Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Introduction

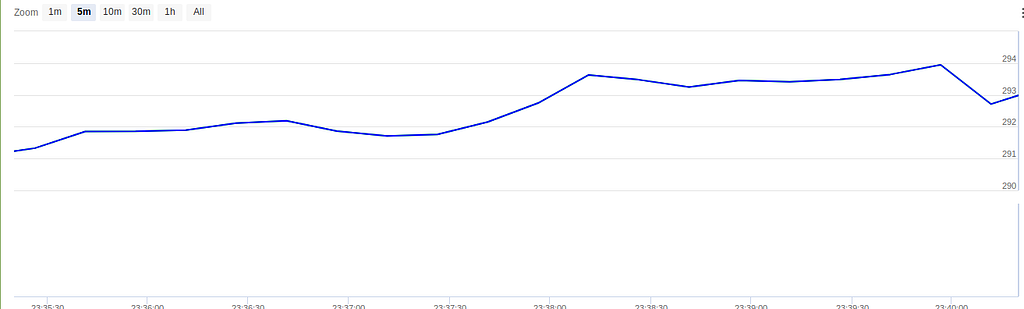

Deciding when to buy low and sell high is the key to any automated trading strategy. We’ve been incorporating many theories in our bot as it evolves over time, and this post will summarize them.

RSI

Don’t buy RSI over 70 — don’t sell RSI under 30. Simple. RSIs are minutely arrays in 6 second update intervals separated into 10 instances, checked against the minutely values from the previous 14 values of bids.

Bollinger Bands

Don’t buy over upper BB band. Simple. Same methodology as RSIs except over 9 minutes.

Tiered Buy Orders Down the Books

As the price declines, and we submit buy orders that turn into trades, we submit smaller buy orders for lesser prices. This allows us to scrape differences in the books easier than holding a coin until it appreciates, and allows us to profit more from holding more and more coins at lesser and lesser values in times of volatility — all else remaining equal, and after you apply a law of averages that equates to coins gaining and losing less differential than the income you’re scraping. There’s a 3 minute delay, though, before placing a new buy order for a pair — to avoid holding too too much before it regains and we scrape, mind you!

‘NeverSellAtALoss’ Minimum Sale Prices

Next, we enable a minProfit * buyPrice ‘minimum sale price’ per tiered buy order that gets executed. This allows us to ensure or project that we’d earn a certain % per trade, and we can also project what our income might look like should we pay lesser and lesser (even get rebates on) fees. We can be buying and selling, we can be selling, we can be buying further down the books — we’ll always anticipate a certain level of income from each individual trade.

Application 1: Mediumish Liquidity Coins with High Spreads

For pairs with >% spreads and lesser volumes, we can profit more per trade (and after fees) than the Application 2, even if less trades are executed — while enjoying potentially more tradeable pairs. We’ll hold our coins longer and risk more exposure from some of these coins tanking, but hope that our minProfit is earning enough per scrape to combat that — and historical trades by the dev bot and community bots attest to this. Also, fear not shit coins — we take the most recent hourly candle and compare the value of volume there vs. the implied volume on the 24 hour ticker, then take the best candidates — according to a variable set by our users. The right combination of overall variables allows us to see profits of 1, 2, 3% daily — although not riskless.

Application 2: Huge Liquidity Stableish Coins with Low Spreads

Conversationally, we can eliminate some of that risk in Application 1 by trading stable-er-coins that shouldn’t die when we hold them — and we can trade far more often, and earn a lesser percent on the spread but as the dev bot and community bots have proven the configurable variables involved here have the ability to turn quite a hefty profit — while the risk still remains you’ll hold a coin that then turns sour, and if you’re trading more often that risk might multiply should your settings not be just right… however as above we’ve seen gains of 1, 2, 3% per day!

Conclusion

Whatever combination of variables you dream up on whichever exchange, your odds increase significantly with volume — we’ve seen balances as little as 0.003 btc turn 0.2, 1.4 btc/day in volume — get in now and achieve a significant reduction in fees to earn your own tidy little pile of (potential) returns!

FUD and FOMO

1. NeverSellAtALoss ‘bag’

Position with negative profit but don’t want to sell at a loss and realize that loss so you don’t sell. This creates a BAG that you carry

1. Scrape Enough to Not Worry

I played with a variable that incremented a divisor that started at 1.0001, then after x number minutes it reduced the min sale price by 1.0001, and increased the divisor to 1.00121 or whatever, but,… with the tiered buy orders all the way down, the goal is to always sell an individual order at a % profit while it scales up and down the books. The theory is that all else remaining equal — and with the law of averages saying stuff will decline as much as it inclines, if you index enough pairs and lessen the risk of any one breaking the bell curve — with the right spread, volume, minProfit, the scraping should outweigh the ‘bag’

Market Maker Bot Signals Overview was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.