Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

“Are ICOs done?” — This thought continues to run around the heads of startup investors these days. Are the ICOs really done for? Has the successful ROI momentum passed yet or is there still some juice to be squeezed? Let’s take a moment to analyze and evaluate what the hell actually happened in the past 2 years and how it affected the investments market.

Let’s start with some simple math, shall we? If a company had a softcap of $3,000,000 USD it would ‘only’ have taken 4,000 Ethereum back in January of 2018. Now fast forward to this day and the same company would require approximately 21,500 ETH to reach the same softcap.

I’m sure we all heard warnings before that crypto is too volatile and now we’ve lived to see it become reality.

A fact people should know firsthand is that during Q1 2018, the average duration of fundraising campaigns went from 30days => 2months!

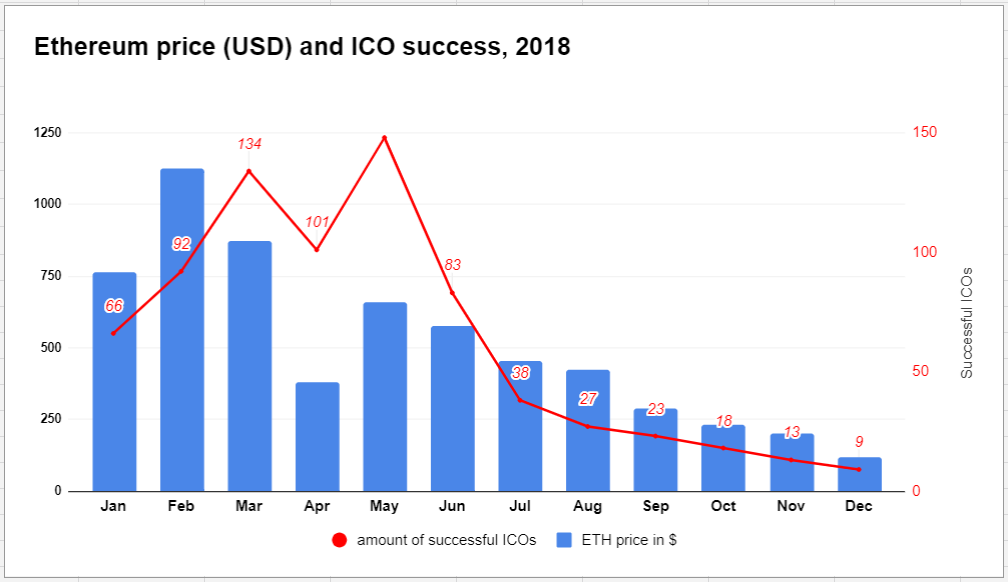

Correlation of Ethereum price in USD and the amount of successful (softcap reached) ICOs.

Correlation of Ethereum price in USD and the amount of successful (softcap reached) ICOs.

If we look at the graphic, we notice that the down-trending volatility was deadly. It is easy to talk in hindsight but the apparent mistake that startups made was not converting the acquired investment to USDT after each round of their respective sale.

Public ICO sales starting to fail significantly from May of 2018 as a consequence of the overall market drop. They didn’t have the resources to keep up with their roadmaps, develop in time and were waiting for the market to stabilize before even thinking about exchange listings.

This came at the cost of losing the trust of the community.

The Rise of a Security Token Offering rhetoric

When ICOs could no longer achieve their million dollar public sale targets and where missing those by substantial margins, investors began to search for high-return glory elsewhere. That’s when the term of Security Token Offerings or STOs came back in the game.

A crypto token that passes the Howey Test is deemed to be a security token. These usually derive their value from an external, tradeable asset. Because tokens are deemed securities, they are subject to federal securities laws and regulations which are strictly enforced by local and regional governments in order to keep markets balanced and protect retail investors from manipulation through the use of complex and convoluted financial instruments.

STOs that have finished over the past half year are struggling to find an exchange capable and verified to list security tokens. A number of exchanges are currently looking towards becoming regulated in order to do so (i.e. The Gibraltar Stock Exchange, Coinbase, ZBX, etc…) while other exchanges are being built from the bottom up already proclaiming themselves to be security token exchanges.

The hard truth is that at the moment no platform is 100% qualified to actually do it. As securities are protected by laws and regulations, so are the vendors which allow the exchange of such assets. And there are a number of jurisdiction issues that no one knows how to handle them.

Imagine a case when an STO is performed by a company in Asia (1) with respective security issuance laws, the security token is listed on an exchange in the U.S. (2) which has to follow local regulations and the trader who wants to buy listed security tokens is from Europe (3) where there are also a different set of laws made to protect retail investors. It’s a real rabbit hole of chaos, wouldn’t you agree?

In theory, the idea of an STO sounds very appealing, but the reality is that we’re far far away from actually creating an efficient market for it.

