Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Open interest on the CME Bitcoin futures has reached an all-time high (ATH) in preparation for the largest ever CME BTC futures expiration on Monday.

Record Numbers for CME Bitcoin Futures

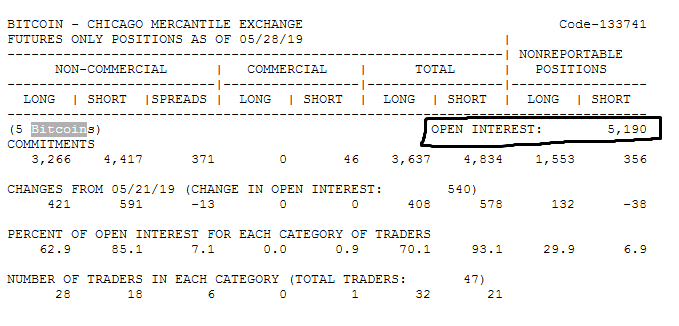

CME’s data sheet for May 28, 2019 shows total open interest on its Bitcoin Futures contract at 5,190. This represents an increase of about seven percent from the figures published the week before (May 21, 2019) as well as a new ATH as far as open interest is concerned.

In 2019, CME BTC futures have continued to post record figures side-by-side with a bullish resurgence in the underlying asset class. Back in mid-May, Bitcoinist reported that trading volume had reached a zenith of $1.3 billion.

Friday (May 31, 2019) was the last day of trading with futures contracts settlement happening on Monday (June 3, 2019). Several industry commentators say Monday’s settlement will be the biggest in the history of the contract and could potentially have profound implications for the price of bitcoin on the spot market.

Going by the May 2019 Bitwise report, regulated futures trading has grown to become about 48 percent of the spot market since April 2019. Bitwise based this particular comparison on what it called “real volume” as against the “reported volume” published by the likes of CoinMarketCap.

The record trading numbers from the CME BTC futures is only part of the bullish institutional BTC interest.

As previously reported by Bitcoinst, the premium on the Grayscale Bitcoin Trust (GBTC) has seen the price cross $11,000 on the platform.

Massive trading volume on CME Bitcoin futures, with 432.5K contracts traded so far in Q2 – and we have 23 trading days left.

CME volumes are authentic and a great proxy for institutional interest. pic.twitter.com/yEQORmUw0A

— Imran Aijazuddin (@I_Aijazuddin) May 28, 2019

Mind the Gap: Where Does BTC Price Go from Here?

With the CME BTC futures expired, there will be a “temporary gap.” However, since these positions are typically rolled-over, the temporary gap shouldn’t exert any downward pressure on the BTC spot price.

Indeed, over the weekend, bitcoin has gained steady ground, settling in at around the $8,700 mark in preparation for Monday’s market which opens in Asia in a few hours. The CME Bitcoin futures expired on the 28th with even more short positions 4,417 than the previous week 3,826.

With Bitcoin up more than 180 percent from its 2018 bottom of $3,100, the long-term sentiment is of course bullish. However, there is still the strong possibility of a slight bearish divergence in the short-term especially if there is a massive liquidity grab.

In summary, BTC could see another downward retrace in the short-term depending on how quickly the CME gaps can be filled.

Do you think Monday will see the start of another push beyond $9,000 for Bitcoin? Let us know in the comments below.

Images via Shutterstock CME and Twitter @I_Aijazuddin.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.