Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Share certificates materialize the ownership of a firm

Share certificates materialize the ownership of a firm

As a serial entrepreneur, I’ve had my share of heavy conversations regarding shares of co-founders, dilutive clauses in investment contracts, and limits set by investors to what the executive team can actually do. Still, as most founders, I’ve been enjoying the feeling of being my own boss, to be empowered to make decisions, and to pocket a fair return on my effort when the company is successful.

When I started to venture into crypto-land, my perspective changed a bit. Blockchain is a decentralized technology, but should projects based on blockchain be decentralized as well? Who should own a decentralized application? Who should decide how it is designed and rolled out? Who should extract some economic value out of it?

Building a community around an open source application and economic incentives is such a new thing. It seemed obvious to me that the usual startup model wasn’t the best way to orchestrate the large-scale cooperation games made possible by blockchain and crypto-economics. The idea of using DAOs (Decentralized Autonomous Organizations) as a new instrument to operate decentralized projects seemed a much more compelling perspective.

But then again, who would own the DAO and set the rules of the game? Most current DAOs seem to be started by centralized teams, similar to startups. Do these teams control their DAOs in the same way that co-founders control a startup? And after all, is it even possible to own a DAO? This article is an attempt to shed a timid light on the issue.

Like it or not, private ownership is a cornerstone of our civilization. The appropriation of resources by natural or legal persons has often been questioned since the famous slogan from Proudhon: “La propriété, c’est le vol!” (“property is theft!”). But most modern attempts to collectivize ownership — by communist States as well as by smaller-scale societies such as kibbutzim — have failed.

The right of property is still seen as a natural right, theorized by John Locke as inseparable from public liberties, defined as inviolable and sacred in the French Declaration of Human and Civic Rights of 1789, and confirmed in the article 17 of the Universal Declaration of the Rights of Man.

In Roman Law, ownership was defined as the conjunction of three rights: usus (the right to use a good), fructus (the right to extract economic value from a good), abusus (the right to dispose of a good). As the owner of a car — let’s say a chariot, back in the days — you can use it to drive somewhere, rent it to others for money, or sell it.

Owner’s control can be temporarily alienated, for example when the usufruct — the combination of usus and fructus — of a good is granted by the owner to someone else. The supremacy of the owner depends then on their entitlement to abusus, which results in an amusing paradox: the truer way to exert ownership is getting rid of it!

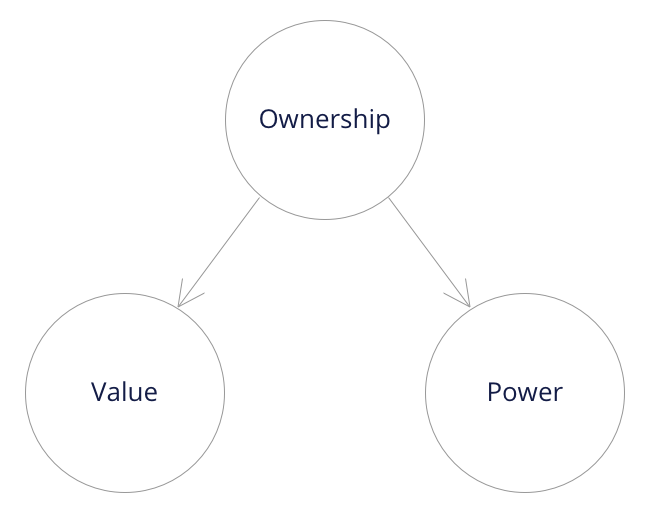

Value and power

Another way to look at ownership is to point out its two essential aspects: value and power. Owners have the ability to extract value from the things they own, as utility or as financial revenue. They also have the power to decide how to extract value (via usus, fructus, abusus) from their goods, or to abstain to do so (as in the case of a landlord who decides to leave some of his properties vacant).

Company shares, which materialize the ownership of a company, combines these two aspects:

- Power over the company strategy and resources is exerted via voting rights that are proportional to the number of shares owned by the shareholders;

- Dividends, as a measure of the economic value produced by the firm, are distributed to the shareholders, in the proportion of their shares.

