Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

2019 could be a big year for Ethereum. The Constantinople hard fork eventually went through with barely a hitch. The first projects using Joseph Poon’s Plasma scaling technology will go live in a matter of months. There are still more developers and dapps on Ethereum than on any other blockchain platform. For these reasons, many Ethereum predictions for 2019 err on the bullish side.

However, when Ethereum launched back in 2015, it had the advantage of being the first of its kind. This is no longer the case. Vitalik Buterin’s creation is now jostling for space between up-and-coming dapp platforms such as Tron, EOS, and Zilliqa. Pretty much every new launch claims to knock spots off Ethereum in terms of scalability and ease of use.

We’ve been out trawling Twitter, Reddit, and the crypto news-scape to round up some of the current thinking on Ethereum predictions – bulls and bears alike.

Ethereum Predictions: The Bulls

Nick Cannon of Ethereumprice.org makes a pretty credible bull case for the price of Ethereum, based on increasing scarcity. The Constantinople upgrade reduced the block reward for miners from three to two Ether. The next significant update is Serenity, currently set for implementation in 2020. At that time, Ethereum will move to the proof-of-stake (PoS) consensus model, and the block reward will be removed altogether.

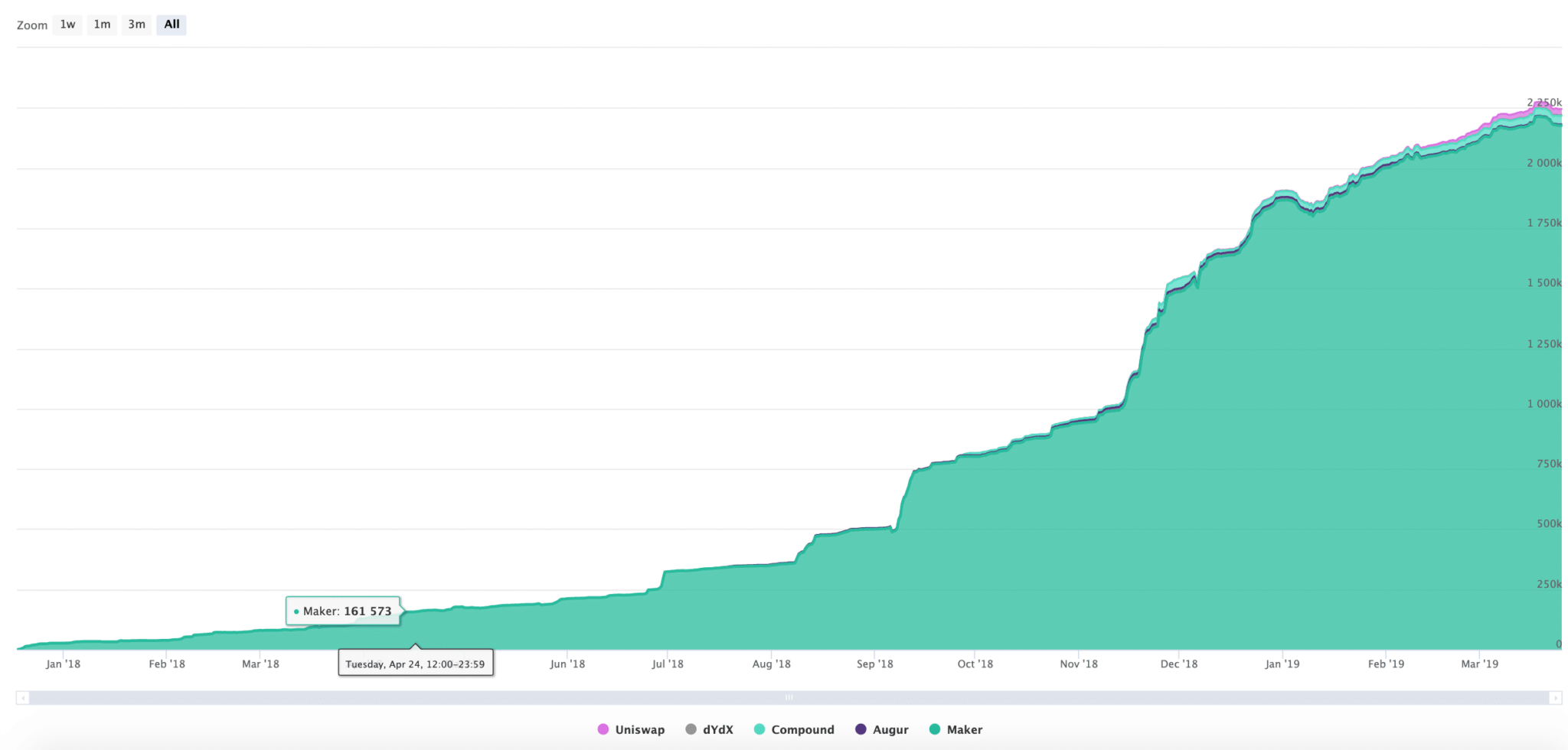

Cannon also points to the high value of ETH staked in decentralized finance projects such as Maker, creating further scarcity in the supply. His Ethereum predictions state that while the bull run may not happen this year, the increasingly scarce supply means it will happen eventually.

