Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

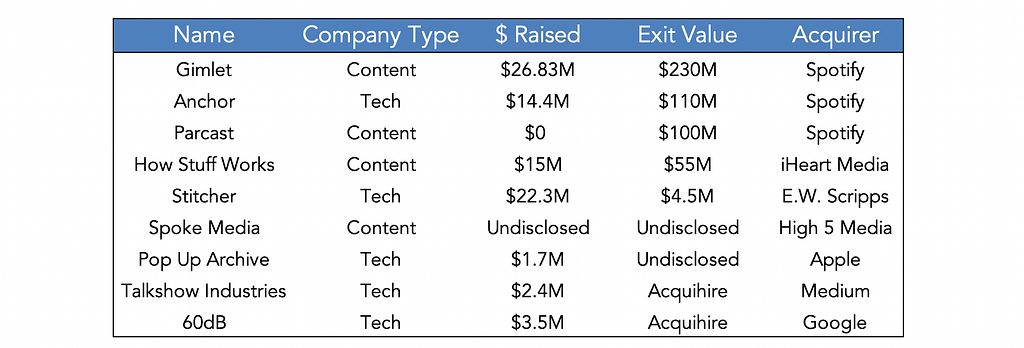

2019 has been an unprecedented year for exits in the podcast industry, driven by one company: Spotify. Spotify paid $340M to acquire content studio Gimlet and hosting platform Anchor in February, and last month purchased true crime content studio Parcast for an estimated $100M. A press release shortly after the first two acquisitions announced Spotify had “line-of-sight on total spend of $400-$500M in multiple acquisitions” for 2019, with planned further spend if the strategy paid off.

This acquisition activity is especially notable in a space with few prior exits — iHeartMedia’s acquisition of Stuff Media (creators of How Stuff Works) for $55M was the largest previous exit. Podcasts also generate surprisingly little revenue — at least in the U.S. While a majority of Americans aged 12 and up have listened to a podcast, with 33% listening monthly, the industry is estimated to generate just over $500M in revenue for 2019. We’ve previously written about how low this revenue is on a per listener basis, especially given podcast audiences tend to be high income and high engagement.

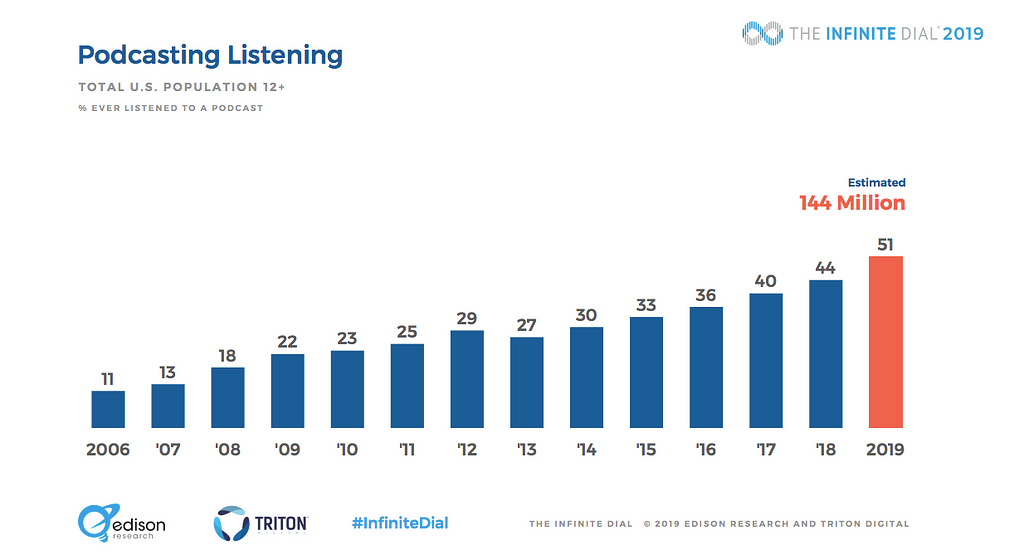

Podcasts crossed an important milestone this year — for the first time ever, more than 50% of Americans aged 12+ reported ever having listened to a podcast. Source: Edison Research Infinite Dial.

