Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

In the current market climate, with BTC going up to $5300~ in April, it’s worth taking stock of some real numbers and how exchanges are leveraging on them for that coveted billion or unicorn status.

This is obviously not meant to be investment advice, I give better in person investment advice to accredited investors, that I can assure you.

Starting with initial exchange offerings, otherwise known as IEOs, it’s the latest talk of town. While the model is not new, projects such as Top Network on Huobi Prime has attracted even a food delivery staff to open up his laptop at work to grab a coveted allocation. With IEOs on Binance selling out in minutes and each user only getting a small allocation, is this really worth it?

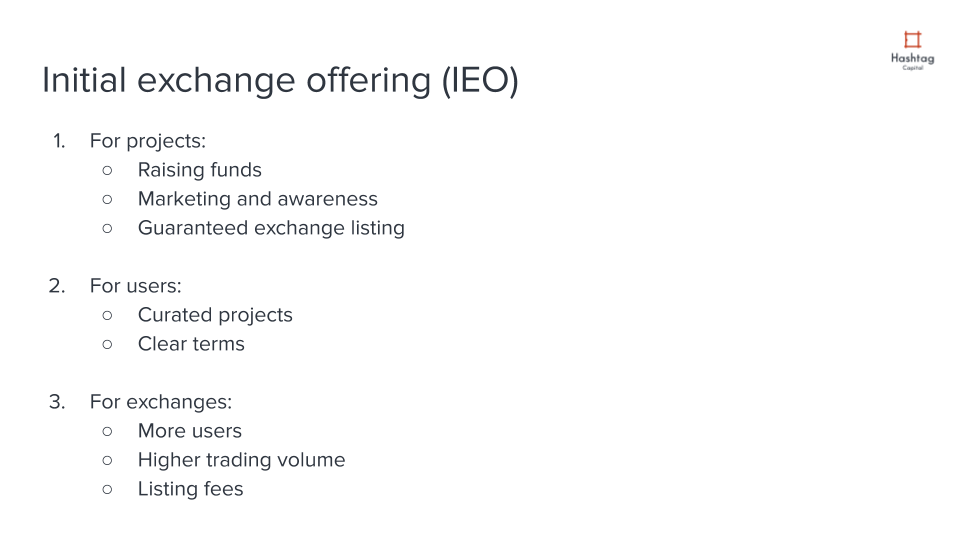

Peeling back the covers, different stakeholders perceive the value of IEO to them differently.

For projects, it’s a great mechanism for fund raising up to $10M. The awareness and combined push with exchanges help projects get noticed by a larger user base, often existing exchange users. After the conclusion of the IEO, project tokens will be open for trading nearly immediately on the exchange offering the IEO. This grants more predictability to the process and projects need not negotiate with each exchange after their own token offering. The time that projects save can perhaps be put forth to other work such as development and partnerships.

For users, should they manage to get an allocation in the sale, have high hopes of doing well on the token from a speculation perspective. Because the projects are curated and fast-tracked to listing, they can also expect faster liquidity and more attention from other parties. Terms are also spelt out more transparently and they need not worry too much about others getting a better price than them — except the private sale or seed round investors of course. Some users employ automation to help them get their hands on some allocation.

For exchanges, IEO provides an increase in projects that want to get out there for a raise. This provides a great additional revenue stream for listing fees and value added services. Should users know that they are offering a great IEO, there’s incentive for them to be more active users and thus increasing their site engagement. Trading volumes for their exchange and whichever token they require to be used for purchase will increase as well. As many exchange have their own exchange tokens, this will be beneficial to exchange token holders.

