Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

In 2019, Initial Exchange Offerings (IEOs) have gained massive attention as Binance successfully launched three IEOs, all selling out in minutes to record-breaking interest. The last project to launch, Celer.Network, had over 30,000 people stuck in Binance’s queue waiting to contribute.

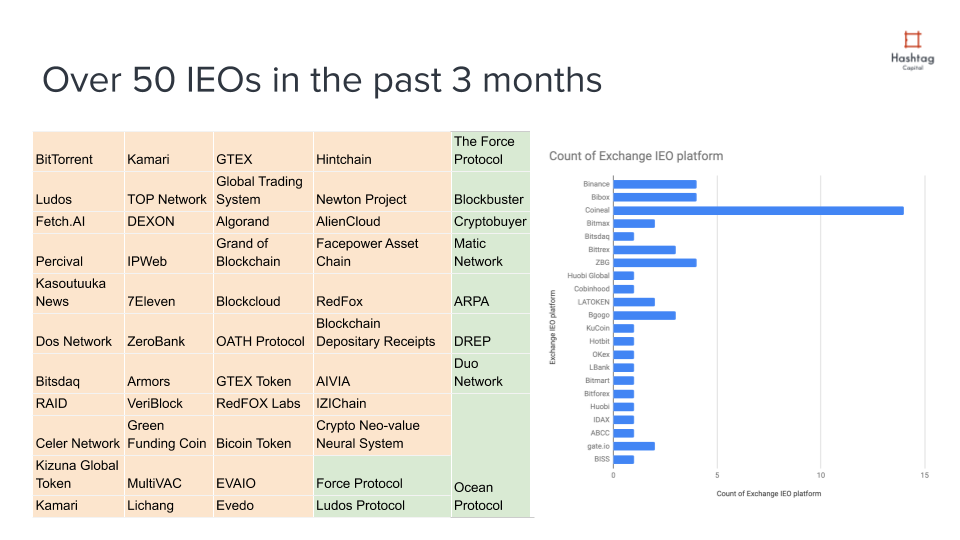

It is safe to say IEOs have brought a spark back to the market with over 50 IEOs being launched this year. Why are IEOs so popular?

IEOs allow companies to raise “moderate” funds (typically up to $10m USD) directly on an exchange portal as opposed to their company websites. Technically, they could do both as IEOs usually have a conservative cap on the number of tokens sold. The best part is after the sale concludes, tokens are guaranteed to be listed on the exchange platform where the IEO was held.

Adding to the hype was the early returns from Binance’s first IEOs:

Despite the rather simplistic process of conducting an IEO, there are still expenses and things to be aware of as a founder. Most importantly, you need to have proper marketing to drive the success of an IEO. You should NOT rely on the exchanges to do all of the marketing for you.

Here are a few tips and observances on IEOs to help guide you on your journey:

1. Shorter Marketing Timeframe and Costs

The good news about IEOs is that the marketing timeframe is now much shorter, allowing you to aggressively go after marketing targets in 1–2 months instead of the 4–6 month range typically seen with ICOs. When projects get approved for an IEO, they are usually given a date the following month to start working towards.

With that being said, you should absolutely have funds ready for marketing and assume most reputable marketing agencies will not work off a backend promise or guarantee. We all learned the hard way in 2017–18 that guaranteed fundraises usually leave one or both parties disappointed. Incorporate a marketing budget into your IEO launch plans.

Top agencies are usually offering all in one marketing solutions in the $50k — $100k range leading up to and through an ICO. Make sure to pick a reputable agency that has a track record with traditional clients and blockchain clients.

2. Be Careful about Exchange Dilution

Let me add one caveat. If you go through Binance launchpad, you should have enough organically generated interest from Binance to have a successful launch.

If the IEO wave is anything like the ICO wave, we should anticipate seeing exchange dilution by exchanges capitalizing on IEO interest (and associated fees) by listing more projects as interest grows. It is also important to note, that a project can do multiple IEOs across various exchanges and existing ICOs have also come back to life by doing IEOs.

This will create scenario where marketing will become vital to stand out.

This chart from Hashtag Capital shows over 50 IEOs this year on 22 different exchanges. The sad reality is that most of these went unnoticed (jump to #3).