How Decentralization affects Ownership

Here is an attempt to define “decentralization”, by Angela Walch: “Decentralization is fundamentally about diffusing power by distributing it away from a central point of control”. The term “decentralization” is often criticized because it’s a negative expression: it says what it isn’t, rather than what it is. However, Walch’s definition is somewhat substantive:

- decentralization as a state: a — more or less — even diffusion of power;

- decentralization as a process: pushing the power away from a single point of control.

As seen above, power is an essential attribute of ownership. As the power over something is decentralized, the ownership of this thing must follow suit, and be shifted away from a central nexus.

Still, our selected definition leaves the space open for different interpretations. If decentralization means “no central point of control”, it doesn’t say much about how control is exerted, nor by who.

So, who owns a DAO?

“DAO” stands for Decentralized Autonomous Organizations. Applying the previous definition leads us to assume that such organizations do not have a central point of control*.

But what does that entail?

One way to see it is to assume that DAOs have many instances of control, rather than one.

If a DAO is owned by many parties, the power between controlling entities is more or less evenly distributed, so that there’s less risk that a single tier or a small group of members exert a disproportionate power over the whole organization.

The measure of decentralization of a DAO is then defined by the number and the respective influence of members of the organization. In the case of a crypto-network, for instance, decentralization will be a function of the number of nodes, the number of miners or stakers, the distribution of token holdings, the number of contributing developers, etc.

There is another way to prevent the takeover of an organization by a single entity: instead of distributing the ownership to multiple parties, giving to no one else than the organization itself. Instead of being owned by many, being owned by none.

This is where the “A” of DAO — A as Autonomous — comes into place. A DAO can be understood as a self-owned entity, which cannot be controlled by anyone but itself.

What is Self-Ownership?

The idea that firms should be controlled from within — instead of depending on the will and the whims of distant shareholders — is not new. Cooperatives have been a way to keep the power inside organizations. The Statement on the Cooperative Identity states that a cooperative is an “autonomous association of persons united voluntarily to meet their common economic, social, and cultural needs and aspirations through a jointly owned and democratically controlled enterprise.”

Another way to prevent the alienation of a firm lies in the economic and legal concept of steward-ownership, which seeks to restrict the ownership of a company to its “fiduciary owners, i.e. stewards who control the company but do not hold dividend share”.

Such self-owned companies have been around for more than one century, mostly in northern Europe. They rely on legal mechanisms to ensure that the control of the company cannot fall into the hands of persons who pursue their own, private interests. A common way to achieve this goal is to give the voting rights to trustees who have no economic interest in the company, often through foundations. Most of the profits are either reinvested in the company or donated.

As Armin Steuernagel noted it, self-owned companies “challenge traditional ideas about the importance of private corporate ownership”. Since controlling rights are split from economic rights, stewards do not hold economic incentives, which contravenes the dominant narrative that links business performance with the financial incentivization of the owners. Actually, self-owned companies outperform the market on average, and include multi-billion businesses such as Bosch or Zeiss.

Self-owned companies put less emphasis on democratic governance (decentralization) than cooperatives, since stewards are generally executives and managers. On the other hand, they use legal mechanisms designed to ensure that the interest of the company itself prevails over any private interest (autonomy), including those of its internal stakeholders.

Blockchain-based autonomous organizations

DAOs give a new meaning to “self-ownership” of organizations. DAOs work according to rules that are defined and enforced through code running on a censorship-free, distributed network. No party has the power to force the DAO to suspend or to change the rules that govern its activity. Political, economic and social forces have little sway over software constructs shielded by a public blockchain.

In this sense, DAOs are truly “autonomous” (from αὐτός — autós, “self”, and νόμος — nómos, “law”), i.e. they are governed by themselves. They achieve a form of self-sovereignty thanks to the emancipation power of the code, even when surrounding jurisdictions do not recognize them as legal persons. Their code is their essence; to the extent that it runs on a public blockchain impervious to political and economical powers, nothing can alter their behavior. De facto, they own themselves, and nobody really owns them.