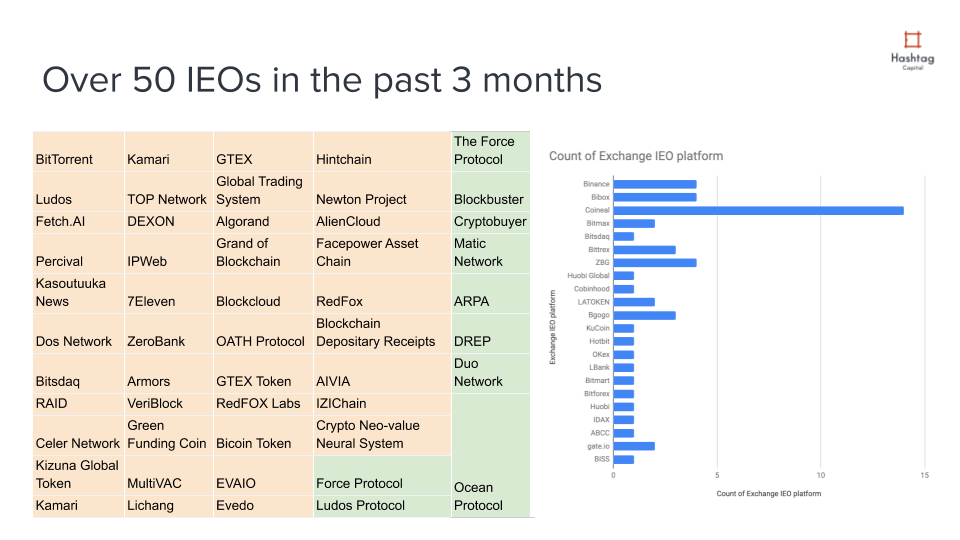

There were many IEOs that were completed this year. Starting with BitTorrent token on Binance, many exchanges have started jumping onboard the IEO train. Most of the main Asian-affiliated exchanges like OKEx, Huobi, Coineal, Bibox have jumped into the fray in response to the 3 projects conducted on Binance Launchpad. Of the conducted IEOs, while the majority of them have hit their funding targets, there are many that have not. This tends to be projects with much less awareness on exchanges with relatively lower user traction. They also could be projects that have not raised sufficient private sale investment prior to the IEO. While some of the projects have raised previous rounds, there’s also readjustment to pre-sale investor lock ups that comes as terms with certain IEO listings.

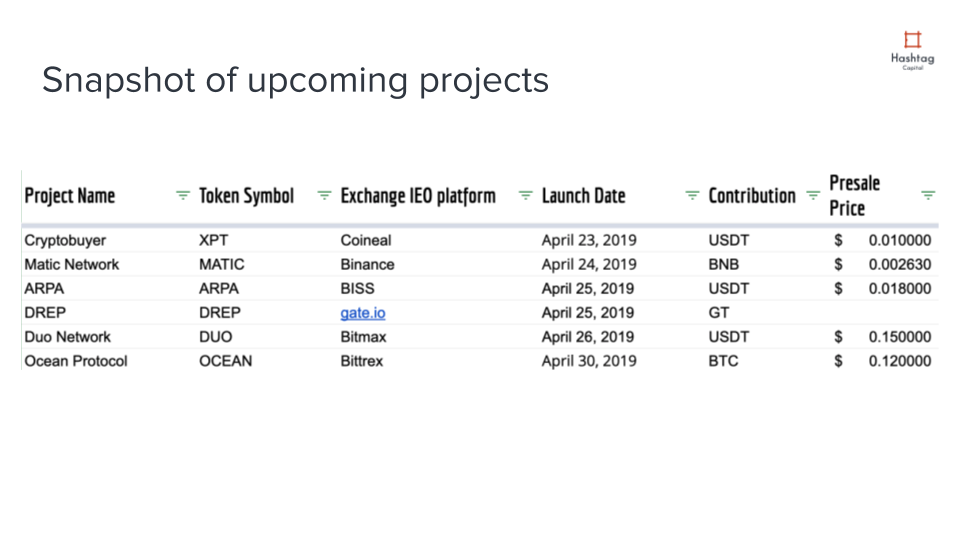

Some of the upcoming projects are Matic Network on Binance Launchpad, DREP on Gate.io, Duo Network on Bitmax and Ocean Protocol on Bittrex. The accepted contribution are usually a mix of USDT or exchange platform tokens. the models of contribution have also evolved from first-come, first-served to a ballot model on Binance with requirements on holding BNB for a specified period of time. Since it’s an exchange promotional activity, the exchanges have the right to set the rules of engagement and users have to evaluate for themselves if it’s worth the effort.

