Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Essential things to know before making your first angel investment

Looking to invest in your first startup? Or, perhaps you’re a serial investor looking for your next investment?

Either way, before you throw money at the next blockchain-powered organic bicycle lock startup that comes your way, here are the 8 essential things to look for in any company you invest in:

1. Picking the good onesAfter seeing many many slide decks and building a few startups myself, here are the top few things I look for in a startup, after the team and the concept:

- Is it run like a military operation, not a hobby?Part-time founders, founders doing other things on the side, delaying key decisions… all these are red flags. Your competitors are laser-focused on eating your market, if you’re not similarly focused it’s not going to work.

- Are they trying to do one thing, not everything?When I see a pitch deck showing how the company will create a B2C product, a B2B portal, sell data, develop an AI system, use blockchain… If you have 50 developers, sure. But if you have 3 developers, pick one thing to focus on, ditch the rest. Sure, have a nice long-term vision, but if the company is doing 5 different things they’re going to run out of money — your money — before they ship anything.

- Who has tried to solve this problem before?As founder at SeedLegals I personally talk to at least a dozen startups a week and I’m often surprised that even though I know little about their sector, I can name a bunch of competitors they’ve never heard of. So as an investor, I like to research their competitors and then ask the founders how they’re different. And if I know of competitors that they don’t, that’s a bad sign.

- Whose problem are they trying to solve?When I come across founders who’ve identified a consumer or business problem and have come up with a faster / better / cheaper solution, that’s a good sign. But when the pitch starts with “Wouldn’t the world be a better place if…” that’s a red flag. Sure, we all want a fairer society, an end to injustice, whatever, but that does not make for a product that people will actually seek out and, more importantly, use.

- Have they embraced customer-driven development?Ask the founders how many of their customers they’ve personally spoken to, how they’ve tested their prototype with their customers, and how they enthusiastically seek and incorporate customer feedback in each weekly update. If the company culture isn’t based around embracing customer feedback, that’s a sign they may well be building something, on your dime, that isn’t meeting a real need.

2. Traffic and growth: Do your own researchCompany claiming 50,000 monthly users? As an ex. CTO and serial founder myself, I always take pitch deck claims as, well, prompts to do my own research! For example, to check a company’s claims on web traffic head over to Similarweb to see their web traffic for yourself, or create a free account at App Annie to check their app download numbers. Once you’ve done this a few times you’ll be able to recognise when companies are buying traffic, or the traffic spikes are driven by press releases, or it’s genuine organic growth.

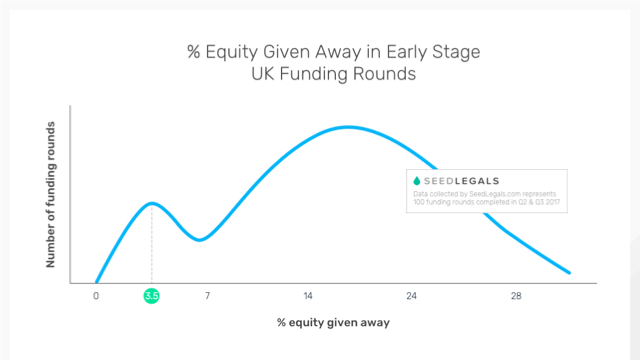

3. Agreeing the valuationOne of the most difficult things in funding round discussions is agreeing the company valuation. Fortunately, using deal data from hundreds of rounds done on SeedLegals, we see that UK startups give away a median 16% equity in early-stage funding rounds.

That creates a handy rule-of-thumb that the pre-money valuation is simply 5X the amount the company wants to raise (when the investment amount will be 1/6th, or 16%, of the post-money valuation).

Our valuation formula is of course just a guideline, but one that is helping a growing number of founders quickly get to the sweet spot of the amount they should be raising, and the valuation that investors will be expecting to see based on the company’s growth stage. More UK funding round deal data here.

4. Make sure the founders have all signed Founder AgreementsWhen founders get together and create a startup everyone has the best intentions. But from the startups we see, around 10% of the time things don’t work out and one or more of the founders leave. Maybe they have bills to pay and need to find a job, or they just don’t get along. Either way, if the founders don’t have share vesting in place it’s a mess, with a non-performing and sometimes antagonistic founders having to be persuaded to give up 30% or 50% of the equity. Worse, they may claim the company’s IP is theirs. It’s often a mess, the company becomes uninvestable and things then fall apart.

So before investing in a company it’s essential to make sure every founder has signed a Founder Agreement with share vesting, IP assignment and non-disclosure provisions. They can do this completely free on SeedLegals. Then, if a founder leaves everyone can remain friends, they return their unvested shares and the company can use those shares for someone to replace them, or just return them to the shareholders.

5. SEIS/EIS Advance AssuranceSEIS and EIS funding fuels the UK startup ecosystem.

For investors, the 50% (SEIS) or 30% (EIS) tax deduction on the investment, no capital gains tax payable if the shares are kept for 3 years and being able to write off the investment if the company fails, means that SEIS reduces the investor’s exposure to, it’s said, 13p in the Pound. SEIS/EIS lets you invest in startups, whether for furthering a passion, wanting to change the world or simply to hang out with the cool kids, while greatly reducing your risk.

