Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Trailing Stop Loss on Binance

Trailing Stop Loss on Binance

(Don’t have much time? Skip to: How to set a Trailing Stop Loss on Binance)

What is a Trailing Stop Loss?

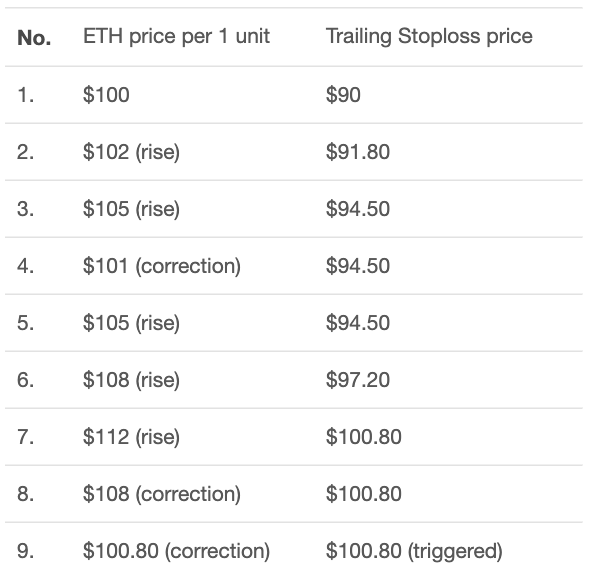

A Trailing Stop Loss (TSL) is placed just like an ordinary Stop Loss when entering a position; the difference here is that unlike a typical Stop Loss which is static, a TSL will follow the price as it moves up and wait if the price moves down.

The distance at which the TSL follows the price can be determined as a percentage, so if the current price of ETH was $100 and you had a TSL of -10% then your TSL would begin at $90 and follow the price at a maximum deviation of 10%.

When should I use a Trailing Stop Loss?

When should I use a Trailing Stop Loss?

Now you may be thinking: this is amazing! Why not use it all the time? But fortunately, I am here to tell you why that would be a bad idea.

A TSL is a tactical tool, it is more than just an extra precaution to throw on whenever you think you are being smart.

If used incorrectly, a TSL would most likely cause you to lose money.

A standard approach to trading, if holding a long position, is to move the Stop Loss up only after a pullback has occurred and the price is rising once again.

Figure 1: Manually Adjusting Stop Loss

Figure 1: Manually Adjusting Stop Loss

The Stop Loss is moved up to just below the lowest swing of the pullback. See Figure 1 as an example.

Unfortunately, if a pullback did occur, an active TSL would most likely be triggered causing you to exit the trade right before the coin rises again.

The true potential for a Trailing Stop Loss (TSL) lies in its ability to exploit a rallying coin, allowing you to capture as much profit as possible without needing to actually call the top.

Let’s look at an example, consider Bitcoin (BTCUSDT) May 13th, 11:00 am:

