Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

What makes token price keep rising? I summarized 3 types of logic for rising token price.

What is the rational token economy model behind token price? How can some cryptocurrencies’ price keep solid in the long run?

Vitalik once mentioned in his blog his valuation for medium-of-exchange token based on Fisher’s formula: M * V = P * T

Here:

— M is the total number of coins;

— V is the velocity of money, that is, the number of times an average token changes hands everyday;

— P is the price level, this is the price of goods and services in terms of the token, so it is actually the inverse of the currency’s price;

— T is the daily transaction volume, which is the economic value of transactions per day

To put it simply, if there are M number of tokens, each of them changes hands N times a day, then there’s a daily economic transaction scale corresponding to the value of M * N tokens. If daily transaction volume is T, then token price is T / (M * N), and the average price level P is T’s reciprocal: M * N / T.

If we simplify the analysis, let H = 1 / V, then H represents the average time span a user holds the token. Let C = 1 / P, so C represents token price.

Then M * V = P * T can be simplified as M / H = T / C or M * C = T * H

We can come to a simple conclusion, purely from a market perspective, that when other basic conditions (M and T) stay the same, the longer a token stays in user’s hands (H), the higher token price would rise.

Of course, the above is a static model. In reality, demand and trading volumes keep changing.

In fact, this is an important reason the U.S. stock market has prospered all these years. A large number of institutional investors and even individual investors in the US stock market are holding stocks for a long time. The holding time is often measured in years.

Now we can talk about our main topic: the logic behind rising token price.

On the high level, we all know that creating more token usage scenarios and increasing demand for tokens certainly help promote the rise of token price.

From a token engineering perspective, successful blockchain projects with good token economy design can be roughly divided into three categories:

The First Category is Tokens with the Mining Logic:

When the token has good fundamentals, the mining token provides a passage for rising token price:

The feedback process of token price growth:Found price of mining coins as A -> price rises -> more miners join -> mining cost increases -> mining cost rises to high level

With a good fundamentals, tokens with mining logic provides a good price support.

The feedback process of price support works like this: the price of coin falls -> price falls to the mining cost -> miners reluctant to sell and selling pressure is lowered, believers provide support -> coin price stop falling

The more miners, the more stable the system will be. With the mining cost continues to rise, coin price gets a high support and the bottom of the mining cost to rise.

In the long run, as long as the feedback loop continues to go on, Bitcoin’s price (no matter as digital gold or as a peer-to-peer version of electronic cash) will have a higher and higher price support.

Of course, mining is not something that all tokens should take. In some cases, a 51% attack can wipe out the entire value of a project. Mining logic is valid only if the value of the blockchain project itself continues to grow.

The perfect thing about Bitcoin is that the more miners, the more stable the system, the more obvious the network effect of Bitcoin, and this fact itself raises the value of the Bitcoin network.

The Second Category is Tokens with Delegated Proof-of-Stake

To some extent, EOS’s supernodes are like miners, and in order to obtain mining rights, supernodes need to buy EOS tokens in the market to obtain mining rights; EOS will allocate a part of the additional issuance of EOS to these supernodes.

It is important to know that there is a capital cost to participate in the supernode election due to the lock-up of EOS tokens. Furthermore, some of the EOS tokens of supernodes are borrowed, the costs above are to some extent the mining costs. The hardware cost, operation and marketing costs can also be considered as fixed mining costs.

The feedback process of token price rise:price rises -> more people join supernode election -> cost for being elected as a supernode increases -> cost for being elected rises from B to B1.

The feedback process of price support: token price falls -> price falls to cost B1-> supernodes reluctant to sell and selling pressure is lowered, believers provide support -> DPOS token price stop falling.

During this process, it is more ideal for the supernode election to happen in real time. Since the DPOS tokens will inevitably need to have additional issuance, the demand for DPOS coins must be increased.

The Third Category is Platform Tokens:

