Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Originally published on the Brex Blog

There’s a good reason Uber is looking for a valuation north of $80 billion. Uber’s services can be found nearly all around the world. If it’s not the Uber product itself, Uber probably owns a piece of whatever rideshare or transportation company you are using. With large stakes in Grab, Didi, and operations in pretty much every continent, Uber represents a landscape-changing company. Uber’s ambitions to become a worldwide operation are certainly not to be underestimated, even if it has exited some regions like China.

It still faces competition, and while it holds a minority of market share, Lyft represents a sizable competitor in the United States. Lyft’s consistent usage among major U.S. cities shows there is room for two players — and that Uber is not invulnerable.

We analyzed Brex customer spend data to consider the dynamics between Uber and Lyft. Brex data represents a snapshot of how startups and early-stage companies deploy their capital across a variety of services including software, operations, and other expenses. Brex data can give us at least a piece of the past year’s story that’s playing out between Uber and Lyft.

These are the kinds of early adopter companies that will likely opt for services like Uber or Lyft for their transportation over traditional services and are thus companies that Uber will hope to grow with as it expands. And this, of course, represents an important market for Lyft. Before we get started, we can see that Uber unsurprisingly has substantially larger usage among Brex users than Lyft.

A look at the overall picture — and startup central

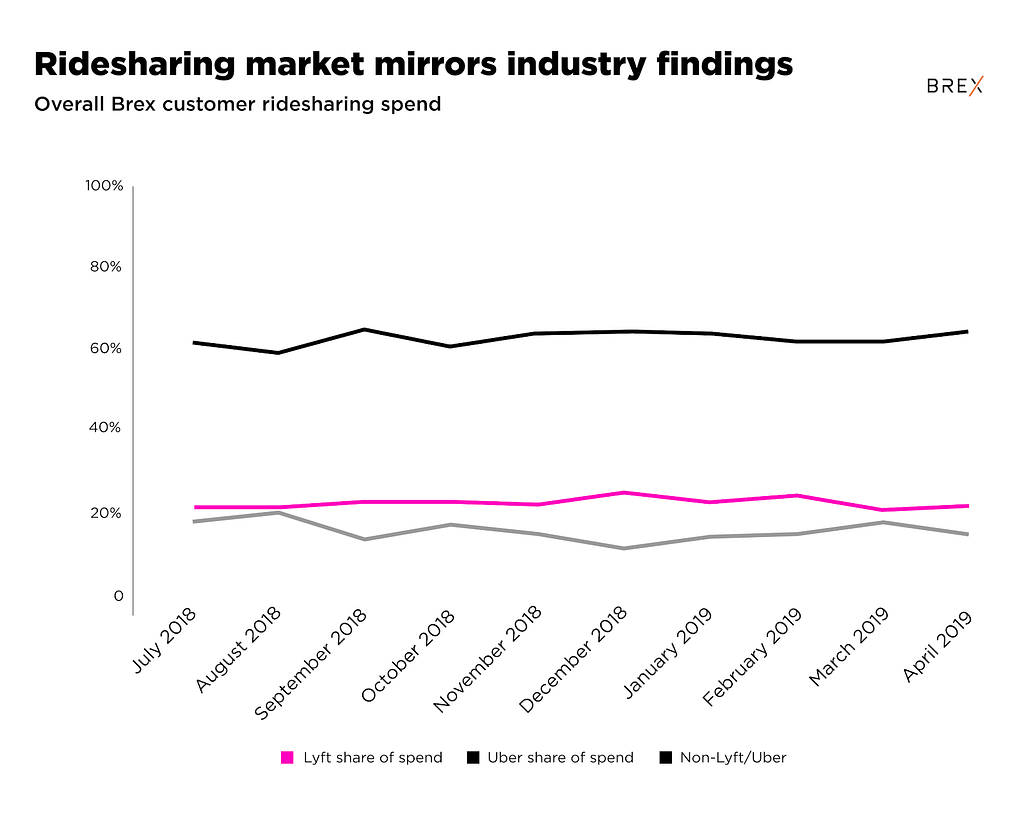

Uber continued to hold a dominant share of total spend by Brex customers, consisting of around 60% of total spend for ridesharing companies for the past year. This distribution remained mostly unchanged for the past year, while Lyft and other taxi services splitting the remainder (with Lyft normally taking the majority of that remainder).

