Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitcoin price has gone parabolic. The past week saw its value go up nearly a whopping 40 percent. But is it now time for a blow-off top or full FOMO to the moon? Let’s take a look.

Bitcoin The World’s Best Performing Asset of 2019

Bitcoin price 00 has made the naysayers look foolish once again. BTC has soared a staggering 40 percent over the past week alone. Moreover, BTC/USD has more than doubled since the December-February lows.

Just yesterday, it broke the $7,000 mark on some impressive volume, the highest since volume since the April 1st rally. In fact, BitMex has announced it achieved record volume on May 11th, a Saturday nonetheless.

New record for BitMEX trading volume. Praise be to volatility and our wonderful traders! pic.twitter.com/iLMGdpz65n

— Arthur Hayes (@CryptoHayes) May 12, 2019

Bitcoin’s market cap has also added $30 billion in value since May began. By comparison, the market cap of every cryptocurrency excluding Bitcoin has only risen by $10 billion during the same time period. Hence, Bitcoin’s market dominance index is now the highest since its $20K all-time high price in late 2017.

Indeed, the voices of ardent no-coiners like Nouriel Roubini who danced on Bitcoin’s grave in November, have gone quiet.

Still feeling vindicated @Nouriel ? pic.twitter.com/5KxtnKQAXN

— Jonathan Hamel (@jhamel) May 11, 2019

Blow-Off or Lift-Off

The parabolic advance that we’re currently seeing was hinted at by veteran trader Peter Brandt in early April. (Brandt also correctly called the $20K top the previous year).

BTC price is already above the previous 6K levels from which it plunged to yearly lows last November.

This is a very encouraging sign. Particularly, when the Bitcoin market is now a lot more mature compared to a few years ago when fundamentals could not keep up with the runaway price.

Now, with the latest upswing, Brandt appears to be 50/50 on whether this rally continues to $10k and beyond or whether a blow-off top correction is imminent. The latter is when a steep and rapid rise in price and volume is followed by a similarly steep and rapid drop.

“Blow-off or lift-off,” he wrote.

Other commentators like ParabolicTrav have pointed out similarities, as well as notable differences, between now and the blow-off top in 2015,

2015 vs 2019 6H trend. Note the 6H top candle on 2015 to mark the blow off. Doesn't look like we're there yet. pic.twitter.com/x7VHQCu7FT

— ParabolicTrav (@parabolictrav) May 12, 2019

Also, worth noting is that the current rally has completely wiped out the ‘Bitfinex premium.’ In fact, BTC is now trading almost $100 higher on Bitstamp.

The Public is Still On the Sidelines

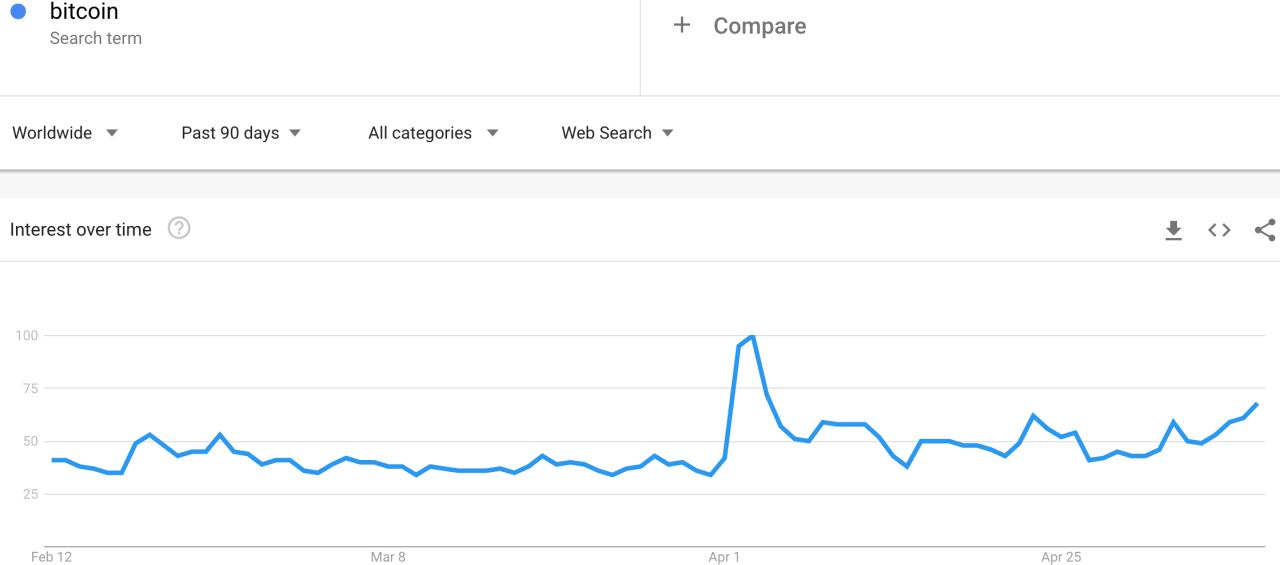

Meanwhile, most of the general public is still unaware of the recent surge in bitcoin price. Google Trends data shows that interest in ‘Bitcoin’ is only now starting to pick up.

The previous 60% spike over the past 3 months was during the April 1st price rally to $5000.

But as Bitcoinist reported last month, people are mostly interested in Bitcoin or buying bitcoin only after a major price move.

This is exactly why fund manager’s like Tom Lee prefers to ‘hodl’ as it’s shown to be a much more lucrative strategy. In fact, it’s the best way to not miss out on the Bitcoin rocket as it historically generates most of its annual gains in just ten days.

Lee also shared a Twitter poll which provides some insight into the possible point of FOMO could be this time around.

Hitting the $10K mark would break a major psychological barrier as many people will realize that Bitcoin is actually not dead. What’s more, many will try to buy back in with the $20K price still fresh in their minds.

Out of over 4,000 participants:

- 44% chose $10K,

- 32% chose over $20K

- 24% think the FOMO is already underway.

Will bitcoin price rally higher or is a blow-off imminent? Share your thoughts below!

Images via Shutterstock, Twitter, Google Trends

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.