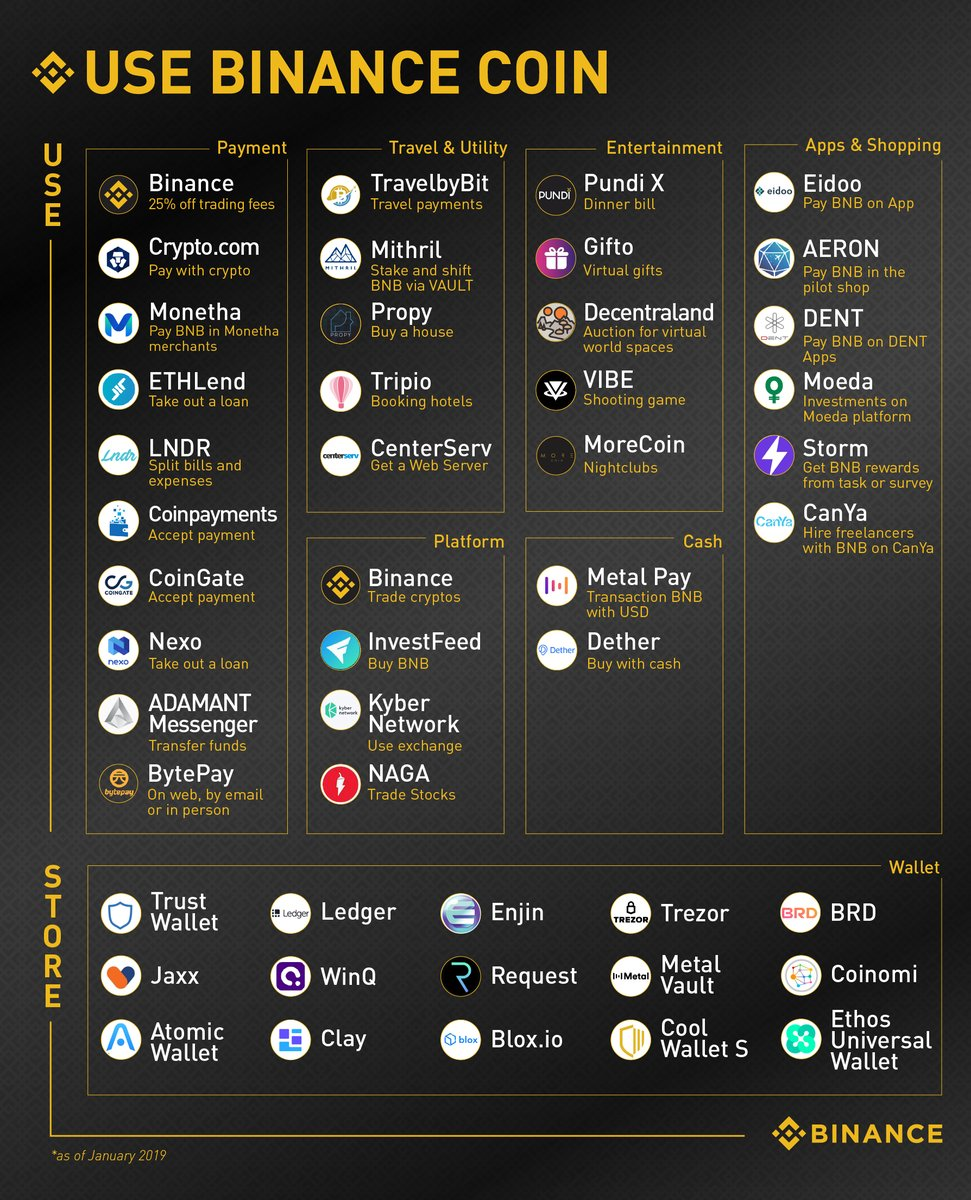

By platform tokens we specifically refer to tokens from trading platforms that regularly distribute profits to token users. The most successful case is BNB from Binance Exchange.

Benefits of BNB: 20% of the quarterly net profit of Binance Exchange is used for BNB buyback, and the BNB tokens which got bought back are burned.

The feedback loop of token price growth is that the buyback action will directly raise token price. Some people will buy tokens because they want to arbitrage, which will push up the price. So every time buyback happens, the price will be pushed up, which in turn will push up the cost of holding these platform tokens. In fact, a buyback program with token burn is very similar to a dividend program.

Another hidden logic for platform token is that: If platform token holders can enjoy the usage of the tokens, they will be willing to hold it for a longer time, otherwise the arbitrageurs will sell soon after buying. Similarly, platform tokens are not suitable for large-scale additional issuance.

Platform tokens perfectly conform to two characteristics:

The first is that all the holders of the token are protectors and even promoters of it.

The second is that the holders of the tokens are also the users of the tokens, so people will purchase platform tokens to use them.

It is obvious that the platform token logic is only valid when the value of the blockchain project itself has growth potential. In the case that an exchange can continue to prosper, the price of the platform token will continue to rise.

The bottom line of the price support for the platform token is provided by the value of the platform itself. If the exchange users are exhausted, the platform token might still drop to zero.

To summarize:

The three models above are summarized as follows: turning speculation into investment and allowing holders of the tokens to obtain stable return.

Of course, for methods like staking and mint-and-burn to successfully decrease the liquidity of tokens and increase holding time of tokens, it requires the support of the value of the project behind the tokens so that the tokens are actually used.

U Network’s UUU tokens model design and upgrade would refer to the second and third category.

The above discussion is based on long-term (measured in years) token design under efficient market conditions, where panic-induced price fluctuations and price manipulations are not discussed.

On Token Economy and Token Price: 3 Best Practices was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.