Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Smart money is going to Asian Blockchain and Crypto Markets

Image by Sofia Terzoni from Pixabay

Image by Sofia Terzoni from Pixabay

In retrospect, the US and European countries like Switzerland; the UK have lead the blockchain and crypto space in terms of innovation, enterprise solutions and adoption.

Although not as prominent as these countries, Asian countries such as Singapore have been in the game for quite some time now although it was largely in the ICO space. But now data suggests that venture capitalists are investing heavily in Asian Blockchain and crypto startups.

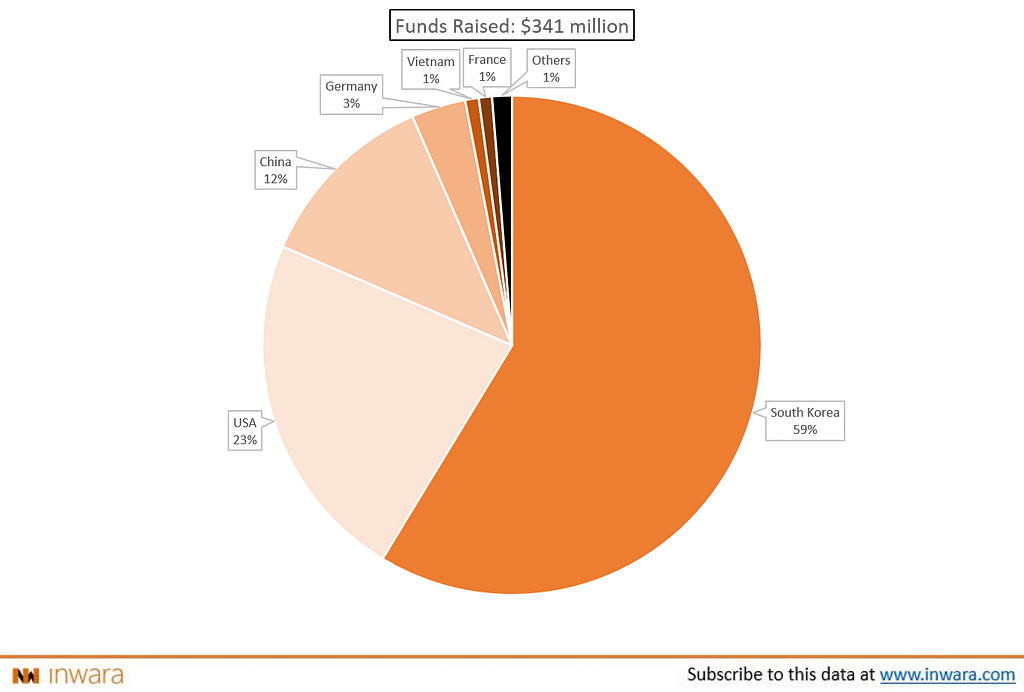

Venture funding in Blockchain: April 2019

For the first time in 2019, VC funding in blockchain and crypto startups based out of Asian markets have surpassed their American and European counterparts and that too by a huge margin. (Source: InWara April 2019 Report)

Are Venture Capitalists focusing their attention (and money) on the Asian blockchain and crypto market? Here’s some interesting data taken from the report. You be the judge.

A staggering $341 million was invested in blockchain and crypto ventures during the month of April alone. Out of which as much as $200 million was invested in Korean companies, accounting for as much as 59% of the total funds raised.

In addition to South Korea, China is another Asian country attracting a significant amount of venture funding this month. Venture Capitalists invested a cool $40 million in Chinese companies -all of them being in the realm of blockchain and crypto.

Also, Venture Capitalists invested $3 million in a Vietnam based startup, Utop. When combined as much as $243 million was invested in Blockchain and crypto startups in Asia which accounts for a whopping 71% of the total venture funding during this month.

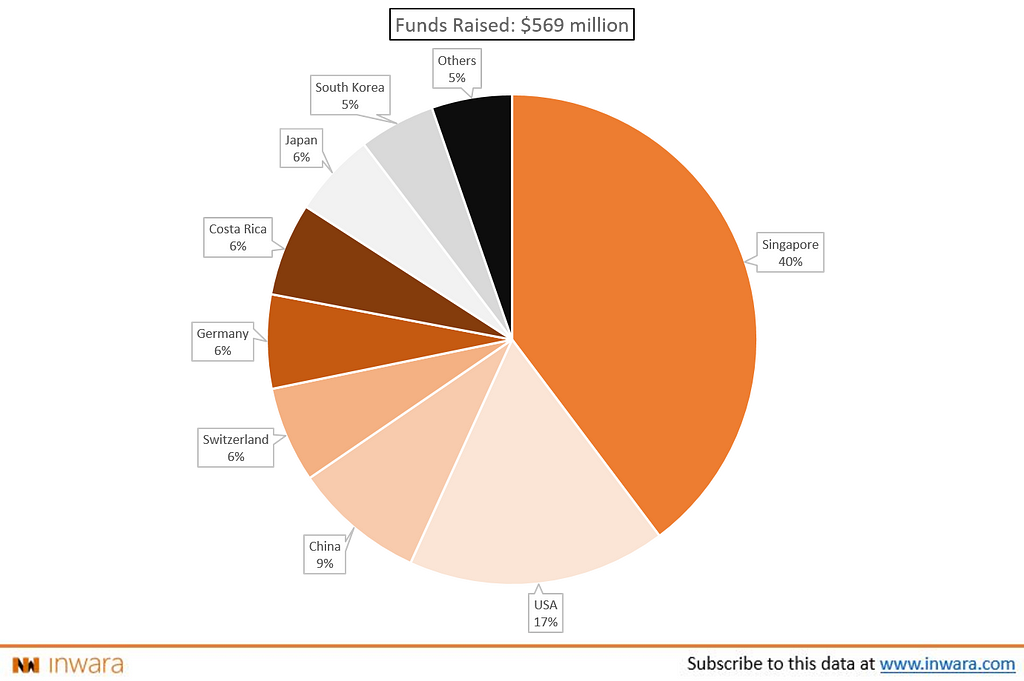

ICO landscape: April 2019

It’s not just venture capitalists who think Asian blockchain and crypto space has great potential for growth. Even retail investors think so.

Funds Raised via ICOs by Country — April 2019

ICOs based out of South Korea managed to raise a cool $27 million but it isn’t the single largest contributor to global token sales during this month, that title goes to Singapore.

Singapore based ICOs managed to raise a whopping $214 million and accounted for as much as 40% of the funds raised globally during this month. Other Asian countries which managed to raise significant amounts include China ($46 million), Japan ($30 million) and India ($5.6 million). Between these countries, a total of ~$325 million was raised through token sales alone which is akin to 57% of the total funds raised globally. A clear majority.

A number of factors could be fueling this shift. Firstly, more and more Asian countries are implementing blockchain and crypto friendly regulations-realizing the potential of this tech to fuel economic growth.

Secondly, the relatively higher population base in Asian countries-combined with the lack of proper financial structures makes Asia a prime market that could fuel the mass adoption of crypto and blockchain.

Disclaimer: All the above data used in this article is sourced from InWara’s market intelligence platform.

Smart money is going to Asian blockchain and crypto market was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.