Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Rebalance your Cryptocurrency Portfolio — Before it is too Late

A guide to portfolio rebalancing in crypto.

Portfolio rebalancing is a simple strategy which has been used by institutions in the traditional financial system for decades. Billions of investment dollars leverage this powerful way to reduce risk, harvest value from volatility, and potentially boost returns.

Our team has an entire telegram group dedicated to portfolio rebalancing. We encourage you to join the group here.

How to rebalance a portfolio

To better understand the process of rebalancing a portfolio, let’s look at a simple example from a practical situation.

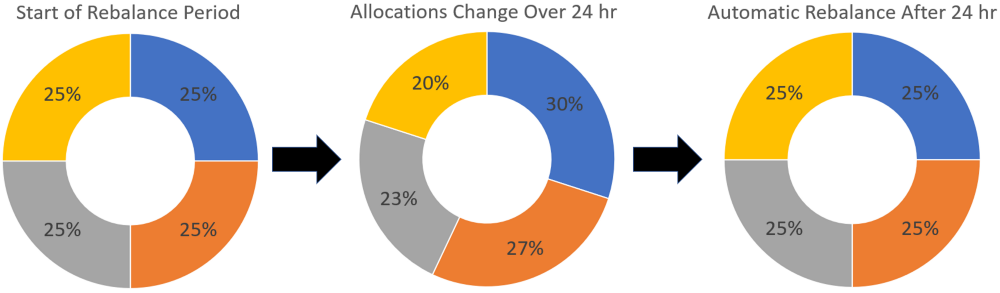

Imagine you have 4 different cryptocurrencies in your portfolio: BTC, ETH, XRP, and LTC. For the sake of simplicity, we will say our goal is to hold equal value in each of these crypto assets. That means each asset will have a 25% allocation or “weight.” If the size of our portfolio was $100, we would essentially have $25 in each of these 4 assets.

When an evenly distributed portfolio is rebalanced, it is returned to a state of having equal value in each asset.

When an evenly distributed portfolio is rebalanced, it is returned to a state of having equal value in each asset.

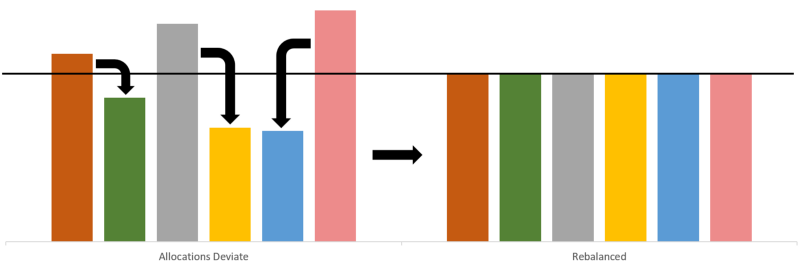

A rebalance is then the process of returning your portfolio to the initial desired allocations. As your portfolio drifts over time due to the price of your assets changing, a rebalance will realign the portfolio.

An example would be if the value of the LTC in our example portfolio went from $25 to $30 while the value of BTC went from $25 to $20. We now have 30% of our portfolio in LTC and only 20% of our portfolio in BTC. This was not the original 25% split we originally desired. As a result, we can sell $5 from our LTC holdings and move that value to BTC. Our example portfolio is then once again at its original 25% allocations for each asset.

Periodic Rebalancing This illustration demonstrates a 24 hour rebalancing period. The portfolio is allowed to drift in value for 24 hours. During that time, the allocation percentages for each asset can change. After 24 hours, a rebalance is performed to realign the portfolio with the desired allocations.

This illustration demonstrates a 24 hour rebalancing period. The portfolio is allowed to drift in value for 24 hours. During that time, the allocation percentages for each asset can change. After 24 hours, a rebalance is performed to realign the portfolio with the desired allocations.

The act of rebalancing a portfolio can take place under a variety of different circumstances. Most commonly, investors use a periodic rebalancing strategy. This simply means a rebalance is executed on a consistent time interval. In the crypto space, this could be every week, day, or even hour. Although the traditional financial system tends to use longer rebalancing periods like yearly, cryptocurrency markets are far more volatile, so it’s possible to implement shorter time periods. We’ve found in our detailed studies that high frequency rebalances can boost returns when performed on liquid exchanges with low fees. You can see this study here:

An Analysis of High Frequency Rebalancing — A New Strategy for Crypto Portfolio Management

Setting up a rebalancing strategy

Getting started with rebalancing can be complicated when done manually. It requires precision, patience, and time to calculate each of the trades that you need to manually place on an exchange. The simplest way to rebalance your portfolio is to use the Shrimpy application. Shrimpy is a free rebalancing app for the cryptocurrency market. It only takes a few minutes to get set up, so let’s go through the steps to implement our first rebalancing strategy.

Create a Shrimpy account by visiting https://www.shrimpy.io/ and clicking Sign Up.

