Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

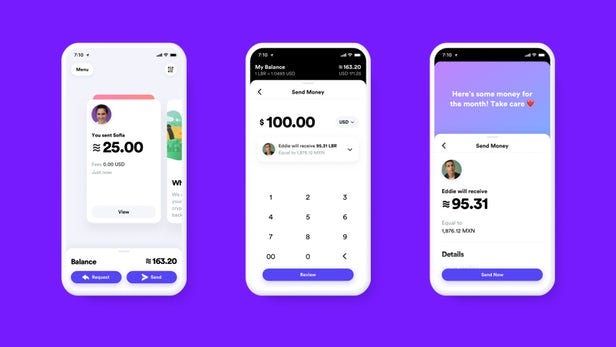

Source: Libra.org

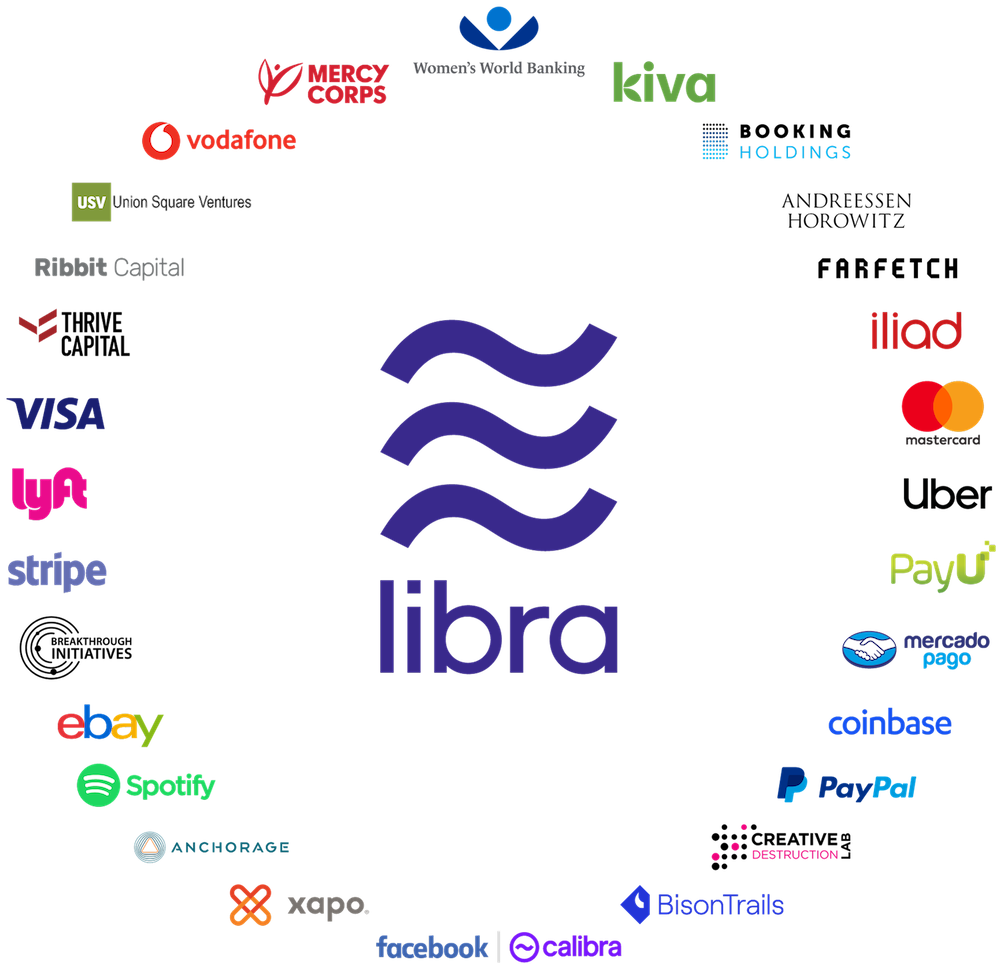

Source: Libra.org

Facebook has finally disclosed the details of its cryptocurrency Libra with the long-awaited Libra whitepaper. Libra will allow its users to buy things or transfer money to others with zero fees.

Libra cryptocurrency holders will also be able to cash out Libra online or purchase things at local exchange points like Grocery stores and pay out using third-party wallet apps or Facebook’s own Calibra wallet which will be integrated into Messenger, WhatsApp and its own app.

Released Tuesday Morning on 18th June 2019, the 29-page Libra whitepaper explains a protocol designed to grow with a new global currency. The document outlines the information about Libra and its testnet for experimenting with the twists of its blockchain system before launching it to the public in the first half of 2020.

The whitepaper opens up by trumpeting the Libra’s mission:

Libra’s mission is to enable a simple global currency and financial infrastructure that empowers billions of people.

In order to achieve the decentralization, a new organization called Libra Association has been established whose members will have separate tokens which will provide them with on-chain voting rights to govern decisions about Libra.