What we’re seeing may seem a little boring — it’s just three about-straight lines, after all! However, this still represents an important market for Uber. From this, we can see a picture of two companies that remain quite competitive with each other, even if there is a substantial gap between them. These results roughly mirror findings from others like Second Measure, though non-Lyft/Uber still retains some share.

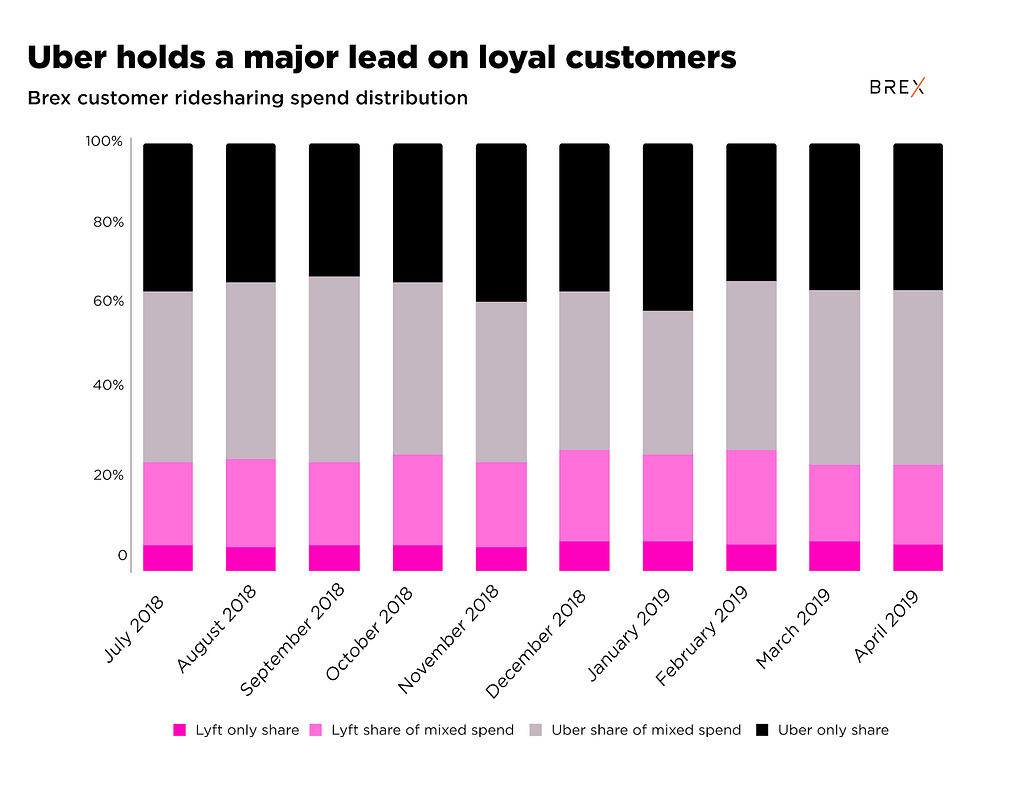

While Lyft spend as a whole still accounts for a good chunk of Brex customer spend, the majority of that falls under Brex customers that use both Uber and Lyft. Indeed, the percentage of Brex customers only using Lyft is quite small when compared to that of Uber. This distribution is roughly consistent across all of our major markets. If we dive further into the spending mix, we also see that Uber also dominates the share of Brex customers using both Lyft and Uber.

This tells us that the majority of Brex customers spending money on ridesharing are using both products. One possible explanation is that startups opt to pick the cheapest option, which would make sense to try to keep corporate spending under control. It also tells us that even though the majority spend on both products, Lyft remains a minority of that mixed spend overall. Third, it tells us that Lyft’s potential “loyalist” subset among Brex users is even smaller — with a total spend of less than 7% each month!

We can get a much clearer picture of Uber’s performance in the country’s early adopters of new technology when looking at our biggest market, the San Francisco Bay Area. This region represents the majority of Brex customer spend on Uber and Lyft with Brex.

