Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

A Divergence of HashRates in 2019

Bitcoin mining operation — https://usethebitcoin.com/bitcoin-computing-power-is-growing-faster-than-its-price/

Bitcoin mining operation — https://usethebitcoin.com/bitcoin-computing-power-is-growing-faster-than-its-price/

Introduction

As I have established in previous posts, the hashrate and price of a cryptoasset are typically linked. As cryptocurrencies recover in 2019, it is worthwhile to evaluate the hash power of the leading cryptoassets to gain a sense of the mining community’s confidence in the future prospects each cryptoasset. In this post I evaluate the hash power of three leading cryptoassets Litecoin, Bitcoin, and Ethereum. I find that hashrates are diverging for Litecoin, Bitcoin, and Ethereum, indicating that Litecoin and Bitcoin will outperform Ethereum in the forthcoming bull market.

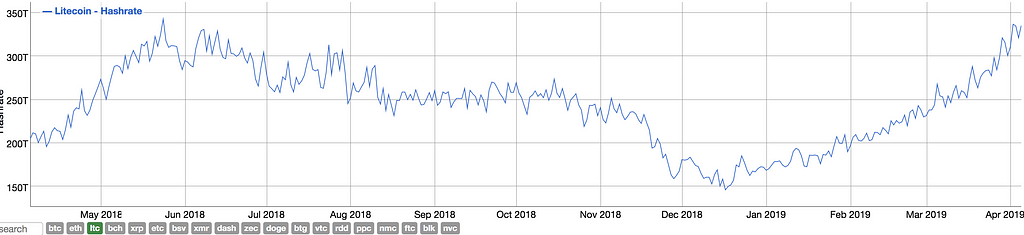

Litecoin

Litecoin has had the most remarkable hash-rate resurgence demonstrating that the mining community is extremely bullish on the future prospects of the crypto-asset. Litecoin will undergo a halving in August of 2019, and is hence experiencing an incredible surge in both its price and hash power.

Litecoin’s hashrate is close to setting a new record

Litecoin’s hashrate is close to setting a new record

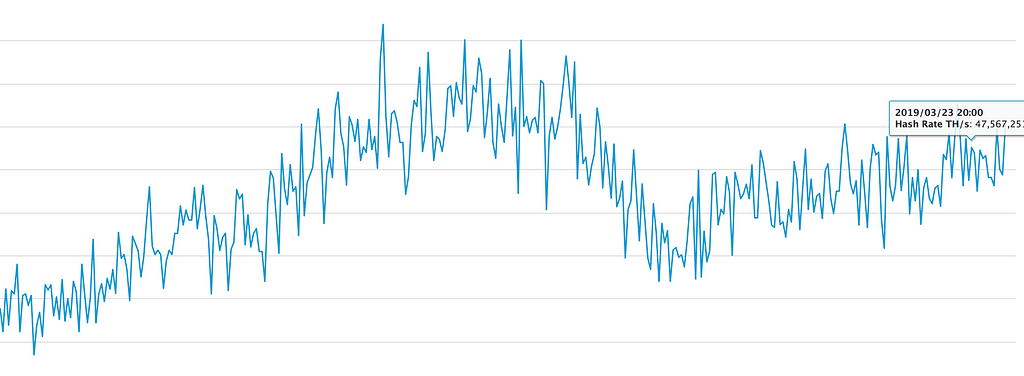

Bitcoin

Bitcoin is widely considered a safe harbor of cryptoassets, the oldest cryptoasset in existence, and it’s price and hashrate are harbingers of how the greater cryptocurrency market will perform. Unlike Litecoin, Bitcoin will not experience an imminent halving, an event that occurs every few years. However, in the months before May 2020, the next halving for Bitcoin, the asset’s hashrate and price will surely ascend.

Bitcoin’s HashRate is slowly reascending in 2019

Bitcoin’s HashRate is slowly reascending in 2019

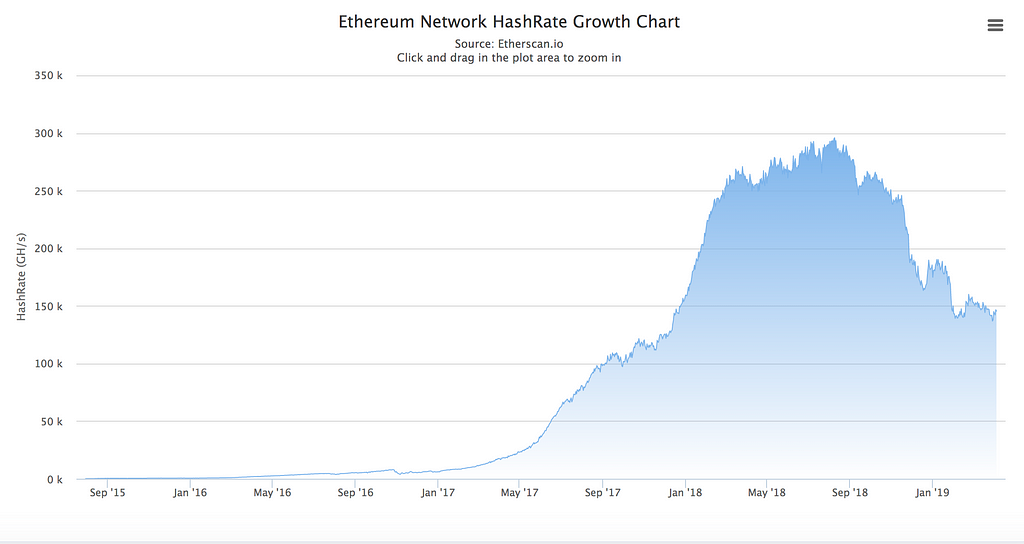

Ethereum

In a previous post, I have established that Ethereum suffers from scalability issues, a weakness that threatens the future prospects of the protocol. The mining community clearly agrees with this observation. Ethereum’s hashrate is not re-surging in 2019 indicating that the mining community may believe that competitors like EoS and Tezos will take the mantle from Ethereum as the new dominant smart contract platform.

Ethereum’s hashrate has not recovered

Ethereum’s hashrate has not recovered

Conclusion

Hashrate is the best metric one can use to gauge the crypto community’s confidence in the future prospects of a cryptoasset. My analysis suggests that the mining community is extremely bullish on Litecoin, somewhat bullish on Bitcoin, and lukewarm on Ethereum. If an investor were to take hash-rate as an indicator of the future price prospects of a cryptoasset, Litecoin would be a certain buy, Bitcoin less so but also a buy, and Ethereum would be a sell.

A Divergence of HashRates in 2019 was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.