, KYC/AML, and infrastructure, and for regulations to solidify, we need a quantum leap in industry.

By connecting stakeholders — across technology, law, finance, and application — we can share brainpower to foster progress.

Introducing the Security Token Alliance

The Security Token Alliance is an international organization dedicated to advancing the technology, law, finance, and application of security tokens. We unite the stakeholders in digitized securities for the purpose of effectively exerting a combined influence upon matters impacting digitized securities interests.

We’re inspired by other industry associations like the Blockchain Research Institute, the Decentralized AI Alliance, and ACM.

We accept a large variety of players, including identity proofing and investor qualification entities, liquidity entities, asset-backed security entities, regulators, Ethereum developers, Secondary Trading Organizations, ATSs, broker-dealers, crypto and traditional investors, VC funds, family offices, franchise committees, securities lawyers, and more.

To learn more about us and inquire for memberships, please contact us at frederik@sta.foundation

You Missed Out On Crypto — Don’t Miss Out on This, Too was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.