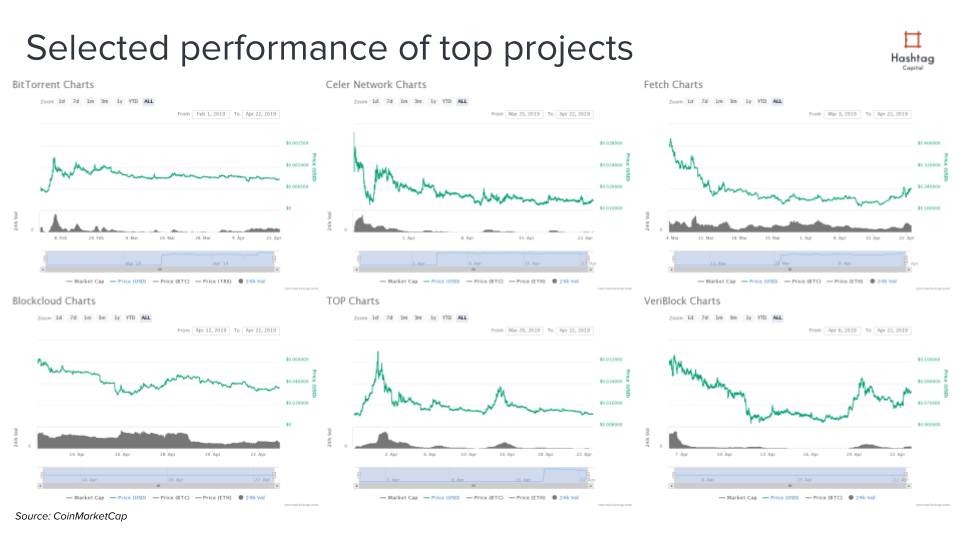

Despite many of the tokens receiving huge interest and multiplying in dollar value by up to 10 times from the IEO price, we can see that trading volumes and prices decline after the initial listing. Overall prices and attention trail down for most of these projects over the following span of 30–60 days after their IEO. The snapshot is taken of the first few well known projects conducted on Binance Launchpad, Huobi Prime, OKEx Jumpstart and Bittrex.

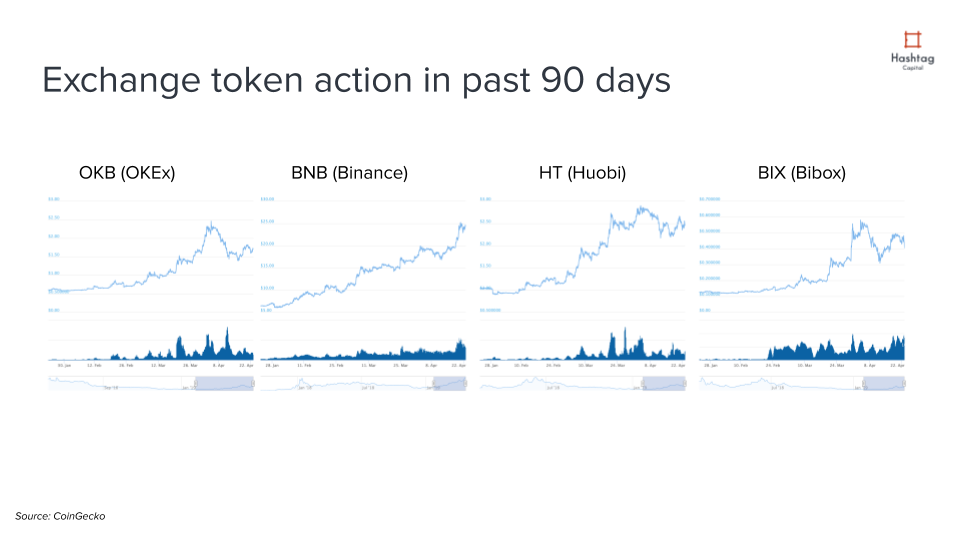

In the past 90 days, while Bitcoin prices have gone up by close to 30%, the exchange tokens of the top exchanges with IEO platform offerings have received a huge boost. Many of them are trading at a 90-day all-time-high with BNB even hitting its historical all-time-high. The increase in price of exchange tokens appear to be correlated with the announcement of various events such as IEOs on the platforms. The combined market capitalization of these exchange tokens are over $3B.