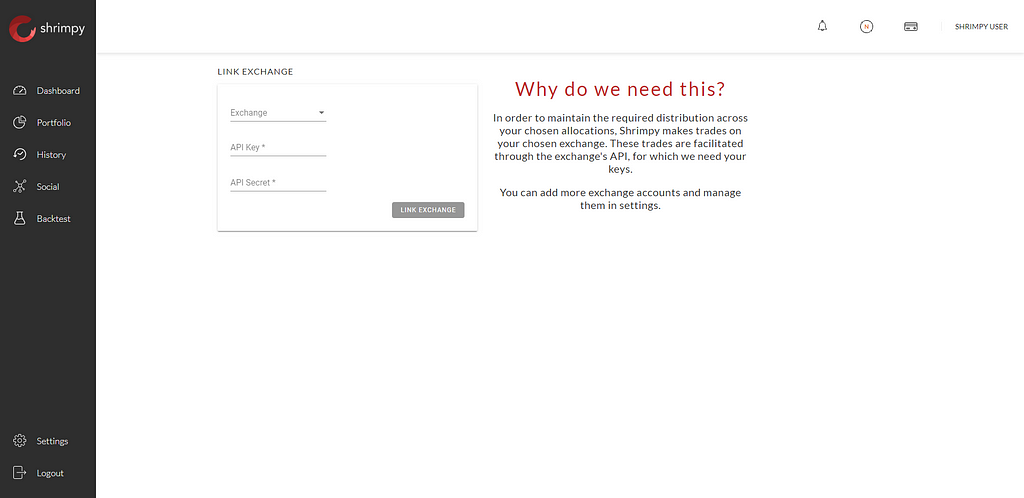

Logging into Shrimpy, you will find the above page after clicking through the initial slides explaining the application. In the input boxes, select the exchange you would like to connect and enter valid API keys that have trading permissions enabled. Detailed guides on how to access API keys for each exchange can be found here.

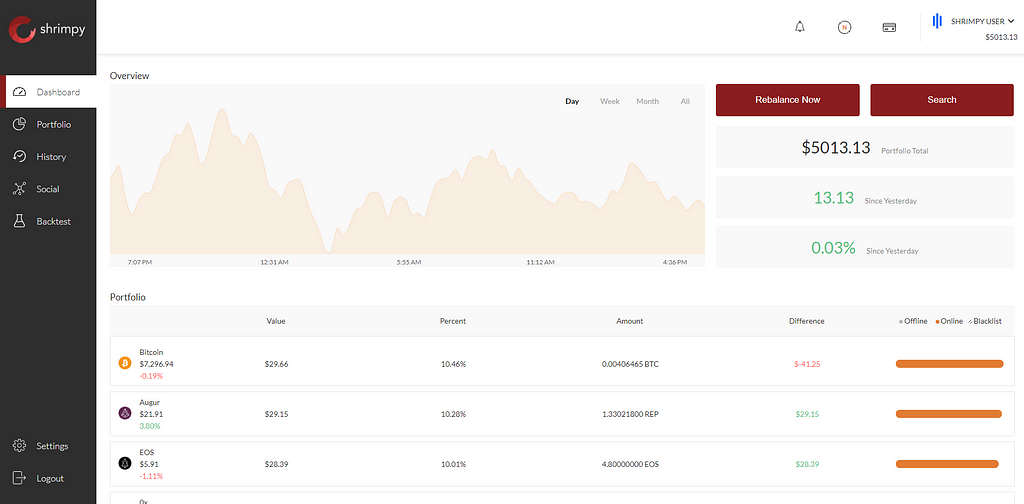

Data will now populate your dashboard.

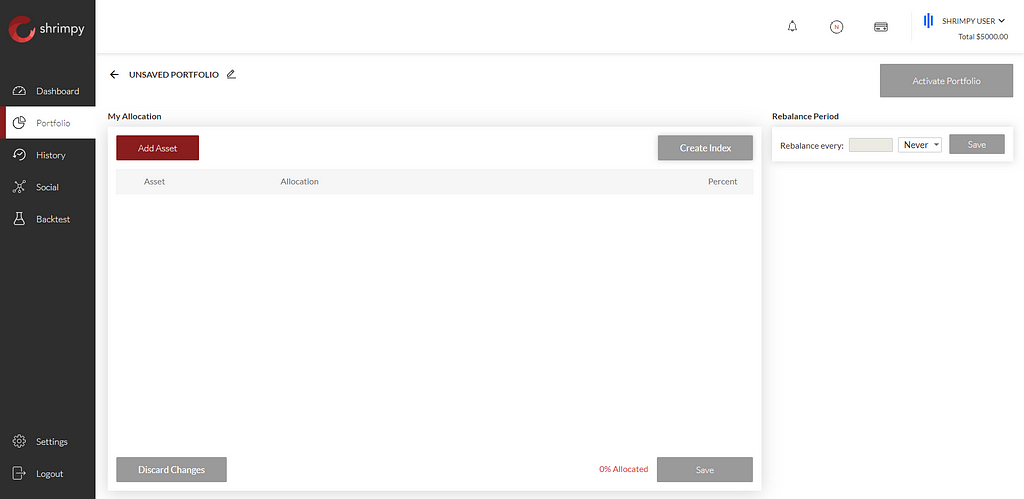

Create a new portfolio on the Portfolio tab by selecting the Create a New Portfolio.

