Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Simply put, cryptocurrency index funds are portfolios designed to track the performance of the entire cryptocurrency market.

The HODL Cryptocurrency Indices Methodology

The HODL Cryptocurrency Indices Methodology

If you’re invested in cryptocurrencies or plan to, here’s why you should consider investing in a cryptocurrency index fund.

Index funds Outperform 80% of Professional Traders:

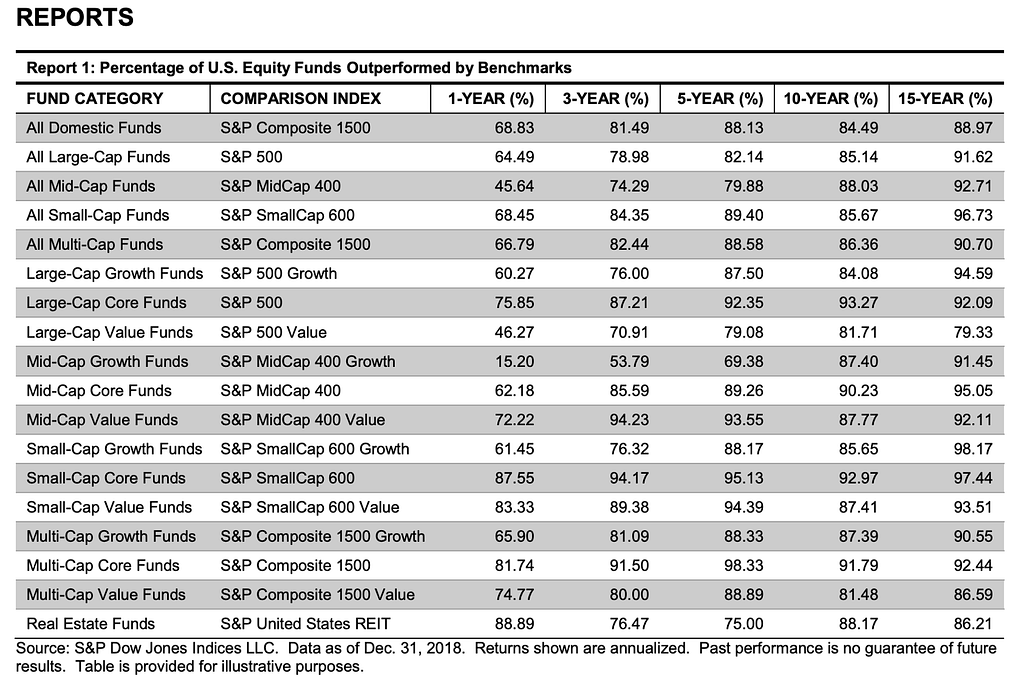

According to the 2018 SPIVA U.S. Scorecard, 80% or more of active managers across all categories underperformed their respective indices.

While short-term results were more comparable, active managers were not able to keep up over the long-run. This is why Warren Buffet famously bet and won $1 million dollars for predicting that the S&P500 index would beat a collection of a Protégé Partners hedge funds over the course of 10 years.

It’s easier to get lucky over the short-term, and harder to get lucky over the long-run.

If professional active managers can’t do it, imagine how difficult it is for the average retail investor. Even if we completely ignored the information and skill discrepancy, retail investors are at a disadvantage because they do not have nearly as much time to spend on researching investments. Most retail investors consider trading a hobby, and not their occupation.

As a side note, because long-run outperformance is so difficult, you should also approach crypto trader gurus with a healthy dose of skepticism. If we can use equity markets as a point of reference, most “expert traders” will lose to an index over the long-run. They might get lucky in the short run, and use that to build up their credibility. Don’t be fooled. Outperformance in the short-run is not very impressive and does not guarantee long-term outperformance.

Obviously, the stock market is not the same as the cryptocurrency market. But I wager that in the cryptocurrency market, it may be even more difficult to beat index funds. Consider the fact that the cryptocurrency market is rampant with market manipulators, insider traders, and pump & dumpers, all looking to rip off the little guy.

Index Funds Are Low Cost & Low Maintenance

Indices use a rules-based, transparent methodology to determine their portfolio constituents ahead of time. Therefore they are very cheap to create and maintain as they do not incur high management fees.