Now that we’ve looked at one of the $B exchange trends, let’s move on to the next. Derivatives in cryptocurrencies have a great place in the heart of many with mentions of 100X leverage invoking strong fears of margin calls.

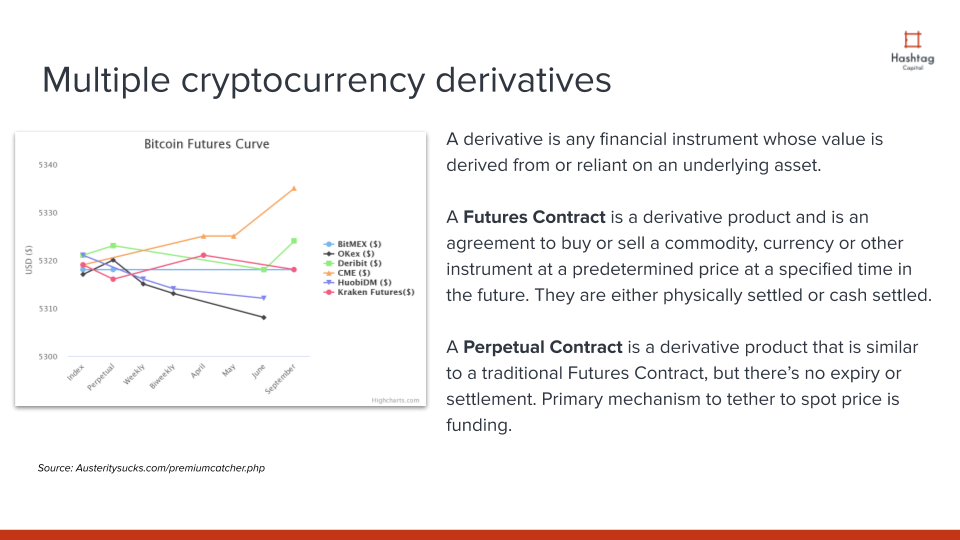

A cryptocurrency derivative is basically a financial instrument whose value is derived from an underlying asset or other external information source such as funding rate. Futures, perpetual swaps and options are commonly traded on Bitmex, OKEx, Deribit, CME, Huobi and Kraken. Of the 6 exchanges mentioned, only CME is a regulated cryptocurrency futures exchange in the United States. The others primarily do not accept users from the US. For Bitcoin futures contracts, there are multiple durations of expiry of futures contracts with products expiring in a week, 2 weeks, a month, a quarter and even 6 months. As of yesterday when the snapshot was taken, the quarterlies were trading at a discount to the spot index.

For regular businesses in the crypto space, derivatives are extremely useful for hedging their positions on mining and payments received from clients. Should they receive a large order paid in cryptocurrencies, they can execute a hedge fairly easily through a trader to ensure they are not subject to downswings in prices in the future.

Cryptocurrency derivatives are heaven for speculators. With the underlying asset being extremely volatile and high leverage of up to 100 times on exchanges like Bitmex, with a relatively small amount of capital, should they get their bets right, they stand to gain a large amount of payout. Even if traders want to have a long position in Bitcoin, they can use futures to speculate against other cryptocurrencies such as Ethereum or Bitcoin Cash.