3. Exchanges Will Only Provide Basic Marketing

As of right now, most exchanges will quickly take your listing fee if accepted (which ranges anywhere from 5 to 40 BTC) and conduct very basic marketing to help you gain exposure.

This basic exposure includes social media blasts and newsletters, which will inevitably end up in your spam inbox as seen here in mine. Sorry Polaris, MPXX, CryptoAds…

I used to say this to clients in the ICO space. What you are after is not some quick flip marketing strategy. You need REAL branding, real marketing, and a plan that supersedes the fundraising period. If you don’t do this, you risk having to start from scratch post-listing, typically when investors are the most sensitive and critical due to price fluctuations.

4. IEOs Bring Security and Limit Jurisdictional Risk for Projects

IEOs are typically launched as utility token offerings and have built-in KYC and country limitations within the exchange. Exchanges will require a legal opinion from the country of origin from the project. All of the other risk, such as country limitations, will be on the exchange as they are responsible for their user base.

This means you save on both legal fees and the hassle of conducting KYC internally, assuming the IEO is your primary raise vehicle. The saved time should be allocated towards marketing and getting your project known prior to the IEO. Running a passive IEO will only leave you disappointed.

Lastly, the benefit of an IEO vs. an ICO is the security that comes with a reputable exchange. Scams and frauds are vetted out in the selection process of reputable exchanges, saving investors from one of the major drawbacks of crypto crowdfunding. Can scams still happen? Sure. Especially if exchanges create a loaded deck scenario. But, it is less likely.

5. Not all IEOs Will Sell Out Instantly

Keep in mind the statistics from above. Most IEOs do and will not hit their IEO hard caps immediately or during the duration of the IEO. Even with a smaller offering consisting of 5–10% of circulating tokens, these sales are not guaranteed and are dependent on multiple factors.

Some IEOs conduct a private sale before an IEO, bringing hype, brand named partners, and additional investors. Others start their journey with an IEO and realize just how important community, PR, and social media engagement is. With the right marketing strategy in place, you can increase your chances of running a successful IEO.

6. IEO Token Prices Have Decreased Short-Term

Similar to ICOs, data collected in Q1 2019 has shown an overall decrease of token prices following an IEO. For top exchanges and projects, there is generally an initial spike and then sell pressure becomes more prominent and pricing declines. This is similar, albeit less drastic, to the ICO environment.

It is important to note that IEOs enforce lockup restrictions on private investors so IEO participants are generally protected against whales or early investors. Rather, they are often battling themselves and new token purchasers. Similar to above, a coherent go-to-market plan and marketing strategy is needed to gain long-term interest and support.

7. IEOs Are Arguably the First Win-Win-Win Situation

Right now the quality level of projects doing IEOs still tends to be strong, with exchanges having a tough vetting and selection process. It is important that projects looking to do an IEO have an existing brand or some traction that will provide value for exchanges and token buyers.

For exchanges, the value proposition is clear. They gain listing fees, but more importantly new exchange users who need to register with the exchange, conduct KYC, and oftentimes buy an exchange’s native token to participate.

For users and investors, right now the biggest challenge is participating in top IEOs as technical lags and over-demand have caused exchanges to freeze. This has caused Binance to since implement a token lottery for holders of their native BNB token. This process should improve with time across all exchanges.

For projects, the value proposition has been outlined above. It includes liquidity, exposure, convenience, and affordability compared to other forms of fundraising such as an ICO or STO.

Will IEOs Survive and Remain a Hot Topic?

Time will tell. Given its nascency, it is safe to assume there will be downsides that become more and more apparent in the near future. Scams, exchange manipulation, regulatory risks, and other third-party risks should all be taken into consideration prior to starting one or investing in one. Despite these risks, IEOs have brought new life to a frozen ICO market and have provided retail investors with another avenue to short-term investing without the hassle of STOs.

Yes, STOs are a hassle for most people. That will likely change, but the comparison of investing and realizing liquidity in an STO vs. an IEO is night and day currently. IEOs are far more convenient and create value for all parties if done correctly.

Feel free to reach out if you have any questions or are considering an IEO. I am far from an expert but after being in the ICO trenches for 2 years, I am comfortable recommending ideas and service providers I trust.

2019 IEO Marketing Guide and Why IEOs Matter was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.