Podcasts crossed an important milestone this year — for the first time ever, more than 50% of Americans aged 12+ reported ever having listened to a podcast. Source: Edison Research Infinite Dial.

As venture investors, we’ve struggled to reconcile the explosive consumer interest in podcasts with lagging revenue and exits, but it looks like this may finally be changing. It’s been particularly surprising for us to see content studios, like Gimlet, Parcast, and HowStuffWorks, driving the exit activity — as next gen media companies more broadly have been struggling. In this article, we will explore what’s getting funded versus what is exiting, why content companies are generating so much interest from acquirers, and what we’ll be watching in the podcasting space through the rest of 2019.

Funding and exit activity

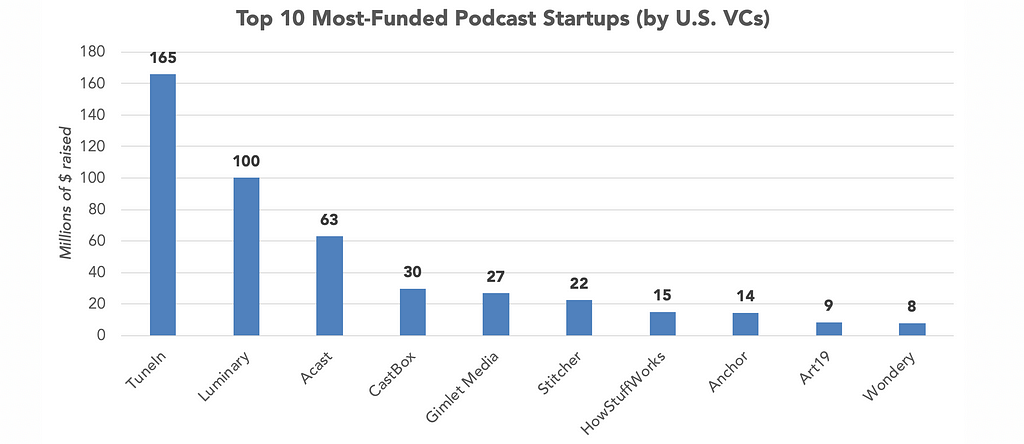

We analyzed Pitchbook data and found 31 podcast companies that have raised venture funding from U.S. investors since 2012. These startups have raised a collective $482M, of which almost 70% ($328M) has gone to only three companies:

- Online streaming platform TuneIn, which also does music/radio, but has recently heavily emphasized podcasts.

- Pre-launch podcast listening app and content studio Luminary (we’ll discuss this one more later!)

- Sweden-based Acast, which has both a streaming app for listeners and content management, monetization, and analytics for producers.

Based on Pitchbook data as of April 2019, these are the top ten podcast startups that have received the most VC or corporate VC funding.

Based on Pitchbook data as of April 2019, these are the top ten podcast startups that have received the most VC or corporate VC funding.

Most of the venture funding in podcasting has gone towards technology platforms ($327M) versus content ($155M)*. Seven of the top ten most funded companies are consumer streaming apps, producer tools, or infrastructure platforms, while only three are pure content studios. This is unsurprising in the broader scope of venture funding, as investors have historically been most interested in tech platforms versus media companies.

*This $155M towards content includes Luminary, which is a streaming app (tech) but is heavily focused on producing exclusive content. Excluding Luminary, content startups have raised only $55M.

In contrast to the tech-heavy funding activity, the largest returns thus far have come from content companies. We’ve listed all the publicly announced podcast startup exits below — there has been an estimated $385M in disclosed exit activity from content startups, compared to $114.5M for tech platforms.

What’s going on with content?

Why have content companies had the most valuable exits thus far, versus tech-focused podcast companies that should theoretically trade at higher valuations? We think it’s because there are still a few major obstacles in the way of tech-focused companies, which typically either focus on consumer discovery/streaming or producer infrastructure and monetization. The last piece of the puzzle comes from the acquirers themselves, as the unique profile of the acquirers in the space today favors content startups.

