Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Biggest Gainers and Losers in the Crypto Market in May

A cryptocurrency research platform Chain Open Research, more commonly known as Corindex, has released its monthly report regarding the most outstanding performances and changes in standings of particular cryptocurrency assets. Let’s go over whether they bring anything new to the table.

As the report was comprised of data reflecting the majority of cryptocurrency exchange operations, it’s safe to say that the statistics accurately reflect the overall state of affairs. The information in the report is split up into five chapters reflecting what they consider to be the most important indicators of cryptoasset performance.

The first chapter is about the change in the transaction volume.

Predictably, Bitcoin experienced the biggest quantificial spurt of transactions during May, bringing the total volume up to 706 068 435 349,00 USD, 161.41% of the April’s monthly volume. Ethereum underwent comparable surge of volume, totaling at 306 447 687 228,00 USD, which is 52.31% larger than the previous month. The third largest volume of 124 779 145 684,00 USD belonged to the Ripple and constituted a 43 percent increase over April. However, the best performers compared to April’s results were TRON, the transaction volume of which almost doubled during May, Ripple, which gained 77.34% and Bitcoin Cash, with an increase of almost 73%, which brought its volume up to the 79 123 499 533,00 USD.

https://corindex.com/reportMarkets/2019/May/1

https://corindex.com/reportMarkets/2019/May/1

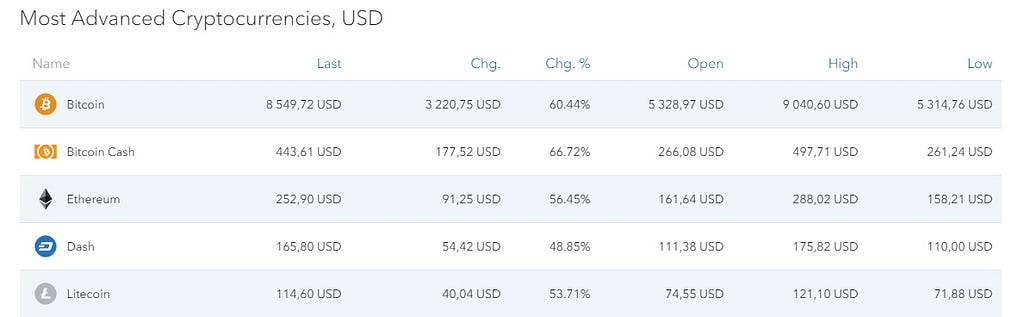

Cryptocurrencies are notorious for their volatility, so the second chapter deals with the flat increases in monthly average rates.

According to it, Bitcoin gained a flat plus 3 220,75 USD — a 60.44% change; its average rate for May is 8 549,72 USD, with a monthly high of 9 040,60 USD and low of 5 314,76 USD. Bitcoin Cash added 177,52 USD to its price over May, a sixty-seven percent hike. Ethereum increased its average rate by 91.25$ — a change of 56.45%. Moving on to lower cap currencies, Bitcoin Gold went through the largest increase of 81.68%, with a monthly low of 13,77 USD and a monthly high of 31,47 USD. The average price of Gnosis grew by 62% and came up to 23,85 USD, and Zcash grew by 48.11%, bringing the average up to 90.11 USD. It’s also worth noting that almost all currencies ended the month remarkably close to their monthly highs.

https://corindex.com/reportMarkets/2019/May/2

https://corindex.com/reportMarkets/2019/May/2

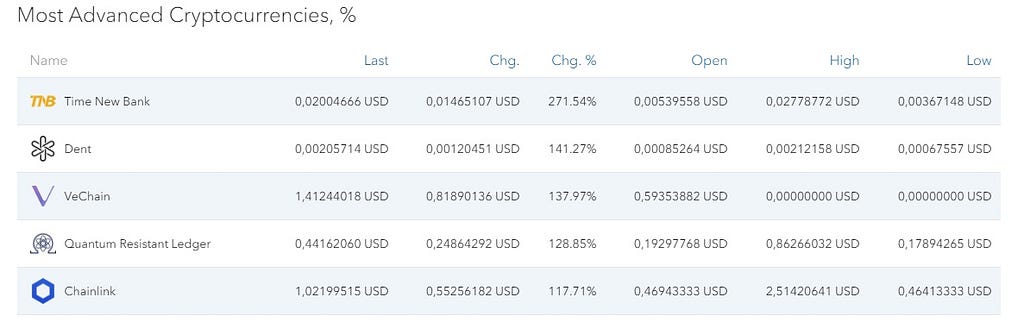

The third chapter tackles the same issue but from the standpoint of relative change.

