Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

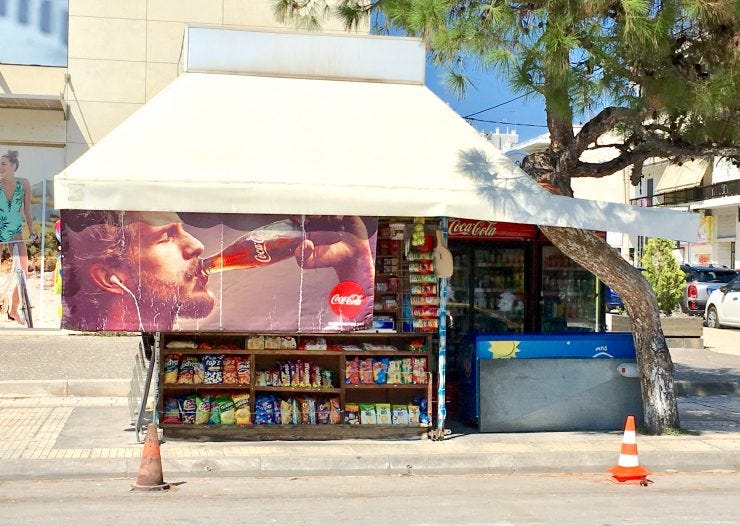

Security Tokens: Can I take my newspaper Kiosk business public?

Security Tokens represent securities. In essence, a security is a fungible, negotiable financial instrument that holds some type of monetary value. It represents an ownership position and enables stakeholders to own a particular stock, bond or in the case of security tokens, it can allow investors to acquire a stake in a newspaper kiosk.

According to the Securities and Exchange Commission (SEC), a security must fulfil the following criteria:

1. It is an investment of money;

2. The investment is in a common enterprise;

3. There is an expectation of profit from the work of the promoters or the third party.

STOs (Security Token Offerings) are fundraising tools similar to ICOs (Initial Coin Offerings) and IEOs (Initial Exchange Offerings — ICOs through exchanges) with a key difference in that they adhere to strict regulations. These digital assets operate within legal boundaries and certain regulators are accountable for their actions.

Typically, tokens (vouchers that can be exchanged for goods or services) are deemed to be securities if there is an expectation of a capital gain, generated from the efforts of others. In other words, security tokens are investment contracts bearing legal ownership rights of the underlying asset.

What happens if I want my business to raise money via an STO?

If a business wants to raise money via an STO and make it available on the blockchain, the business should follow the similar guidelines that a typical company is going through an Initial Public Offering (IPO) process. This entails adhering to rules including specialist assistance usually provided by a corporate finance firm that takes charge of the listing, including permissions to advise and arrange the issuance of investments, i.e. shares.

The listing suggests that the company will be listed on an exchange either on a Regulated Market (RM), an Organised Trading Facility (OTF) or a Multilateral Trading Facility (MTF), where the company must comply with all the specified listing requirements of the venue.

The shares will not be deemed to be listed unless an exchange operator is involved, and a prospectus will only be deemed necessary depending on the number of investors the shares are offered to. The regulator must also be notified prior to such an operation to commence. The listing can also be on a cross-border basis under passporting provisions.

In summary, the company needs to transition from private to public, and an Investment Firm needs to be involved to facilitate issuance and adherence to regulatory rules. The exchange will list the company, all shares will be publicly traded, and the market will regulate this operation following all the required listing procedures.

It is not as easy as it looks — expensive and time-consuming — to conduct an STO for a company and to issue tokens as a security, but what are the alternatives?

Buying a Company through an Investment Fund, and the Fund lists the shares as an STO

Imagine a Master Fund has a Fund called ‘Kiosk’, and this Fund acquires the newspaper kiosk business that you own 1:1 for 100%. This Investment Fund will then be allowed to offer the tokens (aggregated in the fund) through a prospectus and can list these on an exchange making the process even easier. Therefore, a much more efficient way to offer an STO is to use an investment fund structure that facilitates the purchase of companies or vehicles and offers them out to investors as units of that investment fund.

Why are STOs important?

Given the fact that we can now tokenise existing securities such as Apple and Google, this concept can be taken a step further and allow smaller companies to be made available to investors. This is made possible by blockchain technology which focusses on decentralisation and fintech.

STOs facilitate capital market services such as fundraising and commoditisation, but at a grass-roots level which means far more people can participate in capital markets than ever before. Security tokens are structured differently to traditional listings, but in the end, the final result is similar, because STOs allow us to issue securities that are offered via brokerages and regulated exchanges.

If STOs are conducted in accordance with guidelines (while employing protective mechanisms), they are a superb vehicle for securitisation of assets while mitigating the risk of market default.

Summing up the options for a newspaper Kiosk raising capital

1. Crowdfunding platforms (Kickstarter, Seedrs, etc.) can present the project to the public and raise money for a variety of causes;

2. Initial Coin Offerings can create tokens, i.e. ERC20 attached to the utility of a business and can benefit the wellbeing of an enterprise;

3. Initial Exchange Offerings can list the token on the best exchanges, i.e. Binance as a utility token while providing cross liquidity. As it currently stands most exchanges are not permitted to offer STOs;

4. Sell traditional shares to investors on a known basis;

5. Conducting a Security Token Offering via an Investment Firm or via a Fund. In our case ‘Kiosk’, I believe the Fund option is the most straightforward and best course of action.

The truth about Security Token Offerings (STOs) was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.