Going beyond our California bubble

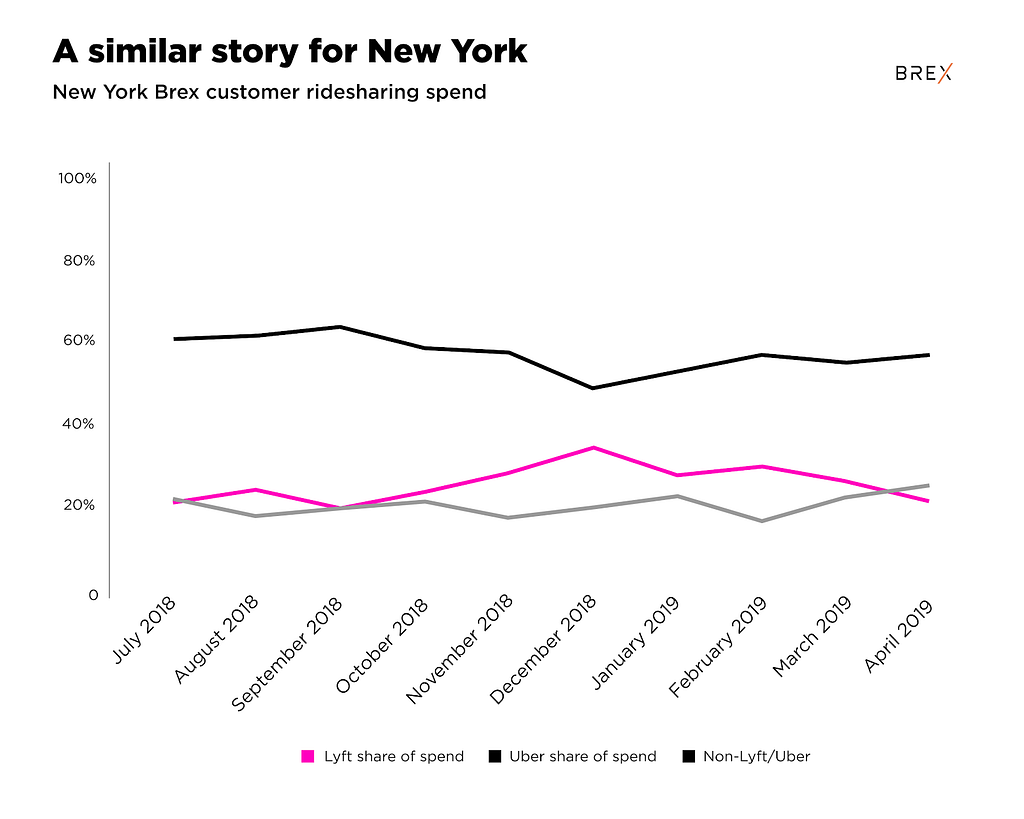

Markets beyond the Bay Area represent a smaller percentage of Brex customer spend, but they still give us a glimpse of how startups are spending money on ridesharing services. New York is, as you’d expect, the next-largest market for Brex in terms of customer spend on Uber and Lyft. To get a better look, we analyzed spend data for Brex customers based in New York — and our picture is quite different than the Bay Area.

In New York, we see what looks like a tighter competition across the three transportation options, and also that services outside Lyft and Uber (like taxis) still remain competitive. Though New York may traditionally be a city where you can step out and hail a cab on a street corner, Brex customers have still clearly opted to make Lyft and Uber a part of their daily operations.

We can see that while Uber has captured much of the Bay Area, it is not invulnerable in some markets like New York. It may be because users are calling two cars at once and taking the vehicle that first arrives, or one has a lower surge pricing or any other set of factors. Either way, Lyft and Uber have over the past few months been in closer competition — and the taxis appear to be a practical option still.

Looking forward, and keeping things in perspective

As Uber goes public, it’s important to remember that the United States still represents a substantial part of its market. In 2018, the United States and Canada represented more than $6 billion of the $10.9 billion in revenue generated by Uber’s “core platform” revenue in 2018, according to the company’s S-1 filing. While ridesharing behavior may differ radically abroad, Uber (and Lyft) still need to keep a hold on ridership in the U.S. — especially among the kinds of companies that may eventually grow to be the next Uber. Being the first option for companies that may one day have thousands, or tens of thousands, of employees is not a market to ignore.

It may still be hard to define precisely what kind of company Uber is, or what it wants to be when it begins trading in the coming weeks. It could be a transportation company, getting everything — including people, food, and beyond — from point A to point B. It could also be a software company, creating the technology that powers all this. Or you could consider it an infrastructure company, creating the pipes that will fuel a new industry.