Thus Times New Bank has achieved impressive growth of 271.54%, with a monthly low of 0,00367148 USD and a monthly high of 0,00212158 USD. Dent and VeChain went through a nearly identical growth spurt of ~140%. Quantum Resistant Ledger takes up the fourth place in this category with a monthly change of 128.85% and Chainlink sits at fifth with a gain of 117.71%. It bears mentioning that the disparity between monthly highs and lows in this category is truly astounding and can reach up to 10x, or, in some cases, even more. For instance, Chainlink’s monthly low was 0,46413333 USD, but monthly high reached 2,51420641 USD, even though the average price changed by “only” 117%.

https://corindex.com/reportMarkets/2019/May/3

https://corindex.com/reportMarkets/2019/May/3

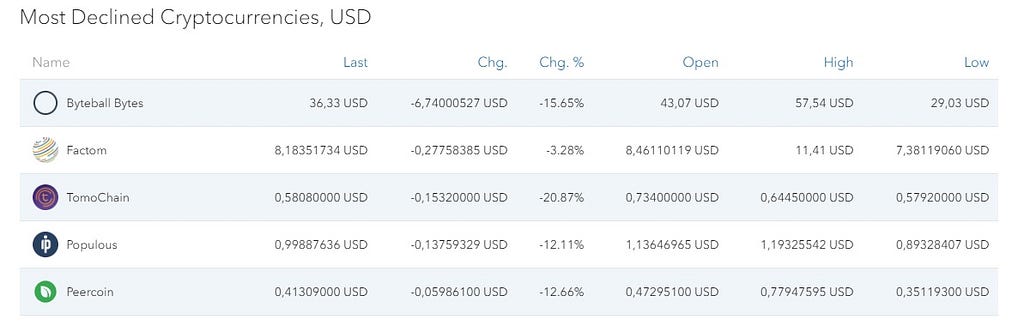

The fourth chapter covers flat declines in average monthly rates.

May was marked by significant growth all across the сryptocurrency board, but some projects managed to go in the red nonetheless. Byteball Bytes experienced the largest flat decline of -6,74000527 USD — A -15.65% drop from April. The price of Factom shrank by about 30 cents up to an 8,18351734 USD during May, which impacted its monthly average by three percents. The third largest decline accompanied TomoChain that decreased by 15 cents — a -20.87% comedown. It really speaks volumes for the overall state of the cryptocurrency market if the biggest decline of the month was shy of seven dollars.

https://corindex.com/reportMarkets/2019/May/4

https://corindex.com/reportMarkets/2019/May/4

The fifth chapter regards the biggest declines in monthly averages, but this time — percentage vise.

The biggest relative decline of the month — -37.6% — belongs to the Burst, which had a monthly low of 0,00264251 USD and high of 0,00806940 USD. Electronum averaged at 0,00410387 USD, which is 66.6% of its April’s average price. Cryptaur and Cred both weakened by approximately 30 percents, and TokenClub had a negative change of -25.63%. Bearing in mind the inherent volatility of cryptocurrency assets, it won’t be an extreme overstatement to claim that there have been almost no declines during May.

https://corindex.com/reportMarkets/2019/May/5

https://corindex.com/reportMarkets/2019/May/5

Please note that any information in the report is intended for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, offer or call to action. The presented information has been compiled using publicly available sources and is accepted as is. The report contains no promotional material and is solely intended to inform its reader. Corindex bears no responsibility for any inaccuracies or misrepresentations in this document, nor any outcomes resulting from actions taken based on this information.

Biggest gainers and losers in the crypto market in May was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.