Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

After swiftly gaining 10.7% in less than 24-hours, Bitcoin reached a new 2019 high and is a mere $1,200 away from the all-important $10,000 valuation.

Bitcoin Price: Market Overview

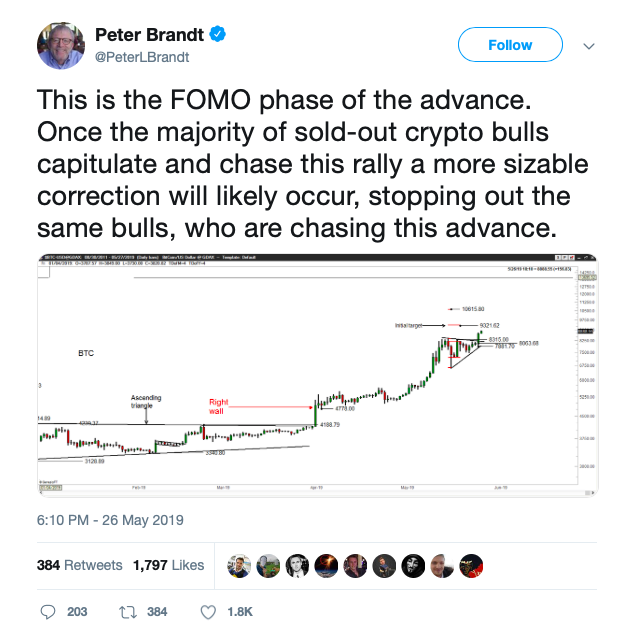

Bitcoin 00 hit $8,947 on Coinbase and to date has gained 143%. Current sentiments remain bullish about Bitcoin’s long-term prospects but analysts like Peter Brandt and Josh Rager are calling for a 30%+ pullback before BTC price really winds up and starts to run.

BTC-USD 4-Hour Chart

As seen by the 4-hour chart, Bitcoin sliced right through the $8,500 and $8,800 resistance after bursting through the symmetrical triangle at $8,048.

Since its initial run to $8,947, Bitcoin has made two more attempts at overtaking $9,000 and the most recent saw the digital assets pullback to $8,612 which is slightly above the 61.8% Fib retracement level and also near $8,550 which according to the Tensor Chart appears to be an area of buying interest.

1-Hour Tensor Chart

As BTC consolidates after such an impressive move, repeated failure to cross above $8,880 could lead to to a retest of the 12-EMA at the 61.8% Fib retracement level ($8,551) and a drop below $8,500 could see BTC revisit $8,330 at the 26-EMA.

Daily MACD & RSI

At the time of writing the daily MACD and RSI are bullish and the MACD remains extended higher than it has ever been since the 2017 bull market. The daily RSI also has room to run and has not exceeded its threshold at 86.6844, which has typically marked the point where BTC is overextended and on the verge of pulling back.

Traders should keep their eyes on the hourly RSI, MACD, and CMF and in the event of a pullback conservative traders could consider placing bids from $8,550 to $8,300, whereas more aggressive traders will consider today’s early bounce point at $8,650 as a possible entry point.

BTC-USD 1-Hour Chart

Over the short-term BTC appears likely to drop near to $8,500 and the hourly chart shows BTC under the mid-arm of the Bollinger Band indicator and on the verge of falling below the lower arm at $8,685. As mentioned earlier, a drop below 61.8% Fib retracement level should attract buyers but any increase in bear volume could press BTC back significantly as yesterday’s breakout candle occurred rapidly without setting any supports.

Happy trades and best of luck friends!

[Disclaimer: The views expressed in this article are not intended as investment advice. Market data is provided by Bitfinex. The charts for the analysis are provided by TradingView. and TensorCharts.com]

Trade Bitcoin, Litecoin and other cryptocurrencies on online Bitcoin forex broker platform evolve.markets.

Images courtesy of Shutterstock, Trading View. Market data sourced from Coinbase.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.