The same logic applies to the value side of the ownership. A DAO controls its own crypto-assets and can use them to perpetuate itself — if this is what its code dictates. These assets cannot be seized by any party unless the DAO’s code authorizes it.

An Irreducible Tension

What can we conclude from this tension between decentralization and autonomy, between the ownership of many and the ownership of none? How may it affect the way we should design DAOs?

We’re contemplating here two irreducible dimensions of DAOs:

- “Owned by many” refers to the social layer, a diverse set of parties who hold influence over the governance of a DAO;

- “Owned by none” alludes to the automation layer, that expresses and automates the working rules of a DAO.

As a deterministic protocol, the automation layer is fundamentally incapable of transforming itself in order to provide adequate responses to evolutionary pressures.

Of course, it is possible to organize social processes through the automation layer, by specifying how the parties may voice their preferences and how decisions should be taken as a result, including decisions that might change the protocol itself. However, such convergence of social and automation layers, often called on-chain governance, has its limits.

The jurist Carl Schmitt asserted that it is the function of the sovereign to deem a situation as an emergency that requires the activation of a state of exception, to suspend the normal legal order as a consequence, and to implement decisions that might lead to a new order. Personal judgment is required to do so — it can be a collective personal judgment — rather than the mere execution of an algorithm.

Reijers, W., Wuisman, I., Mannan, M. et al. have argued that the measures taken by the Ethereum community in the wake of The DAO attack in 2016 can be interpreted in a similar fashion. Social normality was disrupted by the hack, which introduced a systemic financial risk for Ethereum itself. Eventually, a hard fork was decided and implemented, which can be compared to the inception of a new legal order.

The DAO drama was a paroxysmal illustration of the tension between the social layer and the automation layer. From the Bitcoin block size debate to the latest controversy about Szabo’s Law, this tension is constantly at work in crypto-networks.

Complementarity — the Tao of the Dao

Does a DAO belong to itself, as an autonomous entity, or does it belong to many parties, as a decentralized body? I’d argue that in this seeming tension between the social layer and the automation layer lies the true potential of DAOs as a social technology.

The social layer displays two key features:

- legitimacy — formed out of political and social processesThe consensus in a society might be explicit or implicit, rough or formal, implemented as a legal system or as a coded one. But even the most formal, self-enforced agreement requires the approval of the engaging parties, the “meeting of the minds” without which it is perceived as an illegitimate, dictatorial process;

- adaptability — thanks to human creativity and resilienceWhen facing evolutionary pressures and state of exception, resilient systems are able to transform themselves and to let new functions emerge. This transformational ability of complex systems is out of reach of deterministic procedures encoded in a protocol.

On the other hand, social processes are more prone to corruption and inherently opaque. This is where the automation layer shines:

- transparency — offered by the blockchain as a distributed, public record of transactionsAsymmetry of information within social groups leads to exploitative behavior and undermines cooperation between peers. A shared and authoritative record of decisions and contributions is essential to carrying out and scaling up monitoring, accountability and conflict resolution with a broad ecosystem;

- self-enforcement — through the implementation of governance rules as smart contractsThe automation of governance rules lowers the cost of transactions between loosely coupled organizations with siloed processes and information systems, and makes it possible to coordinate without relying on a central authority.

Designing DAOs calls for attention to both aspects. Once integrated, social and automation layers complement each other.

The automation layer protects the decentralization of the social layer, through transparency (that fosters trust) and self-enforcement (that prevents undue concentration of power).

The social layer protects the autonomy of the automation layer, through legitimacy (that prevents forks) and adaptability (that provides resilience).

Hasu demonstrated that the symbiotic relationship between social and automation layers is at the heart of bitcoin. With DAOs, any large-scale, open organization or movement will be able to harness the same powerful dynamics.

Special thanks to Theo Beutel, Hasu, Luke Jordan, Jack Laing, Zefram Lou, Marina Markezic.

Who Owns my DAO? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.