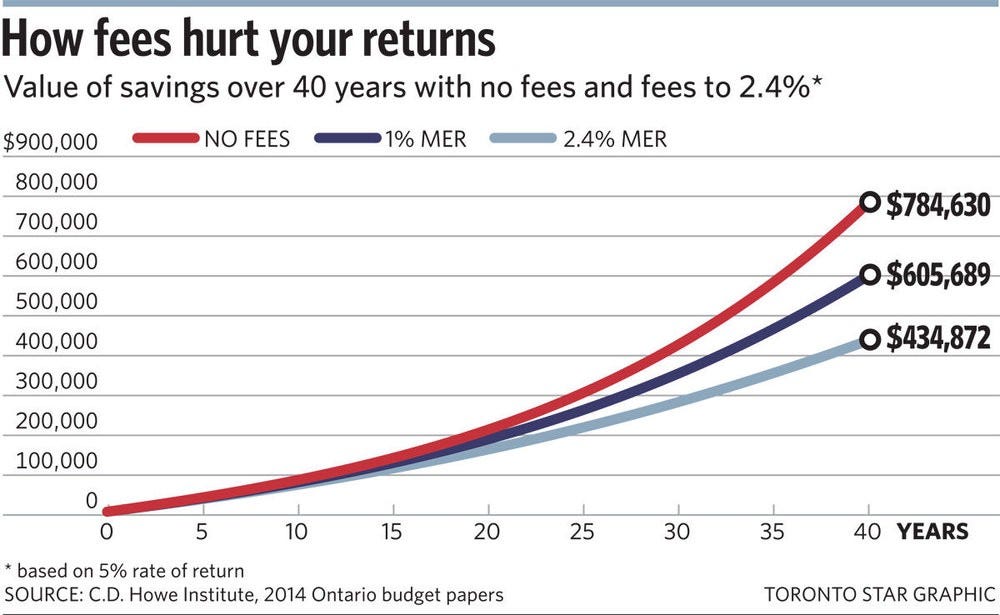

If your portfolio is being managed by someone else, you’re likely to incur a very high management fee. Management fees may seem trivial in the short-run, but over the long-run, they severely impact your returns.

If you’re managing your portfolio yourself, don’t make the mistake of thinking that it’s free. There is an implicit opportunity cost when you are actively managing your portfolio. Time isn’t free. Hours spent trading a week can quickly rack up.

Rather than worrying about trades, rebalances, and market timing, index funds require very minimal work. After the initial set-up, you won’t have to touch it again until it’s time to withdraw funds.

Most index funds handle portfolio rebalances automatically under the hood. For example, at HodlBot we enable investors to create their own personal index fund and handle all portfolio rebalances for them automatically on a fixed, customizable schedule.

Diversify Your Risk — Most Coins Go to Zero:

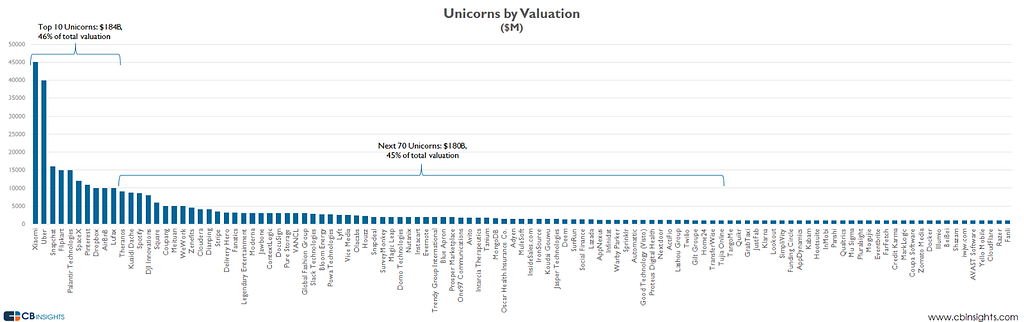

With respect to emerging technologies, it’s very common for a single asset to significantly outperform another. Out of a pool of 100 investments, one might 1000x, while the others go to zero. Emerging tech investments like cryptocurrencies tend to follow a power law distribution.

A study by CBInsights found that the top 10 most valued tech unicorns were valued higher than the next 70.

A study by CBInsights found that the top 10 most valued tech unicorns were valued higher than the next 70.