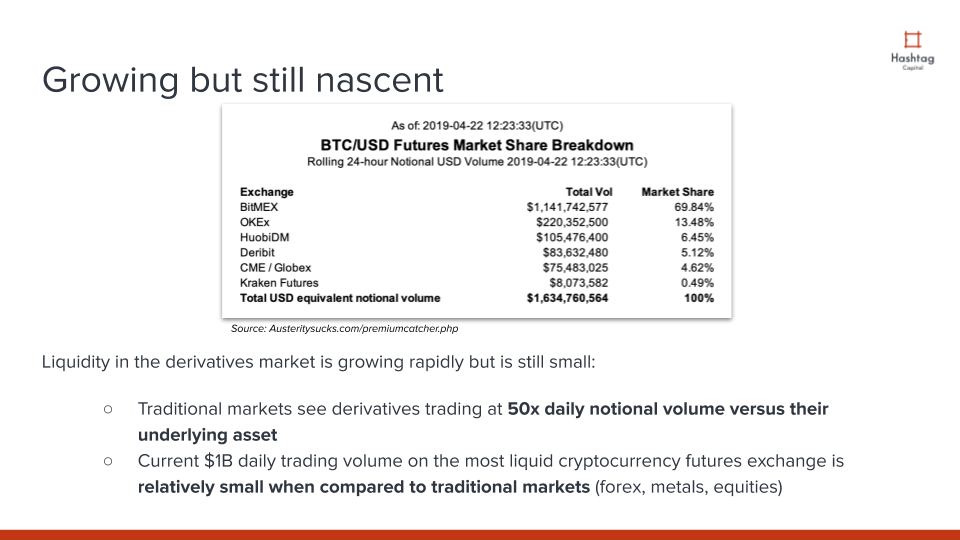

On a daily basis, there are over $1B traded across multiple derivatives exchanges for Bitcoin Futures contracts alone. During times of price spikes such as on April 2, 2019, volumes can spike to over $10B in a 24-hour period. The current trading volume of futures is smaller than that of spot trading volumes. In traditional markets, derivatives trade at over 50 times their underlying asset in volumes, it’s clear there’s room to grow for futures in the cryptocurrency space. Given the volatility of cryptocurrency assets, this would mean that traders of cryptocurrency derivatives have to be extra careful in their trades to avoid liquidation. Exchanges would also have to make sure that to fully capture the market, they will have to continuously innovate in the space.

With derivatives poised to help users capitalize on or hedge against volatility, stablecoins have an interesting position of ensuring low volatility. Counterintuitive as it sounds, low volatility stablecoins represent the third billion dollar trend for exchanges. When you trade BTC to USD on Bitfinex, you may not even notice it but you’ve just traded a stablecoin — USDT.

Stablecoins are essentially cryptocurrency assets with a peg to another asset such as fiat currency, gold, cryptocurrency or a market system. The inherent design of having reserves or other mechanisms to stabilise price is what gives it the notion of being a stable coin. Primarily, it’s used by traders when they wish to speculate against the price of Bitcoin or other cryptocurrency assets. While they can be used to pay for goods and services, due to the lack of integrations, we rarely see stablecoins being used in our day-to-day lives.

Stablecoins largely fall into three main baskets. Fiat or commodity collaterised stablecoins tend to mirror the price of USD, JPY, EUR, Gold, Silver or other real world assets. Crypto-collaterised stablecoins such as DAI have mechanisms against another cryptocurrency that’s required as deposit. Through the use of equity shares, bond structures and other market mechanisms, proposals have been put forth by projects such as Basis (discontinued), Fragment and Carbon to introduce non-collaterized stablecoins.

USDT, the largest stablecoin by market capitalization currently sits at $2.6B. Assuming they have 1:1 reserve ratio, that will mean there’s about $2.6B sitting somewhere in a bank account somewhere in the world. USDT trading volumes over the past 24 hours sit at $11B, over 5X it’s total market cap.

