Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Can A Global Cryptocurrency Dominate Fiat Someday?

Image by tom bark from Pixabay

Image by tom bark from Pixabay

Bitcoin, the pioneering cryptocurrency that has managed to withstand the tests its decade-long life has put it through, still seems far from the dream of overtaking fiat someday. Yet, some staunch Bitcoin evangelists, most of them putting quite a bit of money where their mouths are, are quite convinced that Bitcoin will soon become the dominant mode of payment in the world, outrunning the popularity of centrally supplied fiat promissory notes.

Tim Draper, a rather respected venture capitalist in the field, has in fact gone a step further to articulate his faith in the bright future of Bitcoin, saying that in 5 years, if one tries to buy coffee with fiat and not crypto, they will be laughed at by the barista.

Photo by Austin Distel on Unsplash

Photo by Austin Distel on Unsplash

While I would not be credulous enough to depend upon such a quick and simple change, I cannot wholeheartedly dismiss Draper’s optimism either.

Hear me out! I am not saying that Bitcoin will successfully transcend its shortcomings overnight. However, what it will do, is provide the basis for a viable cryptocurrency that can one day blur boundaries and unite the world as one. I definitely think that it is likely, given time, that there will emerge a dominant global cryptocurrency.

With regard to Bitcoin, two of the most enduring complaints seem to be that it is not stable and that it is not speedy enough to facilitate effective transfer of wealth. The former is a recurrent problem with cryptocurrencies in general. Given its long-standing scalability problem, the second issue has also presented a substantial roadblock to adoption.

Considering these issues, I have to admit that Bitcoin is not necessarily the best there is, or the best there can be. Even so, the very fact that it has managed to survive and in fact, spawn a whole host of altcoins following in its footsteps, tells us that there is some merit to the basic idea. Bitcoin has not failed, and has only served to show us that a decentralized peer-to-peer currency system can exist, and can benefit people around the world. Bitcoin is essentially the proof of concept for a future crypto that can dominate the financial landscape, and based on its success and resilience so far, I can definitely see the light at the end of the tunnel.

A fair number of investors, most of who have bet their own hard-earned money on a crypto, are of the opinion that crypto will take over a large section of the financial market in the next 10 years. Frank Holmes, of the US Global Investors, has emphasized on what the Chicago Feds had said about fiat’s declining supply. The current $1.59 trillion fiat supply in the US could potentially sink to $501 billion in 10 years, making a lot of room for a dominant crypto to find its place.

The St. Louis Federal Reserve had also made a similar comment, giving weight to the idea that central authorities around the world are also warming up to crypto.

Role of Governments

Now, many have warned that having governments embrace crypto can be detrimental to its basic premise of being decentralized. That is a fair concern, which is why, I too am somewhat doubtful as to how well crypto can work in countries like Venezuela, where the government itself has introduced crypto to salvage a fledgling economy. The alternative to all of this, which I believe can be turned into reality, is having a global crypto that strikes at the very foundations of economic division and disparity.

With cryptocurrencies undergoing rapid innovations and the fourth generation of blockchain being developed, I am looking forward to a heightened technological robustness. This will pave the way for a more advanced cryptocurrency that can effectively address the needs of the common people, with a smarter, more efficient blockchain technology at its core.

