Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

It’s 2019 and everyone is talking about blockchain technology. Call it a fad or futuristic, blockchain is one of the buzzword of this decade. Research shows that 65% of businesses with more than 10 thousand employees are either considering adoption or already using the technology. Thanks to intense media scrutiny on the roller-coaster ride of bitcoin’s price, blockchains and cryptocurrencies are now part of everyday conversations. It is still early days and like any other emerging technology, blockchain is going though boom and bust cycles. Gartner says that most companies are still not able to make use of it disruptively because their current legacy systems are centralized. Consequently, smaller firms will drive disruptive development more than larger risk-averse organizations. Here’s how we think that the future will look like for blockchains, and how blockchains will impact the future.

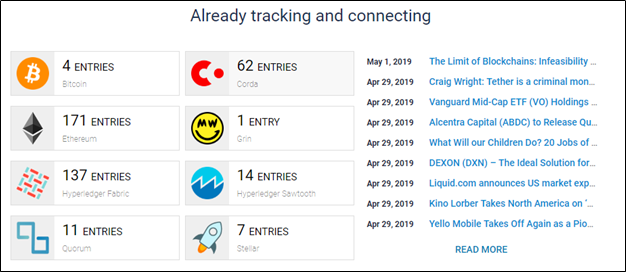

Unbounded Registry: The blockchain equivalent of “Yellow Pages” as on 1-May-2019 (source)

Unbounded Registry: The blockchain equivalent of “Yellow Pages” as on 1-May-2019 (source)

Blockchain Interoperability

SE2’s Thiru Sivasubramanian notes that the “standardization of interoperability” among different chains is inevitable. While there will continue to be multiple blockchains, each with their own use-case and purpose, there will eventually be a standard protocol for different chains to collaborate. Interoperability will be crucial for blockchain adoption. Otherwise, chains will continue to operate in silos and transaction settlements will require third party interventions. Email and internet turned out to be disruptive technologies thanks to universal protocols like SMTP and HTTP. The same needs to happen for blockchain’s transformational power to become widely used. The EU has already identified this issue and has called for a standardized protocol for cross-chain collaboration. A number of projects have also started to work on suitable solutions.

Code is Law (Wider use of Smart Contracts)

Execution of natural language contracts is a tedious process. A smart contract automates the entire process and ensures adherence to T&Cs. We have come a long way since Nick Szabo first proposed smart contracts in 1994. Today’s smart contracts can react to real time data to execute terms of agreement without requiring manual intervention by a human intermediary. However, arbitration can be involved in case of breach of contract which can complicate the whole process. Projects like Kleros have introduced dispute resolution layers on top of smart contracts to facilitate arbitration procedures, thereby making the future of legal tech decentralized. While we are still far from reaching a full replacement of natural language contracts, experimentation by banks, startup investments and regulatory moves indicate that we are moving towards wider smart contract usage.

Centralized DLT projects and permissioned chains

Like it or not, large organizations and government authorities are more comfortable with private blockchains, where they can implement rules and regulations and restrict public access. Moody’s points out that there are a number of risks, including higher exposure to fraud risk, in centralized chains. However, this trend is likely to continue into the future with centralized structures more inclined towards centralized chains. The encouraging bit is that governments are warming up to the benefits of blockchain. For example, Dubai plans to be move all government processes (visa applications, bill payments etc.) to blockchain by 2020. Tech giants like IBM, Microsoft, Amazon and Accenture have already started creating solutions for big businesses and administrative systems to transition into permissioned chains.

Blockchain Identity

A side effect of the internet age has been the deterioration of identity security. Consequently, cases of identity theft and fraud are commonplace now. In 2017, reportedly 16.7 million people were victims of identity fraud and USD 16.8 billion were stolen in the US through identity theft. Non-blockchain services that use passwords and biometrics for safeguards, store the information on centralized systems which are prone to hacking. Blockchain technology’s resilience to data fraud makes it a suitable candidate for identity authentication and verification systems. In the blockchain space, there’s no central repository of data to steal from. Instead, a security protocol creates a unique identity that is indexed on the chain. The index is a metadata that allows a user to prove their identity, thereby protecting the integrity of personal information. Institutional adoption in this space has already started making news. For example, multinational conglomerate Johnson Controls has partnered with Civic in a bid to utilize blockchain technology to control the access management systems in their buildings.

Blockchain-secured Beer Vending Machine by Civic (source)

Blockchain-secured Beer Vending Machine by Civic (source)

Real Estate and Asset Tokenization

Tokenization is the ownership of an asset through the possession of a blockchain-based token. It increases the liquidity of an asset, allowing anyone anywhere to invest in it. Moreover, since the asset history is tracked through blockchain, it reduces the risk of fraud to a great extent. Real estate is a promising sector where tokenization can be applied effectively. Research suggests 25% of all title reports have defects in them. Tokenization would reduce instances of these defects and make title search easier. It, however, involves complications in terms of legal issues, taxation, and auditing, apart from the usual technological challenges. aXpire provides consultation on these different aspects, for both real estate owners and potential investors. Following Propy’s precedent setting blockchain-powered real estate deal, Vermont has passed a law which mandates feasibility study of blockchain tech usage for maintaining land and public records. This is just the beginning of more things to come in this space.

Improved Supply Chain Management

One of the biggest impacts that blockchain will make will be in the logistics and supply chain space. From tracking luxury goods for authenticity, to tracing baby foods for tampering,to identifying counterfeit drugs — blockchain adoption is already picking up steam for product trace-ability applications. In addition to this, audit trails help prevent corruption at multiple levels when a product changes hands through the supply chain. DHL notes that blockchain adds value to logistics by “boosting supply chain transparency and automating administrative operations”. Analysts estimate that blockchains offer a USD 500 billion revenue opportunity in the freight transportation space.

Revolution in Financial Services

Ray Valdes from Gartner says “restructuring an ecosystem and displacing established players is the classic pattern of innovative disruption”. This is what blockchain is doing at the moment — disrupting the current financial services infrastructure through positive innovation. Austin Trombley, data scientist at Franklin Templeton Fixed Income Group, agrees that blockchain technology will make banking models more efficient by making transactions and settlements cheaper and faster. Ripple’s xRapid cross-border payments solution is already in use with 12 banks and payment services.

Satoshi Nakamoto had conceptualized Bitcoin as a decentralized, border-less and trust-less payment solution. Blockchain technology is all about realizing this vision of eliminating third-party intermediaries and geographical boundaries from payment systems. Though not many merchants accept Bitcoin today, the list of merchants that do has been growing steadily. Even leading central banks are experimenting with blockchains and digital currencies. With blockchain adoption at an all time high, the future of fintech is fast and cheap.

The next generation of blockchain tech development and adoption is already underway, and this development is more at a deeper protocol layer than the front end consumer facing level. Glenn Hutchins, chairman of North Island, notes that “when you send an email out today, you don’t think about the underlying technology you are using.” This is because it works so well. Similarly, in the future, we wouldn’t even realize that a particular contract executing successfully or a transaction going through seamlessly is because of the underlying blockchain technology. And that would be the essence of the transformative power of blockchain. Silent disruption.

About the Authors:

Rohit Chatterjee is an Analog Design Engineer working at Texas Instruments. Abhijoy Sarkar is a banker-turned-entrepreneur. They are high school friends who lost contact years ago. They reunited over crypto in early 2018 and have been investing through mutual research and shared knowledge. Both are community members of aXpire and have written this article as freelancers through MatchBX.io

Blockchain: The Future is Calling was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.