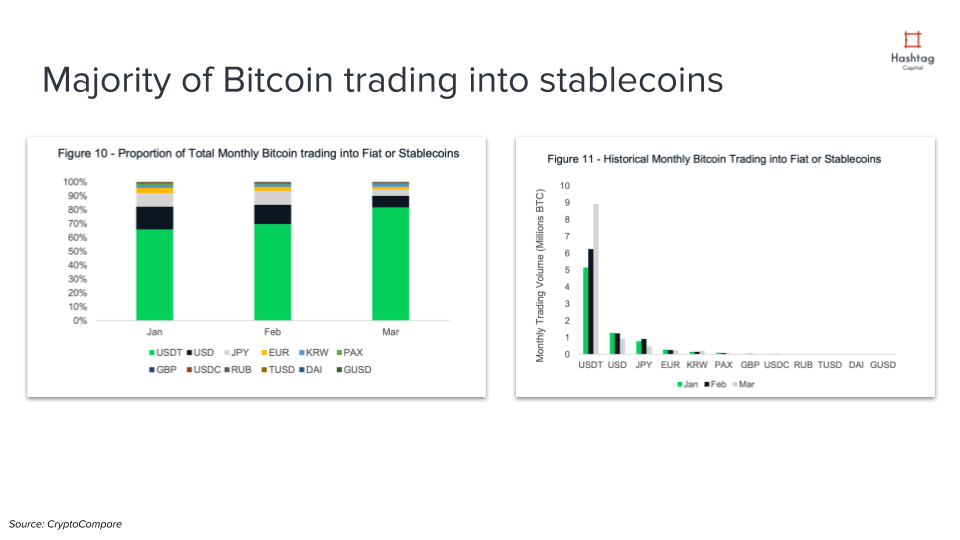

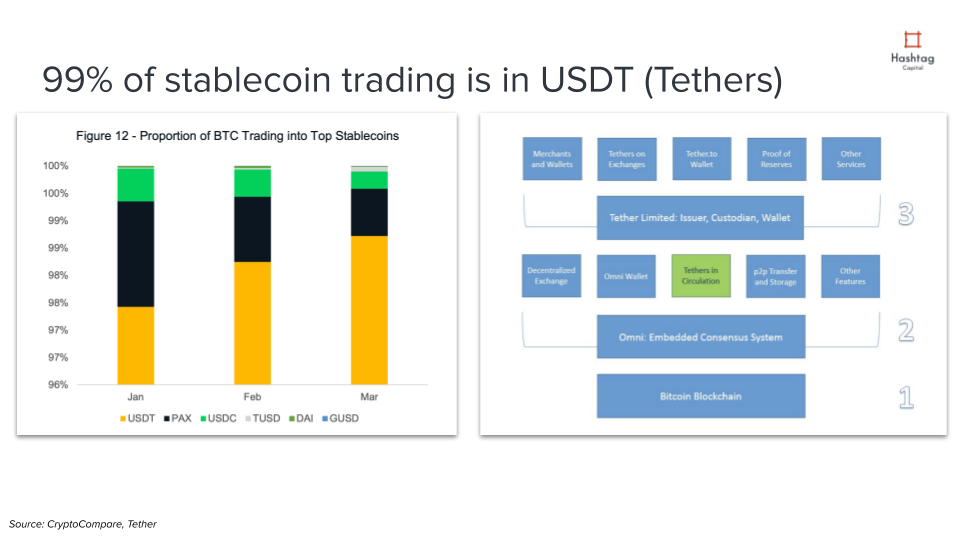

From the analysis by CryptoCompare for Q1 2019, we can observe that over 80% of trading of Bitcoin into fiat/ stablecoins result in trading via the stablecoin mentioned above — USDT. The other country currencies that are in demand are JPY, EUR and KRW. This is a good indication of the dispersion of trading volumes of cryptocurrencies across these multiple markets.

With the various stablecoins in the market such as USDT, PAX, USDC, TUSD, DAI and GUSD, USDT still comprise up to 99% of trading volumes in Q1 2019. Since of the trading volumes of BTC is against USDT, trading via USDT indeed accounts for a significant percentage of total trading volume across all exchanges for all cryptocurrencies.

USDT in circulation today are issued on the Bitcoin blockchain with the Omni embedded consensus system as the middle layer. Issuance, wallet and custodian is held by Tether Limited. We’ve also seen similar models and structures emerge in other fiat collaterized stablecoins such as TrueUSD, USDC, PAX and GUSD. Banks such as MUFG and JPM are also evaluating models in this area. It will be exciting to observe which of these implementations will gain the biggest adoption in the next 5 years.

Hashtag Capital is a multi-strategy electronic trading fund for crypto assets. We capture alpha from quantitative cryptocurrency asset trading and strategic investment. We contribute back to the cryptocurrency and blockchain community by running a non-profit accelerator program and community events.

Crypto-Exchange trends: IEO, derivatives and stablecoins was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.