Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Korea is the biggest Crypto market in the world, but still, the Korean government, similar to that of the Chinese government, cannot seem to shift its negative view of blockchain, cryptos, and the exchanges. It can be said that as of now, Korean and Chinese governmental regulations are heading in the same direction.

Fortunately, The Korean government has recognized that blockchain technology is emerging very quickly and this technology will be the essential energy resource for the future.

The ever-expanding and the solid user base of the Korean people who are actively trading and using cryptocurrencies have become an even more important issue to the government than collecting taxes from major Korean exchanges.

It is very obvious that the Korean government cannot make such a profitable financial project by itself without exchanges who earned more than KRW1375 billion(About USD 1.2 billion) as revenue in just one year. One shocking fact that I recently read is that major Korean crypto exchange (Upbit) is printing the cash out which will be equal to the annual budget of the Ministry of SMEs’s helping young adults start-up businesses project.

Since the ICO, and subsequently, this way of fundraising for the blockchain project was banned in Korea, several projects and major exchanges such as Bithumb and Upbit were under prosecutor’s investigation in allegations of manipulations and frauds. As a result, there are a lot of complex KYC regulations to be able to sign-up and begin trading digital assets on Korean exchanges, such as the real-name system.

While government kept their eyes on relationships between crypto exchanges and financial institutions, one of the major banks, Shinhan Bank and NH Bank, which were the first to take the lead in the blockchain industry as a financial institution, signed an agreement with Upbit on April 4th, opening a service to check real-time market prices of major cryptocurrency in the NH Investment & Securities mobile app.

http://www.cbci.co.kr/news/articleView.html?idxno=323780

http://www.cbci.co.kr/news/articleView.html?idxno=323780

With the Mobile app, users can bookmark certain cryptocurrencies that they are interested in, and as the app is now fully synced to Upbit, the user can easily access crypto trading with a lot more ease.

As you can see, It was just a small start of a collaboration between NH Bank and securities Co. and Upbit. However, we hope that this will be the start of many to come in the future.

There is no denying the fact that a traditional financial institution started blockchain and crypto related business with one of the major crypto exchanges in the world, Upbit, has caught many audiences’ attention, with this collaboration news bolstering peoples hope that we could see a huge injection of capital from these top tiered financial institutions that the whole crypto market has craved for such a long time.

NH Bank and Securities Co. are one of the banks who has a close relationship with many big Korean exchanges such as Bithumb, Upbit, and Coin One. In 2017 September, Even when ICO is banned and there are many complex regulations came out, this bank woke up with an open mind.

In the near future, through this partnership, I reckon the number of new accounts (average 1,200 per day) of NH bank and Securities definitely influences Upbit’s trading volume.

A few days ago, we got over a very long term of “barley hump” and faced, what looked to be, the return of the long-awaited bull market for a short time.

Bitcoin broke all expectations, breaking the USD 4,000 and USD4,200 line, reaching levels above USD5,000, again showing the previous power of bitcoin, whilst also reminding us of one thing: the cash flow from financial institutions is the core source of energy which can ramp up the blockchain and crypto industry.

On April 6th, eToro’s senior analyst Mati Greenspan mentioned that over USD300 million of capital will soon be coming to the crypto industry, pumping Bitcoin, and alt coins again.

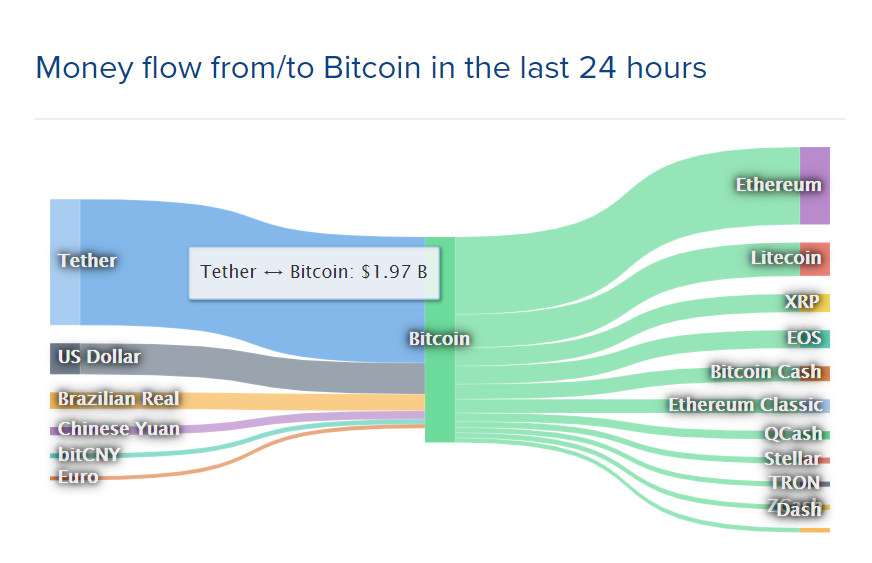

According to the renowned blockchain and crypto data provider, Coinlib’s graph, USD200 million capital is now tied to one of the well-known stable coin Tether ($USDT). The other about USD 100million was from the Chinese yuan (CNY) and Brazilian Real (BRL). This data is crucial, showing us the capital flow into BTC for 24 hours.

https://coinlib.io/coin/BTC/Bitcoin

https://coinlib.io/coin/BTC/Bitcoin

This massive capital flow, was what many believed to be the catalyst behind the recent ‘pump’, raising the demand for Bitcoin, temporarily breaking the long “winter”.

Total 7000 BTC, about USD294 million was flowing from somewhere to exchanges. Did this massive amount come from individual investors?

Well, no one can really confirm where this capital actually was originated from. However, in my opinion, it’s clear that this enormous amount has flowed from the corporation, not the individual.

We all already know that whenever major financial institutions and experts begin to inroad to this industry and their capital begins to flow in, the whole crypto industry will be a tremendous boom.

The synergy between the traditional financial market and blockchain and crypto market has just begun to “bloom”.

The Synergy: Traditional Financial Institutions’ Capital and Crypto was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.