Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Image by Negative Space on Pexels.

Image by Negative Space on Pexels.

Wall Street is Las Vegas for smart people. It’s where you take your money if you want to have the odds on your side. Like Las Vegas, it’s full of people who think they have the winning system to get even further ahead. Hedge funds, value investors, your uncle, who is sure that they connect the next big thing, and especially Jim Cramer.

They are all trying to outsmart everyone else, and this makes sense. The legend and mystique around Wall Street is that if you’re smart enough, you can be like Midas ensuring everything you touch will become gold.

There’s a clip from the movie “Limitless” that perfectly encapsulates this allure of Wall Street. Super intelligent guy gets on Wall Street and from nothing makes millions because he sees things, the others don’t. He outsmarts them.

Of course, you have to take out the exaggerated Hollywood elements, but for many people, this is the sexy side of Wall Street. Bring me your four masses and if you’re smart we will make you rich. Moreover, many people believe that story and chase its promise.

However, there was an idea that challenged that narrative that radically suggested that it may be impossible to improve your odds beyond the average. Even brilliant money managers, hedge funds and the best investors may be no better than monkeys at picking stocks.

But before we go to the monkeys, let’s first talk about the big question. The question some of the greatest minds in the world have spent their lives trying to answer, the one that would make you rich.

What will the Price of a Stock be Tomorrow?

The answers to this question are as numerous as you might expect for an alchemy recipe. There is fundamental analysis, technical analysis, buy and hold, value investing, growth investing, it can go on pretty much forever… And the point is at this time it was thought that if you had money, you needed to find a genius on Wall Street to invest that money for you.

Someone who through some secret strategy, managed your wealth in exchange for a fee. The idea was that their expertise would get you returns and your money that would more than pay for their secret formula. This is how you made the big bucks if you’re on Wall Street, managing people’s money and charging a fee for it.

These competing views of the stock market and wealthy wealth managers along comes an American economist Burton Malkiel who looks at the market and essentially throws a monkey wrench at the traditional theories.

In his book “A Random Walk Down Wall Street”, he says, “No, you’re all wrong. The stock market can’t be consistently predicted by any theory. The only predictable thing we have about the market is that the whole thing tends to increase over time.

No one is able to consistently pick winners over anyone else. A blindfolded monkey throwing darts at newspapers financial pages could select a portfolio that would do just as well as one carefully selected by experts.”

If this is true Mauao goes on to say, instead of paying big bucks to Wall Street to let experts manage your wealth, the best thing to do is to find a minimum fee fund that buys up hundreds of stocks without discrimination for winners and losers, and just holds them passively.

Because the future of a stock is fundamentally unknowable anyways. Because if your average return is the same for both strategies -expert management and monkey management- why would anyone pay for the experts?

Enter the index fund of the early 70s. Exactly the kind of low fee fund that now Gail proposes. You buy it, pay a small maintenance fee, and it just plies and holds hundreds of stocks. Now if you’re one of those expert investors, an index fund seems both silly and insulting. Random stocks, no technical analysis, no psychological analysis, no chart analysis. This was a challenge.

Over the next decades, the data between expert funds and monkey funds raged on. After almost 50 years of data, the results are in, and it’s overwhelming.

You can find hundreds of studies on this, because this is one of the most surprising and overanalyze things in finance. But here are the headlines, “Over the last 15 years, index funds outperformed 90% of actively managed funds when you account for their fees.”

Let me repeat that, 90%, not 50%. 90% of the smartest people on Wall Street made less money than monkeys. The 10% while given the averages it starts looking a lot like luck rather than skill. After all given enough investors it’s self-evident that someone will gain above average returns just by sheer luck.

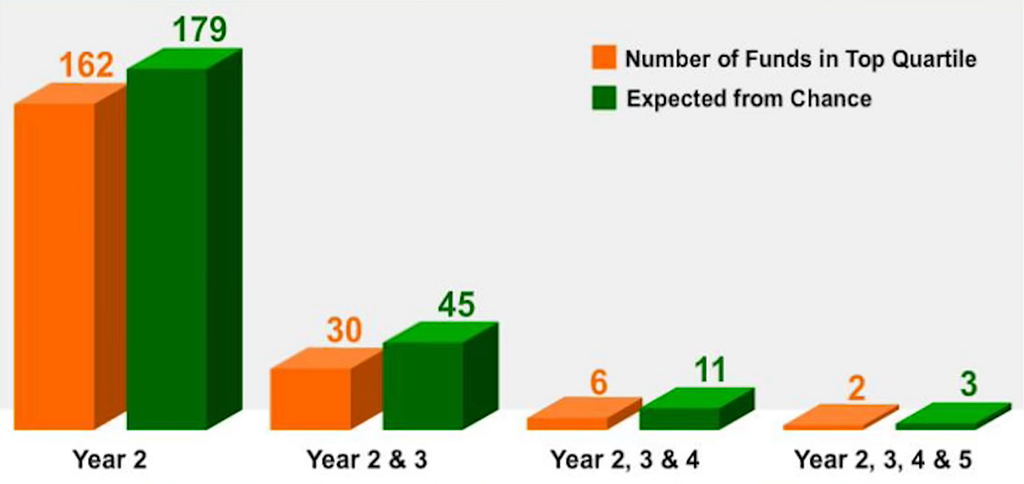

We also have a study that even the funds that do beat the index fund one, three, five years struggle to continue that positive performance. And the number that does continue that positive performance year over year is about the number that we’d expect from blind chance.

Just because you won 15 coin flips in a row doesn’t mean you’re any more likely to win the next one.

Let’s talk about why the future of the stock market can’t be predicted. This is a long-theorized idea called the efficient market hypothesis. And even for the people who don’t subscribe to that idea, there’s another confounding problem at work here. It’s a game theory problem.

It’s a situation where there are so many rational actors in the system that the market can’t be reasonably predicted. Because each time someone gets a winning method of valuing stocks, the next person will find a way to incorporate that strategy into a new strategy to beat the first strategy.

In other words, every one strategy must take into account different dominant investing strategies into their formula for how the market will swing. But it’s self-referential because the other rational actors will feasibly be trying to incorporate your strategy into their investing strategy.

This is kind of where it all breaks down; it’s an ever-evolving game that you’ll never win it long enough to beat the market average.

So while occasionally there are exploits in the market, they rarely last for long and they almost always found by different people. Even Warren Buffett who is on the very short list of people you might argue has consistently beaten the stock market when asked what to invest in doesn’t bother naming his own or any other.

Instead, he has a simple answer that would make smile, and he recommends you get some index funds.

It turns out that predicting winners and losers is impractical over long periods. There’s no such thing as a consistently winning strategy over the long haul. It’s much more like gambling where the house odds are on your side. You’re going to win some, and you’re going to lose some, and you can’t predict which.

However, if you stay around long enough, you’ll gain more than you lose. The only thing you shouldn’t do is pay someone to come up with fancy models and strategies for something that ultimately comes to chance. Just go and get some monkeys.

References:

- https://www.investopedia.com/terms/e/efficientmarkethypothesis.asp

- https://us.spindices.com/documents/spiva/spiva-us-year-end-2017.pdf

- https://us.spindices.com/documents/spiva/spiva-us-year-end-2017.pdf

- https://startbusinessjourney.com/what-is-gdpr/

- https://www.ifa.com/articles/does_past_performance_matter_view_from_jones_indices/

- https://www.investopedia.com/terms/i/indexfund.asp

- https://www.investopedia.com/terms/e/efficientmarkethypothesis.asp

Can Stock Prices Be Predicted? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.