Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Photo by Jezael Melgoza on UnsplashE X P L A I N E DWhat are Prediction Markets and who uses them?1. What are Prediction Markets?

Photo by Jezael Melgoza on UnsplashE X P L A I N E DWhat are Prediction Markets and who uses them?1. What are Prediction Markets?

Prediction Markets are basically Futures Markets.

They are based on the concept of a binary event, i.e. an event that will or will not occur. In the world of finance, participants trade contracts whose profits vary depending on the outcome of future events: Prediction Markets make the results of such events exchangeable.

Basically, you place a bet on the probability of a specific event happening in a specific situation, such as elections, sale of companies, price fluctuations or even changes in the climate.

The value of a bet is in most cases directly proportional to the probability that a certain outcome will materialize.

2. We use the word ‘bet’, but how does it differ from gambling?

As time goes by, it becomes easier to predict the outcomes of future events.

Whether or not a profit is generated depends on the accuracy of the forecast with respect to the outcome of a given event. Therefore, participants will strive to make the most accurate forecasts possible.

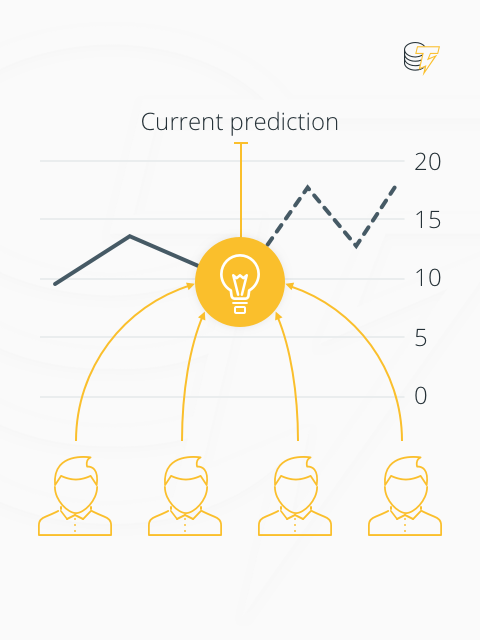

If a large portion of the participants, after making the appropriate market analysis, comes to the same conclusion, the forecast will tend more on one side than the other.

For example, if you place a bet on a coin toss, there will always be the same odds of a head coming out or a cross coming out. No external condition can influence this result: it is pure gambling, as luck plays a key role in the outcome of the event.

Prediction Markets instead rely on the collective wisdom of a large group of individuals regarding the possibility that a future event will materialize.

https://cointelegraph.com/3. How do Prediction Markets work?

https://cointelegraph.com/3. How do Prediction Markets work?

They are linked to contracts based on the outcome of future events.

To better explain the concept, let’s take the presidential elections as an example.

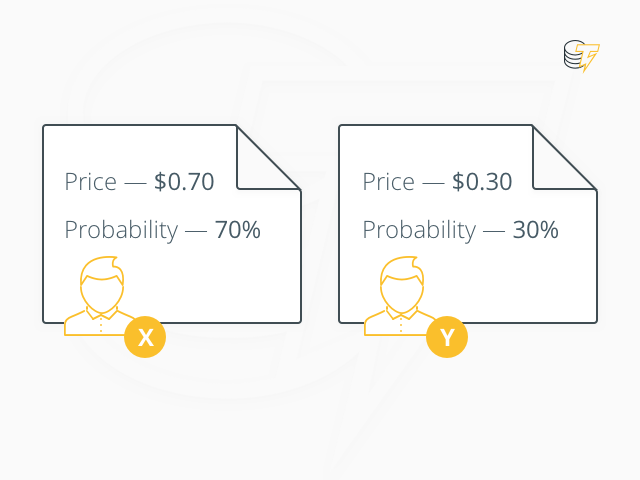

The futures contract in question is structured to offer $1 if the expected outcome occurs, or $0 if it does not.

If a contract, which states that “X” will become president, were to be worth 70 cents, it means that according to the market there is a 70% chance that that candidate will win the election.

