Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The Bitcoin hash rate has climbed to its highest level since late October 2018 as the BTC spot price looks to break $5,800.

Bitcoin Hash Rate Reaches 4th-Highest-Ever Level

Data from Blockchain.com currently shows the Bitcoin hash rate – the computing power responsible for securing the network, at above 58 quintillion hashes per second (58 million tera hashes per second – TH/s).

This figure represents the highest hash seen since late October 2018 and the fourth highest ever hash rate recorded on the Bitcoin network.

The increase in hash rate points to more mining nodes being active on the network. With more mining nodes, comes greater security for the Bitcoin network making it more difficult for attack vectors to succeed in compromising the fidelity of the blockchain.

Since the start of the year, the Bitcoin network hash rate has consistently increased over a 7-day average period. Back in December 2018, the hash rate plummeted by about 45 percent following the mass shutdown of mining nodes after the almost 50 percent price slide of mid-November.

Increasing Difficulty Quashes Mining Capitulation Fears

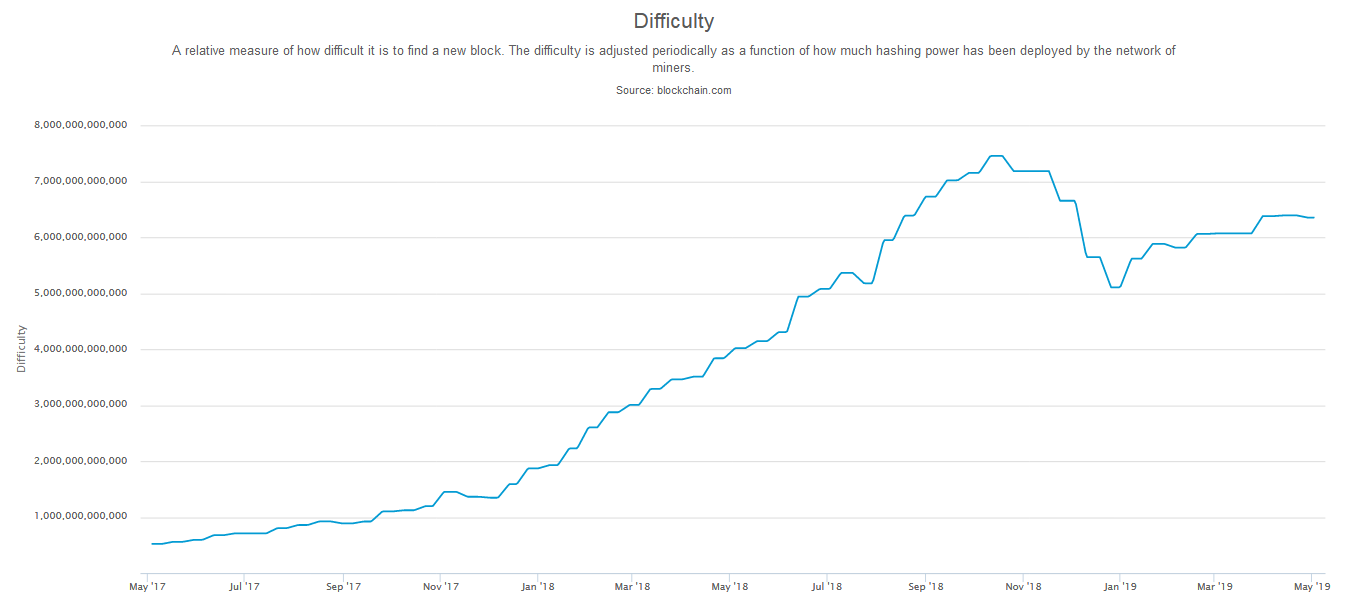

With rising hash rate should come increasing mining difficulty – the hash power required to discover a new block. Difficulty acts as a counterbalancing parameter on the network, adding another layer of security.

In 2019 so far, the difficulty progression has been a recurring series of climbs and flat periods as more miners come online after the mini capitulation of late 2018.

The Bitcoin difficulty is currently at the same level as at late August 2018 when BTC was trading at about $7,000.

BTC Shakes off Late April Decline

Meanwhile, the top-ranked cryptocurrency continues its 2019 price growth with another significant 1-day price gain. BTC is six percent in the last 24 hours and looks set to break $5,800.

May’s price gain has also seen the Bitcoin market capitalization top $100 billion. The last time the BTC market cap was north of $100 billion was in mid-November 2018.

Bitcoin ended April 2019 on a high accumulating 30 percent in gains despite a $400 drop following the $850 million Tether/Bitfinex bombshell. BTC is currently up by more than 55 percent since the start of 2019.

The bitcoin mining operational breakeven for efficient mining operations currently stands around $3550. pic.twitter.com/gQrNYBcvLH

— Alex Krüger (@krugermacro) April 21, 2019

With numerous analysis putting Bitcoin mining cost between $3,500 and $4,000, the continued upward price trajectory means increasing profits for miners. Thus, it is unsurprising to see more mining nodes coming online as BTC looks to be gearing up for another parabolic growth cycle.

Do you think there is any correlation between hash rate spikes and increase in BTC spot price? Let us know your thoughts in the comments below.

Images via Blockchain.com and Twitter @krugermacro, Shutterstock

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.