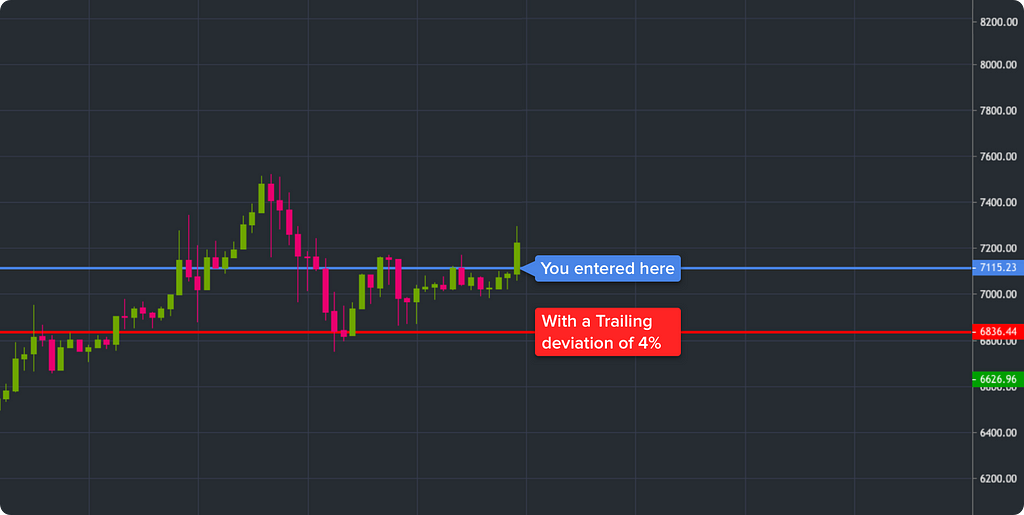

Imagine that after spotting a potential inverse head and shoulders, you see that BTCUSDT has tested its 7115.23 resistance and is ready for a breakout. You keep your eyes peeled and wait for your opportunity to enter a position.

Volume spikes and BTCUSDT breaks its resistance! You buy in around 7115–7120 with a TSL percentage deviation of 4%.

Typically, based on past highs, you would have some indication as to where the top might be. However, BTCUSDT has not traded within this range for over a year now, so accurately calling the top is almost impossible.

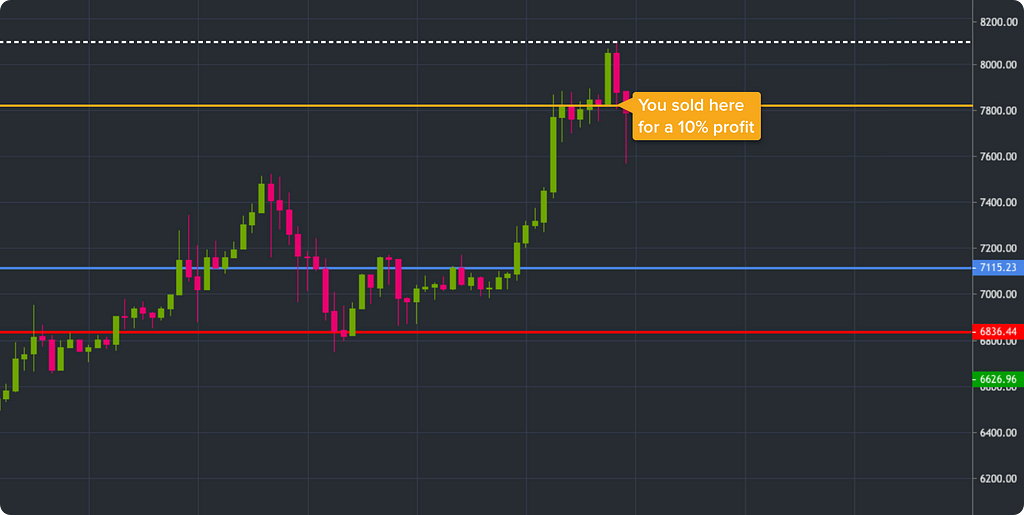

With your TSL in place, you ride it out and BTCUSDT reaches a high of 8099.60 before closing on the daily candle. At 7818.71, you exit the position and lock in a profit of 9.93%.

Ultimately, I made $142 on this exact trade since using a TSL enabled me to ride the rally until it had reached the top.

Another example of this happened on May 18th at 1:00 pm, where I used this same approach for NAVBTC. I entered a position at 0.0000310 with a tight TSL of 4.52%.

After 4 hours, NAVBTC closed the hourly candle with a high of 0.0000389; and locking in a profit of 20.96% (TSL triggered at 0.0000372). My position closed and I left with a gross return of $604.80 (approx. $500 starting position size).

In conclusion, using a Trailing Stop Loss (TLS) proved to be extremely successful when used on rallying coins, especially in situations where the top is hard to predict.

Enjoyed this article?

Please clap👏 or applaud 👏👏👏 if you enjoyed this article.Feel free to share it with anyone you think would benefit from it!

How to Profit from a Trailing Stop Loss on Binance was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.