Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Executive Summary

Executive Summary

Most of the Fortune 500 are implementing or experimenting with blockchain applications,[i] and thousands of small companies have launched pursuing some new blockchain business application in hopes of disrupting established big businesses.

Many companies know about blockchain, but struggle to estimate the likely Return on Investment (ROI) of a blockchain application, a requirement for getting corporate funding approval. Compared to a typical IT project where all aspects of the system and its use are inside your firm, blockchain applications are used for sharing information with business partners or customers and thus not completely under your control. Blockchain offers great potential benefit, but entails far more complications and uncertainty in ROI calculations. There are dozens of factors or criteria you need to consider in deciding whether or not to pursue a blockchain application, and to select which potential applications are the most promising, offering the best ROI. Many or most benefits may be intangible, like uncovering a shipping delay faster.

The approach Blockchain Business Consultants uses to assess whether a blockchain application is worth pursuing relies on a proven decision analysis tool called multi-criteria decision analysis (MCDA). We consider a range of ROI estimates — but also weigh other factors that may not be easily incorporated into ROI estimates. MCDA is ideal for highlighting intangibles and uncertainties for management that should not be buried in an ROI calculation or ignored because they are too uncertain or difficult to quantify.

An ROI calculation of a blockchain application can be made, but should be prepared as a range of values given the huge uncertainties and intangibles, and should be supplemented by multi-criteria decision analysis that highlights all the risks and potential benefits rather than hiding the multitude of risks and issues in a blockchain project in a single number. We use the word “assessing” ROI or “analyzing” rather than the norm of “calculating” to emphasize that these assessments are inherently uncertain, and strongly recommend providing a high/low range for the “likely ROI,” not just a point estimate.

This article provides an overview of our methodology and examines many of the special issues we’ve helped clients assess to estimate the likely ROI for a blockchain application. A full white paper explaining the methodology is available at www.bchainconsult.com

Why Blockchain can be Valuable in Business Applications

Blockchain technology enables one shared database with all the information, versus siloed databases that must be connected or accessed — and may not be trustworthy if controlled by another party or vulnerable to hackers and data theft or alteration. Blockchains allow for greater traceability of transactions — and confidence that the data is correct, with “immutable” (unchangeable) entries, complete history of all transactions. It’s great for avoiding counterfeit goods and disintermediating banks and even lawyers and courts. Blockchain’s capability to allow integration and limited/trusted/secure sharing of data across not just multiple IT systems but multiple business parties yields significant advantages for business operations. An article detailing this seldom mentioned, but key advantage of blockchain for business applications is available at:

Blockchain’s underappreciated, greatest application is Integration: IT Systems and Business Partner…

“Smart contracts” that are locked into the blockchain system and executed by the computer network when agreed upon conditions are met are another powerful advantage of blockchain technology. If a shipping delay, problem with payment, anything out of what is planned, “Smart contracts” (programmed instructions) can immediately notify all relevant parties of the change and execute agreed contract terms. Smart Contracts are valuable for automatically sending information, updates, authorizing or making payments. For businesses, Smart Contracts may be more valuable than traditional blockchain advantages. The ability to use cryptocurrency (which could be a digital fiat currency as well) facilitates automated payments and cutting out middleman banks. In sum, blockchain is ideal for sharing information amongst business partners (and government regulators where appropriate), and automating many administrative and payment functions with smart contracts.

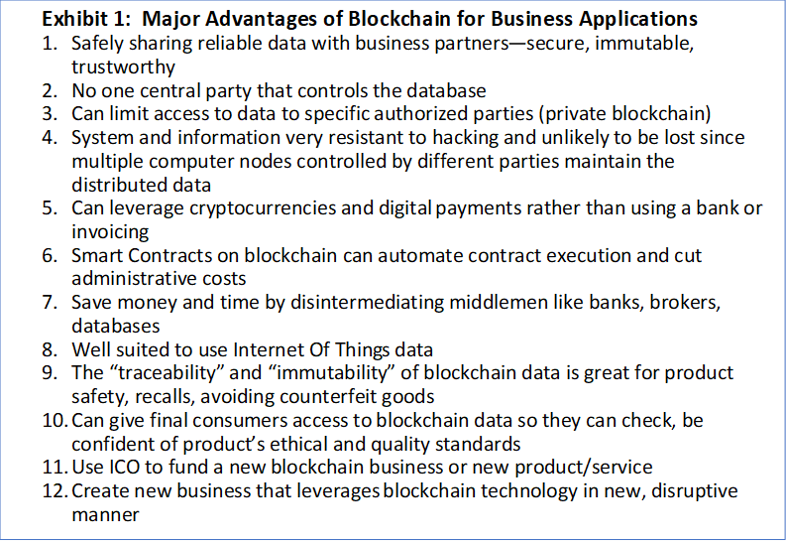

The key advantages of blockchain and its related capabilities of smart contracts and cryptocurrrency are summarized in Exhibit 1 below.