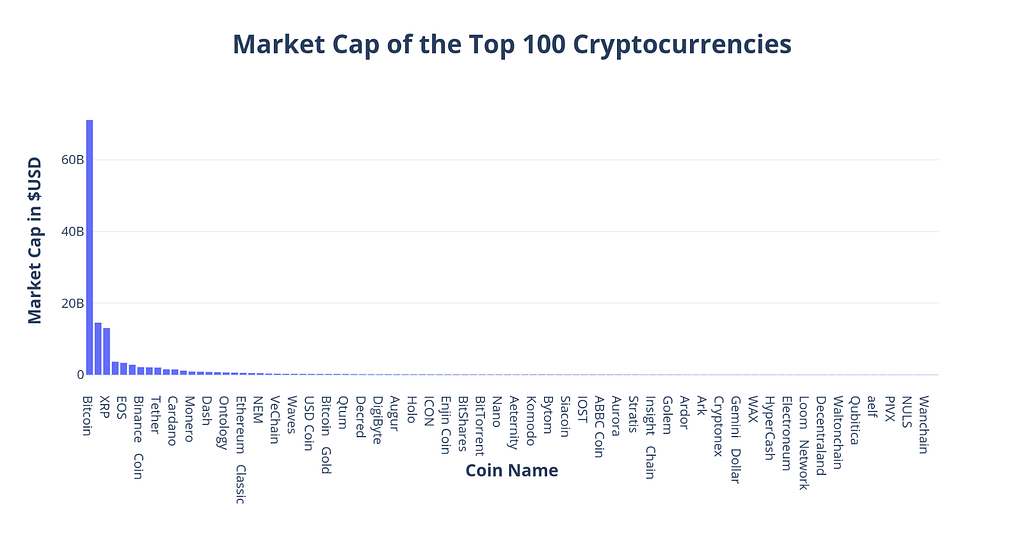

If we look at today’s market cap for cryptocurrencies, the combined market cap of the top 20 coins makes up 89% of the entire market.

Assuming returns in the cryptocurrency market also follow a power law distribution, we can expect that a few coins will net colossal returns, while others perish.

That’s why it’s so important to diversify. You must shield your portfolio against catastrophic failures, and improve your odds of picking a winner.

In classical finance, the two kinds of portfolio risk are classified as:

- Systematic risk — The inherent risk of participating in a market (i.e. investing in the cryptocurrency market)

- Unsystematic risk — The risk an investor brings upon themselves when picking an individual asset (i.e. picking a coin).

Systematic market risk is inescapable, but unsystematic risk is a choice. In my opinion, most investors don’t benefit from taking on unsystematic risk. As aforementioned, most active traders who take on unsystematic risk, fail to beat the market in the long-run.

That is to say, if you’re as confident in the crypto market as I am, then it is wiser to bet your money on the entire cryptocurrency market rather than test your luck picking individual coins.

I know that the asset class will grow, but I don’t know who the winners will be.

Letting Your Winners Run & Selling Coins that are on its Death Spiral

One of the biggest dangers to traders is sunk cost bias and fear of loss.

“I can’t sell at a loss. I’m waiting for the coin to bounce back. I might even double down” — Anonymous Trader #253

As we mentioned before, if cryptocurrency market returns follow a power-law distribution, then most coins are going to go to zero. If you stubbornly hold them, or worse, double down as they go to zero, you’ll lose quite a lot of capital along the way.

Comparatively, a total market index is resistant towards catastrophic failure and sunk cost bias. If a coin goes to zero, the index will get rid of it.

Imagine if you’re holding an index of the top 30 coins by market cap. If a coin drops out of the top 30, you’ll sell it on the next scheduled rebalancing period, and replace it with the new one that has taken its place. Index investors will not be stuck with dead coins.

For this reason, index funds have some of the characteristics of a momentum based strategy. With the risk of over-simplifying, a momentum strategy beckons you to increase your holdings as prices move up, and decrease your holdings as prices move down.

What Index Funds Are Available Now?

Because the cryptocurrency market is so young, there are not many easily accessible index funds in cryptocurrency.

Nevertheless, I’ve collected the top ones and have made a comprehensive list below.

Note that not all indices are created the same. Many have their own unique construction methodology. For a deep analysis of how well different total market indices track the market, check out this article.

Total Market Index Funds

Everyday Investors:

Only Accredited Investors:

Not all indices are created the same. For a deep analysis of how well different total market indices track the market, check out this article.

About the Author

I quit my job recently to start HodlBot.

We created HODL10, HODL20, HODL30 indices and the first ever application that allows you to create your own personalized cryptocurrency index fund.

To get started all you need is a

- Cryptocurrency Exchange Account

- $200 in any cryptocurrency

Originally published at https://www.hodlbot.io on May 28, 2019.

Why Invest in a Cryptocurrency Index Fund? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.