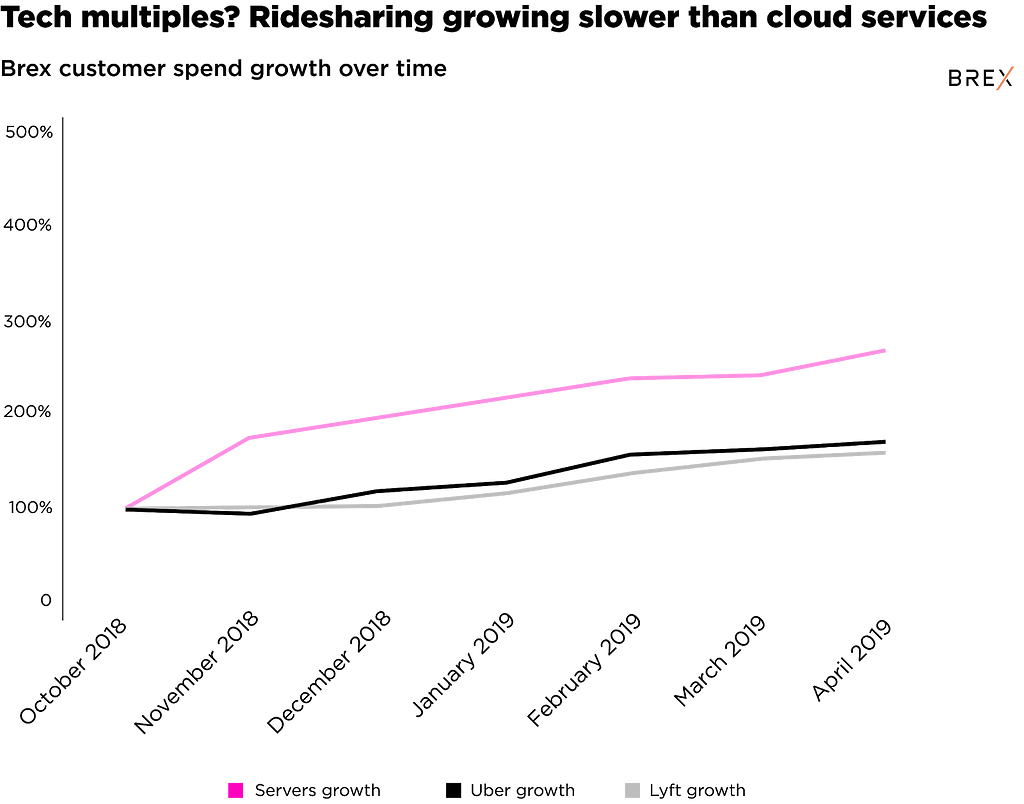

The latter one probably isn’t entirely the best comparison, however. The ridesharing industry as a whole is growing considerably, but so is the backbone of the internet: Servers.

Amazon, after all, turned its AWS server business into one of its most efficient business lines that can generate more than $10 billion a year. Uber may be upending the transportation industry, but it’s not quite an Internet-defining company just yet.

Methodology

Brex examined spending data for Lyft and Uber through June last year when the first Brex card launched. Share of spend is defined as the total dollar amount for either Lyft or Uber transactions over the entire spend for both Uber and Lyft in a time period. Customer usage is defined as the total number of accounts spending on Lyft or Uber compared to the total number of Brex customers authorizing transactions on the Brex card. This data on Uber does not include Uber EATS — for which we are very much grateful to our data science team. This data also excluded spend from some companies that use Uber or Lyft a large amount for operational purposes.

About Brex

Brex is transforming B2B payments by creating financial products that are tailored to specific industries. In 2018 Brex launched the first corporate card and rewards program specifically designed for startups. By rebuilding the credit card tech stack from the ground up, Brex is able to reimagine every aspect of corporate cards, including underwriting, transparency and approvals, to create a radically better experience for customers. Brex has raised $215M in funding and is backed by Y Combinator Continuity, Peter Thiel, Max Levchin and more. The company’s headquarters are in San Francisco.

We’re still early, and we welcome as much feedback as we can get. Also, we are hiring like crazy. Check out any openings we have!

Uber Holds 60% Ridesharing Marketshare Amongst Startups was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.