- On the consumer side, the podcast discovery problem is tough to solve as a startup with limited users & data. Despite many attempts by startups to build a dominant new streaming app, there has not yet been a breakaway success — Anchor data from September 2018 shows that aside from Spotify and Apple, no listening platform holds even 5% of “earshare.” Why not? Building the “Netflix of podcasts” is harder than it sounds. First, it’s tough to drag users away from apps like Apple Podcasts or Spotify, which many consumers already have installed and are comfortable using.

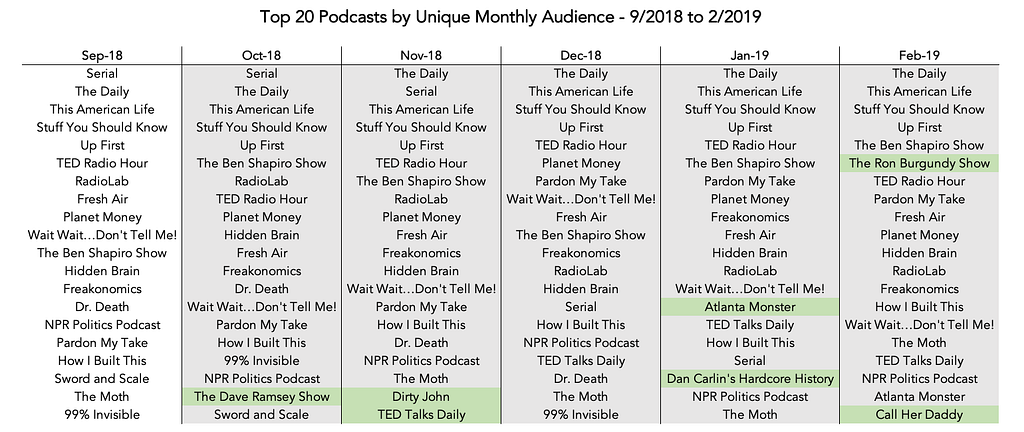

Data is from Podtrac — green represents shows that are new to the Top 20 in that month, while grey represents shows that previously appeared over the six-month period. Over the last six months, only 28 unique podcasts have been in the Apple Podcasts top 20 list. Though there is no public show-by-show listening data, this supports our theory that most podcast listening is concentrated in a fairly small group of top shows that are consistent over time and easily discoverable.

Data is from Podtrac — green represents shows that are new to the Top 20 in that month, while grey represents shows that previously appeared over the six-month period. Over the last six months, only 28 unique podcasts have been in the Apple Podcasts top 20 list. Though there is no public show-by-show listening data, this supports our theory that most podcast listening is concentrated in a fairly small group of top shows that are consistent over time and easily discoverable.

It’s also difficult for these apps to make great recommendations. There’s an extremely long tail of podcast content, but most regular listeners consume a mix of “Top 200” shows (easily discoverable via Apple Podcasts chart) and niche content they find through friends or family. We’re not denying there’s an opportunity for algorithms to surface hidden gems, but right now, it feels like none of the smaller listening apps have enough user data to generate recommendations that are (1) high quality and (2) feel truly personalized — and we’ve tried a lot of them! The bigger players in this space like Spotify, Pandora, and Apple also benefit from their learnings developing similar algorithms for music, making it harder for podcast startups to catch up.