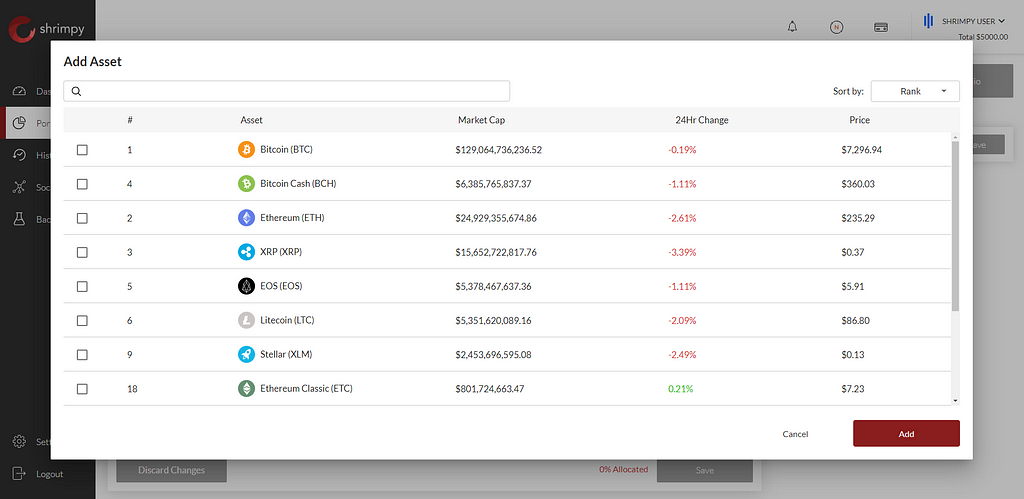

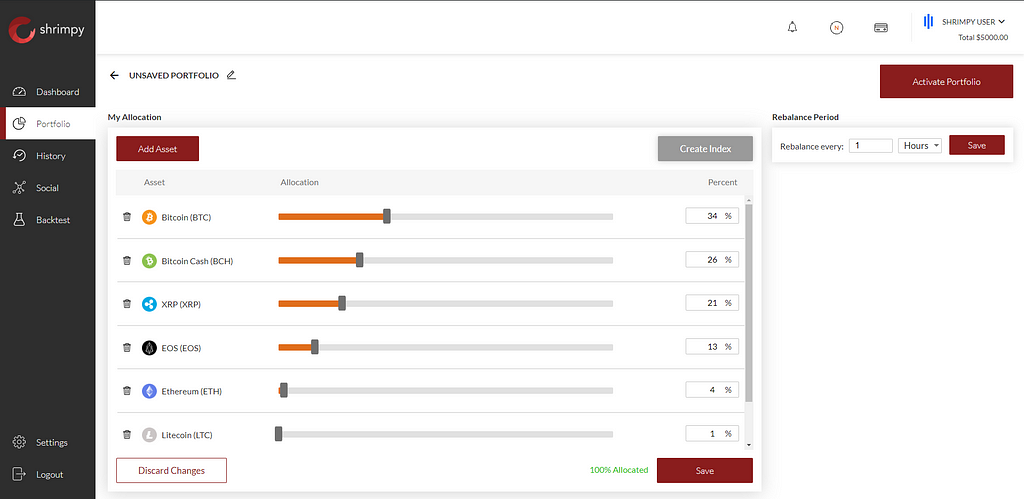

Using the Add Asset button, select the assets you would like in your portfolio.

Use the sliders or the input boxes to select the percentage of each asset you would like to maintain in your portfolio. Once you select Save for the allocations, select a rebalance period that is appropriate for your portfolio strategy.

Use the Rebalance Now button to execute a rebalance immediately. Once you hit the button, Shrimpy will allocate the portfolio to the desired allocations specified in your portfolio tab. After the initial allocation, each time you subsequently click the Rebalance Now button, it will realign your allocations to once again match your desired allocations.

Congratulations! You have successfully executed your first portfolio rebalance! Rebalances will continue to take place on a consistent interval based on the period that is set in your portfolio settings.

Additional Reading

How to Create a Diverse Crypto Portfolio with Coinbase Pro

The Whitepaper for Portfolio Rebalancing in Crypto

Crypto users who diversify perform better

Shrimpy Adds Social Portfolios for Crypto

About Shrimpy

Shrimpy is a free automated cryptocurrency rebalancing tool that lets users automate their strategy with only a few clicks. Follow other users in our social program, backtest strategies, and monitor your portfolio across exchanges.

Shrimpy’s Crypto Trading API is a cloud-based solution for cryptocurrency developers. Integrating the Shrimpy Developer APIs provides access to 16 exchanges, uniform trading endpoints, product scalability, and user management.

CoinOrderBook is a free real-time crypto exchange order book data provider that leverages the powerful Shrimpy Developer APIs. Browse asset listings, analyze arbitrage opportunities, collect order book data, and evaluate trading pair spreads.

~The Shrimpy Team

Originally published at https://blog.shrimpy.io on May 22, 2019.

How to Rebalance your Cryptocurrency Portfolio was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.