Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Security tokens have become a trending topic among the financial industries and blockchain communities as it is all set to disrupt how investment can be carried out globally.

Though it may seem a new concept for many entrepreneurs, it has been around for a long time. Bonds were issued for the first time in 1517. In today’s modern era, creating security tokens means taking the existing financial instruments and maintaining shareholder balances on blockchain or distributed ledger. This entire process is called as tokenization.

Tokenization can also be defined as issuing digital tokens which represent the shares of financial instruments on a blockchain.

A security token performs the same role as that of conventional security. The only difference is that it verifies ownership through transactions of a distributed ledger and enables fractional ownership.

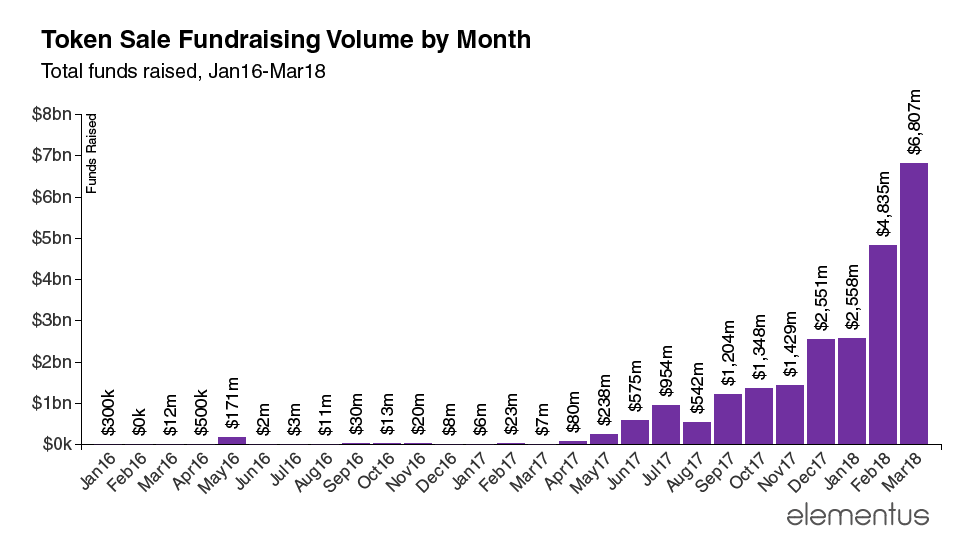

Earlier, ICOs (Initial Coin Offerings) gained a lot of traction in 2017. Over $6 billion were generated in global startup capital throughout 2017 by these coin offerings. But 80% of them were marked as scams.

2018 initiated the STO era which provided more protection to the blockchain investors as it can be subjected to federal laws. Because securities are tokenized on the blockchain, smart contracts can run operations without the involvement of a third party.

Here are some of the benefits of Security Token Offerings

- Cost EffectiveAs compared to other financial modes for investment, security tokens have zero administrative costs of trading. Reduced costs enable people to make a substantial amount of returns on investments.

- Global Trading Capability Since security tokens are eligible for global trading, they offer high levels of liquidity. Security token offerings enable anyone across the world to access and trade the security tokens. Increased adoption of financial instruments has helped to boost the liquidity levels.

- FastWith the automation of KYC (Know Your Customer) and AML (Anti-Money Laundering) checks, the process of trading security tokens to accredited investors also tends to be a little faster.

- 24/7 TradingAbility to sell or buy security tokens 24/7 also makes them desirable than any other traditional models which are a time constraint.

When should your business consider an STO?

Your organization should consider an STO if you want to generate a lot of capital. Ensure that your business aligns with some of the following conditions:

- The company’s annual turnover is more than $10 million: To run the successful funding round with STO, it is essential for a business to generate the maximum valuation. The higher will be the turnover and profits of a business, the higher will be the company’s valuation. As a result, it will increase the amount of capital you may get for the percentages of the business.

- Your business operations are global:You should be able to market to a global audience to maximize the potential of a security token offering, rather than staying limited to a specific region. Running business internationally can help you raise a lot of capital quickly and efficiently.