There is a tendency to think of a blockchain project as a largely IT affair, but for business applications, a blockchain project is better thought of as process re-engineering. Blockchain work is largely process redesign that will involve all aspects of operations, not just IT staff. William Mougayar, author of the The Business Blockchain, which is a great book on blockchain though somewhat out of date now, made the observation that a blockchain project for business is 80% about business process change, the technology is a small part of it.

If the blockchain application is designed to improve operations with outside business partners, then a lot of the key analysis and work is convincing other parties to use your blockchain — it is not a simple internal IT system change!

Dealing with Intangible Blockchain Benefits

Some consultants believe that “Intangible (or soft or non-financial) benefits should not be included within ROI calculations” since “Whilst they are often as important as tangible benefits, they are very difficult to financially quantify.”[ii] We strongly disagree for these reasons:

1. Intangible benefits can have just as much impact on a firm’s sale and benefit

2. You can usually reasonably quantify intangibles at least in a good to bad scale, and include them in multi-criteria decision analysis, as explained later in this article.

3. Ignoring intangibles can result in very bad decisions: for example, all the costs of a new blockchain are tangible and relatively easy to quantify — while the benefits in gaining new customers, reducing errors, faster and more reliable information, less hacking risks though intangible and difficult to assess benefits can dwarf the tangible costs.

Blockchains are being used now by many businesses to validate and give customers confidence that the produce they order really is an organic food, not counterfeit, really is fresh, did in fact come from Factory X in County Y with humane treatment of workers. Increased customer satisfaction is an intangible, uncertain impact, but with the ability to check information you can trust on a product’s origin, whether or not it was produced under the conditions you want, may yield huge benefits and increases in sales and profits. In some blockchain assessments we’ve done, most of the benefits were intangible and highly uncertain, but very reasonable and likely impacts we were able to assess and reasonably estimate.

Following a ridiculous recommendation to ignore intangibles in ROI calculations can lead to dismissing most of the impacts of a blockchain application, virtually guaranteeing an unsound assessment and bad decision.

Multi-Criteria Decision Analysis for Blockchain ROI Assessments

The approach Blockchain Business Consultants uses to assess whether a blockchain application is worth pursuing relies on a proven decision analysis tool called multi-criteria decision analysis (MCDA). It considers a range of ROI estimates — but also weighs other factors that may not be easily incorporated into ROI estimates. MCDA is also ideal for highlighting intangibles and uncertainties for management that should not be buried in an ROI calculation or ignored because they are too uncertain or difficult to quantify.

