Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The world is undisputedly moving towards a digital ecosystem. Cryptocurrencies are a promising addition to that ecosystem providing unparalleled benefits to consumers and merchants. Digital currencies have become a hot topic in the past two years mostly due to the rise of Bitcoin. In late 2017, bitcoin hit its all-time high of almost $20,000. This caught the attention of many investors from across the globe. According to Statista, there are around 3.4 million people who actively use crypto-wallets.

However, there are still people who do not know much about virtual currencies. They are versatile, secure, and can be used for buying and selling of goods online. A lot of industries like travel, clothing, food, etc. have already started accepting crypto payments. Let’s see how accepting crypto payments can help your business grow and succeed.

Low Transaction Fees

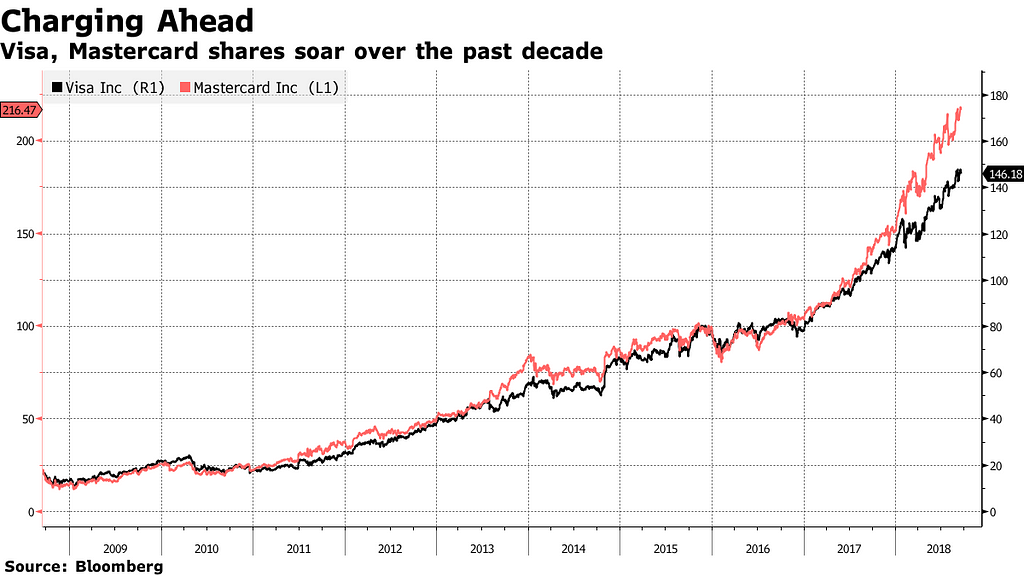

Accepting crypto payments mean lower fees when compared to traditional payment systems. As of 2017, merchants paid $90 billion to Visa and Mastercard in credit card swipe fees alone.

This means that for every $100 you spend, $4 goes to credit card companies. There are debit card fees, credit card fees, ATM fees, transfer fees, overdraft fees, and whatnot. However, this is not the case with cryptocurrency payment systems. For example, leading crypto payment gateways like Bitpay charge between 0.5% to 1% per transaction which is nothing compared to traditional payment processes. In most cases, a digital wallet is completely free and will not cost you anything. No more sharing your hard-earned money.

Sensitive Data Is Protected

Banks obtain too much data from us and retain it. They have our name, address, phone number, financial information, credit score, and more. They also know where we’re spending our money. So, with fiat currencies, it is impossible to preserve our privacy. However, virtual currencies assure a higher level of privacy. With crypto payments, the transaction data is limited to certain numbers. When a transaction takes place, the most you can know is a transaction id and the wallet address. The cryptocurrency payment processor will require your name and shipping address. No other information is shared with anyone. Thus, sensitive information is protected with crypto payments.

Security

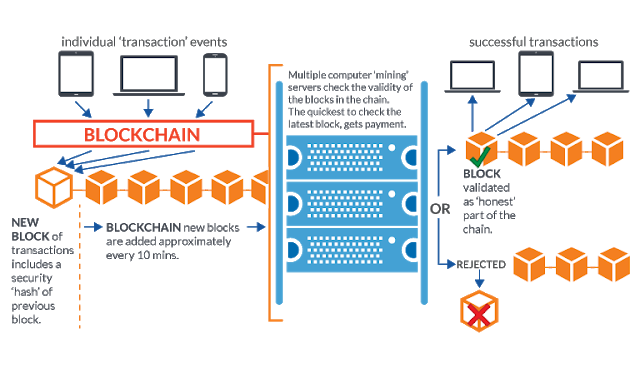

Cryptocurrencies such as Bitcoin are based on blockchain which is a distributed, decentralized, digital ledger. The transactions made are permanent. They cannot be modified or deleted. So, the chances of fraud are reduced to a great extent. There will be no counterfeit attempts or identity theft. Besides, blockchain has never been hacked because, in order to change one block, the hacker will need to change all the other blocks on the blockchain since they’re connected. It is enough proof that blockchain is secure. Moreover, you have complete control over your funds.

Instant Borderless Transactions

Cryptocurrencies are a great way to send and receive money across the world instantly. You don’t have to wait for transactions to be processed, no international fees, and everyone with internet access can send funds to anyone they want. Unlike banks, the transactions are completed within minutes.

If you have a smartphone with an active internet connection, you’re good to make transactions anytime you want. Also, cryptocurrencies are recognized everywhere. You can use them even when you don’t have an ID or a bank account number. For businesses who are looking to acquire international customers, crypto payments are a must.

No Chargebacks

Enterprises have to bear a lot of loss due to chargebacks. Business owners complain that they lose a lot of money to chargebacks. A chargeback is basically a one-way scam where customers use the products and services for free by reporting fraudulent charges against the business to their credit card company. While it is not impossible to fight those charges, but it takes a lot of time and effort for the businesses that they finally decide to take up the loss.

Well, crypto payments can help here too. The transactions that take place cannot be altered. They are recorded on an immutable public ledger. Therefore, businesses can eliminate potential fraudulent chargebacks by accepting crypto payments.

No Third Parties

Traditional payment methods involve a third party. You provide services to your customers and receive payments in your bank account for your services. But still, it is the bank who has control over your money. They can freeze your funds for whatever reasons. Also, your account can be closed if deemed necessary. This can result in huge monetary losses for businesses. But with crypto payments, that will not be a problem.

Since there is no third party involved, the money goes to your crypto wallet that you have full access to. No one else controls your wallet. So, the money stays with you no matter what. Also, the government has no control over the transactions nor they can keep an eye on the transactions. And they cannot take away your money as it happened in Cyprus.

Also, if you’re a business owner who wants to stay ahead of the competitors, it is important that you keep up with the latest trends. You have all the great reasons to start accepting crypto payments.

6 Reasons To Start Accepting Cryptocurrency Payments was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.