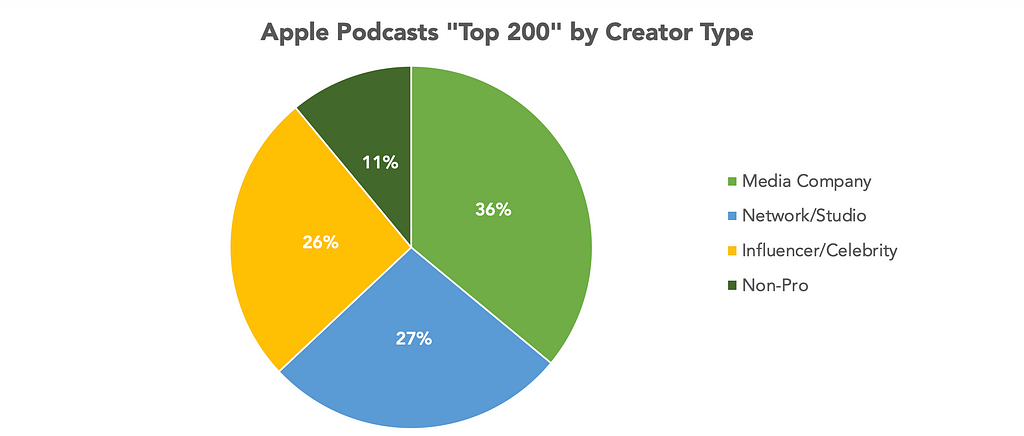

- On the infrastructure side, many of the big shows/networks have relatively custom solutions, and the long tail is tough to monetize. As of April 17, we took a look at Apple’s Top 200 podcasts list, and found that 89% were produced by professionals — namely, media companies (36%), podcast networks/studios (27%), and influencers/celebrities (26%), often in collaboration with a network. This leaves only 11% of podcasts produced by “everyday people” who have to find their own tools. (In case you’re curious, almost all of these top independent podcasts were either about religion or Game of Thrones.)

When it comes to infrastructure, these professional production companies don’t often turn to startups. For hosting and analytics, many have internal tools they use for other content or are locked into legacy platforms like Blubrry and Libsyn. In advertising/monetization, deals for big shows are often negotiated individually or on a network level. Even VC or corporate-backed companies in podcast marketing/sales, like Cadence13 and Art19, focus on higher-touch relationships with larger producers and networks — and don’t seem to be aimed at most of Apple’s 600,000+ podcasters.

The exception to this rule, of course, is Anchor, which was part of Spotify’s recent wave of acquisitions. Anchor aims to help non-professional podcasters host and monetize their shows, and was acquired only months after its Sponsorships product (an open ads platform) launched. Because of this, we feel it’s too soon to tell how far ad revenue will really travel down the “long tail” of podcasts. However, given Anchor’s huge library (as of early 2019, the company was powering 40% of all new podcasts), it makes more sense as an acquisition target for Spotify. We’re curious to see whether Radio Public and Panoply’s new ad marketplaces are similarly able to pick up steam.

- Natural acquirers are audio giants, who are looking for ways to expand their user base and margins. These potential acquirers (like Spotify and iHeartMedia) typically already have their own tech platforms on both the consumer streaming side and the producer infrastructure side. These potential acquirers have a few things in common, all of which make content companies the most compelling acquisition targets:

- Many have already developed tech internally to tackle content discovery (serving the right content to a user at the right time) and infrastructure (e.g. hosting, ads, and analytics), as discussed above. They’ve built these tools for their core competency of streaming music, and don’t need to buy more tech to serve this need.

- Music streaming services are low margin, so it makes sense for these platforms to look for opportunities in higher-margin verticals. Spotify forecasts a loss of between $200 and $400M for 2019, and Pandora, iHeartRadio, Tidal, and even Apple Music are also facing losses.

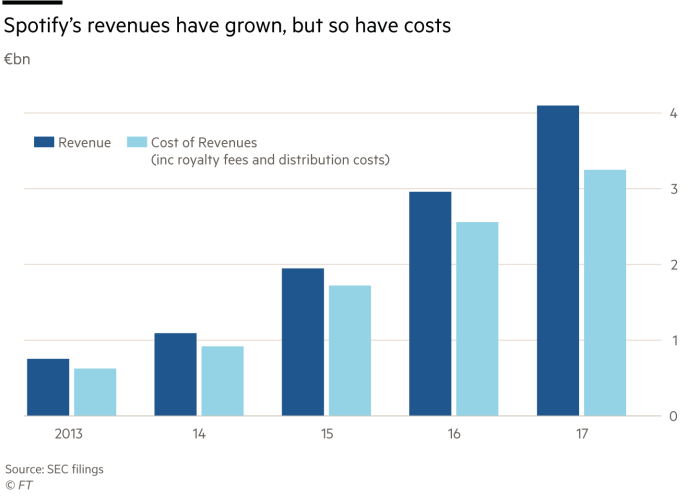

A Financial Times chart from March 2018 illustrates the company’s narrow margins — the vast majority of revenue is paid out in royalty fees and distribution costs.