ETH staked in DeFi, mostly Maker. Source: https://mikemcdonald.github.io/eth-defi/

$2500 by Year’s End?

Adam Todd of soon-to-launch futures exchange Digitex is even more bullish. His Ethereum predictions for 2019 include the price going up to around $2000-$2500. Of course, Digitex is developed on Ethereum so that would be great news for his company if it proves to be the case.

Todd argues that the current low price of ETH is due to manipulation and points to EOS as being part of the problem. He claims that because the $4 billion EOS ICO was held on Ethereum, it drove the price down once the EOS main net went live. Now that it has a chance to recover, he believes it could skyrocket.

Wall Street appears to be backing up Todd’s view. Tom Lee of Fundstrat Global Advisers reportedly told his clients late last year, “We believe Ethereum is about to stage a trend reversal and rally strongly.”

Nigel Green of the deVere Group also threw his hat in the ring of Ethereum predictions. He too believes that the price will go up to $2500, driven by more platforms using Ethereum and the rise of cloud computing. He also predicted further regulation is on the way, leading to greater protection for investors, which would increase confidence in the markets.

Ethereum Predictions: The Bear Case

Crypto journalist Matthew Da Silva leads the bears. He’s an outspoken critic of Vitalik Buterin, stating that “it’s hard to see how his invention has made any difference, beyond inflating the crypto bubble.” His Ethereum prediction is that the ETH value is approaching its rightful price: zero. Harsh.

For context, here is what I wrote: pic.twitter.com/nTaY7FAuAZ

— Matthew de Silva (@matthewde_silva) September 12, 2018

Crypto website Wallet Investor is a little more generous, although less than reassuring for anyone all-in on ETH. Their analysis is that the price will more than halve from its current value of around $140 to about $63. It doesn’t explain why this is though, just stating that their predictions are based on “smart technical analysis.”

Blockgeeks founder Ameer Rosic is similarly bearish, stating his belief on Twitter that we can expect another “80% haircut” for the crypto market overall. He’s also pretty scathing about Ethereum’s dapp user base. Presumably, this is the reason for his bearish outlook.

If you think the bear market is bad now, just wait…

Prediction: We will see another 80% haircut.

Reality will soon set in.

Ethereum. $20B MCap. Really? only 1200 Dapp users lol

EOS: $4B Mcap. Based on what? zero adoption.

Tron $1.8B Mcap. Where do I even begin!! pic.twitter.com/2cCOOMpP4e— Ameer Rosic (@AmeerRosic) October 18, 2018

What Do the Ethereum Experts Think?

Buterin himself has been famously uninterested in price hype, preferring instead to focus on the potential of blockchain technology. However, in a recent episode of the Unchained podcast, he conceded that the ETH price does matter. He elaborated that if it goes to zero, network security inevitably becomes compromised.

He also admitted that Ethereum has lost some of its market share to newer entrants. However, as always, he didn’t make any specific price predictions.

If Ethereum has lost out on market share, Joe Lubin appears to be less than concerned. Back in December, the founder of ConsenSys unleashed an epic tweetstorm of facts and statistics to back up his view that blockchain is “more than a market. It’s a movement.”

Market cap doesn’t reflect activity. Decentralized networks are growing.

-10B+ daily API requests served by @infura_io

-1M+ @trufflesuite downloads

-1M+ @metamask_io downloads

-12K+ live @Ethereum nodes

-48M+ unique #Ethereum addresses

-3x @LinkedIn #blockchain job openings— Joseph Lubin (@ethereumJoseph) December 1, 2018

Our Two Cents

For what it’s worth, here are our two cents. Ethereum’s biggest weakness has always been scalability. That mattered less when it was still the dominant platform; however, there are new kids in town now. If the Plasma protocol achieves what it aims to, and Ethereum can compete with rivals like EOS on transaction speed, then it could retain its position as the developer platform of choice.

The Serenity upgrade and the decentralized finance movement also make the bull case a fairly credible one. Plus, crypto markets overall have been showing more positive movements of late. Although $2500 may be a tad ambitious, our overall prediction is that Ethereum still shows plenty of potential for a bright and bullish future.

Featured image courtesy of Pixabay

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.