Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Sharing economics is not a new phenomena. In fact, the modern sharing economies catalyzed by Uber and Lyft, often touted as innovative, are a derivation of the most primitive economic structure: trade and barter. The Uber and Lyft S-1s have shed light on the vulnerabilities in the economics that underpin their business model. This has brought about discussion with respect to the long-term viability of these businesses, and at a cursory evaluation of the financials, it makes sense that people would draw that conclusion. The problem with that analysis, however, is that it takes a nearsighted view of a long term play.

Uber and Lyft are multi-sided platforms with two customers: service consumers (riders) and service providers (drivers). They have been pouring on incentives and subsidies to keep the drivers engaged while maintaining a low-cost service to riders. Wall Street has correctly identified this as unsustainable. The common thread being the inevitable day where Uber and Lyft will have to raise prices to reach profitability. There is extreme skepticism that they will be able to maintain the customer base when that day comes. But I’m not so sure that day will come.

Uber and Lyft are not asleep at the wheel and ignorant to these challenges. Quite the contrary. The problem isn’t the business model, the problem is their current reliance on inefficient resources: humans. However, this is not a systemic challenge. To use accounting speak, it is a timing difference.

Like the wolf in sheep’s clothing, Uber and Lyft are actually single sided platform businesses disguising themselves as multi-sided platform businesses. Soon there will be a phase shift and they will abstract one side of the equation away on their way to economic prosperity. Drivers are merely a short term bridge until the “A-word” becomes viable. Automation is careening down the pike and once it arrives, these platforms will be able to drop the dead weight of inflated variable costs associated with an army of drivers and reach their final form as a single-sided service provider. It’s no wonder drivers haven’t been given equity stakes; they aren’t viewed as long-term participants of the network.

This playbook runs contrary to most platform businesses that start with a single player mode and evolve to a multi-sided platform. As Chris Dixon says: come for the tool, stay for the network. However, in pure-play service networks like Uber and Lyft, the other side of the network is commoditized. As long as I get from Point-A to Point-B efficiently and safely, I don’t really care who is driving me. In fact, more often than not, I’d prefer a robot was driving me anyways — no offence to my recent Uber drivers.

Uber and Lyft both recognize the most important thing is accumulating a base of loyal consumers that love the service, even if that means overextending themselves in the near term. The long-term prospect of a market leadership position in something as fundamental as mobility is too great to wait. So when the automation arms race kicked off, it’s better to collect the valuable part of the equation (riders) and find a way to bring the consumer-side economics of a future steeped in automation to the present. Once automation arrives, the bottom will fall out on the cost side and these platforms will be able to keep offering the same service at the same cost to consumers, and will more than recoup the years of running at a loss.

Contrary to my tone in the preceding monologue, I view automation as a fundamentally good thing. There are certain things that — until AI reaches General Intelligence (more on that in a later post) — automation can not replace. Humans have unique qualities that machines cannot replicate, so if we can automate processes that free up more humans to maximize and commercialize their unique talents, that is an inherently good thing, and something we should embrace. The threat of automation is only present if we refuse to adapt.

In this post I will outline areas where systemic inequality has manifested due to inefficiencies in the labour market of physical production, and how this shift to automation can bring about a new economy of knowledge workers that could bring greater balance in global equality.

The foundation of human prosperity starts with three things: food, shelter, and water. And for much of human history, we have been responsible for producing those ourselves (save for God providing Manna to the Israelites as they escaped the persecution of Israel).

There are efficiencies gained by centralizing production, but this centralization also creates a systemic issue that leads to inequality. Large players own the majority share of resources and means of production, then squeeze the most out of the contributors of the value chain to marginalize non-incumbents through economies of scale. With a higher rate of return through economies of scale, this vicious cycle continues, pushing more and more people to the side and while enriching the incumbents at the top even more. That is the same thing that drove the aforementioned Israelites out of Egypt (putting aside God’s provision of the promised land). The Egyptians owned the means of production, so could then exploit the Israelites and with every unit of input from the Israelites, the Egyptians gained an unequal unit of output. This means that the gap between the haves and the have-nots widens — not linearly, but logarithmically.