A Financial Times chart from March 2018 illustrates the company’s narrow margins — the vast majority of revenue is paid out in royalty fees and distribution costs.

Why is music streaming such a low margin endeavor? Most of the income goes to the artists and “middlemen” like record labels and publishers — historically, Spotify has paid out ~70% of revenue to these players. In contrast, podcasts are freely available (no associated royalties), which means Spotify can keep 100% of the ad revenue generated against this content. Spotify is heavily incentivized to get users to spend more time listening to podcasts, as it’s their highest margin content.

3. Music streaming services (e.g. Spotify, Pandora, Apple Music, Tidal, Amazon Music, and Deezer) are all competing for the same demographic, and we expect CACs to rise as these companies continue to pour money into customer acquisition. Exclusive podcast content may be one way for an app to differentiate itself from the pack. If the music listening experience is relatively similar between Spotify and Pandora, for example, but Spotify offers an exclusive podcast from your favorite influencer, you may pick Spotify.

What’s next for podcasting in 2019?

One of the most heavily anticipated events in podcasting this year is the launch of listening app Luminary on April 23. The startup raised $100M in VC funding pre-launch, and has (tellingly) seemed to pursue a strategy of content over tech. Luminary’s marketing campaigns thus far suggest the product will be a smooth-looking, if fairly standard podcast player — with all the emphasis placed on a slate of top-tier podcasters that will make Luminary-exclusive shows behind a $7.99/month paywall.

Some of the Luminary creators who will be debuting exclusive shows on the app include Guy Raz, Lena Dunham, Malcolm Gladwell, and Trevor Noah.

Some of the Luminary creators who will be debuting exclusive shows on the app include Guy Raz, Lena Dunham, Malcolm Gladwell, and Trevor Noah.

We also expect to see Spotify move podcast content behind the paywall — we wouldn’t be surprised to see Gimlet and Parcast start producing Spotify-exclusive shows that stream early, ad-free, or even exclusively on Spotify Premium. We also expect to see other music streaming services, like Pandora, acquire their own podcast studios or networks to compete (Wondery is one potential candidate, as are Tenderfoot TV and Gen-Z Media). These efforts will also all likely be competitive with Luminary, and may push upstart podcast discovery or consumption apps to either develop their own original content (as Stitcher and Castbox have done) or pivot.

We also hope to see more acquirers emerge beyond Spotify. It seems like Apple would be a likely entrant, due to the popularity of its native app and 2017 acquisition of a podcast search startup, Pop Up Archive. And though Apple’s historical strategy in gaming, music, and video has been to be a marketplace for content rather than a producer, this is quickly changing! However, Apple’s interest in podcasting seems tepid — it hasn’t helped podcasters monetize via ads (as YouTube did for video creators), and only recently added rudimentary analytics despite launching its app in 2012.

Other companies trying to capture “share of ear” are likely acquirers — think Pandora, Deezer, or Tidal. We also wouldn’t be surprised to see Google make another acquisition in this space (after acquihiring the team behind 60dB in 2017), as the company launched a standalone podcast app last year and seems to be investing in the industry. And you can never rule out Amazon, particularly given the company is always looking for more use cases for Alexa and for exclusive content to put behind the Audible paywall.

Thanks for reading! We’re curious to get your thoughts on the future of the podcast industry and likely acquirers in this space — email us at twins@crv.com or tweet us @venturetwins.

Like this post? Clap for it to help more people see our story, and share it with your friends!

Interested in reading more content from us? You can subscribe to our weekly newsletter, Accelerated, for more insights on millennial and Gen Z trends: https://accelerated.carrd.co/

Why content, not tech, is king in podcasting was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.