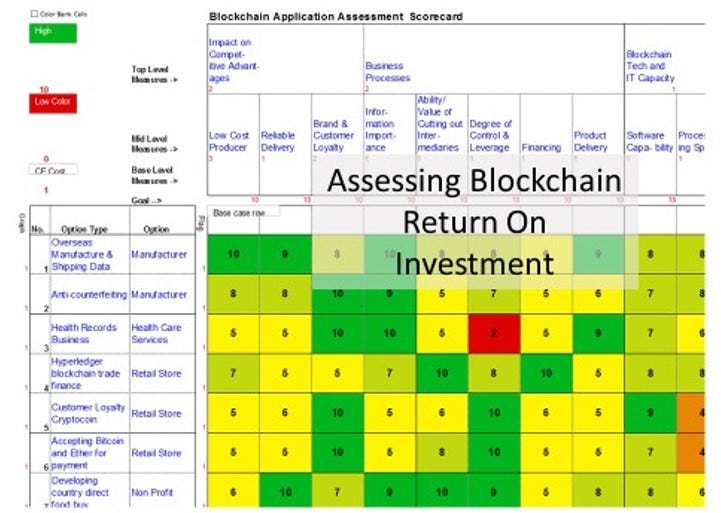

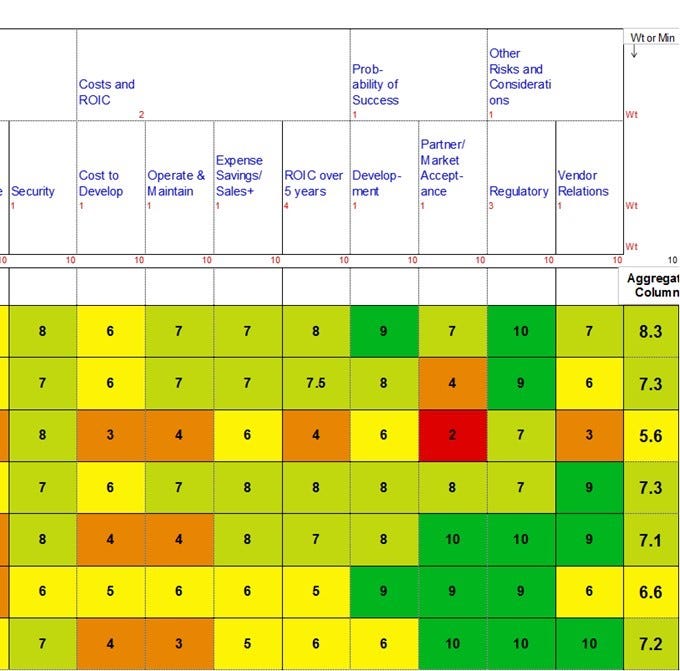

Exhibit 2: A Multi-Criteria Decision Analysis “scorecard” blockchain applications assessment (1 of 2)

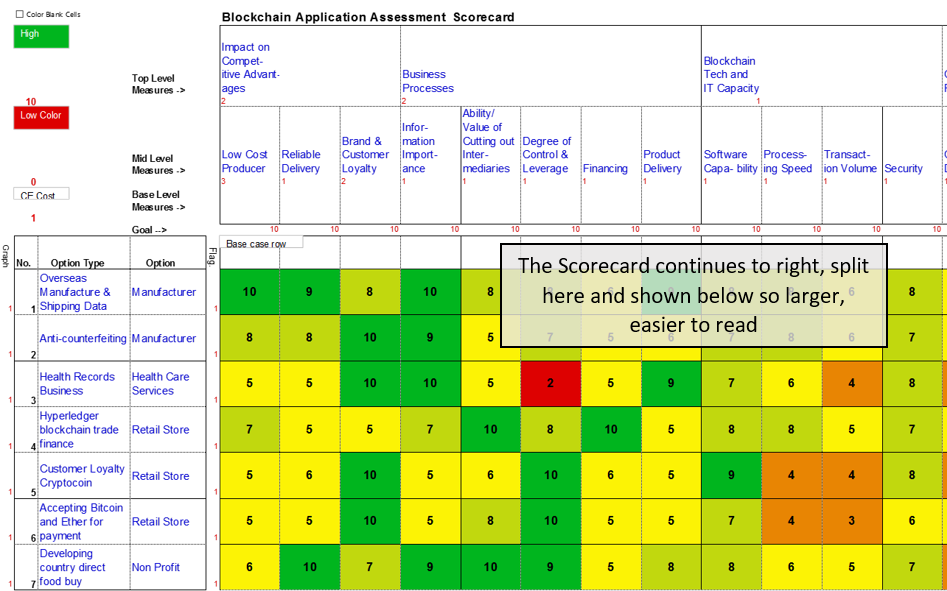

Exhibit 2: A Multi-Criteria Decision Analysis “scorecard” blockchain applications assessment (1 of 2) Rest of Blockchain Assessment multi-criteria decision analysis scorecard (right half)

Rest of Blockchain Assessment multi-criteria decision analysis scorecard (right half)

This methodology lets you consider and weigh all relevant criteria, factors that will impact the success or failure of a blockchain application — including intangibles and difficult to quantify factors. It lets you compare dozens of applications at once so you can identify the best.