On the contrary, if the contracts for “Y” were to have a value of 30 cents, the market estimates its chances of winning at 30%.

If what is reported on the contract purchased from an investor coincides with the outcome of the event, he will get $1. Otherwise, he would receive nothing.

As time goes by, more and more people will buy contracts, and prices will fluctuate depending on market conditions and the information available to participants.

https://cointelegraph.com/4. Why are Prediction Markets so Efficient?

https://cointelegraph.com/4. Why are Prediction Markets so Efficient?

Because it relies on the opinion of many, not on the convictions of one individual.

It is assumed that a large group of people have much more information overall than a single individual.

Participants in the Prediction Market bring their money into play and are therefore encouraged to study and analyze both the market and the topic in question in depth so that they can predict the outcome of the event with greater precision.

5. What impact will Blockchain technology have on the Prediction Market?

The main advantage of a Blockchain system is decentralization.

Decentralization is the removal of central authorities or intermediaries responsible for administering trade.

It is therefore not necessary for users to pay very high commissions, as no third party body is involved. The Blockchain allows investors to participate quickly and easily in a contract, without having to rely on a professional broker to manage the trades.

In addition, in a centralized platform, some important market information may be concealed by the central authority, so as to gain an advantage over other participants.

In a decentralized system, however, there is no central authority: all market information is publicly available.

6. Can the concept of Prediction Market have other applications?

Such a system can be very useful for resolving disputes.

The purpose of such markets is only to trade on the outcomes of certain events, but they can also be exploited as oracles. The number of possible applications of this system is very large.

Let us take a decentralized freelancing market as an example.

A freelancing market built on a Blockchain has all the benefits of a decentralized system: reduced commissions, no censorship, and no limits to the price or complexity of the tasks.

But it also means that there is no central authority for handling disputes. In such a market, the resolution of disputes is usually entrusted to a voting system, in a similar way to how the consensus in the Prediction Markets is reached thanks to the wisdom of the masses.

However, a decentralized freelancing market presents a huge problem: scalability.

7. What is the problem of scalability?

Too many votes can lead to network traffic jams.

In networks where consensus is reached through a voting mechanism, everyone can vote on everything, there is no hierarchy. It is as if, in a traditional legislative system, the Supreme Court were to resolve every single case in the country.

This system is therefore not suitable for a decentralized freelancing market, as too many disputes may arise between users and employers. These disputes must be resolved as soon as possible, so that the user can receive his payment and the provider of the task get the product finished.

8. How to solve this problem?

The answer lies in how voters are selected.

A Blockchain-based freelancing network, such as CryptoTask, introduces special randomly selected voting groups for dispute resolution: this selection is communicated to users outside the chain. At the end of the vote, examiners must finally prove, this time within the chain, that they have actually been chosen by the system to resolve a dispute.

Unlike Prediction Markets, where the price of the outcome of an event fluctuates continuously, in a decentralized freelancing market the value of a task is predefined.

A “task market” therefore does not present the problem of scalability, since the revision process is carried out only in case of disputes. In most cases, the user and the employer do not need any mediation.

9. How does a review process work, and what are the benefits?

It starts with the placement of a deposit.

In an evaluation system such as CryptoTask, examiners place part of their tokens in a repository in a quantity equal to the value of the task under consideration. It is therefore sufficient to have tokens to be selected, with a probability directly proportional to the volume of your deposit, so as to prevent attacks by Sybil.

In the event that a user is selected to resolve a dispute, he must vote on whether or not to complete the task. If an examiner also votes against the consent or does not vote at all, the deposit will remain intact.

The advantages of this system are as follows:

- The selection is made in secret so that the examiners cannot in any way influence the consent.

- Thanks to a two-stage voting process, which involves announcing the results only after the vote has been completed, examiners cannot take a look at the consensus before making their choice.

- Examiners are usually professionals with a large deposit of tokens and are therefore best placed to resolve disputes.

Prediction Market, simply explained was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.