- Ready to take a risk:Since regulations surrounding STOs may change in different countries, you should be prepared to take a risk. Countries with more spending powers like USA, UK, Russia, South Korea and Germany tighten their own regulations. So, there can be a massive risk of business losses.

If your business fits in the majority of conditions mentioned above, you are likely to gain a lot of funds and support from the fundraising efforts with STO.

In case, your business fails to meet these points; it is not worthy to launch a security token.

If the amount of capital raised comes out to be lower than that of the amount of money invested in setting up the offering, it is not good to launch a security token.

Here are some of the essential regulations required to launch an STO successfully:

- Regulation S

Regulation S is a safe harbor exemption which is available for firms outside the USA. So, it is not subjected to any registration requirement under section 5 of the 1993 Act. Creators need to follow the security regulations of the country where they are going to launch an STO. The Securities and Exchange Commission in the US adopted Regulation S to confirm the application of the Securities Act Registration Requirements outside the United States of America and its territories.

Regulation S consists of five rules:

1. Rule 901:

It sets forth the general statement that the US registration requirements can only be applied to “offers and sales” of securities within the US and its territories.

2. Rule 902:

It can set forth definitions for Regulation S.

3. Rule 903:

It offers a safe harbor for transactions which involve issuing of securities that comply with certain guidelines.

4. Rule 904:

It provides with a safe harbor for offshore resales which comply with appropriate guidelines.

5. Rule 905:

It presents that equity securities of US domestic issuers which are sold in compliance with the Primary Offer Sale Harbor requirements are deemed “restricted securities” defined in Rule 144 under the Securities Act. Also, it is subjected to holding periods before it can be resold without limitations in the USA.

- Regulation A

Regulation A+ is applicable for businesses that want to raise funds under $50 million and solicit non-accredited investors. With the restriction to provide two years of financial statements, Regulation A+ is highly considered for established startups. As compared to Regulation D, securities issued under Reg A+ do not have limitations on resale, which can result in high levels of liquidity.

- Regulation D

Security token issuers have to work with the three rules: Rule 506(b), Rule 506(c) and Rule 504 under Regulation D.

Rule 506(b) and Rule 506(c) do not have any restriction for the fundraising but only allows accredited investors in the US. On the other side, Rule 504 does not put any restriction on the status of investors.

According to Rule 503, issuers are only restricted to the capital raise of $5 million and need to register the security with state regulators. By allowing for General Solicitation, Regulation D also enables companies to advertise the fundraising and projects.

- Regulation CF

Raising funds with Regulation CF allows startups to raise up to $1.07 million. Small projects can be funded quickly to boost innovation with this regulation. SEC filing requirements for Regulation CF are Form C and two years of audited financial statements. The downside of the regulation is the locking period of 12 months for secondary markets.

Since security tokens are different from utility tokens, they require a unique infrastructure and a new approach to execute them.

Many blockchain companies have come up with a security token issuance platform to launch a token easily and quickly.

Read: How to Launch Security Token Offering ?

Read: STO Guides: Top 5 STO guides of 2019

Here are some of Security Token Issuance Platforms which can be used to launch STO:

- Polymath

It offers the technical as well as legal solutions to securitize the assets, stocks or bonds on the distributed ledger, i.e., blockchain. By connecting the KYC providers, legal experts, token investors and smart contract developers on the same platform, Polymath works like Ethereum and has its own native ST-20 standard token, “POLY.”

- Securitize

Securitize is an end-to-end blockchain platform for security token issuers who are looking to tokenize the assets. From handling the login to capital received, management and issuance of security tokens, the platform can manage the processing of solicited investors.

- Swarm

Backed by the blockchain, Swarm is another real-world asset tokenizing platform which offers a cryptographic standard for asset tokenization. Tokenized objects can be renewables, tech companies, real estates, agriculture, crypto hedge funds and so on.

Since Swarm provides SRC20 protocol, the standardization can help developers to develop applications which use security tokens seamlessly.

Please visit the Insights section on our website to learn more about STO and its launch process. Follow us on Facebook, LinkedIn and Twitter to stay updated with developments around Blockchain.

Contact Leewayhertz at Info@leewayhertz.com

What is Security Token Offering and why should you consider it? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.