Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

2018 vs 2019. How to Invest in Crypto without a Huge Risk?

Photo by Dmitry Moraine on Unsplash

Photo by Dmitry Moraine on Unsplash

After many investors lost their money last year, the market was devastated, and many people did not believe in the growth of Bitcoin until it sharply jumped up to $ 8,000.

At that time, while the newcomers of the last year were actively selling their crypto, whales came to the market. Their purchases continued almost until the end of the crypto of winter and now they own a significant amount of bitcoins.

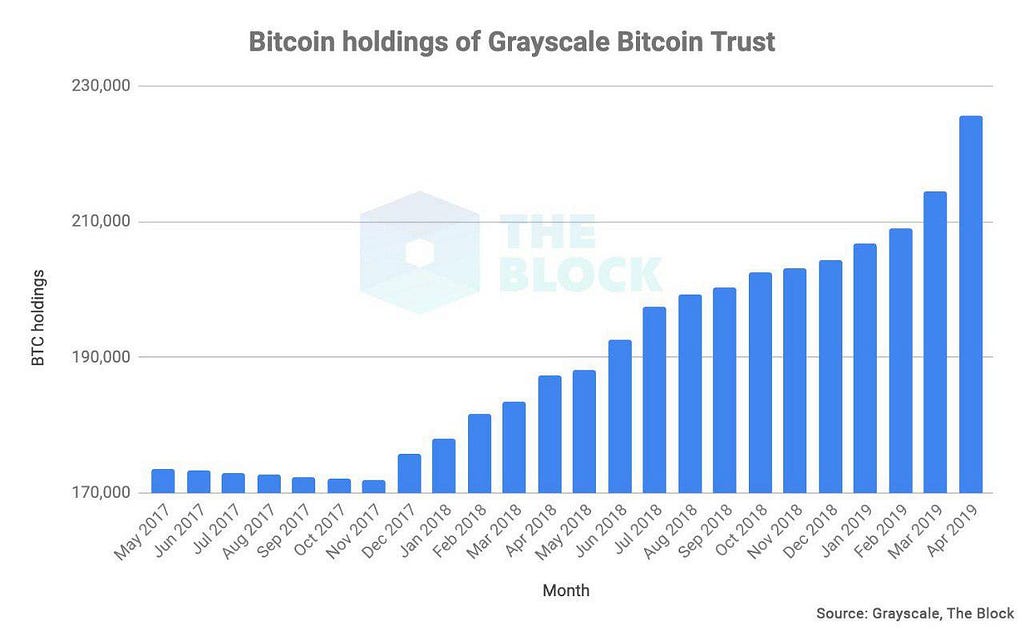

For example, the Grayscale fund is actively investing in cryptocurrencies; during this time, it managed to increase a rather large amount in Bitcoins.

225638 BTC owned by Grayscale customers, it’s over 1.3% of all bitcoins in circulation today. The company’s assets in Bitcoins have continuously grown since December 2017, i.e., throughout the downturn in the market. By The Block.

225638 BTC owned by Grayscale customers, it’s over 1.3% of all bitcoins in circulation today. The company’s assets in Bitcoins have continuously grown since December 2017, i.e., throughout the downturn in the market. By The Block.

At the same time, statistics show that the total number of Bitcoin addresses has increased and is steadily increasing. Of course, the higher the number of addresses, the more people are interested in cryptocurrency.

Addresses with at least 0.1 bitcoins on their wallets reached a historical maximum.

Addresses with at least 0.1 bitcoins on their wallets reached a historical maximum.