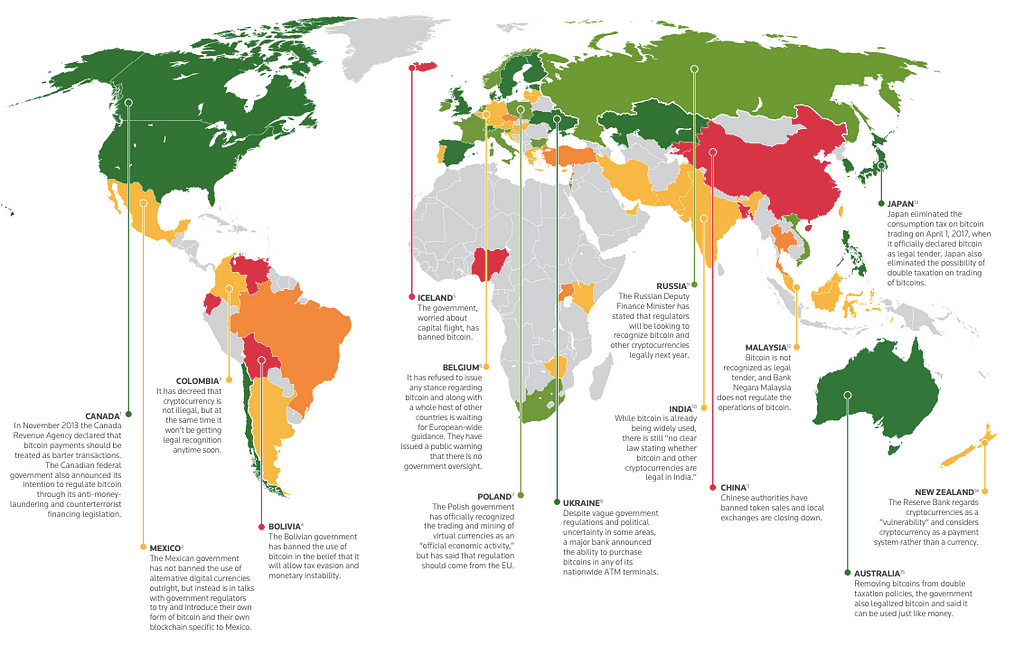

Source: A World of Cryptocurrencies by Thomson Reuters

Source: A World of Cryptocurrencies by Thomson Reuters

An issue that may present itself in trying to move towards a global cryptocurrency is how different countries react to crypto adoption. There are nearly 200 countries in the world and each of them have their unique economic needs and structures. Having a single crypto will not help bypass all the issues that arise at the macro and micro levels for all these disparate economies. Different countries will also have their own timelines of adoption and change, making it hard for a global crypto to find its way into common people’s hands. Moreover, in developing countries, with little education and training, laymen might face difficulties in navigating the world of digitized decentralized payments and increased crypto mining might effectively put a strain on the resources available to these countries.

Does this mean all hope is lost? Not quite! I still see the future for a dominant crypto working out just fine, provided there are clear exchange rates with local, centrally backed fiat currencies. As fiat backed by the central government comes with a certain sense of assurance, its complete dismissal can actually lead to political and economic instability. Therefore, instead, I envisage a situation where crypto usage outpaces the use of traditional fiat currency, and gives back control to the common people without threatening the foundations of political structures around the world.

Process of Globalization

I like to see this as being analogous to the process of globalization. The periods before, and especially after the Second World War were marked by heightened distrust and fear, hatred and hostility. Despite that, as the Cold War situations thawed and the economic liberalisation occurred, boundaries started blurring out, and walls came crashing down in the wake of globalization. If globalization can turn the world into a global village without necessarily uprooting the entirety of its socio-political foundation, I don’t see why crypto cannot permeate the global financial fabric in the same way.

In essence, I see a dominant crypto taking over quite organically even as centrally backed crypto continues to exist. This way, people all over the world will be able to use a currency system that is transparent and accountable, immutable and decentralized. This will no longer require them to place their trust in a central authority and it will also make them responsible for the smooth and scrupulous functioning of the financial system. Having an accountable and trustworthy system as its rival might potentially lead to fiat being reformed as well, ushering in a new era of economic inclusivity.

Clearly, in some time, we will see that crypto is no longer playing second fiddle to fiat and that common people around the world are more effectively in charge of their financial decisions.

Technological and financial literacy are prerequisites to this change but that too, will come in due course of time as well. It is definitely easier said than done, but as long as we don’t lose sight of the light beckoning us from the end of the tunnel, we should be alright!

Can A Global Cryptocurrency Dominate Over Fiat Someday? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.