Initial Exchange Offerings comes to the scene

As we already mentioned before, investors are looking for alternatives when their investment isn’t brought to the trading market fast enough and Initial Exchange Offerings are exactly what they are looking for at the moment.

Investors don’t need to ask ‘when exchange’ as the public sale is being conducted through an exchange already, the name itself is kind of suggestinve. Moreover, it helps to avoid a lot of negative pressure (FUD) and is perfect for maintaining the trust of the community and therefore the project!

Projects can host their private sale on their own accord. Through an IEO, the exchange takes care of the KYC procedures and the unlock of the tokens which in turn helps to save operational funds for the underlying project.

Received funds are available for withdrawal 24/7 and can be used to do extensive marketing and be injected towards business development. To be honest, those activities should be the main focus after all while the IEO-hosting exchange can take care of the rest.

IEO is on hype from which the project and the exchange can benefit from. Through cross-marketing promotion many doors open and the project as well as the exchange both grow in unison.

Not every launchpad does extensive marketing support and guidance so it is very important to pick a vendor which is willing to stand-by and work as a team. Both successes become one.

What we have and what comes next

Based on data for 2018, a staggering 58% of ICOs did not manage to raise $100,000 and only 2% of all announced ICOs has been listed on exchange. It’s time to evolve and IEOs are immediately becoming super effective!

Initial Exchange Offerings are done through launchpads. Until Bitmax stepped forward there wasn’t really any traction for it. Bitmax performed perfectly for ANKR and FET while Binance was developing their launchpad. Now Binance does 1 IEO per month, in which you can only contribute with BNB (Binance’s native token). Binance IEOs get sold so fast that the the platform itself simply cannot process the contributions so fast. This transfors into frustration for the people who fail to contribute. Even more concerning is that only bot-fueled engines successfully manage to get the maximum amount of contributions.

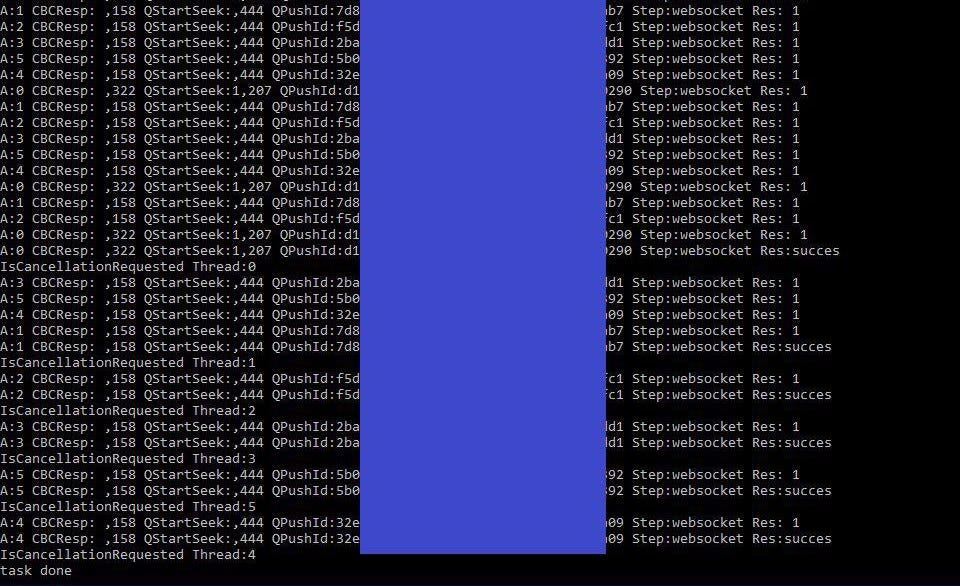

What we see here on the left is the evidence of that. A bot was constantly pinging Binance to participate in CELER IEO until it succeeded and reached the maximum amount of contributions allowed. That is 6 times. So it’s not only that people are having trouble to get in on the action, but the launchpad discriminates in favor of automated algorithms… Doesn’t really sound like a decentralized solution, to us.

There are other exchanges who also have a launchpad and enjoy this publicity they get from it. However, if they don’t coordinate cross-promotion and marketing efforts properly, they struggle.

On the other side, there is ExMarkets, a family member CoinStruction’s liquidity framework, which is growing at a rapid pace. Not only marketing wise they deliver successful and amusing results but are also bringing us the next step in contributing to an IEO.

ExMarkets launchpad brings you an opportunity to attract fiat (euro) contributions. The older generation of hodlers prefer not to invest their ETH but are more open to doing a simple fiat investment directly through the launchpad.

It gets even better as the big step for non-crypto people to invest in a project became a lot shorter. Fiat — Token pair. Definitely worth to keep an eye out on this exchange as they are taking the lead in innovation.

Disclaimer: This article has been co-written with the help of my good friend Christof Waton also known as Cryptowaton in the cryptocurrency space. Kudos to you, Chris.

ICO is Dead. Long live IEO: A closer look into investment evolution was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.