This same phenomena has manifested in every eraGreco-Roman: Patricians and PlebeiansMedieval: Lords and SerfsMing Dynasty: Shi and NongPost-Modern: Elite and Working Class

For all the progress we have made, we still see a divide.

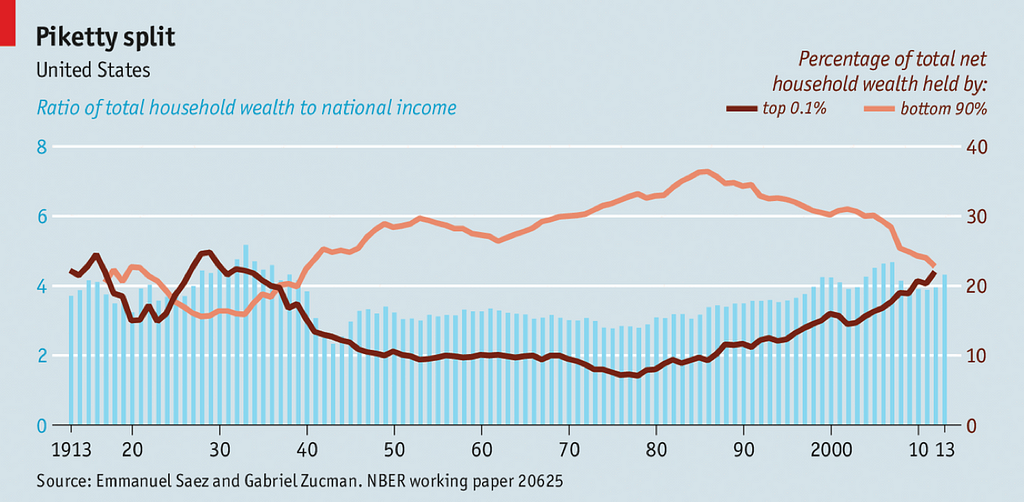

This map from the World Bank illustrates the rate of inequality within each country using the Gini coefficient as its measure. You’ll notice that the US nets out at the median in global inequality, yet when contrasted with the rate of inequality within the US borders we see that the ‘average’ is hardly something to strive for. Even with the highest global GDP, the top 1% and the bottom 90% have converged at the same % of wealth. Centralization of wealth and power has accelerated the trajectory for the top percentile while the middle class is disappearing.

Not only is intra-border inequality growing (as depicted above), inter-border inequality is compounded on top of that as evidenced by the growing divide in purchasing power parity. The promise of upward mobility in a market dominated by physical production is a fallacy. This is all perpetuated by the systemic problem of centralization. The concentration of wealth and power has a compounding effect that marginalizes more and more of the global workforce given the higher rate of return for owners of capital and production capacity.

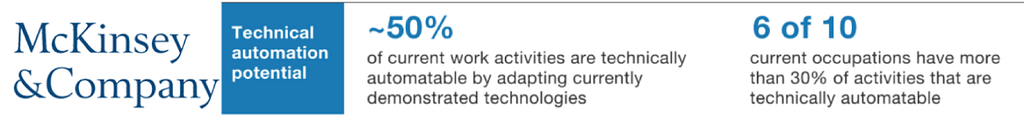

Much of the population is finding themselves changing teams from the ‘haves’ to the ‘have-nots’ because they no longer have the means of production. The rate of automation threatens to move more people from a “skilled” to an “unskilled” labourer where the rate of return on output is a step function lower:

One argument would be to implement more stringent anti-trust laws and break up bus business. Another would be the more grassroots movements you see with a social push to “buy local”. The problem is, the increasing efficiencies that big business create far too good a service at too low a cost for the objective rationale actor to turn their back on that.

A recent study showed that although the number of people working in manufacturing has decreased by 40% since 1979 [1], the output from manufacturing has nearly doubled [2]. It’s foolish to resist this kind of advancement, yet so many pundits ignore the 100% increase in production and focus on the 40% job loss.