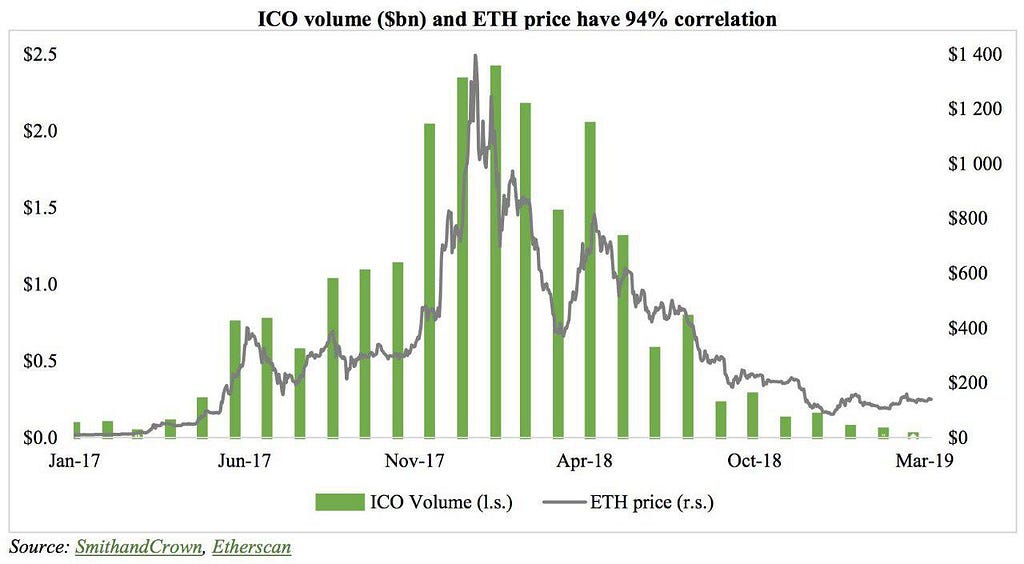

End of ICO

That ended the era of failed startups and those who wanted a quick profit “got it in full.” The market is now self-cleaning, new major players are coming: Gram (Telegram), GlobalCoin (Facebook), etc.

Investors become more careful with cryptocurrencies. They prefer to learn more about founders, what the team did before crypto, etc. And of course, if you are a crypto startup and want to get investment, it will be more difficult.

The growing interest in IEO (Initial Exchange Offering) also demanded that the exchanges study the projects before listing. After all, exchanges act as guarantors, and they have something to lose (at least their reputation).

Crypto market 2k18 vs 2k19

Come on! I know that you would like it!

Come on! I know that you would like it!

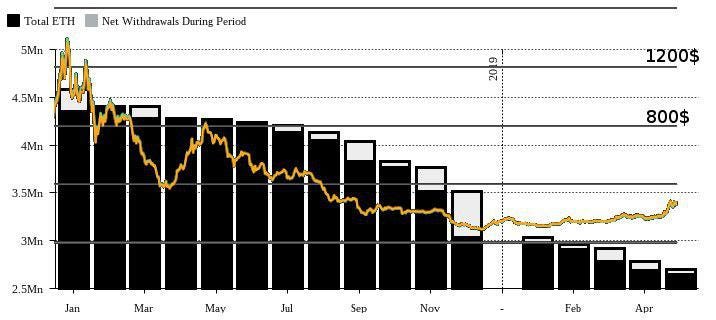

2018 was marked the next funeral of Bitcoin and other cryptocurrencies. Many ICO’s quickly sold Ethereum in the hope of getting at least something …

ICO’s reserves are predictably moving towards zero, and the price of Ethereum (ETH) shows signs of support.Dynamics of reserves ICO — Diar, data on volume — coin360.

ICO’s reserves are predictably moving towards zero, and the price of Ethereum (ETH) shows signs of support.Dynamics of reserves ICO — Diar, data on volume — coin360.

As you can see on the graphs, after the fall of interest in the ICO, the price of Ethereum went down. Moreover, Ethereum now has an excellent competitor — BNB.

Crypto Marketing

I would also like to note how marketing has changed. It is no longer possible to make fast some crypto channel/website and immediately sell advertising…no it doesn’t work anymore.

All marketing ICO agencies disappeared🤷♂️. Many crypto YouTube bloggers and other celebrities of the industry disappeared too, but as soon as the price went up, everyone remembered Bitcoin.

Bans…Large advertisers such as Google, Facebook, Twitter have banned the mention of cryptocurrency in their advertisements…however…

Come on, I know how much you spend on crypto marketing… Meme by imgflip.comNew Tools for newbie and professionals

Come on, I know how much you spend on crypto marketing… Meme by imgflip.comNew Tools for newbie and professionals

And of course, professional investors brought tools from the stock market such as:

- Crypto indexes — CIX100 and Huobi10.

- ETF(Exchange Trading Funds)

- Trading bots(Be careful when you chose a trading bot).

Conclusion

In 2019, the new trend will be the professional tools of major players, because now the game will go according to their rules. It is possible to make considerable manipulation from their side to discriminate a new market again.

Do not forget to diversify your crypto portfolio. Good luck!

Thank you for your attention!

2018 vs 2019. How to invest in crypto without a huge risk? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.