Appropriate weights (some factors more important than others) are applied, and a weighted average score is calculated. Uncertain as to which factors are most important? — change the weight, and see how that changes the total weighted score. Look at how the different blockchain applications perform across all relevant factors. Trying to keep track of all these tradeoffs and issues in your head, or in a spreadsheet or PowerPoint presentation, is impossible. You need this software — and you need to do sensitivity analysis, inputting different ratings and possibilities to see how blockchain applications will perform under different circumstances.

There are dozens of factors or criteria you need to consider in deciding whether or not to pursue a blockchain application, and to select which potential applications are the most promising, offering the best Return On Investment.

Your ROI assessment of different blockchain applications and variants of them needs to consider dozens, sometimes over a hundred issues.

The biggest value of this process using multi-criteria decision analysis is that you often come up with ideas to change the options under consideration, avoiding some vulnerabilities, overcoming shortcomings, and hedging against adverse developments. When airing disagreements on ratings and impacts of different blockchain applications, we usually get into discussions about how you might be able to fix perceived problems. This often leads to ideas to change the options under consideration, avoiding some vulnerabilities, overcoming shortcomings, and hedging against adverse developments. For example, two parties favoring different blockchain applications in a firm came up with a hybrid approach that achieved key benefits of both applications.

Once the initial scorecard is built, you can have sessions to get more inputs and let people challenge and discuss different views of how applications will perform, risks and costs in pursuing them. You’ll get new ideas, and usually end up modifying some criteria and adjusting some scores. Often you’ll come up with ideas on how to change the blockchain application or some aspect of the business process to fix a problem.

Special issues for analysis in blockchain ROI assessments, such as blockchain processing speeds, convincing business partners to use your blockchain, and many mistakes we’ve seen in blockchain projects are covered in the full paper on assessing blockchain available at www.bchainconsult.com.

The full paper also addresses developing a prototype blockchain application to help narrow down uncertainties on the feasibility of the blockchain, the costs to develop it, and, perhaps most important — the likelihood that your business partners or customers will be willing to use it.

The paper also covers why PowerPoint is really bad for decision making, and explains why Multi-Criteria Decision Analysis is a far better methodology for blockchain ROI assessment. Another great tool for assessing investments with many important, highly uncertain conditions or events that will determine success like blockchain applications, a decision tree, is also covered in the full paper.

The fact that most of the Fortune 500 are using or exploring blockchain and thousands of startup blockchain businesses that have launched planning to disrupt existing businesses is another good clue that there is great though highly uncertain potential with this new technology. Assessing the impacts of a new technology is inherently uncertain and requires estimating a multitude of intangible impacts. Ignoring them in an ROI analysis is stupendously bad advice.

The bottom line is that ROI analysis can be extremely valuable if performed correctly as an assessment of likely costs and benefits — not a reliable calculation of an answer. With a diverse team of personnel, most not IT specialists, using MCDA to consider all impacts of a contemplated blockchain application, you’ll at a minimum learn a great deal about the likely return for your firm. If you build a prototype, you’ll both learn more and get a more valid, narrow assessment of the likely range of ROI possible.

If you find blockchain benefits too uncertain, intangible, or difficult to assess, you should at least consider the answer to these questions before you decide blockchain is too risky to pursue: What’s the impact of a competitor’s pursuit of blockchain projects on your business? For example, if a competitor implements a blockchain that achieves a fantastic reduction in counterfeit goods and reduces administrative errors and costs in ordering are you going to lose customers to them? Blockchain is touted as the “Second Internet Revolution”[iii] for good reason. With benefits from a hack proof distributed ledger that lets you share information reliably and safely with business partners and customers, smart contracts that can automate billing and possibly cryptocurrrency payments to avoid banking expense, blockchain is going to disrupt many industries and eliminate some companies that failed to exploit this new technology.

This article provided an overview of our methodology for estimating the likely ROI for a blockchain application. A full white paper explaining the methodology is available at www.bchainconsult.com

Dr. Drew Miller, CMA, CM&AA, CFP, DDP

Managing Director, Blockchain Business Consultants

drmiller@blockchainhainconsult.com

[i] Deloitte, “Breaking blockchain open, Deloitte’s 2018 global blockchain survey”

[ii] https://www.axia-consulting.co.uk/html/basic_roi_calculation.html

[iii] Don Tapscott and Alex Tapscott, Blockchain Revolution: How the Technology Behind Bitcoin Is Changing Money, Business, and the World, 2016

Assessing the Return on Investment (ROI) of Blockchain Applications was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.