Facebook is not only responsible for fully controlling Libra, but Facebook has also got a single vote in Libra’s governance like other founding members of Association including Uber, Andreessen Horowitz and Visa. Each of these organizations has invested at least $10 million into the project’s organizations. The Libra Association will market the open-source Libra Blockchain and Developer Platform with their own Move programming language.

Facebook will also launch a subsidiary company named “Calibra” that will manage crypto transactions and ensure user’s privacy by never integrating Libra payments with Facebook data to avoid ad targeting. Also, the users’ identity will never be mingled to publicly transparent transactions.

Facebook/Calibra and founding members of Libra Association will earn interest when users cash in money held in reserve, to maintain the stability of Libra.

After evaluating the existing blockchain platforms, Facebook decided to build a new platform, Libra based on the following requirements:

- Highly secure, ensuring the safety of financial data and funds.

- Flexibility to power the Libra’s ecosystem governance and innovation in financial services.

- Ability to scale to billions of accounts that need low latency, high capacity storage system and high transaction throughput.

The Libra Blockchain has adopted the BFT (Byzantine Fault Tolerance) approach with the LibraBFT consensus mechanism to facilitate agreement among validator nodes on transactions to be executed. Also, the data on the Libra Blockchain implements Merkle trees to enable detection of any changes made to the existing data, thereby storing transactions securely.

How does Libra Blockchain work?

Libra does not allow real identity on its blockchain system like other platforms. It is only public-private key pairs that exist. The Libra protocol never links to a real-world identity. However, a user can make multiple accounts with multiple key-pairs. Accounts managed by the same user have no link to each other.

The consensus mechanism for Libra Blockchain will be dozens of organizations that will run nodes on the network to validate transactions. Every time consensus is voted for new transactions; a leader is selected randomly to count up the votes.

Libra has opted to depend on familiarity instead of democracy to establish consensus in initial days. Founding members of the Libra Association are the entities who can vote at the outset by holding Libra Investment Tokens.

Libra Investment Tokens provide founding members with the voting rights on the network to make decisions about letting new validators join the network and handling the reserve.

Unlike Ethereum, Libra has come up with two essential changes in smart contracts. First of all, it restricts how much users can do at the protocol. Secondly, it breaks out the data from software so that one smart contract can be directed to a pool of assets, known as “resources” by Move programming language.

Libra will never use a burning mechanism to improve the value of the coin. Instead, tokens will be issued and burned consistently when the association will respond to demand shifts for reserve with no minimum or maximum supply.

Similar to Corda, Libra’s Blockchain Ledger is also disposable, meaning that the historical data can grow beyond the limit managed by an individual server. However, validators can choose to discard historical data when it is no more needed for the processing of new transactions.

The Libra Blockchain is open source with Apache 2.0 license and developers can build apps on it using the Move programming language. Libra has launched its testnet today and it’s in developer beta mode until it officially gets launched in 2020. The Libra Association has collaborated with HackerOne to create a bug bounty system that will reward security researchers for identifying glitches and flaws safely.

The Libra Association

Every founding member of the association has paid a minimum amount of $10 million to join and become a validator node on the Libra Blockchain Network. In return, they have gained one vote in the Libra Association Council and are entitled to a share of dividends from interest earned on the Libra reserve.

According to the report by The Block’s Frank Chaparro, the following are 28 soon-to-be founding members of the association:

- Technology Marketplaces: eBay, Lyft, Booking Holdings, Facebook/Calibra, Farfetch, Spotify AB, Uber Technologies, Inc. and Mercado Pago.

- Telecommunications: Vodafone Group and Iliad.

- Payments: PayPal, Stripe, Visa, Mastercard and PayU.

- Venture Capital: Andreessen Horowitz, Ribbit Capital, Breakthrough Initiatives, Union Square Ventures and Thrive Capital.

- Blockchain: Bison Trails, Xapo Holdings Limited, Coinbase, Inc. and Anchorage.

- Nonprofit and multilateral organizations and academic institutions: Kiva, Mercy Corps, Creative Destruction Lab and Women’s World Banking.

Who can be a part of Libra Governance?

In order to join the Libra Association, members must have a half rack of server space, the dedicated internet connection of 100Mbps or above, enterprise-grade security and a full-time reliability site engineer. Businesses must hit two of three goals of a $1 billion USD market value, reach 20 million people in a year and/or recognition as a top 100 industry leader by a group like S&P and Interband Global or $500 million in customer balances.

Wrapping up

If Facebook achieves the success and a lot of people cash in money for Libra, the founding members of the association could obtain big dividends on the interest. Once it becomes super quick to buy things using Facebook’s cryptocurrency, businesses would also like to boost their ad spend in it. The announcement news of the launch of Libra cryptocurrency has made every tech enthusiast more excited and everyone is curious for more updates from Facebook’s Blockchain Team.

Visit our website to know more about our blockchain work and technologies we understand. Follow us on Facebook, LinkedIn and Twitter to stay updated with developments around Blockchain.

Facebook announces the Libra Cryptocurrency with the release of Libra Whitepaper was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.