For founders, SEIS/EIS doesn’t just open the doors to a giant pool of UK angel investors. The rules of SEIS/EIS investment mean that investors have to take “the ordinary risks of an investor” which means they can’t get Preference shares, anti-dilution or a promise of a return on capital promises — things that are often demanded by US and non-SEIS/EIS investors, to the considerable detriment of the founders later on.

But, recently HMRC raised the bar on SEIS/EIS qualifying. Companies now need to provide the name and address of at least one potential investor. That doesn’t mean the investor is obliged to invest, but they can only apply for SEIS/EIS Advance Assurance after they have their first interested investor… which of course could be you. HMRC also now require a Risk To Capital condition is met, and a few more additional recently added requirements, so it’s important to get professional help doing the Advance Assurance application. SeedLegals is now the leader for this, we’re doing up to four SEIS/EIS Advance Assurance applications per day, with HMRC approval times of typically 2–4 weeks.

SEIS/EIS Advance Assurance isn’t legally required, but given the HMRC changes it’s a useful insurance to have, you might want to suggest to a startup that they get it ahead of your investment.

6. A fair deal for allThe perfect funding round balances the risks and rewards of the founders and investors:

- Founders usually have 70%+ of the equity, giving them a shareholder majority… which means that, without other checks and balances in place, they could do pretty much whatever they want, for example issuing free shares to themselves and diluting the investors.

- So, in return, investors usually get an Investor Director position (we have data for that) and investor consent rights for rounds of over £200K.

- SEIS/EIS investors don’t get Preference shares, but get tax breaks instead (though they can get an SEIS/EIS compatible liquidation preference)

That’s the way UK angel rounds go.

So when I see founders trying to give themselves shares with 2 votes per share, or create holding companies for the IP, or not having share vesting in place, those are all signs that the founders are optimising for themselves rather than for the company and the mission. Usually that just means they don’t know what’s standard, and that’s where our SeedLegals deal data can really help, but if it’s deeper than that, well, there are many other startups looking for your investment.

And, ditto, when I see investors looking for a guaranteed return of capital, or non-diluting shares, or a promise of a share top-up in the next round, that’s a sign the investor isn’t familiar with SEIS/EIS investment where any of those lead to their investment being disqualified from getting SEIS/EIS.

7. Term Sheet, Shareholders Agreement and other deal docsAround 1 in every 12 early-stage UK funding rounds are now being done on SeedLegals, the vast majority of them SEIS/EIS rounds. We’ve developed the workflow and deal documents designed to reflect what’s market in the UK, to create deal documents where everyone can see the underlying deal terms ensuring everything is open and transparent, so the parties can reliably close the deal quickly and efficiently.

Picture your next holiday: The get off the plane at Rome airport, head to the car rental counter, grab the keys, hop into your rental. If the ignition switch, indicators, wipers, window switches are in the usual places, great, you can just get in and go. But imagine that the car maker decided to be clever and swap everything around, it would be a disaster. And that’s exactly the case for early-stage funding rounds — if as a startup you create a set of legals that’s exactly like the legals your investors have seen before, fabulous, you’re set to go. Which is why at SeedLegals we intentionally try to create documents that are market-normal (and increasingly market-standard). Bespoke deal terms and language aren’t a sign of clever deal-making, they’re simply adding friction that’s going to make everything slower and more expensive.

8. Don’t forget your SEIS/EIS certificatesRight after a funding round closes we have founders call us saying their investors are asking for their SEIS/EIS certificates so they can claim their tax deduction. That’s jumping the gun… the company needs to have been trading for at least four months or have spent 70% of the SEIS/EIS money before they can file their SEIS/EIS Compliance with HMRC.

Fortunately the bad old days of having to manually fill in paper printouts provided by HMRC are over, everything is electronic. On SeedLegals we’ve automated the entire process, from the completion of the SEIS/EIS Compliance questions to sending our the SEIS3/EIS3 forms to every investor in one click. We’re seeing HMRC approval times of as little as a few days, which is brilliant.

Bonus: Five things most investors don’t know about SEIS/EISI’ll finish with a few things most SEIS/EIS investors aren’t aware of:

- Although SEIS/EIS investors can’t get Preference shares, you can get an ordinary share with a liquidation preference that gives you your money back first on a sale of the company.

- Everyone knows that EIS is available for 7 years after the first trade. Fewer investors know that if the company has raised EIS in the first 7 years, it can continue to raise EIS after that.

- Even if a company is past the 2 year SEIS time limit, if they pivot to a new product, they can still get SEIS.

- You can get SEIS/EIS even when investing in a non-UK company, so long as it has a UK presence.

- You can backdate your SEIS/EIS tax deduction to the previous tax year.

More SEIS/EIS tips and tricks here

8 Essential Things to Check Before Your Next Investment was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.