We should be embracing this for two reasons: (1) it frees up more human capacity elsewhere, and (2) it obfuscates human participation in physical production where inequality is so pervasive given the centralized control of the means of production that renders outsized returns.

We can either resist or we can lean into this unique period of automation and the associated job cannibalization to create a new means of human production. A means of production that is more inclusive and more value generative.

New economics steeped in old principles

What we can learn from businesses like Uber and Lyft is the power of peer-to-peer value transfer. The proliferation of the internet, combined with the reduced friction of mobility has laid the foundation for global connectivity where value transfer not confined to nodes in the network that are in close proximity. These modern innovations, combined with the cyclical nature of economics have converged on a modern rendition of barter economics we have dubbed the sharing-, or the gig- economy.

This kind of micro-entrepreneurship puts the power back in the hands of the commons to be producers themselves, not just spokes in the hub of centralized production.

The problem with the sharing economy in its current state is that it has one foot in the door and one foot out, with the inherent centralization of the platforms facilitating connection. In the industrial age, the centralization of production capacity led to a concentration of wealth in the hands of those with factories, materials, etc. In the information age, the concentration of wealth is in the hands of those who monopolize distribution.

The platforms driving the sharing economy are misaligned with the consumers and producers, extracting rent along the way. Staying with our ride sharing example: centralized platforms like Uber and Lyft fight for consumer market-share through price competition, then extract a big piece of every transaction. Centralized control over the consumer:producer relationship marginalizes the participants in this sharing economy and the promise of micro-entrepreneurship is a merely a delusion. (recent study shows drivers are netting below min wage on average)

That’s not to say that we should break up companies like Uber and Lyft and create a decentralized marketplace of drivers and riders interacting on open protocols. If anything we should use these services more and hope that they are able to reach the automated end-state faster. This extends to a lot of other physical production jobs as well: manufacturing, farming, etc.

I recognize this view is likely unpopular given it would initially displace a large cohort of the workforce. My argument is that it is a necessary phase transition for us to unlock higher long-term production potential.

The digital economy

It may seem counterintuitive, given when we think of automation, we think digital; but the digital world is actually the very place where humans can generate outsized value.

The physical world has innate barriers that segregate opportunity. Economies-of-scale marginalize those who do not own the means of production. The ROI for those that own the physical assets is higher than those contributing labour.

In the digital world, economies of scale are neutralized and the means of production is more accessible. We’ve evolved from the industrial age to the Information Age. With more than 50% of the world connected through the internet and regions like Africa coming online at a parabolic rate (+10,000% since 2000), the digital world is an increasingly growing, open, borderless marketplace.

Everyone has unique talents, unique insights, and unique value they can share. The sharing economy I envision is not sharing commoditized resources, it’s sharing the value that is unique to us as human beings. And the power of digital is that everyone connected to the network has equal opportunity to participate.

Learning becomes unbounded. No longer is access to higher education confined to the corridors of old, expensive institutions. And no longer is collaboration constrained by the need for physical presence in high density cities that are less than accessible, either because of rising cost of living, or less than conducive immigration laws.

The promise of the digital world is bright, but in order for it to reach its potential, it must be on the foundation of decentralized networks. There cannot be a centralized actor controlling the connectivity of the network. We see this with nation states like China and North Korea throttling access to the global network. Not only is this damaging to those within those networks, given the implicit cost of incomplete information; it is damaging to the rest of the network, given the implicit opportunity cost of not having full participation.

We see less extreme examples right here in North America with large social networks controlling who sees what information, and who can connect to whom.

That is why I am excited about the combination of crypto networks with open internet protocols. Decentralized networks with decentralized value transfer provide the kindling for an emerging economy in the digital world where value creation and value capture is non-discriminatory.

There may be a messy transition as those who optimized for the present adapt to the future. But this future will unlock higher potential, and that to me is exciting.

Sources

[1] https://fred.stlouisfed.org/series/MANEMP#0

[2] https://fred.stlouisfed.org/series/OUTMS

Automation and the Sharing Economy was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.